Dear fellow readers,

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Telegram channel : https://telegram.me/tradeview101

__________________________________________________________

31st

August 1957 will always be a historical and meaningful day in the

hearts of all Malaysian. Whenever I see the chants of Merdeka by Tunku

Abdul Rahman, there is a feeling of nostalgia and great pride that

flutters in my heart. I am not able to explain that emotion. It closely

resembles the moments when I witness our Malaysians athletes competing

at Olympics.

I

have much admiration of the leaders and founding fathers of our

country. The hardship and journey endured to bring up a small diverse

nation like ours is extremely difficult. What makes it harder is

liberalising the country from the shackles of colonisation of the

British Empire and forging an uncertain future. Here we are now 2020,

the start of a new decade where the world is divided, volatile and

fearful in the face of Covid-19 pandemic, Trade War between US &

China and protests raging on in various parts of the world. Will there

be a resolution to these issues we are facing?

A

global pandemic of this scale was not what I imagined how the new

decade would begin. Domestically, a change in government mid way through

a 5 year term was a rude awakening. Then came the global lockdown of

unprecedented speed to contain the pandemic came underway. This showed

the resilience of mankind. No matter what challenges were thrown at us,

we adapt.

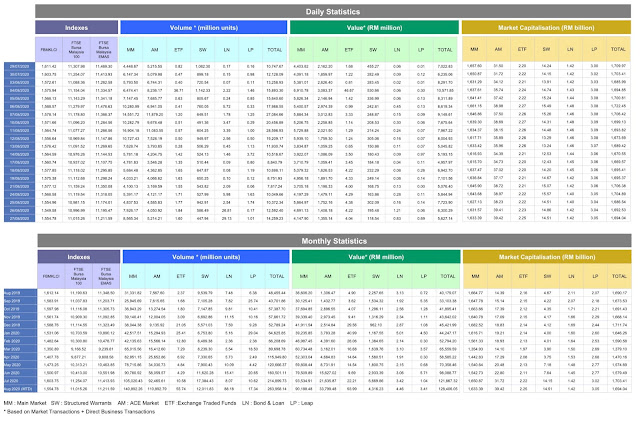

KLCI

Index was trading at 1554 points as at 2nd February 2020, it then

plunged to a low of 1207.8 points on 19th March 2020 before rebounding

to a high of 1618 on 29th July 2020 and settling at 1525 as of 28th

August 2020. What a roller coaster ride for the market and investors.

We

have witnessed records being made as well in KLCI with the highest

every retail participation for the year. Bursa volume hit record high

on 11th August 2020 with 27.8 Billion shares traded whilst Bursa value

hit record high on 4th August 2020 with 10.45 Billion. August 2020

was even a Bursa historical record high in volume and value for the

month with 264 Billion units traded and RM 128 Billion value traded. What

does this signify? Well, if any investors were able to buy / invest

shares during the March plunge and hold it through to August months,

they would probably have made one of the best returns from the share

market in their lifetime. At least for me personally, I can say, this is

the best year in investment returns in the shortest span of time since I

started investing my first dollar.

I

would bet my dollar that 90% participants in the share market must have

invested or held gloves stocks at any one point in 2020. Most would

make money. Similarly, I would also bet that the number of those

invested in gloves stocks have reduced following the onslaught of

negative news flows from Russia's Covid-19 Vaccine, Maybank's Windfall

Tax Research Report, AmBank Downgrade of Glove Sector to Neutral, JF

Apex Cutting of Gloves Stocks Target Price, Bloomberg Negative Comments

on Profit Taking from Fund Managers and so forth. This would have cause

substantial anxiety to other investors who are still holding on to the

Glove stocks. With MSCI Inclusion, Bonus Issue and Top Glove results in

mid September, those who are invested must have a deep conflict whether

to continue holding or just lock in profit and move on. At least, I have

received the plenty of questions on this.

I

have written on the Gloves Sector extensively before. I wont repeat

here in detail, for those who missed it, you can read it here again : http://www.tradeview.my/2020/06/tradeview-2020-in-conclusion-is-glove.html

The

Glove Sector was not built overnight. Today, Malaysia controls 65% of

world supply with the next country being Thailand & then China at

18% and 10% respectively. Malaysia's industry developed through sheer

competitiveness, innovation and entrepreneurial spirit. In short, it is

real "Kung Fu", not fly by night con job tactics. The Glove Sector is

also not the face mask or PPE sector. It is not easily replicated, it

has high barriers of entry and there is no supply glut / potential

supply glut. Unlike Face Mask & Covid-10 test kits :

Ex : face mask has a ceiling price which the government revised multiple times downwards. There is a supply glut in China.

Ex

: Covid test kit is now affordable and fast with the latest being from

Abbot Labs which cost only $5 per test kit which gives results in 15

minutes.

Hence,

it is right for investors to be fearful if they have chosen to invest

in companies that ventured or announced MOU on producing face mask /

distributing Covid-19 test kits. The same is not applicable to Gloves.

The industry consolidated from 300 players in the 1990s to only about 40

players today in Malaysia with 20 world class suppliers. The industry

went through intense R&D innovation with little support from

Government, safety & quality standards certification and goodwill

building with clients globally. Even the sector as a whole has evolved

from vinyl plastic gloves to latex gloves to nitrile gloves. We all know

Nitrile Gloves are what set us apart from our Thai and China

counterparts. The king of Nitrile Gloves are right here in Malaysia -

Hartalega, Riverstone, YTY, Kossan, Supermax and Top Glove.

Gloves

Sector is the only true bright spot in KLCI. It is also the glove

stocks that single handedly lifted our index back to positive territory

with substantial weightage today. Who would have thought that gloves

(which is sold $10 sens per piece) would surpassed banks, casinos,

plantation, utilities, telco, consumer and tech stocks in both value and

volume invested? Hence this is why, Malaysia has a something unique to

offer to the world which cannot be found elsewhere. Gloves did the

extraordinary and placed Malaysia in global stage - for the betterment

of mankind in the fight against Covid-19 pandemic. Personally,

I am happy to root for the run to continue not only because I am

invested but because this is one the rare occasions that Malaysia has a

significant role to play in contribution towards mankind &

humanity.

Decision - To Take Profit or To Continue Riding?

I

think before making any decisions, one must always know what is the

pros & cons. This must be done in light of your own personal

situation / background and recalibrate that fact with the pros &

cons before deciding. One should not blindly follow newsflows. Just as

there are good analysts & lousy analysts, there are also competent

& incompetent fund managers and there are accurate newsflows &

inaccurate newsflows too. Also, please do not listen to tips or follow

prominent investors. You

must consider holistically before deciding making your investment

decision. I will share a few simple example which I hope can shed some

light on making the right decision :

1.

If you have substantial position invested in Gloves, you can consider

taking 50% profit and ride the balance. This way you can protect your

profit and enjoy the potential upside as well without having to run the

full risk along the gyrations and volatility.

2.

If you do not have a meaningful size in Gloves, you can consider to

just continue riding all the way past Bonus issue and into the future

quarterly results. This is because your position is small to make a dent

in your overall portfolio, there is no harm riding.

3.

If you have invested early and sitting on substantial profits (profits

you have never experienced in your life), you are contented with the

profits and do not want to stomach the risk of gyrations, then please

sell all your holdings and enjoy the fruits of your investments.

I was

reading an article from a local newspaper over the weekend equating

gloves with face mask & PPE, calling it game over for Gloves. This

is the ignorance of people in position to influence market participants.

There will be even more such negatives newsflows along the way. For

me, I am of the view that the market has not fully understand the

impact of the earnings of the Glove sectors. Currently, with only 2

quarters into supernormal profits in an unprecedented global pandemic

with future earnings lock in for at least another 4 quarters, whilst the

entire economy is in shambles, it is too early to throw in the towel.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought: https://klse.i3investor.com/blogs/tradeview/2020-08-31-story-h1512628092-_Tradeview_2020_Celebrating_Our_National_Pride_Gloves_on_Merdeka_Day.jsp