Dear fellow readers,

Once

again, these writings are just my humble highlights (not

recommendation), feel free to have some intellectual discourse on this.

You can reach me at :

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

__________________________________________________________

If

there is a fear index created to measure emotions of investors for the

past 1 week in Malaysia especially, I believe the chart of that fear

index probably hit limit up for 5 consecutive days. This is no joke at

all when we look at how much the healthcare index and specifically the

glove stocks have fallen in the past weeks.

It

is hard to imagine that these stocks were just touted as the Darlings

of Bursa barely 1 month ago by the entire investment community be it

banks, funds, media, retailers and others. What has changed in 1 month?

Did the share price hit new high before leading to this protracted

irrational selloff? Or did the factories burnt down? Or was windfall tax

imposed? Or did US and Europe banned gloves from Malaysia?

Answer : None of the above. In fact, nothing changed. Fundamentally or structurally.

Vaccine news - factored in.

Windfall tax news - factored in.

Customs Detention - factored in.

Labour Remediation fees - factored in.

My

4 points above are just highlighting the major concerns in the analyst

reports which are often bantered about by those who do not believe in

the glove story. There may be more considerations like politics, raw

material supply, USD strength and what not. But let's not go there yet

as I will share in my table below.

Things will get worst before it gets better?

In

many ways, I can say with conviction based on channel checks that the

selloff really went into full gear when Local Funds / Institutions

pulled the rag under the investors' feet. Meaning, they not only failed

to support, they even sold the stocks across all sectors specifically

Gloves. Some say they did it to book profit, some said they don't

believe in the Glove story anymore due to vaccine, another extreme is

taking the view that Glove stocks are overvalued. This is where I

differ. I am of the view taking profit is fine, as it is part of risk

management. However, I think the lack of understanding and knowledge

caused a gap in deriving the value of Glove stocks. At the end of

the day, it all comes to profit & growth. Neither are at its peak

for Glove stocks. The earnings will continue to grow, the cash flowing

into the company will continue to sustain and the visibility is for the

next 12 months / 4 quarters. Not next 1-2 months.

In

fact, the post Covid-19 Normalisation of ASP argument hold no ground at

this juncture because no one knows when Covid-19 will end. Not Fauci,

Not Nor Hisham, Not WHO and definitely not Trump. So how is it that the

share price currently are trading at close to / below post Covid-19 ASP

normalisation valuation at FY 2022/ 2023? This is what I cannot wrap my

head around.

Furthermore,

funds have no where to go for yield. Dividend yielding stocks was

crushed this past year due to Covid-19, your traditional defensive

stocks like Utility, Banks, Consumer staples, REITs are not giving the

dividend as expected. But if any company or sector can deliver bumper

dividend / special dividend, it is the Glove companies due to their cash

hoard.

In

a way, whilst writing this article, I have a mixed feeling. I feel the

Local Funds shot ourselves in the foot and killed our own uptrend both

in the Glove stocks & the Index, because of the naysayers and

non-believers in the capability, entrepreneurial spirit

and competitive nature of these Glove manufacturers. In fact, even

Foreign Analyst from Foreign Banks are more bullish about our Glove

Sector than Local Analysts from Local Banks. However, I am also excited with this opportunity.

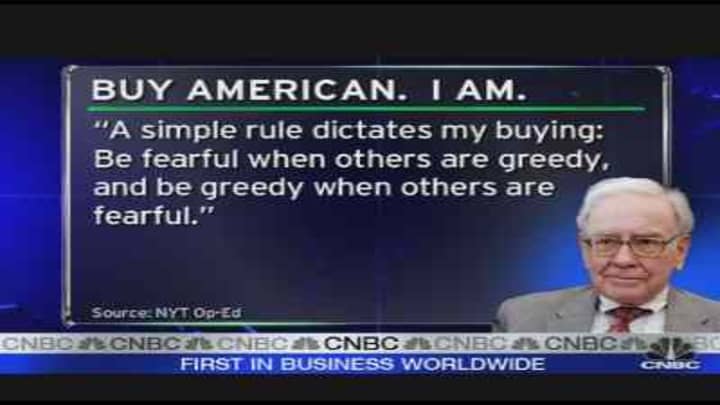

In

the event my conviction turns out right, this selloff has given many

investors who dare to be a contrarian to take an opposing views against

funds by buying on weakness to make huge returns. Fundamentals always

prevail over short term trades. No one can time the market to perfection

but share price moves in tandem with earnings. Earnings grow, valuation

is cheaper, share price rises. It sounds simple but its the truth. I

believe Local Funds & Institutions who threw the shares will realise

they are making a huge mistake sooner than later.

So Which Side Are You On? Pick Your Side But Choose Wisely.

|

For

Gloves

|

Against Gloves

|

|

Record Earnings For The Next 4 Quarters (Minimum. May Be More than 4Q)

|

Vaccine Approvals / End of Covid-19 Pandemic

|

|

Committed & Lock In Orders with Deposit Paid

|

Post Covid-19 Normalisation of ASP

|

|

Delivery Lead Time of 20 months

|

Too Expensive Valuation

|

|

Huge Cash Hoard / Net Cash position

|

Windfall Tax

|

|

Potential Special Dividend / Yield Play

|

Labour Remediation Fees

|

|

Further ASP Increase

|

Higher Cost of Raw Materials

|

|

Additional Capacity

|

Potential Oversupply from New Entrants

Into The Market

|

|

Structural Change in Demand &

Hygience Practices Post-Covid 19

|

Weaker USD, Stronger MYR

|

|

Continuous Stock Piling by Governments

|

US / Local Election

|

|

Rerating of Latex Gloves ASP as Nitrile

Gloves waiting time far exceeds Latex Gloves

|

End of Loan Moratorium, Retail

Investors leave Bursa

|

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

http://www.tradeview.my/2020/09/tradeview-2020-argument-for-against.html