XINHWA (5267) XIN HWA HOLDINGS BHD - A Potential Forward PER at 1X? (Under Discovered Gem in EMS, after VS, SKPRES and ATAIMS?)

1. Introduction

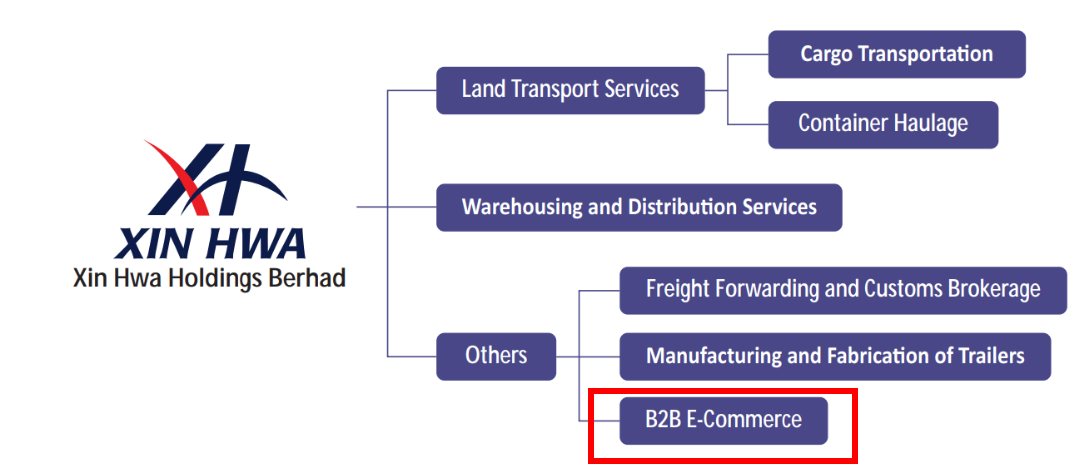

An Integrated Logistics Services Provider in Malaysia, Singapore, and Indonesia

XINHWA is an integrated

logistics service provider involved in land transport operations,

warehousing and distribution operations and other services. Their land

transport operations incorporate cargo transportation services and

container haulage services whereas other services incorporate freight

forwarding and customs brokerage services as well as manufacturing and

fabrication of trailers.

Source: Xin Hwa Annual Report 2019

Xin Hwa has ventured into the e-commerce business-to-business segment in 2019, where global e-commerce has been doing exceptionally well due to Covid-19.

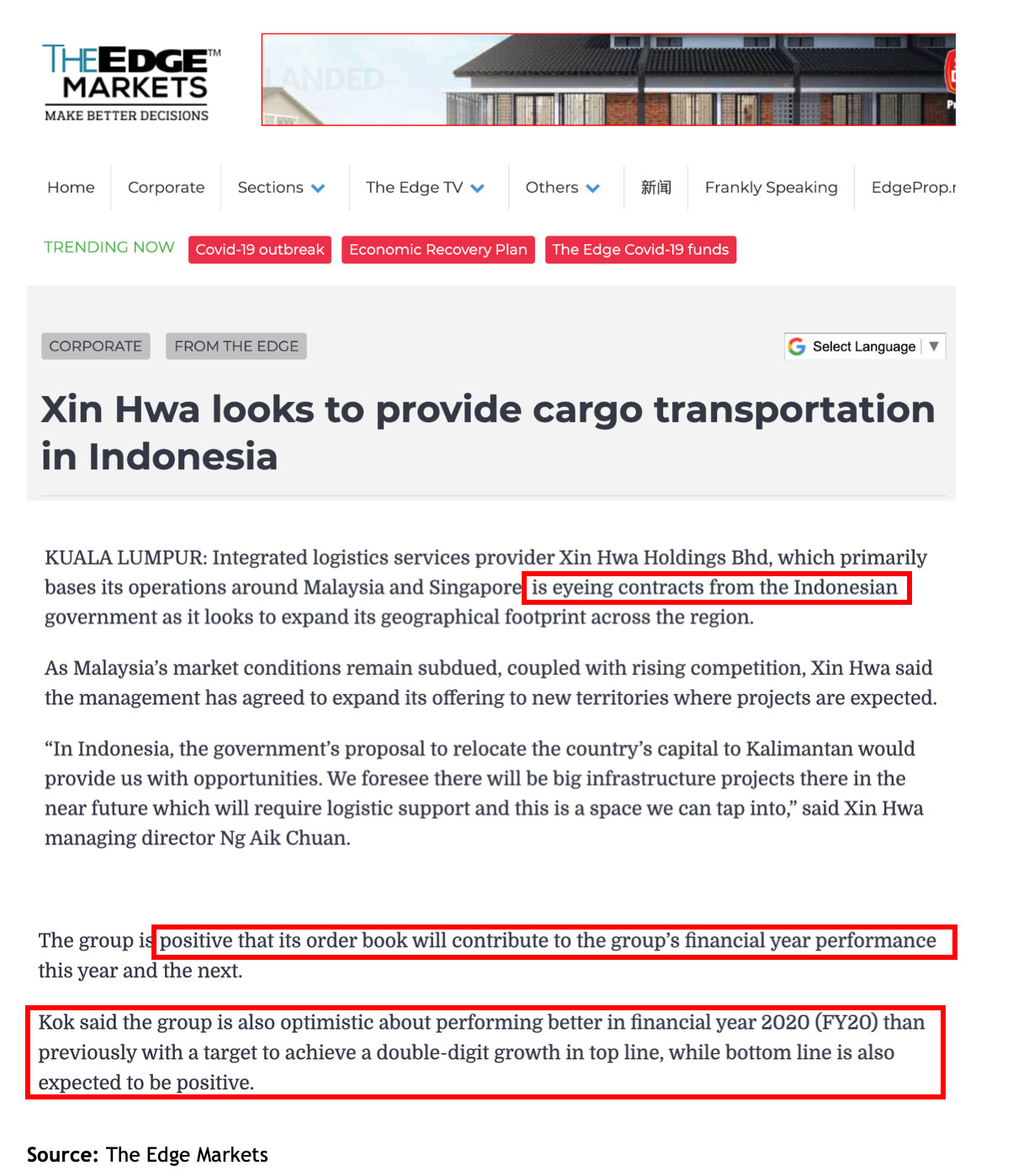

2. Eyeing Contracts from Indonesia

Group

is optimistic about performing better in the FY20, with a target to

achieve double-digit growth in top line, while bottom line is also

expected to be positive.

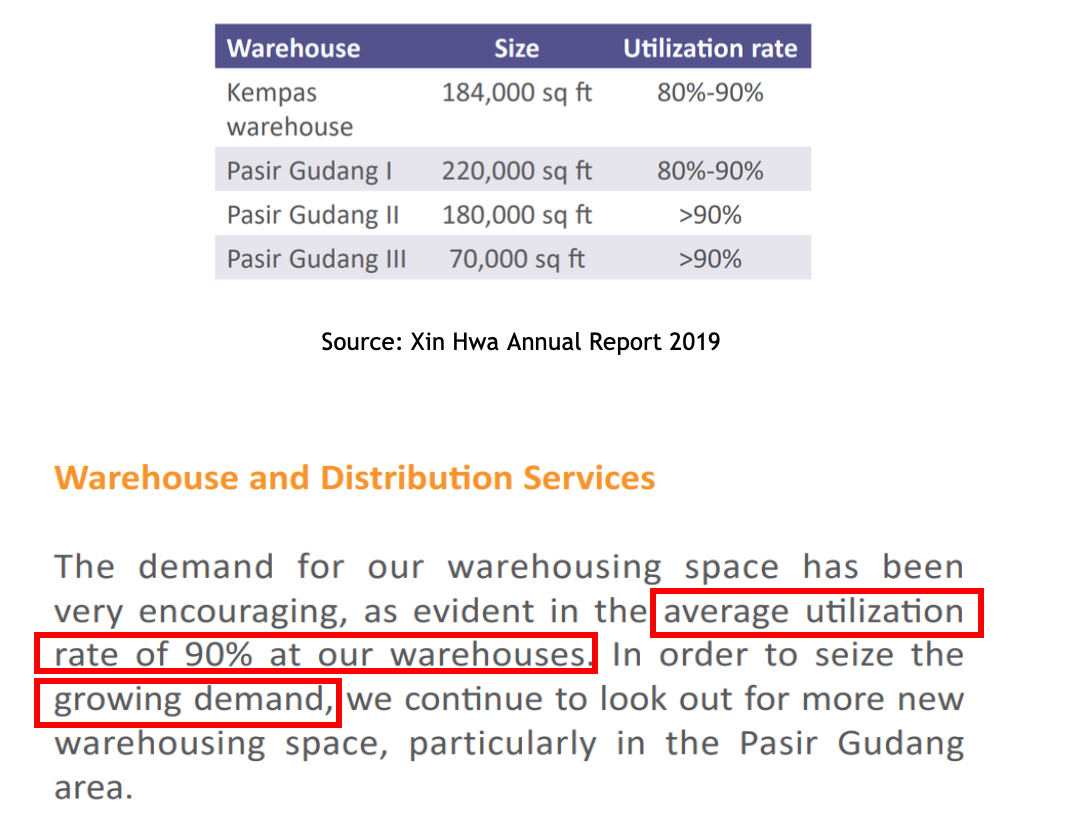

3. Strong Demand for Warehousing Space, even Before Covid-19

New Warehouse in Shah Alam will be Completed end of 2020, bringing Xin Hwa’s warehousing space close to 1 million square feet.

In 2019, Xin Hwa operates 4 warehouses in Johor with a total warehousing space of 654,000 square feet:-

New Warehouse in Shah Alam will be Completed end of 2020, bringing Xin Hwa’s warehousing space close to 1 million square feet.

The

construction for our E-Fulfilment Centre in Shah Alam is underway with

completion slated for 2020. The centre comprises a 7-storey office and a

3-storey warehouse. Upon completion, this would add an approximately

another 300,000 square feet of warehousing space, and thus, bringing Xin Hwa’s warehousing space close to 1 million square feet.

Source: Xin Hwa Annual Report 2019

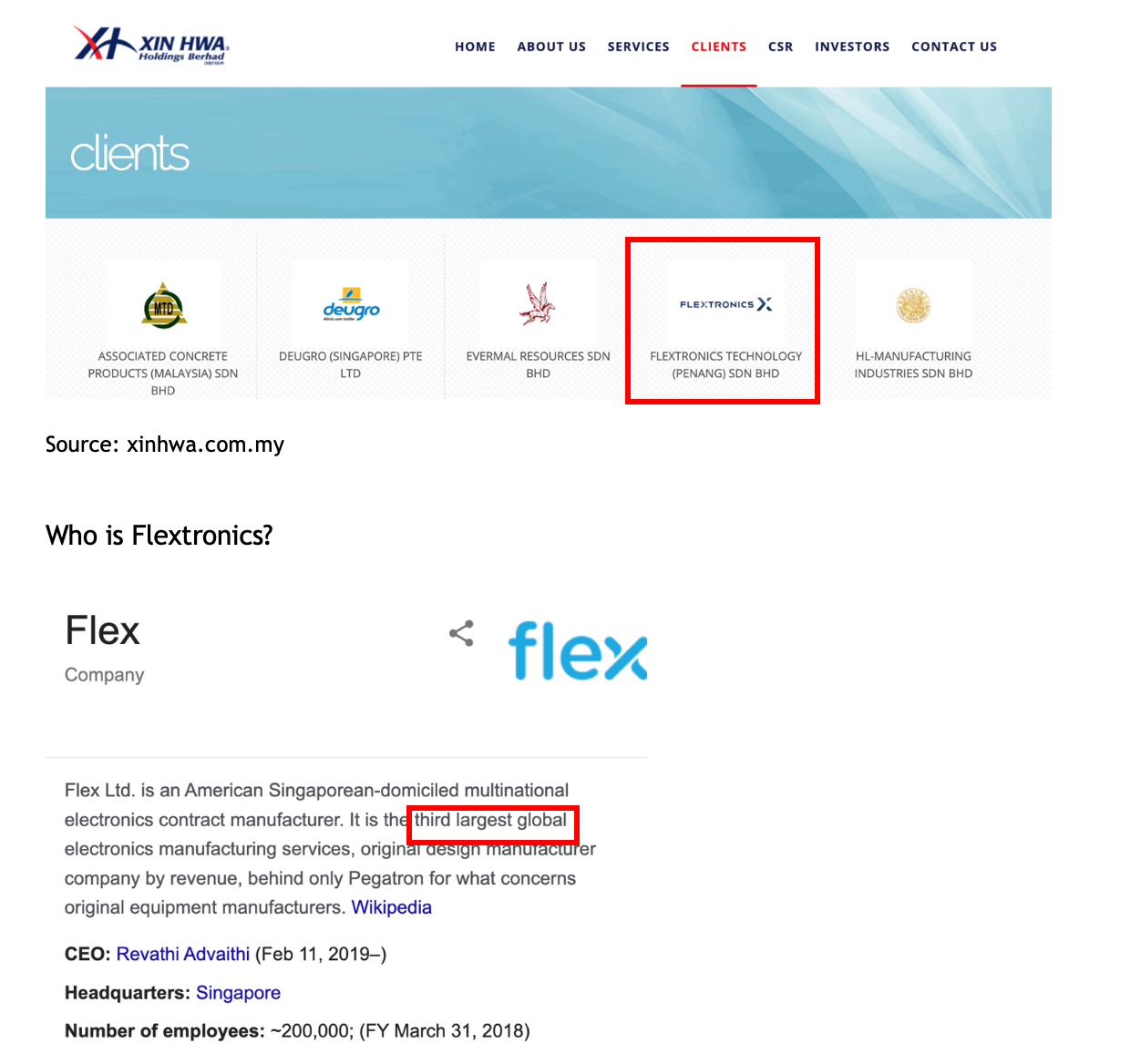

4. One of the Top EMS Players is Xin Hwa’s Existing Client?

Malaysian EMS Players benefited from US-China trade war, and now, Demand for Warehouse Surges further after Covid-19.

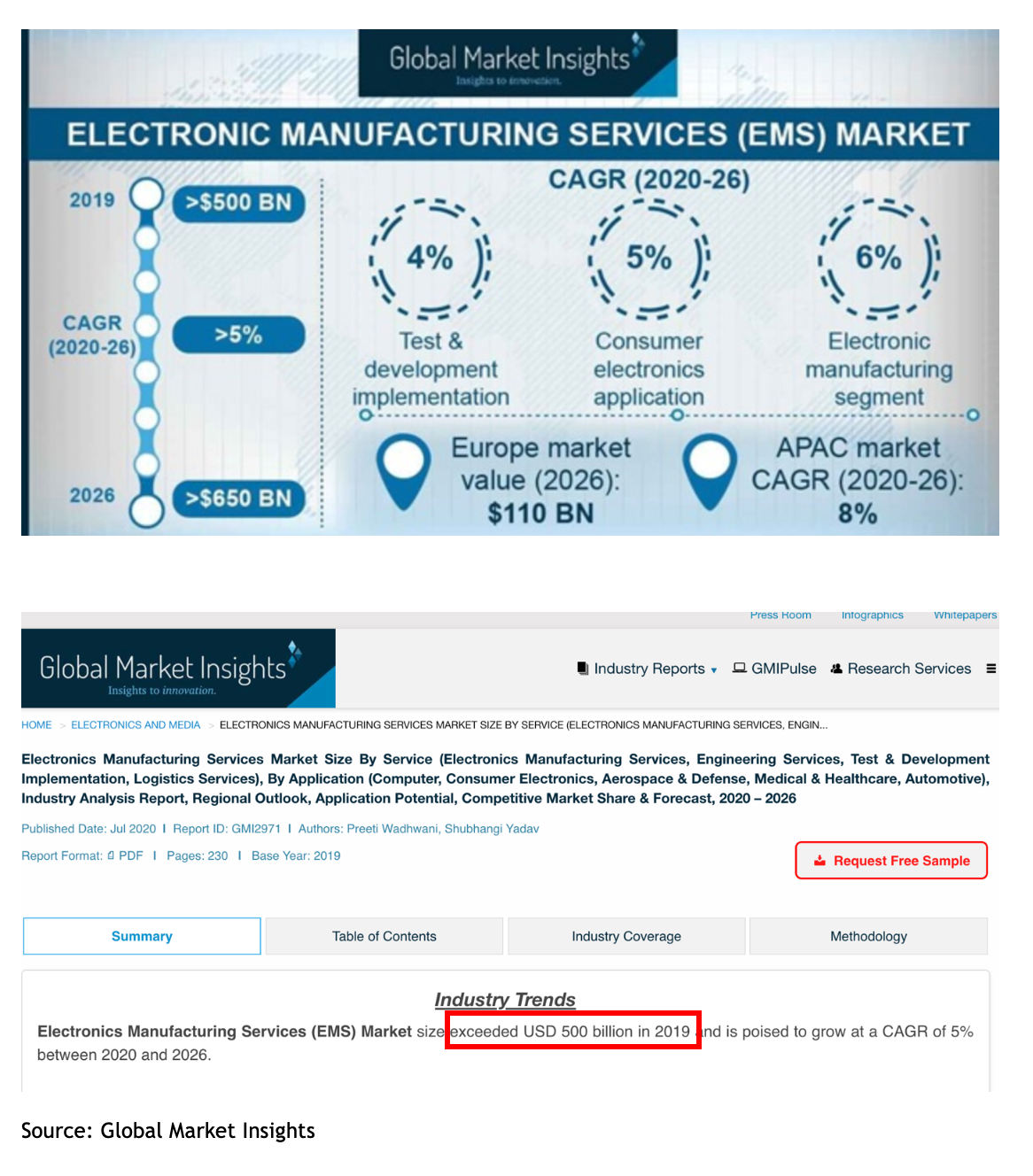

5. XinHwa, with Strong Demand in

Warehousing, A Potential Beneficiary for Electronics Manufacturing

Services (EMS) Market Size exceeded USD 500 billion?

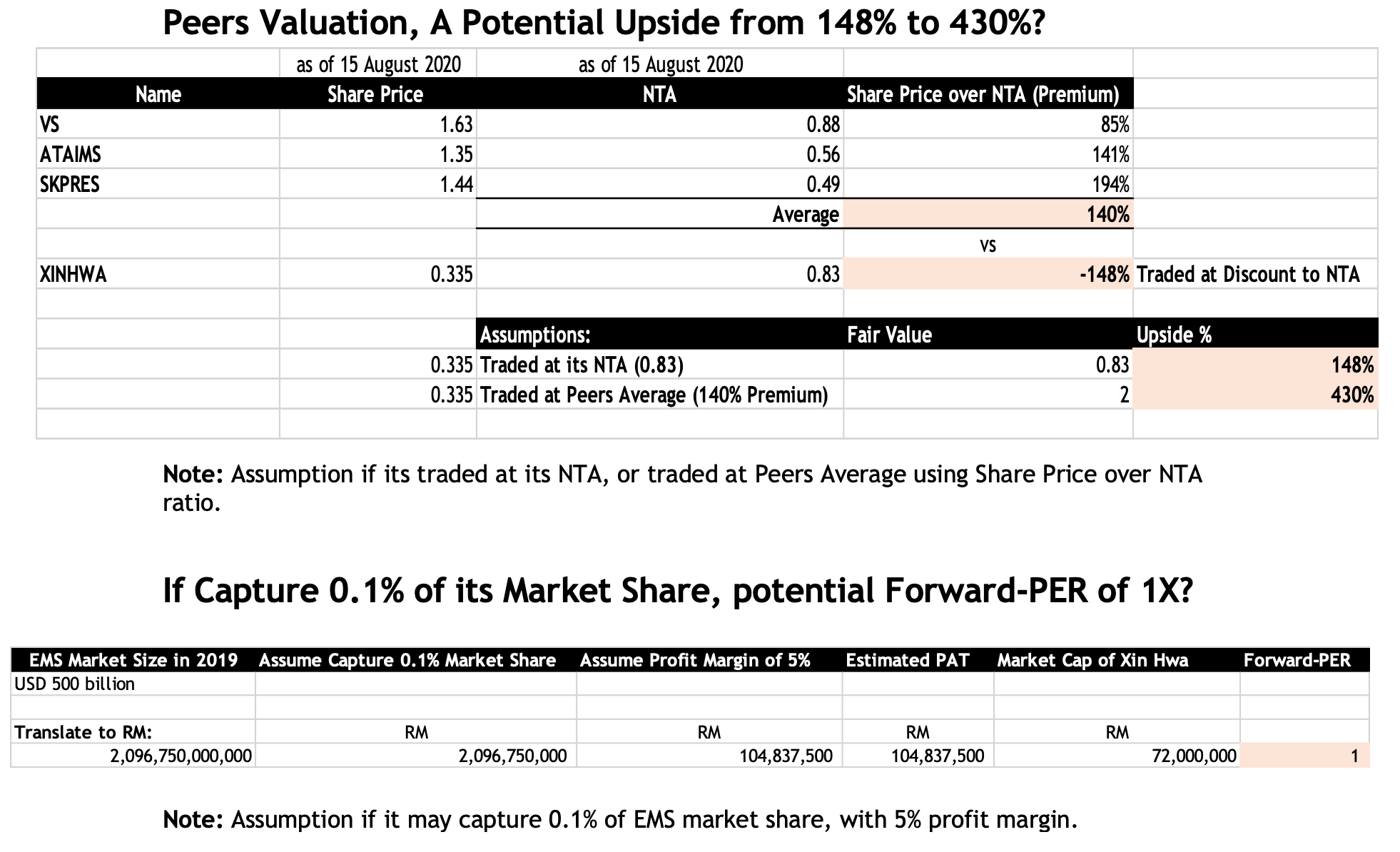

6. Valuation of Xin Hwa, against its EMS-related Peers

7. Appendices

Disclaimer:

This

writing is based on my own assumptions and estimations. It is strictly

for sharing purpose, not a buy or sell call of the company and the

contents of this report should not be

considered as professional financial investment advises or buy/sell

recommendations. I strongly encourage you to do your own research and

take independent financial advice from a professional before you proceed

to invest.

I make no

representations as to the accuracy, completeness, correctness,

suitability, or validity of any information on my report and will not be liable for

any errors, omissions, or delay in this information or any losses and

damages arising from its display or usage. All users should read the

posts and analysis the information at their own risk and we shall not be

held liable for any losses and damages.

https://klse.i3investor.com/blogs/findinggem/2020-08-15-story-h1512360197-XINHWA_A_Potential_Forward_PER_at_1X_Under_Discovered_Gem_in_EMS_after_.jsp

https://klse.i3investor.com/blogs/findinggem/2020-08-15-story-h1512360197-XINHWA_A_Potential_Forward_PER_at_1X_Under_Discovered_Gem_in_EMS_after_.jsp