Here are the facts at hand. Please go through and make your own conclusions.

PS: If there is any error, please let me know.

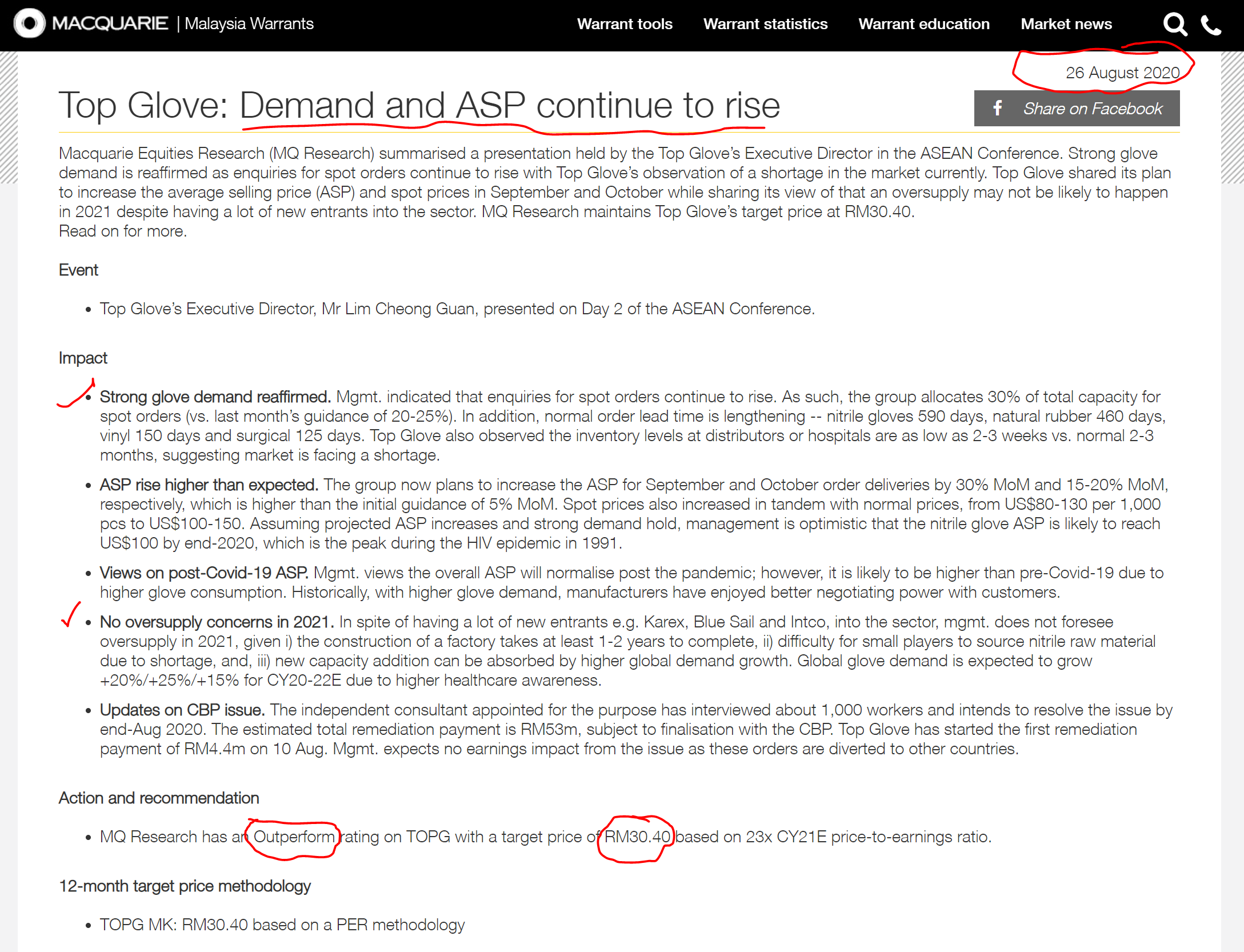

Item #1: Macquarie report @ 26 August 2020

Source: https://www.malaysiawarrants.com.my/marketnews/highlight?cat=todayhighlight&id=6417

- Demand and ASP continue to rise

- No oversupply concerns in 2021

- Recommendation: OUTPERFORM with target price of RM30.40 (before bonus issue price)

Note: Underline and emphasis in red are mine.

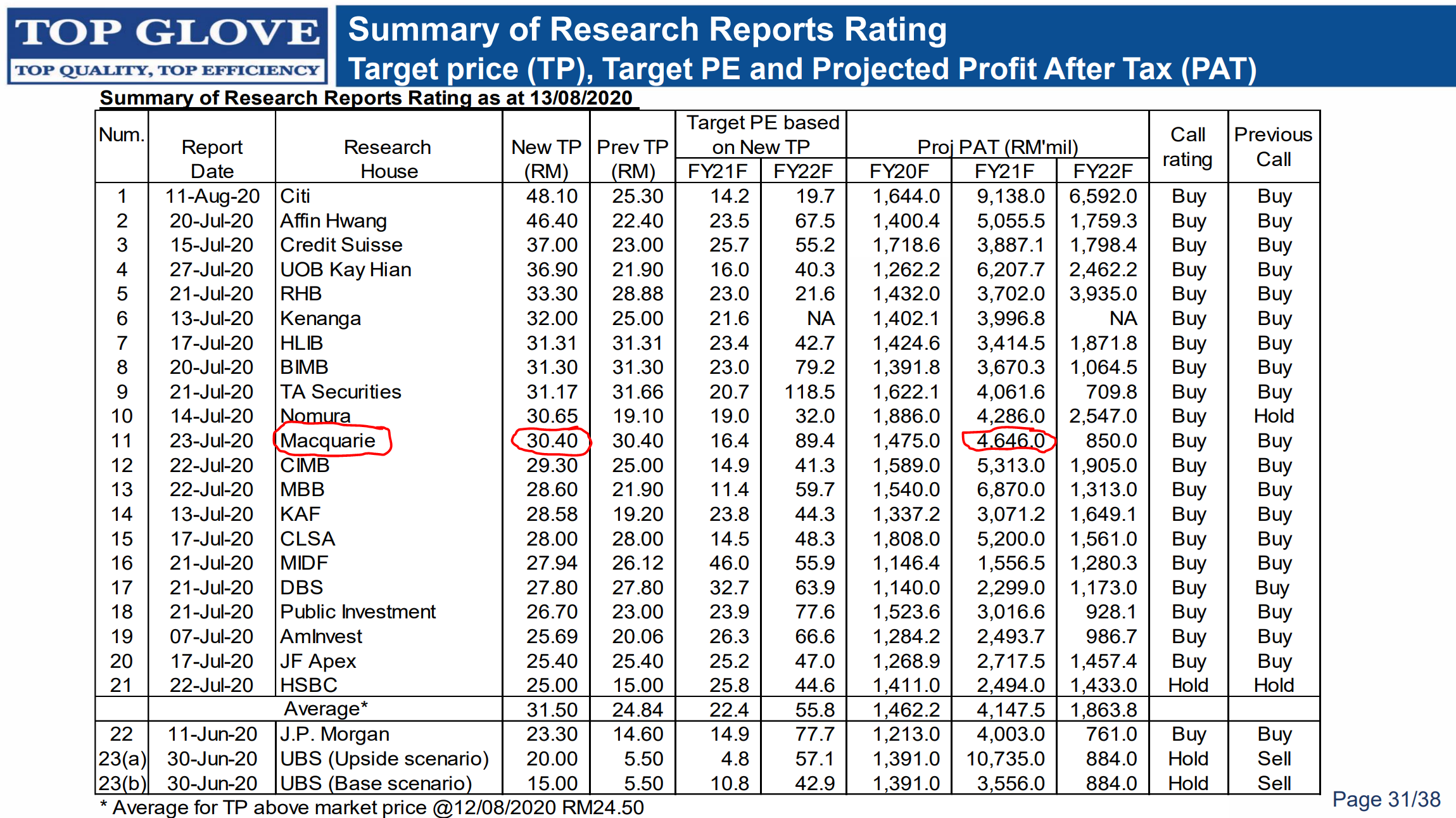

Item #2: Macquarie's estimate for Top Glove's FY2021 profit is RM4.646 billion @ 23 July 2020

Source: Top Glove August 2020 EGM Presentation Slides

- Macquarie's estimated FY2021 profit for Top Glove: RM4.646 billion

Note: Underline and emphasis in red are mine.

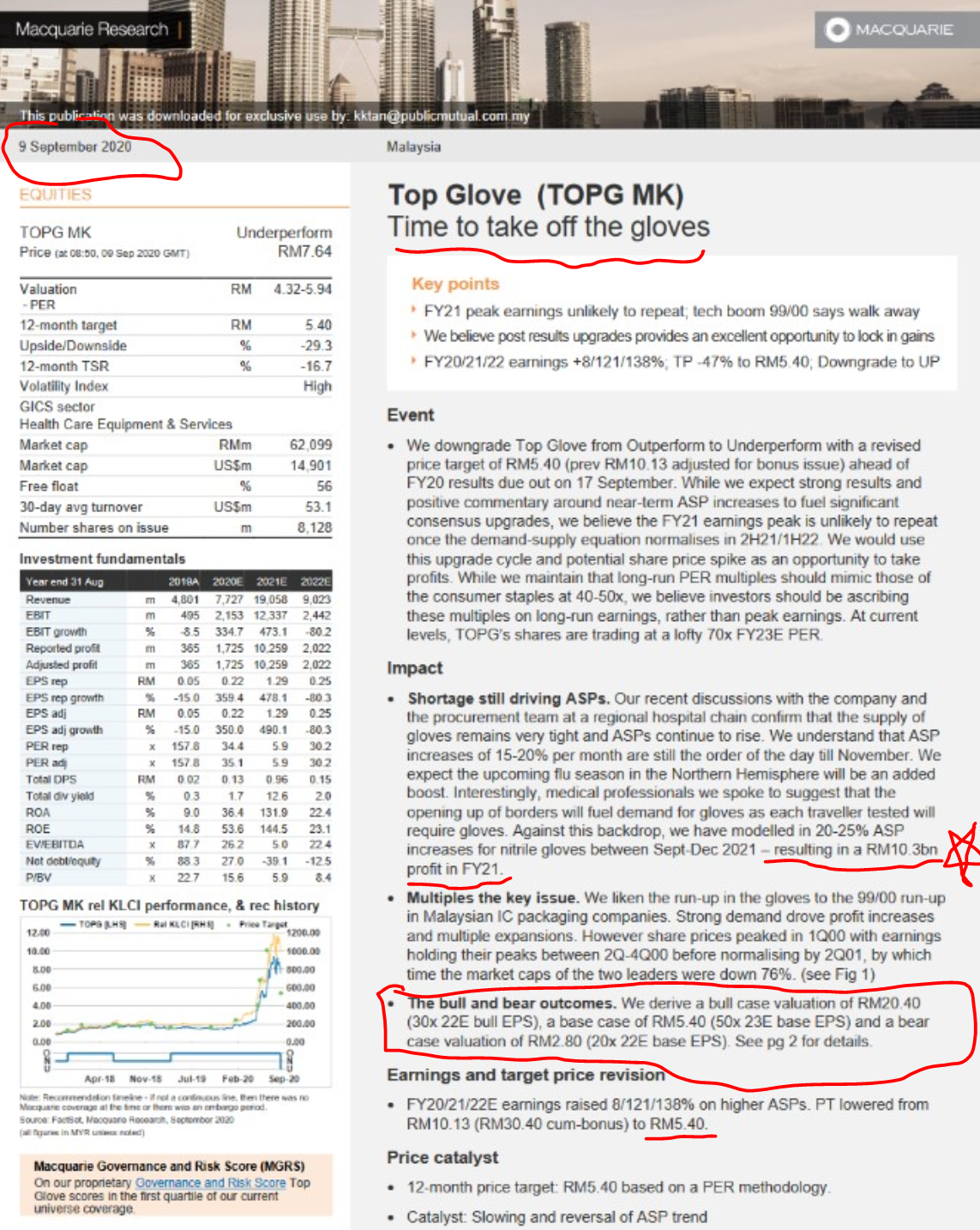

Item #2: Macquarie report @ 9 September 2020 (i.e. 10 working days after Item #1)

Source: https://klse.i3investor.com/blogs/gloveharicut/2020-09-10-story-h1513430499-MACQUARIE_Research_downgrade_TOPGLOV_to_RM5_40_Can_PM_me_the_full_repor.jsp

- Title: Time to take off the gloves

- Bull case of RM20.40 vs base case of RM5.40 vs bear case of RM2.80 (i.e. variance of RM17.60 between bull and bear case!)

- Macquarie's estimated FY2021 profit for Top Glove: RM10.30 billion (increased by more than 2.2X from July 2020 report as per Item #2)

- Recommendation: Downgrade to Underperform with lower (-47%) target price of RM5.40 (i.e. RM16.20 before bonus issue)

Note: Underline, emphasis and star in red are mine.

https://klse.i3investor.com/blogs/glovesvsvaccine/2020-09-10-story-h1513433504-Macquarie_s_TOP_GLOVE_call_look_at_the_facts_and_draw_your_own_conclusi.jsp