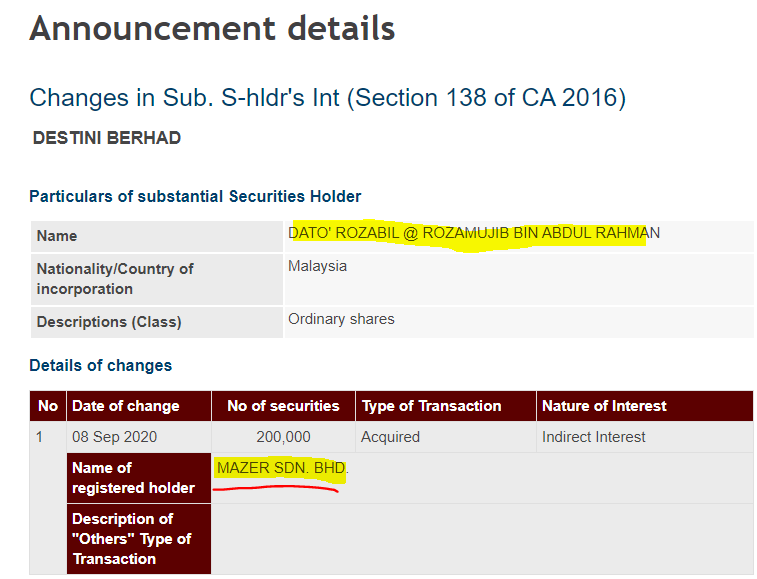

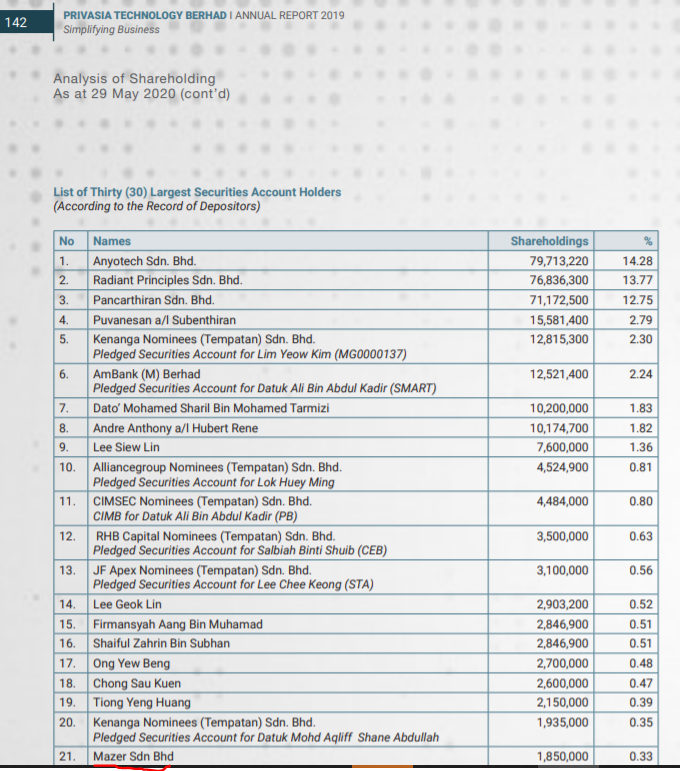

Something is brewing is PRIVASIA Technology Berhad! Dato' Rozabil Abdul Rahman bought a stake of PRIVA (Code 0123) via Mazer Sdn Bhd. Adopted from the recent Annual Report 2020. RANK 21!

- By the way, who is DATO' ROZABIL @ ROZAMUJIB BIN ABDUL RAHMAN?

Dato’ Rozabil entered Destini’s Board as an independent & non-executive Director in November 11, 2010 and was re-designated as the Destini’s Managing Director in January 3, 2011. He was later then re-designated to Group Managing Director on January 7, 2014 prior to becoming the President and Group Chief Executive Officer on April 19, 2018.

- Why Dato want to invest in PRIVASIA? Let’s see the Prospect of PRIVASIA

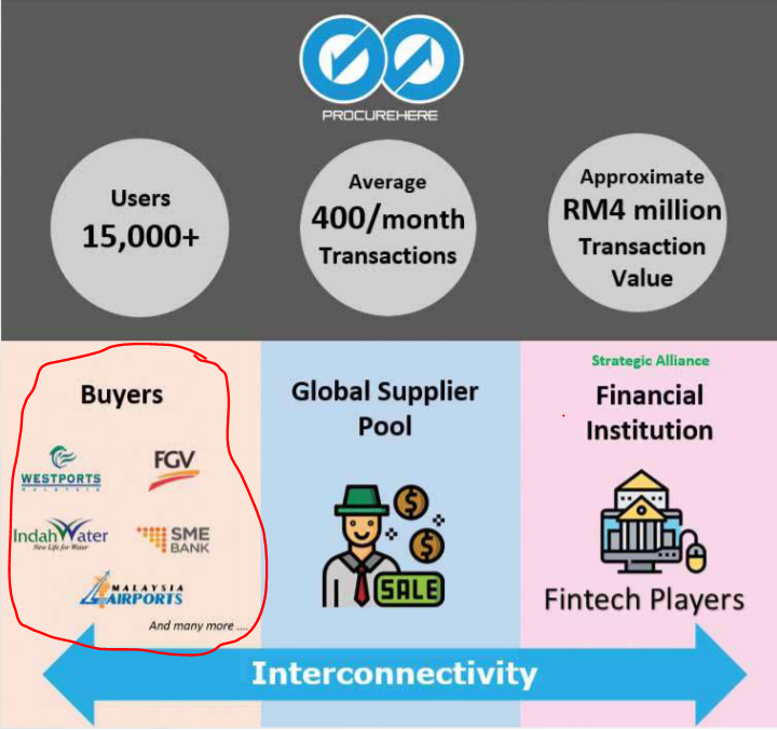

The pandemic has also offered new business opportunities for companies such as PRIVASIA as the need and demand grows for adoption and digitisation of business services. We believe in the value of our offerings to fulfil corporations’ requirements for cost- and operations-efficiency. Thus, we will leverage our expertise and continue to persevere to meet the demands in the industry. The IT division will remain the main revenue generator going forward, as the awareness and adoption of our Intellectual Property (IP) products, namely ProcureHere and Port Management Solutions continue to rise. We will also continue to deliver our outsourcing projects to our clients. Going forward, we will be actively looking towards enhancing our IP portfolio, particularly with next-generation technology. For Procurehere our eProcurement product have been getting interests which have been translating to new customers. We believe this product will contribute more to our revenue as we keep introducing enhanced value add features like: spend analytics, contract management and vendor management in Q3 2020. We have spent the better part of this year focused on the redevelopment of our Port Management Solution (iTap), to include a cloud-based version with more automation and data analysis features. As a result, we have managed to secure new contracts from existing clients to enhance their iTap experience including in areas of gate automation and paperless document processing. The new, enhanced solution, also allows us to target additional ports of different sizes with the better ‘feature and price flexibility’ in the offering. For our ICT division, we have expanded our service scope besides In-building Coverage (IBC) and Outside Plant (OSP) to the last mile enterprise services (on-net services). We have also added in a new major client into our portfolio. Despite various challenges, we will continue to deliver on our order book, with the current balance standing approximately at RM52 million. The Group will also be keeping a keen eye for any opportunities in the technology space to boost future performance.

- The private placement for working capital and future upcoming project

Priva launches the private placement assuming an issue price of 11 sen per placement share. "The board is of the view that the proposed private placement is an interim measure to address its immediate working capital requirements. As digitisation has shown to be significant in business continuity, the group has identified opportunities for companies to adopt digitalisation which include business automation and cloud management services," said Privasia.

"Payment of administrative and operating expenses, as well as payment to the group’s suppliers and/or creditors will allow the group to have the required financial resources to continue to carry out its operations including tendering for any upcoming projects," it added.

News adopted: Privasia Technology to raise RM6m to repay debt, working capital

- Technology Stocks with the customer based linked to Gov linked Company

One picture below explains all the reason why investors are keen on their Procurehere our eProcurement product have been getting interests. Project awarded from Destini is from government-based. Are they one of the users as well?

To be continue..

Join our Telegram Channel for our latest stock discussion.

All the information is available online and I compile for readers reference, this is not a buy call or sell call.

https://klse.i3investor.com/blogs/Privasia/2020-09-19-story-h1514207175-CEO_of_Destini_Berhad_bought_Substantial_Stake_in_Privasia_Technology_B.jsp