This is my Long Term Value Pick for 2020.

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Telegram channel : https://telegram.me/tradeview101

__________________________________________________________

Long Term Value Pick 2020 : Sri Trang Agro-Industry PCL (Initial Fair Value SGD $ 1.90 / THB 43.20 )

This

is my third "Long Term Value Pick series for 2020". In the past, my

long term value picks include the likes of Allianz, QL, DKSH, RCE

Capital, Poh Kong, Riverstone Holdings, Oriental Holdings amongst

others. This does not mean I only have few stock which I like but rather

to be classified as Long Term Value Pick it must meet 5 of my stringent

criteria as below :

1. Strong, honest and capable management team / owner

2. Consistent Growth, Earnings & Dividend payout

3. Strong balance sheet & cash position / cash flow

4. Can hold across decades / generations without risk of delisting or bankruptcy

5. Undervalued & lack of appreciation from investors

It

is extremely hard to find a stock that can meet all the above mentioned

criteria. This doesn't mean all other stocks are lousy stocks but

rather, to find a stock that I am willing to lock in my funds long term,

it requires utmost justification as the time value of money must

correspond with the potential return otherwise it is an act of

futility.

So why did I pick Sri Trang Agro ?

Sri

Trang Agro-Industry PCL was founded in 1987 and IPO in Stock Exchange

of Thailand (SET) in 1991 at the price of THB 60 (Par value THB 10 -

today Par value THB 1). It subsequently did a dual listing in SGX at IPO

price of S$1.20. It remains the only dual listed Thai Stock in SGX

today. It is one of the world largest natural rubber supplier with 8%

global market share & glove manufacturer with 7% global market

share. Based on data from MARGMA, Malaysia as a country controls 65% of

world's gloves supply. The second largest country is Thailand with 18%

of world's supply. From this you can see, Sri Trang is the largest glove

manufacturer in Thailand. Whenever we talk about gloves, everyone

has heard about the "4 Kings" of the glove sector in Malaysia, namely

Hartalega, Topglove, Kossan and Supermax. Sri Trang Agro together with

the 4 are known the Big 5 with Sri Trang Agro coming in number 3, bigger

than Kossan with an annual capacity of 33 Billion gloves.

The

Chairman and founder of the company, Mr Viyavood Sincharoenkul was PHD

graduate in Chemistry from Queen Mary University, London. He originally

returned to Thailand after graduation for a short visit as he was

supposed take a Professorship in United States however he joined a

rubber company in Hat Yai, Southern Thailand before setting up their own

small outfit. with his father (who retired) renting a small rubber

factory in 1987. The rest is history. Sri Trang is part of SET 100 index

and as a fully integrated rubber player with their own rubber

plantation, natural rubber latex processing facilities and glove

manufacturing factories, Sri Trang controls end to end process from

upstream to downstream.

Unlike

Malaysia where there are many world class glove manufacturers supplying

to international markets such as Hartalega, Top Glove, Kossan,

Supermax, Riverstone, Comfort amongst others, Thailand has few world

class players (many of which has JV with foreign firms) with the market

leader being homegrown Sri Trang Agro. Sri Trang Agro is the Hartalega

& Top Glove of Thailand enjoying a strong legacy and dominant

position via their associated company Sri Trang Gloves. In fact, Sri

Trang Gloves recently IPO at THB 34 whereby Sri Trang Agro still retains

51% stake and released 20+% for unlocking of value in the IPO exercise.

The performance of Sri Trang Gloves was truly phenomenal more than

doubling since July 2020.

In addition, the company controls also another listed company by the name of Thai Rubber Latex Corporation which is mainly in the business of supply of natural rubber latex raw materials for many products such as tyres, medical devices, gloves and others. Sri Trang Agro controls the end to end process as they cultivate the rubber plantation with over 7200 hectares and manufacturing facilities to process concentrated latex. They also have their own distribution arms and ventures in various overseas markets such as Myanmar, Indonesia, Shanghai, Qingdao etc. Even Malaysia gloves manufacturers purchase their raw materials from Sri Trang Agro over the years. This is especially applicable to latex gloves producers. Furthermore, they have foreign partners like Austrian Semperit and Japanese Itochu in the early years though today they are mainly running business fully in control.

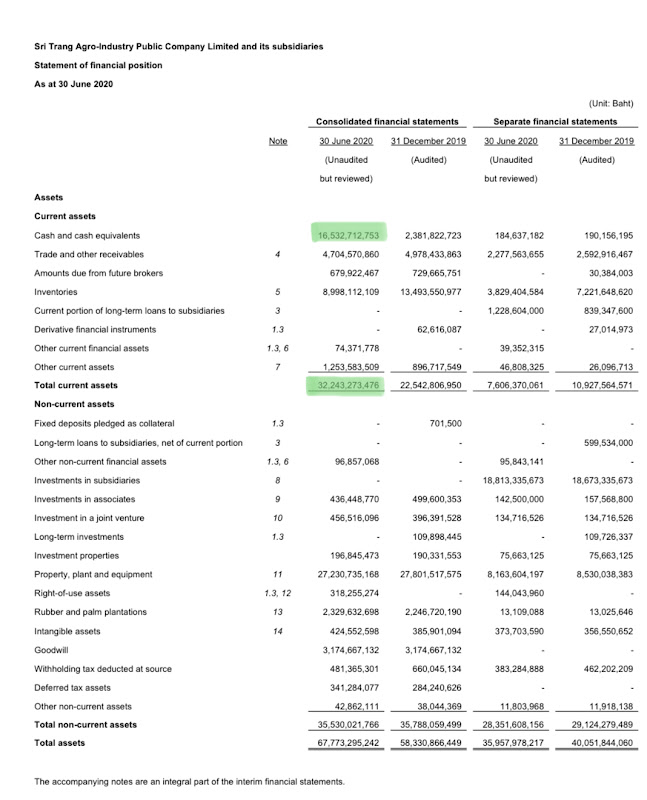

3. Outstanding Financials and Balance Sheet (Updated with Q2 2020 Results)

What is important to us will always be the strong financial numbers and balance sheet of of a company before investing. Sri Trang Agro fulfils this criteria. We believe the reason they can manage well although they have huge exposure to the commodities cyclical nature as one of the largest supplier of natural rubber latex in the world is their ability to have end to end control via their own products developed (Gloves) instead of solely relying on their MNC clients in the automotive, logistics, healthcare & other sectors to take orders for the natural rubber latex raw materials. Have a look at the numbers for a 6 months period below :

What is important to us will always be the strong financial numbers and balance sheet of of a company before investing. Sri Trang Agro fulfils this criteria. We believe the reason they can manage well although they have huge exposure to the commodities cyclical nature as one of the largest supplier of natural rubber latex in the world is their ability to have end to end control via their own products developed (Gloves) instead of solely relying on their MNC clients in the automotive, logistics, healthcare & other sectors to take orders for the natural rubber latex raw materials. Have a look at the numbers for a 6 months period below :

Sri Trang Agro current assets as not June 2020 stands at THB 32.2 Billion, whereas the total liabilities (non-current & current) stands at THB 25.5 Billion. This means the current assets alone is sufficient to cover the total liabilities. This is extremely impressive. Due to the recent strong earnings in the latest 2Q2020 results, the cash balance stands at THB 16.5 Billion. Similar to other Big 4 gloves players, the cash received from the strong sales exceed expectations although it is not yet fully net cash companies, it is close to it.

At

today's price of THB 26 / SGD$1.21 (Sri Trang Agro SG trading at slight

premium to Sri Trang Agro Thai), it is extremely low compared to the

actual value be it book value or earnings yield. Please note that we

first shared above Sri Trang few months back when we highlighted

Riverstone. The

thing is Riverstone has went up to $4.08 today where as Sri Trang Agro

SG is still trading at only $1.21. If we summarise the financial

numbers, it can be read as below based on trailing quarters :

Trailing PER = 9X

Forward Dividend Yield = 2.88%

ROE = 7.41%

The

results EPS is THB 0.71 for recent 3 months QR & 6 months June

2020, the EPS is THB 1.27. Assuming we annualised the EPS by 4 Quarters,

it is THB 2.84 for full year. At current price of THB 26, it is only

trading at 9x. At 2ox PER, the fair value should be worth THB 49.60.

However, we must not forget that Sri Trang Gloves went for IPO in July

2020. So there will be minority interest calculation moving forward. I

will explain further below

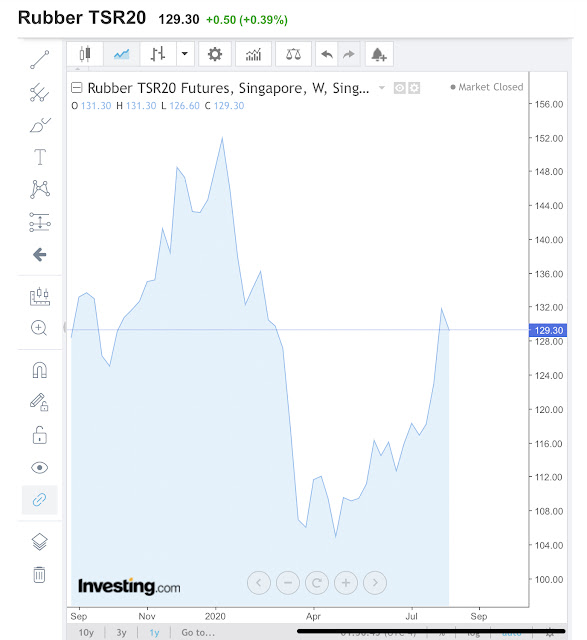

4. Future & Continuous Growth Potential + Improving Outlook (Both Commodities & Sector Tailwind)

This

stock is clearly a beneficiary of Covid-19 pandemic and also affected

by the demand shock resulting from the pandemic to their natural rubber

latex supply. Thankfully, following the lockdown globally, the pent up

demand is driving the increased demand & price for TSR, RSS and

Latex concentrate in the coming months. In fact, even the commodities

prices have performed much better compared to April & May surging

above pre-Covid 19 level. Have a look at the chart below :

5. Value Growth Investment - How Cheap is Sri Trang Agro-Industry?

With

the share price being consistently whacked down, even when it

rebounded, it was dumped again. This repeated many times for Sri Trang

Agro. At some point, I even wondered whether I made a huge mistake. Some

of my subscribers also constantly voiced their concerns to me as they

were worried with their diminishing profits. I too was worried that

their natural rubber supply division would be impacted severely that the

profits from their glove division wouldn't be enough to compensate.

After all, the biggest users of natural rubber was the automotive &

logistics sector (tires). Clearly, the irrational price movement also

affected my confidence and state of mind. But I held on.

From

the results, indeed revenue fell 12% QoQ but thanks to the gloves

divisions, the net profit was still able to grow 28% QoQ and 305% YoY.

The best part is, because of the overall market sentiment and lack of

confidence of investors whereby no one expect it would do well, the

continuous sell off has resulted it to be so cheap and laggard compared

to peers as well as value for the entire company. Our valuation of its

true value after factoring the minority interest given the IPO of Sri

Trang Gloves in July 2020 are as below :

Net profit Q2 - 2020 : THB 1.094B

Total Shares issued : 1.54B

EPS for the Q2 : 0.71 sens

Annualised 4Q : THB 2.84

At 56% shareholding post IPO (Prior IPO was 81%), combining Sri Trang Agro & subsidiary Rubberland Products Co Ltd. :

PE 15x - THB 32.40 (SGD $1.43)

PE 20x - THB 43.20 (SGD $1.90)

PE 25x - THB 40.09 (SGD $2.16)

Currently

it is only THB 26, which is a single digit below 10x PER valuation with

a strong forward earnings outlook and coming rebound in natural rubber

price & demand. I haven't even factored in further ASP hike,

capacity expansion of their gloves division, rebound in natural rubber

price & most importantly the arbitrage gap between Holding Co

discount & Subsidiary Sri Trang Gloves which is trading at 30x PE

last week prior results announcement. Originally when I saw Citigroup

research and TP of Sri Trang Agro was THB 71 (base case), I was thinking

this is too bullish. Now, all I can say, it is not impossible.

6. Conclusion - To Invest?

The

ever changing landscape of healthcare, hygiene and sanitisation will

spur continued growth of Sri Trang Gloves and with additional capacity

brought forward, Sri Trang is poised to maintain its position amongst

the world Big 5 gloves manufacturers in the world. The potential is

limitless with new markets and demand globally. Even if the demand may

normalise once a vaccine is found, the behavioural change is set in

motion just as how SARS pandemic brought about different approach when

it comes to utilising PPE and attitude of healthcare professionals in

handling patients. Furthermore, the automotive, logistics and healthcare

sector will continue to help sustain demand even after the pandemic.

Either way, heads you win, tails you win. Sri Trang's business model

paid off where it controlled end to end from raw material supply to OEM

of finished product. It is just like a chef who is good at cooking &

selling Nasi Lemak, he owns the anchovies farm, paddy field and sambal

processing facilities which he supply himself for his Nasi Lemak but

also sell to other F&B restaurants at the same time.

For

those who likes such a company and would want some overseas investment

exposure, one can consider Sri Trang Agro-Industry PCL. As it is dual

listed, you can consider Sri Trang Agro Singapore instead of Sri Trang

Agro Thailand as not everyone can access SET. We

are personally invested and we believe this company will keep growing.

This was a difficult and complex analysis due to the many parts and

subsidiaries, associate companies involved but it was worth it. Simply

because, it is the cheapest and most laggard glove stock at the moment.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

https://klse.i3investor.com/blogs/tradeview/2020-08-16-story-h1512363758-_Tradeview_2020_Long_Term_Value_Pick_3_Sri_Trang_Agro_Industry_Biggest_.jsp