Yesterday AmBank research downgraded glove stocks from overweight to neutral. I have excerpted the publication as follows:

KUALA LUMPUR (Aug 25): The run-up among glove counters may have peaked, said AmBank Research, which has downgraded its call on the sector to “neutral” from “overweight” in view that the share prices are fully valued.

In a research note this afternoon, AmBank Research opined that the elevated average selling prices (ASPs) enjoyed by glovemakers “will begin to taper off in 1Q21”.

The research house has Top Glove Corp Bhd, Kossan Rubber Industries Bhd and Hartalega Holdings Bhd under its coverage.

“Share prices of all of the glove companies under our coverage have exceeded their target prices,” it said.

“We believe that at current share price levels, the valuations for glove companies under our coverage have fully priced in the companies’ earnings outlook,” it said.

Many investors were frightened by AmBank’s publication and sold their holdings aggressively. As a result, Top Glove dropped Rm 2.50, Supermax dropped Rm 2.30, Harta dropped Rm 1.00, Ruberex dropped 54 sen and Comfort also dropped 54 sen.

Covid 19 pandemic has been affecting everybody and all the listed companies with the exceptions of glove stocks and other medical products for the prevention of the virus. Investment Banks including AmBank usually have a basket of stocks and they have to sell all their holdings to cut loss to buy glove stocks. AmBank would have been buying Glove stocks and all of them have gone up a few hundred percent in the last few months.

Many investors strongly suspect AmBank purposely downgrade all the glove stocks so that it can continue to buy at cheaper prices.

Perhaps Security Commission should look into this case.

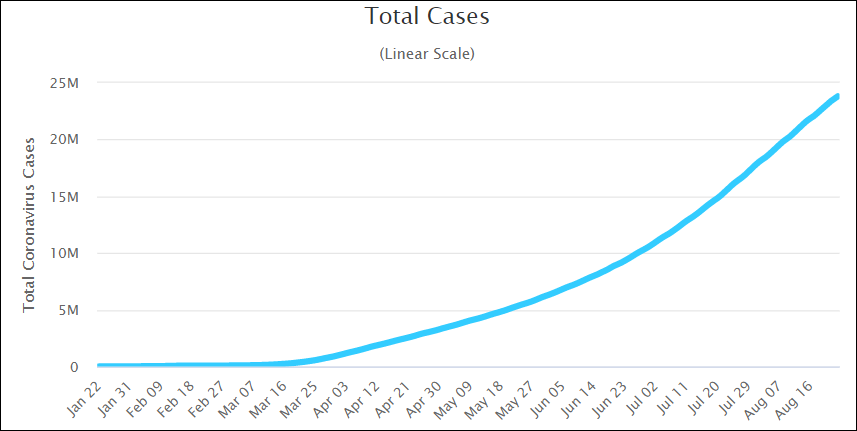

Currently there are 23.95 million Covid 19 cases and 820,000 deaths in the world. As shown on the chart the number of cases and deaths are still spiking.

About 1 month ago, on 21st July I posted an article namely “Top Glove: 8 Investment Banks updated target price”. I pointed out that there were 14.876 million Covid 19 cases and 614,000 deaths in the world. Due to the pandemic, the demand for medical gloves far exceeds supply. As a result, all the glove makers could easily increase their selling prices to make more profit. I also pointed out that the following 8 investment Banks updated their target price for Top Glove when it was selling at Rm 22.98.

Affin Hwang Outperform Rm 46.40 20/7/2020

Credit Suisse Outperform Rm 37.00 15/7/2020

Kenanga Investment Bank Outperform Rm 32.00 13/7/2020

TA Securities Buy Rm 31.66 14/7/2020

Hong Leong Buy Rm 31.31 15/7/2020

Cimb Securities Buy Rm 31.30 14/7/2020

Nomura Buy 30.65 14/7/2020

Macquaries Outperform 30.40 14/7/2020

About 1 month ago when I posted my article there were only 14.89 million Covid 19 cases and 614,000 deaths in the world. Currently there are 23.95 million cases and 820,000 deaths.

There are an additional 9 million cases and 200,000 deaths in 1 month.

Why would AmBank research downgrade Top Glove and other glove stocks when the number of Covid 19 cases and deaths are still spiking up more and more?

Why would Investors believe AmBank Research when the other 8 Investment Banks have not downgraded Top Glove?

Supermax recently reported the best quarterly profit in the history of the company.

Top Glove will also report historically best profit in about 2 months.

Top Glove will give 2 bonus shares for every one share held by shareholders. Supermax will give 1 bonus share for every 1 share held by shareholders. The X dates for bonus shares are 3rd and 4th September. Investors should not sell their holdings but wait to receive bonus shares.

https://klse.i3investor.com/blogs/koonyewyinblog/2020-08-26-story-h1512539687-AmBank_Research_is_misleading_Koon_Yew_Yin.jsp