TENAGA NASIONAL BHD (TENAGA, 5347) UTILITY STOCK - THIS POWER GIANT STILL UNDERVALUED!

WANT TO BE KIM'S STOCKWATCH GROUP?

Official Telegram : https://www.telegram.me/kimstock

Official Website : http://www.kimstockwatch.com/

Date : 17 June 2020

UTILITY STOCK - THIS POWER GIANT STILL UNDERVALUE!

TENAGA NASIONAL BERHAD

Current Price : [ RM12.00 ]

Target Price : [ RM13.40 ]

Target Price : [ RM13.40 ]

Call Warrant : TENAGA-C74

Target Price : [ 0.31 sen]

Time Frame : 1-4 weeks

Chartist :

TENAGA - A

closer look on the chart pattern. (5 years chart showed the strong

supportive bottom line around RM11). What do you thing about this closer

look on the 6 months chart pattern? Once it break the yellow line. Will

definitely change the chart pattern to bullish. No one will say this is

boring dividend stock after this.

* Chart interpret by Kim's Chartist Team (Mr. Cheah) . Telegram : @KhengHan

STILL UNDERVALUED?

- TENAGA has a price to earnings ratio

of 18.55, based on the last twelve months. That means that at current

prices, buyers pay MYR18.55 for every MYR1 in trailing yearly profits.

- TENAGA is trading below my estimate of fair value (MYR12.69)

OVERVIEW

Power

giant Tenaga Nasional (TNB) is the largest electricity utility in

Malaysia and a leading utility company in Asia with an international

presence in United Kingdom, Kuwait, Turkey, Saudi Arabia, Pakistan,

India and Indonesia. Since their listing on 28 May 1992, they have grown

from strength to strength to become a utility that is responsive to the

needs of their stakeholders and the marketplace. In all of their

endeavours, they are driven by their firm belief that they have

responsibility to improve the lives of the people of Malaysia. They

therefore look forward to continuing to ensure a better and brighter

tomorrow for em all.

Listed on Bursa Malaysia and one of the

largest constituents of the KLCI, Tenaga Nasional Berhad is Malaysia’s

incumbent power company in Malaysia. It provides the services of

generating (53% market share in Malaysia, 60% in Peninsular Malaysia),

transmitting (100%) and distributing (100%) electricity. Over the years,

Tenaga has been performing a public service which at times compromises

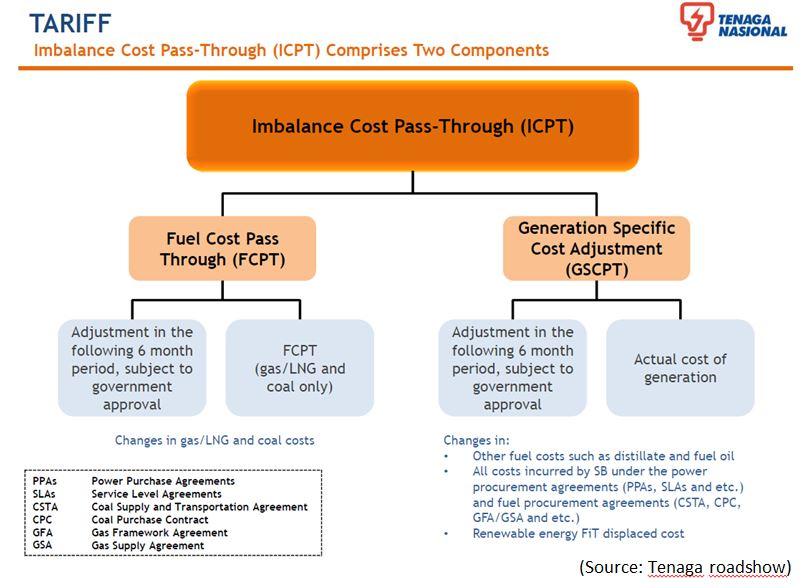

its bottom-line. However, investors have been more excited about its

prospect recently due to the implementation of the imbalance cost pass

through (ICPT) mechanism. As a result, this will allows the company to

pass on changes in fuel prices to end consumers. We have seen the ICPT

mechanism function in a low fuel price environment but we have yet to

witness its success in a high fuel price environment, which is subject

to the Cabinet’s approval. Should that happen not only would Tenaga’s

earnings growth be more stable but it could also be a re-rating factor

as well.

KEY OPPORTUNITY

ICPT and fuel prices

Let’s shed some light on how the ICPT works. Firstly, a base electricity tariff is derived based on this formula:

Aggregate

revenue = Base tariff x total kWh generated = WACC x regulated asset

base+ Projected Costs + efficiency carryover amount

Tenaga’s working average cost of

capital (WACC) is also the desired internal rate of return (IRR) in

investing in power assets. It is set at 7.5%. The regulated asset base

is basically the cost of assets that transmit and distribute electricity

approximately in the size of RM45b. In other words, Tenaga needs to

have a rate of return on investing in its assets which are better than

returns it could have gotten from investing in the capital markets (WACC

is the forgone return).

Projected cost items include fuel prices, depreciation costs of the assets etc.

Efficiency carryover amount is part of

the Incentive-Based Regulation (IBR). In addition, it allows Tenaga to

enjoy higher profits should it excel in certain KPIs (e.g lower

frequency of blackouts) or lower profits should it underperform.

All these are forecasted and summed up

to calculate the base tariff. However, if the forecasts are higher/lower

than the actual generation costs, then the ICPT mechanism takes place

and fuel price changes are passed on to consumers every six months.

However again, we have not seen the

ICPT function in an environment of rising fuel prices. Therefore, we

should keep track of the fuel prices its generation mix, which is

largely made of Gas, LNG and Coal.

FINANCIAL CAPITAL

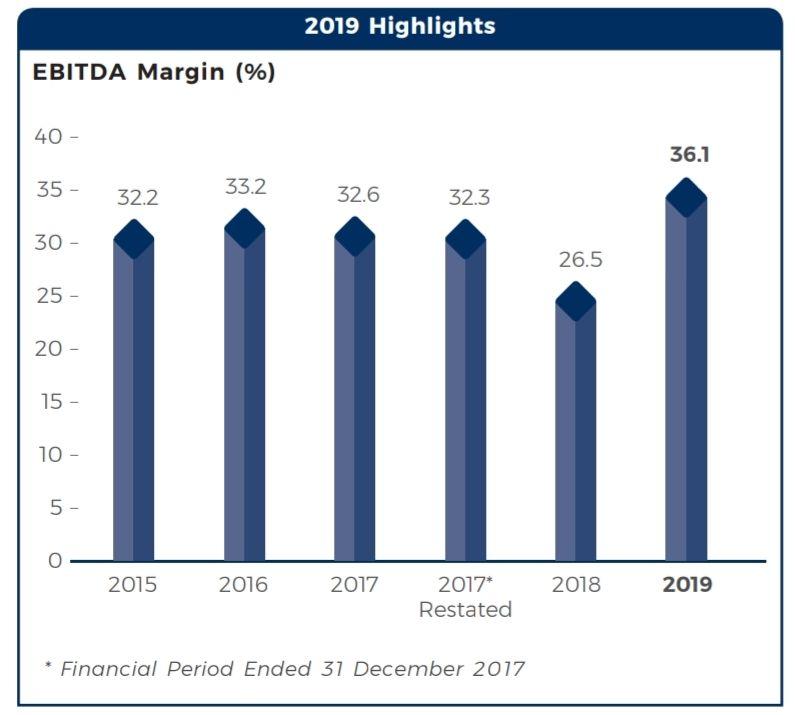

TNB Group recorded a revenue of RM50.94

billion for the financial year 2019, marking an increase of 1.1%

compared to the financial year 2018. This was supported by 2.7% growth

in gigawatt hours (GWh) demand which resulted in a 0.9% or RM0.42

billion increase in total electricity sales. Profit attributable to the

owners of the Company for the financial year 2019 was RM4.53 billion

compared to RM3.72 billion in the previous financial year. Group EBITDA,

meanwhile, was RM18.40 billion with a margin of 36.1% compared to

RM13.37 billion and 26.5% margin in 2018. The increase was mainly

contributed by lower impairments and a decrease in operational expenses.

The Group’s PAT – impacted by regulatory adjustments which were

returned to the industry, forex transaction losses, finance cost and

fair value changes of financial instrument – came in at RM4.45 billion.

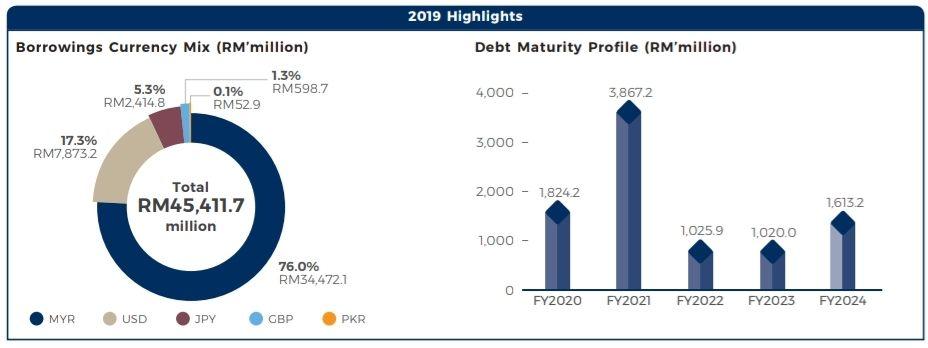

BORROWING

TNB’s strong financial standings are backed by its credit ratings accorded by both local and international rating agencies (AAA

Stable by RAM, AAAis/AAA Stable by MARC, A3 Stable by Moody’s and BBB+ Stable by S&P) was able to tap into local and

international funding sources including the capital market, banks and other financial institutions.

TNB are governed by their Treasury Policy in managing forex and interest rate exposures with the objective of protecting the

Group’s profit from material adverse movements due to rate fluctuations.

TNB have been managing their short-term forex exposures through hedging a minimum of 50% of known foreign currency exposure

up to a 12-month period through forward exchange contracts and natural hedges.

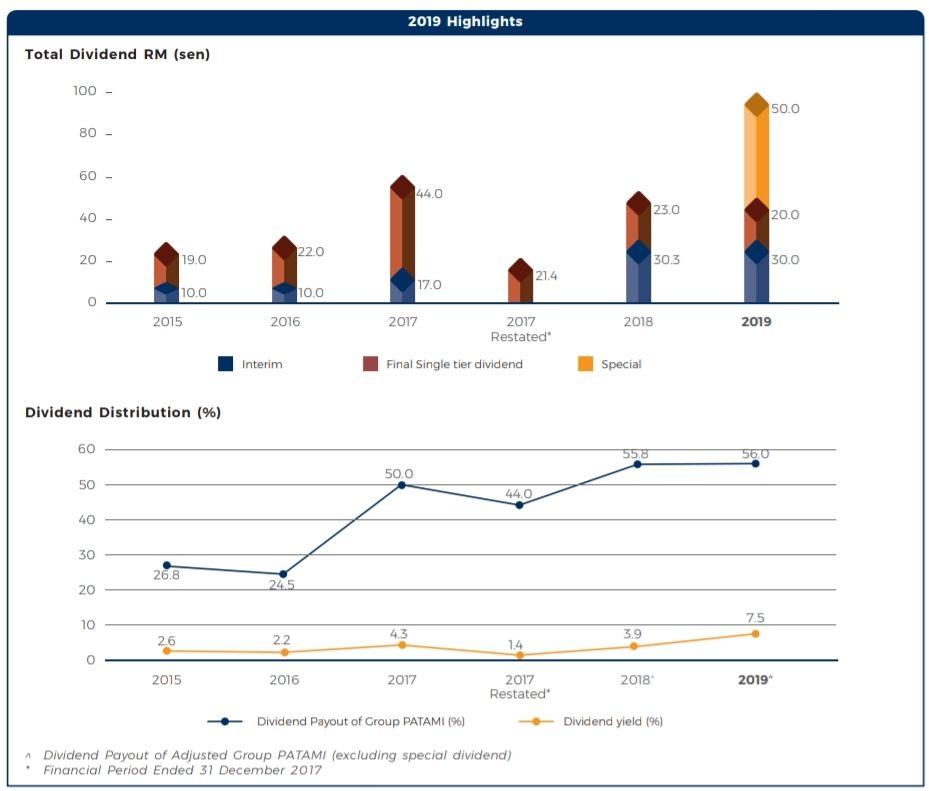

DIVIDEND

For the financial year 2019, TNB’s Board of Directors had approved a total RM5.69 billion in dividend payout. This includes a special

dividend of 50.0 sen per share on top of a core dividend of 50.0 sen.

The total dividend issuance of RM1.00 per ordinary share as compared to 53.3 sen in financial year 2018 is a record high and definite indicator of TNB’s strong fundamentals.

The core dividend payout amounting to RM2.84 billion translates to a 56.0% dividend payout ratio from the Group’s adjusted PATAMI of RM5.08 billion. This is consistent with our Dividend Policy of providing shareholders between 30% and 60% of the Group’s consolidated net PATAMI excluding extraordinary, non-recurring items.

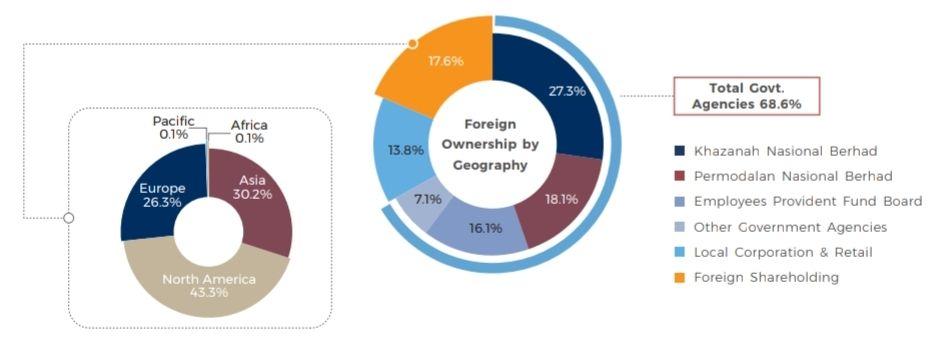

SHAREHOLDER INFORMATION

As at 2 March 2020, Khazanah Nasional Berhad remained as our largest shareholder, with 27.3% of shareholding. Other Government related agencies cumulatively holds around 41.3% with Permodalan Nasional Berhad at 18.1%, Employees Provident Fund at 16.1% while others at 7.1%. The balance of 31.4% are held by Other Local Corporations, Malaysian Retail and Foreign Shareholders.

Based on the geographical spread of

TNB foreign shareholding, the largest shareholding base is North America

with 43.3%, followed by TNB shareholders from Asia (excluding Malaysia) and Europe, which accounted for 30.2% and 26.3% of the shares respectively.

PERFORMANCE REVIEW 2019

KEY FEATURES

- The 2 x 720MW combined cycle gas-fired Southern Power Generation plant in Pasir Gudang, Johor, in which we will have 51% equity, was 97.8% complete at year end. Once commissioned in July 2020, it will be the world’s first Combined Cycle Gas Turbine (CCGT) plant to use 9HA.02 gas turbine technology with efficiency exceeding 60%.

- Expect to complete the Ulu Jelai-Telom transfer tunnel scheme on schedule in August 2020. This project is expected to increase the amount of firm energy for Ulu Jelai Hydroelectric plant by 40%.

- In line with preparations for MESI 2.0, we are setting up a new subsidiary, TNB Power Generation to manage all their domestic generation assets, including their development, as well as their subsidiaries TNB Repair and Maintenance Sdn. Bhd. (REMACO) and Integrax Berhad. Its focus will be to optimise the performance of generation assets and services under its portfolio.

- Fifteen strategic initiatives have

been mapped to achieve the objectives of their transmission grid

strategic plan. These will continue to be rolled out in 2020 and beyond. In 2020 itself, TNB will continue to engage with key stakeholders on the need to complete the existing 500kV grid superhighway interconnections, the backbone of our Grid of the Future.

- Among the core initiative for 2020 is the rollout of AMI in Melaka, Klang Valley and Putrajaya/Cyberjaya to meet the target of 1.5 million AMI deployed. In addition to improved billing and metering quality, AMI deployment is key in ensuring thatMESI 2.0 reforms on retail liberalisation are delivered.

- 2020 will also be the year in which TNB will be negotiating on the development plans for RP3. TNB submitted their proposal in December 2019 and look forward to the start of discussions at the end of the first quarter of 2020

- With the setting up of TNB Retail, there will be more and great focus to increase their service delivery standards and to exceed customer experience. New solutions will continuously be developed while they continue to enhance existing offerings such as rooftop solar and smart home solutions. All these efforts are made in their bid to become the retailer of choice for their customers.

- At the same time, TNB will complete the deployment of their NFCP network in 2020 to cover approximately 100,000 premises leveraging our 18,000km of fibre network across Peninsular Malaysia.

CONCLUSION

Within 1-3 month I believe this Power Giant will deliver more better and archieve my target as soon as possible. In

light of the shadow cast by the COVID-19 pandemic, growth projection

for Malaysia’s electricity industry is uncertain and will be dependent

on the Nation’s economic recovery post COVID-19. I am forsees TNB are

closely monitoring the related risks and potential impact as well as

implementing necessary measures to ensure electricity demands are met in

a sustainable manner. For 2020, TNB will look forward to the 1,440MW

gas-fired plant in Pasir Gudang, Johor and the 30MW LSS in Bukit

Selambau, Kedah coming on-stream in July and December respectively

resolved the technical issues at TNBJ.

Good luck and stay tuned! #staysafe #stayhome

Best regards,

Kim

The Founder Of Kim's Stockwatch

The Founder Of Kim's Stockwatch

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advisor.

https://klse.i3investor.com/blogs/spartan/2020-06-17-story-h1508818842-UTILITY_STOCK_THIS_POWER_GIANT_STILL_UNDERVALUED.jsp