Basic Profile & Key Statistics

Parkway Life REIT (PLife) invests in healthcare properties which

include hospitals, medical centres, nursing homes, and a pharmaceutical

product distributing and manufacturing facility. I've classified the

distribution and manufacturing facility under the industrial sector.

Lease Profile

Occupancy is at a max capacity of 100%, which is normal for healthcare

REIT. WALE is long at 6.12 years where the highest lease expiry of 57.5%

falls in the year 2022. Weighted land lease expiry is slightly long at

74.15 years.

Debt Profile

Gearing ratio is slightly high at 38.3%. Cost of debt is very low at

0.6%, which is the lowest among SREITs. Fixed-rate debt is high at 88%.

100% of its debt is unsecured. Interest cover ratio is high at 15.8

times. WADE is short at 2.3 years where the highest debt maturity of

26.9% falls in the year 2021.

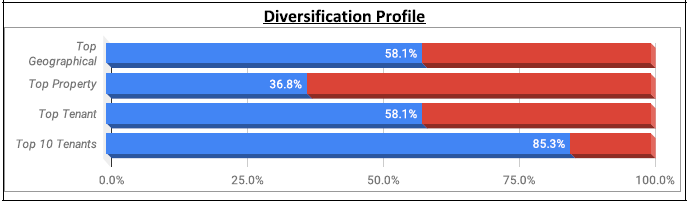

Diversification Profile

Top geographical contribution is moderate at 58.1%. Top property, top

tenant, and top 10 tenants contributions are high at 36.8%, 8.1%, and

85.3% respectively.

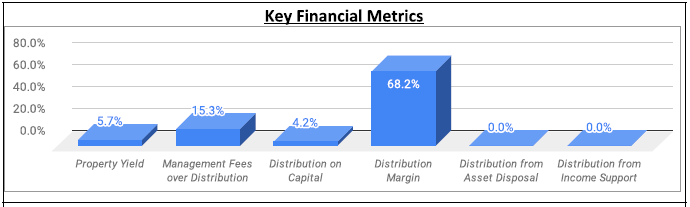

Key Financial Metrics

Property yield is moderate at 5.7%. Management fee is moderate in which

unitholders receive S$ 6.54 for every dollar paid. Distribution on

capital and distribution margin are high at 4.2% and 68.2% respectively.

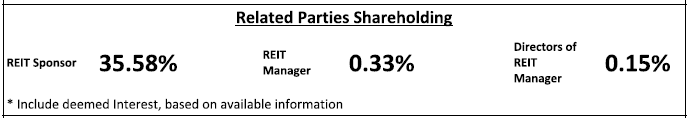

Related Parties Shareholding

As compared to SREITs median, sponsor and directors of REIT manager

holding more stake while REIT manager holding a lesser stake.

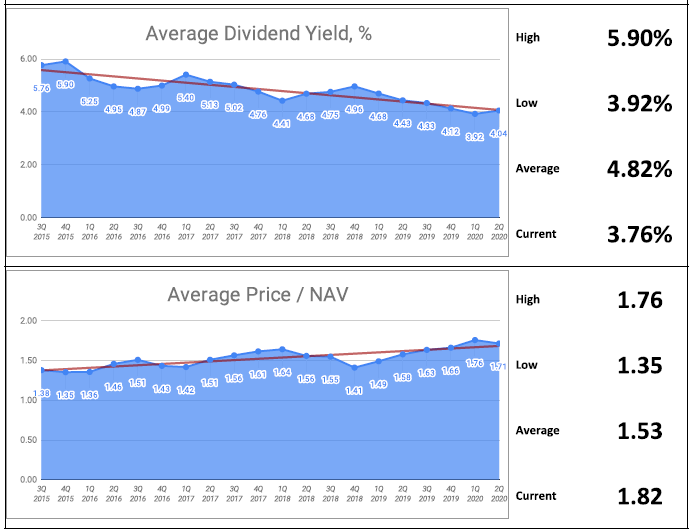

Trend

For DPU between 3Q 2015 to 4Q 2015 and between 1Q 2017 to 4Q 2017,

there are top-up by distribution from asset disposal. Nonetheless, DPU

and NAV per unit are on uptrend. Distribution margin is more or less the

same for the past 5 years.

Relative Valuation

i) Average Dividend Yield - Apply past 4 quarters DPU of 13.32 cents to average yield of 4.82% will get S$ 2.76.

ii) Average Price/NAV - Average value is at 1.53, apply the latest NAV of S$ 1.94 will get S$ 2.97.

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Occupancy | Concentrated Lease Expiry |

| WALE | WADE |

| Cost of Debt | Top Property Contribution |

| Unsecured Debt | Top Tenant & Top 10 Tenants Contribution |

| Interest Cover Ratio | |

| Well Spread Debt Maturity | |

| Distribution on Capital | |

| Distribution Margin | |

| DPU Uptrend | |

| NAV per Unit Uptrend |

PLife flagship property is the well-known Mount Elizabeth Hospital. All

the 3 properties in Singapore are leased to Parkway Hospitals Singapore

Pte. Ltd., which is the top tenant. The lease expiry is in the year

2022, very likely Parkway Hospitals Singapore would exercise the option

to extend their term for another 15 years.

PLife is the only SREIT that does not issue shares to pay management

fee, which means there is no share dilution. However, REIT manager is

slowly reducing their shareholding throughout the past 5 years, from

0.45% @ 3Q 2015 to 0.333 @ 2Q 2020. Nonetheless, it is a well managed

REIT with many favorable points.

The above analysis information is extracted from SREITs Dashboard, you are welcome to use the information for your own analysis or blog post. You could also refer SREITs Data for an overview of Singapore REITs. If you like my sharing, please join the Facebook group - REIT Investing Community where you could read, share, and discuss REITs related topics. Please also invite your like-minded friends to the group.

*Disclaimer: Materials in this blog are based on my research and

opinion which I don't guarantee the accuracy, completeness, and

reliability. It should not be taken as financial advice or statement of

fact. I shall not be held liable for errors, omissions as well as loss

or damage as a result of the use of the material in this blog. Under no

circumstances does the information presented on this blog represent a

buy, sell, or hold recommendation on any security, please always do your

own due diligence before any decision is made.

https://klse.i3investor.com/blogs/reittirement/2020-08-18-story-h1512391812-Parkway_Life_REIT_Analysis_18_August_2020.jsp

https://klse.i3investor.com/blogs/reittirement/2020-08-18-story-h1512391812-Parkway_Life_REIT_Analysis_18_August_2020.jsp