HIL Industries Berhad is a relatively unknown company, but dive into the quarterly report and you'll find that it's very healthy with NO DEBT and a cash per share of a WHOPPING RM0.32 per share!

Latest Q report:

https://www.malaysiastock.biz/GetReport.aspx?file=2020/8/27/8443%20-%201706488832146.pdf&name=HIL%20-%20Financial%20Results%20Q2%202020.pdf

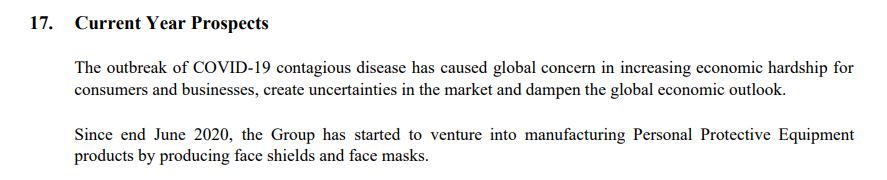

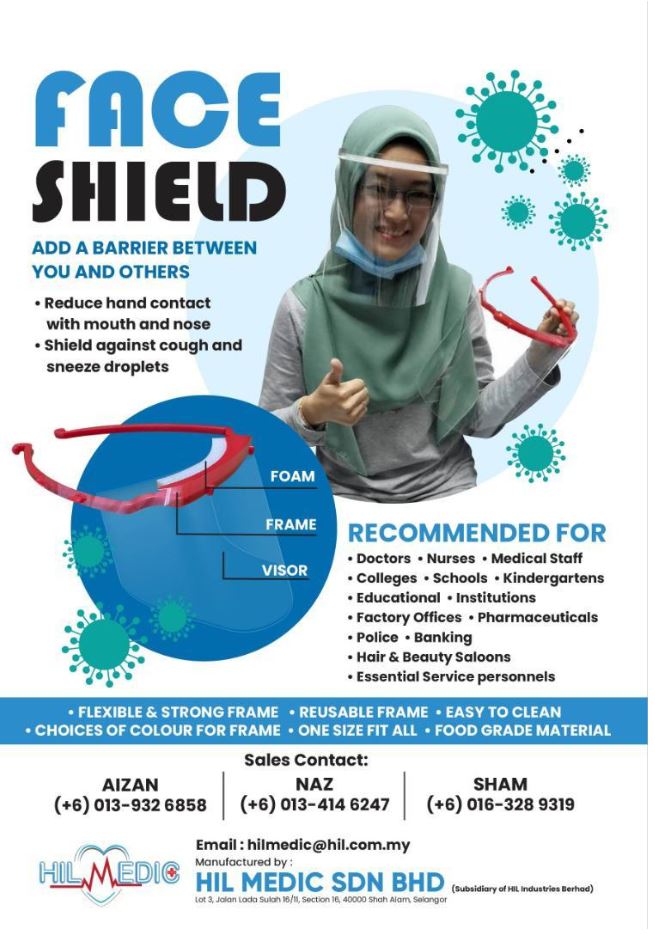

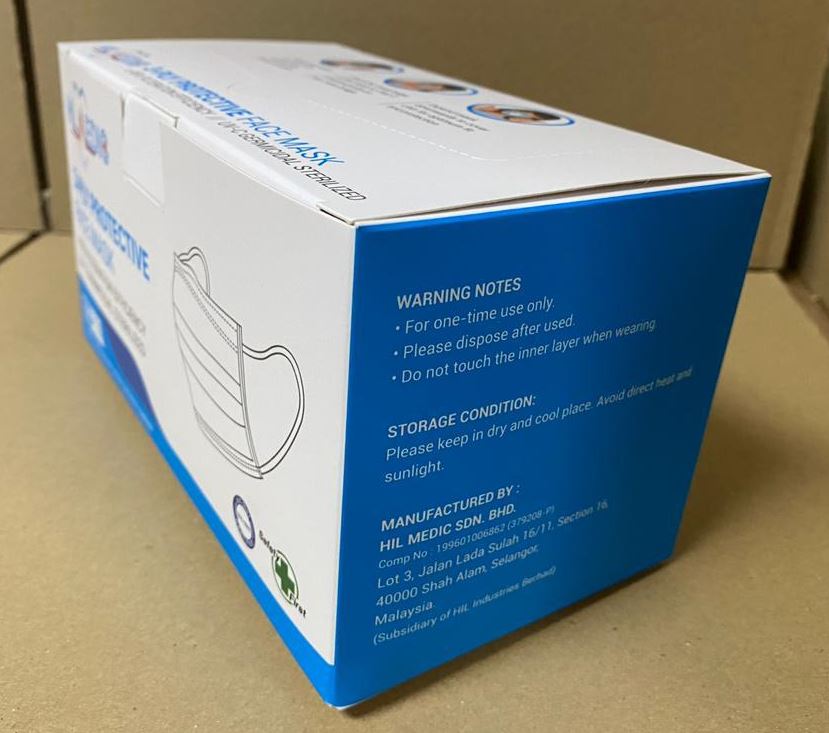

There you can find that they are starting to get into PPE in view of the COVID 19.

There are many companies moving into this space, let's take one as an example.

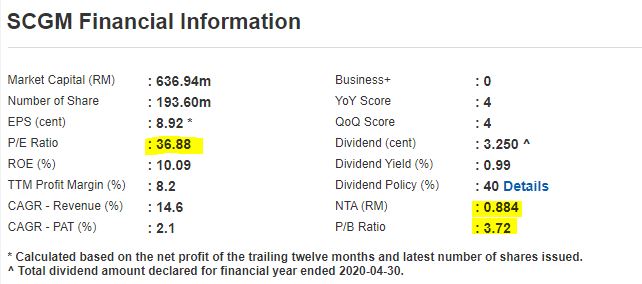

SCGM has been flying since it announced that it was getting into PPE. You can even see it in their front page of their CSR report. https://www.malaysiastock.biz/GetReport.aspx?file=AR/2020/8/28/7247%20-%201324394191185.pdf&name=SCGM%20Bhd%20Sustainability%20Report%202020%20Part%201.pdf

Looking at SCGM's valuation of > 35PE that's what we're expecting from PPE players which are not loss making.

HIL on the other hand is sitll very early in the climb and it's valuations are significantly cheaper, not to mention it's balance sheet is superior. (SCGM is in a NET DEBT position of 44c/ share).

Technically the upleg is very early:

Don't be scared about the price movement. This stock can easly be worth RM1.60 (PE of only 25).

Look at my last blogpost on Frontkn. I recommended it at 33c, and people said that it moved up from 18c so it was too late.

Today it is RM3.80.

Let's get that 100% profit.

https://klse.i3investor.com/blogs/100percentprofits/2020-08-31-story-h1512627259-The_Sleeping_King_of_the_HIL_New_PPE_and_Mask_Player.jsp