SAMCHEM (5147) SAMCHEM HOLDINGS BHD : Healthcare Related Play with Evergreen Products

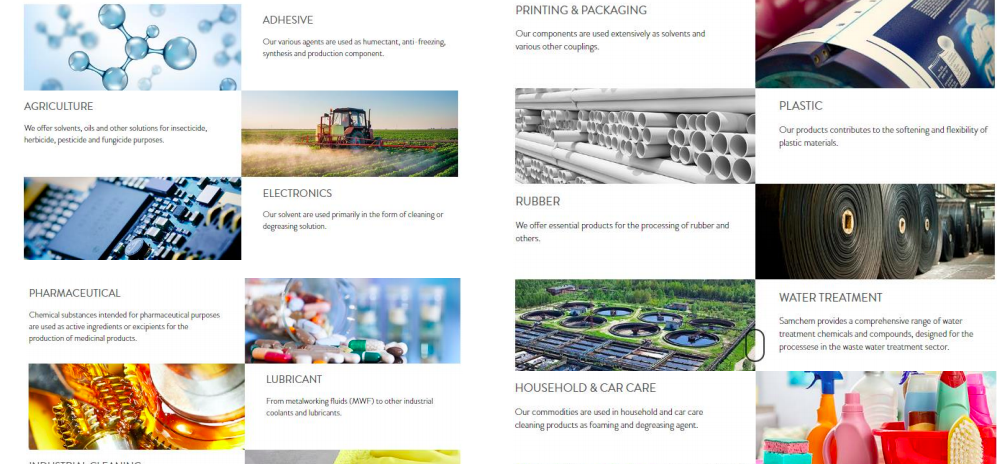

SAMCHEM is an established regional chemical distributor. Samchem distributes industrial chemicals and

specialty chemicals across the region, including Malaysia, Vietnam,

Indonesia and Singapore. The group supplies about 500 types of

petrochemicals to over 7,000 clients across various industries, such as rubber, pharmaceutical, plastic, automotive, personal care, agriculture and etc.

Source: SAMCHEM website

1. Have Been Growing in the Past 30 Years (Experienced a few times of Crisis) and May Continue to Grow

Samchem

started operations as a chemical distributor in Malaysia in

1989. Today, the Group has subsidiaries around South East Asia and is

continuing to expand its network in the region.

2. Samchem companies are in the Supply Chain (as chemical raw material distributor) to Essential Goods Manufacturers

While

supply chains were affected during the Movement Control Order (MCO),

Samchem was allowed to operate because chemical products are considered

essential goods.

Samchem supplies to Essential Goods Manufactures (hand sanitisers, disinfectants, personal and household care, gloves, some personal protective equipment,

as well as the printing and packaging associated with all these

products) and were able to meet the demand from these manufacturers in

spite of the lockdowns.

Samchem

may see increase in demand of hand sanitisers, disinfectants, personal

and household care which caused a surge in demand for ethanol-based

products.

3. Anticipate impending improvement in demand for chemicals

Besides

a surge in demand for ethanol-based chemicals during MCO, there is

increase in demand for chemicals used in the packaging, and

petrochemicals, as most industries started their operations since the

RMCO.

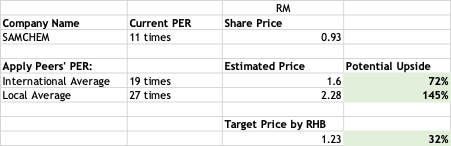

4. Highest ROE but Cheapest Chemical Player among Peers - with Potential Upside of more than 100%?

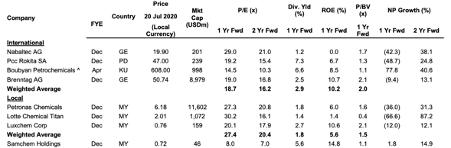

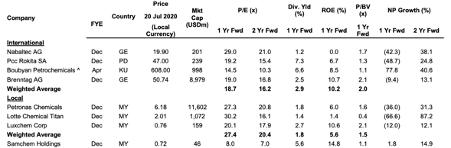

Source: RHB estimates, Bloomberg

If you look at Samchem’s valuation and its peers, it was only traded at 1 year forward PER at 8 times.

By using whichever valuation metric, SAMCHEM appears to be extremely attractive.

In the PART II, some of the details may be discussed especially on how

Samchem benefited from its direct and indirect customers as a Essential

Goods Manufacturers in hand sanitisers, disinfectants, personal and

household care, gloves, some personal protective equipment.

That will give a clearer picture of SAMCHEM as one

of the best healthcare plays with its defensive business model, strong

dividend yields and indirect beneficiary of strong demand in PPE sector.

Disclaimer:

The information is provided for

information only and does not constitute, and should not be construed

as, investment advice or a recommendation to buy, sell, or otherwise

transact in any investment including any products or services or an

invitation, offer or solicitation to engage in any investment activity.

It is

strongly recommended that you seek professional investment advice before

making any investment decision. Any investment decision that you make

should be based on an assessment of your risks in consultation with your

investment adviser.

https://klse.i3investor.com/blogs/chemicalguy/2020-08-01-story-h1511473032-SAMCHEM_Healthcare_Related_Play_with_Evergreen_Products.jsp