I have a thought that we must have a glove counter in our portfolio.

The reason is simple, we do not know what will happen to COVID-19,

Will it end in 2020 or 2021?

Or continue to COVID-22, COVID-23 until COVID-29?

So, may be a small part of our investment portfolio should be in glove counter for hedging purpose, or you can call it paying a small insurance premium to protect our investment portfolio.

And buying a call warrant of glove counter is nearly perfect for that purpose.

After searching among the big glove players, I like HARTA as the target prices given by the investment banks are sky high.

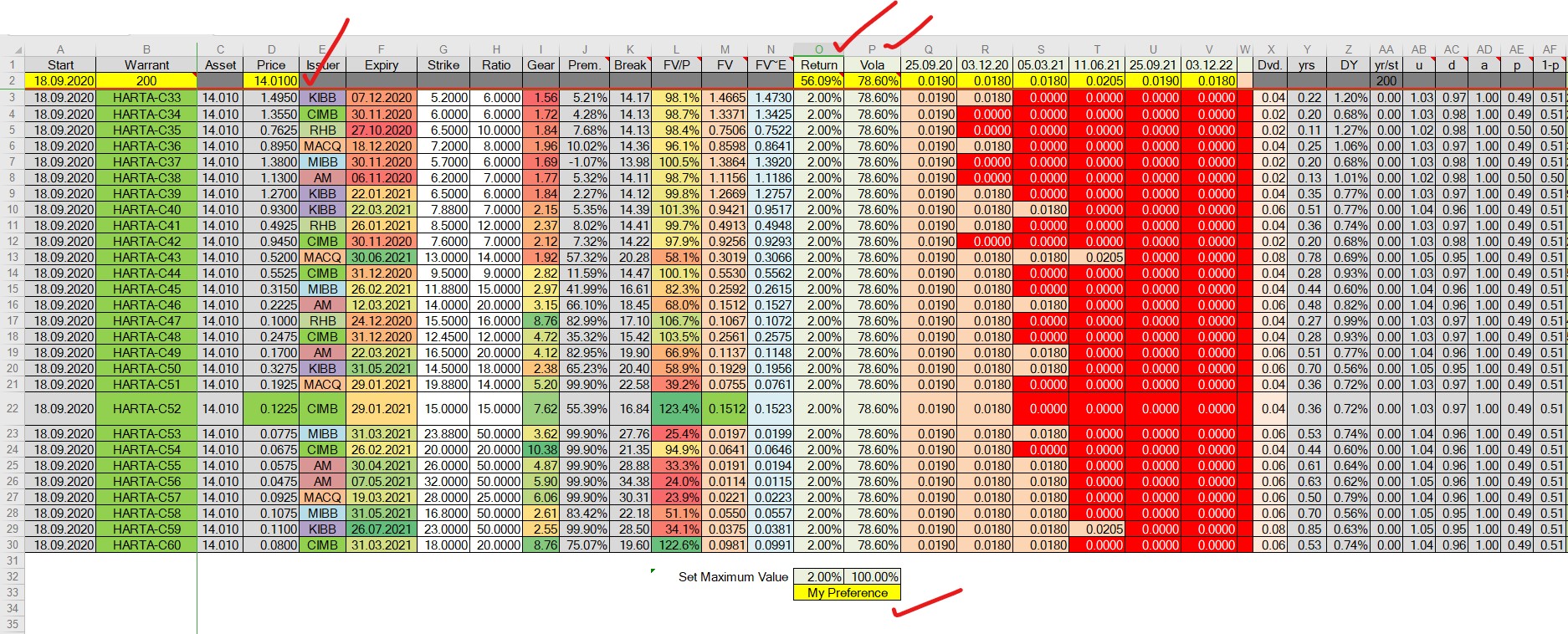

Make reference to the above screen shot.

First we look at HARTA target prices given by investment banks.

Thanks to i3investor.com for the listing the target prices.

I captured only the target prices given in the latest 3 months, as the older one might no longer applicable.

The average target price are sky high, an upside room of 56.09%, very rare for a blue chip.

Now, to calculate the fair value of call warrants, we need inputs to the calculation, the two critical and arguable inputs are:

1) Interest:

Common practice:

Input the risk free interest rate, in our current case, should be around 2%

2) Volatility:

Common Practice:

Calculate from the last 90 trading days, and assume same volatility will be maintained in coming months.

Make reference to the following screen shot:

1) Column C and D:

The middle price at 4.30 pm on Friday, 18th Sept 2020.

Note that the middle price for HARTA at 4.30pm was RM14.01, but actually it closed at RM14.16 today.

2) Column M:

Fair values calculated using 200 steps binomial method.

3) Column L:

Fair Value over Market Price.

4) My selection is HARTA-C52.

Now we focus on HARTA-C52.

Refer to the following screen shot.

We see how HARTA share price spreading according to 200 steps Binomial Distribution on the expiry date i.e. 29th Jan 2021.

There are a total of 201 points because of 200 steps.

Then the fair value of HARTA-C52 could be calculated from each of the 201 points, sum up and discount back from 29th Jan 2021.

But what is the risk?

We transform the above Binomial Distribution to the following S-curve,

Then we can have important information.

The exercise price for HARTA-C52 is RM15.00, meaning to say if HARTA is not higher than it on expiry, then HARTA-C52 settlement value is zero, it is a total loss.

Look at that point, if we buy HARTA-C52 now and keep it until 29th Jan 2021, the probability that we end-up total loss is 67%.

However, the other 33% chance will bring good return for us.

This is so called High Risk High Return.

Last one, very important, so must say three times,

Trade at your own risk!

Trade at your own risk!

Trade at your own risk!

https://klse.i3investor.com/blogs/gambler/2020-09-18-story-h1513558281-HARTA_s_Call_Warrants_I_select_HARTA_C52.jsp