According to acticle below, most of the bank expecting TOPGLOV to make 10 billion or more net profit in year 2021.

https://www.theedgemarkets.com/article/bullish-analysts-expect-top-glove-net-profit-swell-above-rm10b-fy21-falling-fy22

READ UNTIL FINISH BECAUSE I WANT TO TAKE OVER TOPGLOV AND PRIVATIZE IT AT RM 10.00.

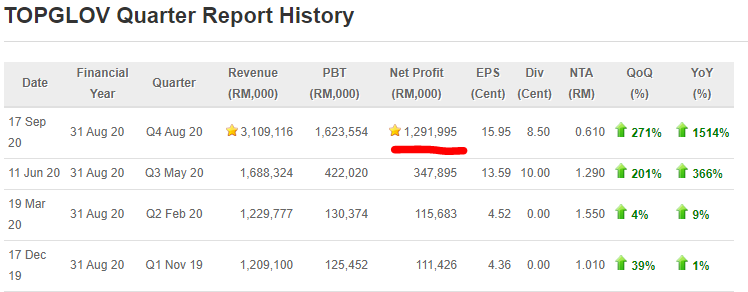

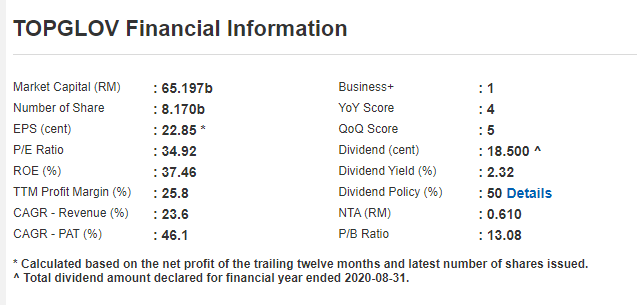

The latest result we can see is making RM 1.29 billion net profit. and the market capital currently stand at ONLY RM 65.197 billion.

In business point of view. Put it this way.

If i want to take over or privatize TOPGLOV, the market price I have to pay in full is RM 65.197 billion.

Imagine the next two year this company can give you at least RM 1.29 bil x 4 quarter (which is below bank expectation of 10 bil)

you will get RM 5.16 billion a year. This translate to a 7.9% return for year 2021. ( 5.16 nett profit / 65.197b (take over value)

for year 2022, let say asp dint up and continue maintain just RM 5 billion net profit, you get another 7.9% return.

Spending RM 65.197 billion you get back RM 10.32 billion IN CASH. Your cost left RM 54.87 billion.

----------------------------------------------------------------------

IF BASED ON ANALYST 10 BILLION NET PROFIT

2021 You spend RM 65.197 billion, you can get back 10 billion in year 2021, its 15% return straight away.

On 2022 let say drop to 5 billion, you get back 7% return.

Your cost already drop to 50 billion !!

-----------------------------------------------------------------------------------------

What about year 2023 back to normal let say only make 1-2 billion net profit. ? Your return will be 1.5b/54.87billion = 2.7% (also better than current fix deposit).

Not to forget that, you take over this company not just have a

guarantee return for next two year, you also owned the factory, glove

manufacturing technology, highly talented engineer, staff, huge land,

huge asset.

FORGET ABOUT PE AND OTHER VALUATION. Such simple mathematic business sense already show that

ITS DIRTY CHEAP NOW.

LETS TAKE IT PRIVATE TAN SRI LIM.

Since market and MALAYSIAL BANK don't value your company well.

Or sell it all to me at RM 10.00 which is only RM 81.70 billion. Very cheap.

I willing to lauch a take over offer.

https://klse.i3investor.com/blogs/pakatanharapan/2020-09-19-story-h1514207206-TOPGLOV_STILL_VERY_UNDERVALUE_In_BUSINESS_POINT_of_VIEWS_I_WANT_TO_PRIV.jsp