Join our Telegram channel for stock and market insights:

P.I.E

GRABBING THE RM1 BILLION PIE

ANOTHER EMS GEM AFTER VS?

HIGHLIGHTS-

PIE, A LESS-KNOWN EMS PLAYER DUE TO SMALLER MARKET CAP OF RM0.6 BILLION

-

CONSISTENTLY PROFITABLE FROM 2013 UNTIL 2019, WITH AN AVERAGE ANNUAL PAT MARGIN OF 6.8%

-

RECORDED HIGH EMS DEMAND, RUNNING AT FULL CAPACITY SINCE JUNE 2020

-

GROWING GLOBAL CONSUMER ELECTRONICS MARKET, PIE CAN GET A ‘PIE’

-

TARGETTING RM1 BILLION REVENUE GENERATED FROM AN ALREADY-SECURED, BIG, GLOBAL-PLAYER CUSTOMER

-

RM1 BILLION IS A RECORD-HIGH REVENUE, AT THE SAME TIME EXPECTING INCREASED SHIPMENT AFTER A YEAR

-

PROXY: THE EMS LEADER, VS, IS DOING WELL

-

HAVING A SUBSIDIARY SPECIALISING IN MEDICAL DEVICES, ISO-COMPLIANT, USA & EUROPE CUSTOMERS

-

BUSINESS RISKS: COMPLEXITY OF EXECUTION, CHANGING TRADE-WAR SITUATIONS & COVID-19 DEVELOPMENT

-

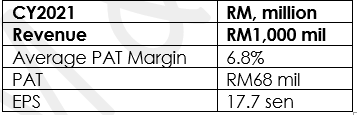

ASSUMING RM1 BIL

REVENUE ACHIEVED & AVERAGE PAT MARGIN OF 6.8%, PIE WILL GENERATE A

PAT OF RM68 MIL IN 2021, EQUIVALENT TO AN EPS OF 17.7 SEN. AT A SHARE

PRICE OF RM1.70, PIE IS TRADED AT A FORWARD 1-YEAR PER OF JUST 9.6X

-

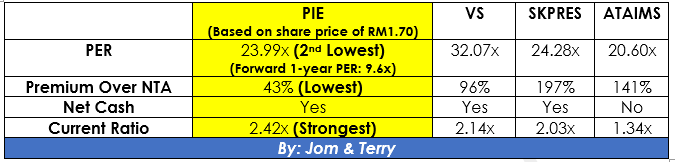

COMPARISON AMONG EMS

PEERS, PIE IS SHINING BRIGHT - SECOND LOWEST PER, LOWEST PREMIUM OVER

NTA OF 43%, NET CASH, STRONGEST CURRENT RATIO OF 2.42X

-

ACQUISTION OF SHARES BY PRINCIPAL OFFICERS AT RM1.40 & RM1.45"

- BROKEN 1-YEAR HIGH OF RM1.62 WITH STRONG BUYING INTEREST

PIE, A LESS-KNOWN EMS PLAYER DUE TO SMALLER MARKET CAP OF RM0.6 BILLION

PIE has been consistently profitable from 2013 since 2019, with an average PAT margin of 6.8%

PIE is less known by the market due to its relative smaller market capitalisation of just RM0.6 billion. On the other hand, the big boys – VS, SKPRES and ATAIMS have market capitalisations of about RM3.5 billion, RM1.8 billion and RM1.6 billion respectively.

RECORDED HIGH EMS DEMAND, RUNNING AT FULL CAPACITY SINCE JUNE 2020

In the first quarter of 2020, PIE registered a loss-making quarter due to COVID-19 and MCO lockdown in April 2020 which led to halted operations and decline in customer orders. PIE’s operation and production fully recovered and started running at full capacity since June 2020 to clear their backlogs.

In the latest quarter, that is the second quarter of 2020, PIE recorded a higher demand for EMS. Due to intensifying trade-war, PIE expects EMS orders to increase in the long run from both existing customers and potential new customers.

Sources: PIE 20Q1 and 20Q2 Quarter Report

GROWING GLOBAL CONSUMER ELECTRONICS MARKET, PIE CAN GET A ‘PIE’

The consumer electronics market, valued at US$1 trillion in 2019, is expected to grow at a compounded annual growth rate of over 7% between 2020 and 2026. Continuous investments by industry players in R&D for development of new consumer electronic products including smartphones, smart wearables and home appliances will drive the market growth.

Source: Global Market Insights

As an EMS player, we believe PIE is qualified to get a pie of the growing consumer electronics market.

TARGETTING RM1 BILLION REVENUE GENERATED FROM AN ALREADY-SECURED, BIG, GLOBAL-PLAYER CUSTOMER

Source: The Star

On 24 August 2020, PIE stated they target to hit RM1 billion revenue in 2021. PIE's group managing director, Mr Alvin Mui stated that substantial revenue would be generated from a new portable electronic device project that PIE had secured late last year. This customer has strong global distribution networks for portable electronic devices, box-build consumer and industrial electronic products.

RM1 BILLION IS A RECORD-HIGH REVENUE

PIE's highest annual revenue achieved was RM679.3 million in 2017. A RM1 billion revenue in 2021 would be a record high.

REALISING THE RM1 BILLION REVENUE TARGET, AT THE SAME TIME EXPECTING INCREASED SHIPMENT AFTER A YEAR

To cater for this customer demand, PIE has pumped RM50mil to extend its present manufacturing site by 50,000 sq ft. The extension, completed in early 2020, is ready to start production in August for the new product. PIE will ship around one million units of a portable electronic device to the customer, every year. More importantly, this demand will be sustained. PIE expects the volume of shipment to increase after a year.

Electronic manufacturing services (EMS) activities makes up 73% of PIE’s revenue. It is PIE’s largest business segment. PIE expects orders to increase in the long run from existing customers and potential new customers through its fully built-up vertical integrated manufacturing facilities, which will be further improved in operation for the coming years.

Source: The Star

PROXY: THE EMS LEADER, VS, IS DOING WELL

As a proxy, VS the largest EMS player in Malaysia has been securing new orders from different global customers in recent months. Supported by strong EMS demand, VS’ share price has rallied from RM0.90 to RM1.90 within 3 months.

HAVING A SUBSIDIARY SPECIALISING IN MEDICAL DEVICES, ISO-COMPLIANT, USA & EUROPE CUSTOMERS

PAN-INTERNATIONAL ELECTRONICS (MALAYSIA) SDN BHD (178248-H) is PIE’s subsidiary. Fulfilling ISO 9001 and ISO 13485 standards, this subsidiary is experienced in assembling, testing and releasing medical devices up to CLASS IIB and has current projects shipping to the USA and Europe.

SMALLER WIRE & CABLE MANUFACTURING BUSINESS EXPECTED TO GROW WITH CONSISTENT MARGIN

PIE expects revenue from the manufacture of raw wire & cable (18%) to continue growing, with consistent profit margin in the near future. Its two main raw material costs, copper and PVC are expected to be relatively stable in the near future.

REMAINING 4% TRADING BUSINESS WOULD REMAIN FLAT OR SHRINK

PIE’s trading segment (1%) will continue to promote products from their parent companies in the ASEAN market. However, they don’t expect significant growth from this segment in the near future due to the lack of attractive products from the parent companies. On the other hand, PIE expects revenue from cable assemble and wire harness (3%) activities in Thailand to remain flat or shrink in come years due to their declining demand due to shift in technology. Overall, these only make up 4% of PIE’s businesses. The impacts are minimal.

AT RM1 BIL REVENUE, HOW MUCH EARNINGS CAN PIE POTENTIALLY GENERATE?

It is important to understand due to various factors such as complexity of execution, operating efficiencies, changing trade-war dynamics and global COVID-19 development, the revenue target may or may not be hit. Therefore, for estimation, we can first determine PIE’s average annual PAT margin.

PIE has been consistently profitable from 2013 since 2019, with an average PAT margin of 6.8% (we calculated it). Assuming PIE is able to deliver their secured orders with solid execution, PIE will generate a PAT of RM68 mil in 2021, equivalent to an EPS of 17.7 sen.

At a share price of RM1.70, PIE is traded at a forward 1-year PER of just 9.6x.

COMPARISON AMONG EMS PEERS – PIE IS SHINING BRIGHT

We made a comparison among EMS players – PIE, VS, SKPRES and ATAIMS.

- PIE has the second lowest PER among them, with a forward 1-year PER of only 9.32x - Signs of undervalue.

- PIE has the lowest premium over NTA of 43% - another sign of undervalue. The market is paying 96%, 197% and 141% to premium to buy VS, SKPRES and ATAIM shares.

- PIE is net cash, similar to VS and SKPRES (ATAIMS is the only EMS players with net debt). This enables PIE to expand their capacity without incurring debts that impact their bottom lines.

- PIE has the strongest current ratio of 2.42x. This enables PIE to meet all their short-term financial obligation easily, allowing them to focus on achieving their RM1 billion target.

ACQUISTION OF SHARES BY PRINCIPAL OFFICERS

PIE’s Principal Officers, Ms. Liao Yueh-Chen and Mr Law Tong Han have acquired 45,000 and 25,000 units of PIE shares at RM1.45 and RM1.40 on 21 and 17 August respectively.

As of 25 August 2020, PIE broke its 1-year high of RM1.62, with strong buying interests.

DISCLAIMER

It is important to understand due to various factors such as complexity of execution, operating efficiencies, changing trade-war dynamics and global COVID-19 development, the revenue target of PIE may or may not be hit.

This article is produced based on our own study and analysis based on publicly available information, for sharing purpose only. Our views could be impartial and/or inaccurate. There is no buy/sell recommendation.

Join our Telegram channel for stock and market insights:

https://t.me/jomnterry

https://t.me/jomnterry

https://t.me/jomnterry

https://klse.i3investor.com/blogs/jomnterry/2020-08-25-story-h1512515717-P_I_E_GRABBING_THE_RM1_BILLION_PIE_ANOTHER_EMS_GEM_AFTER_VS.jsp