Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

SYMPHONY LIFE BERHAD or SYMLIFE (Code 1538, MAIN Market, Property)

Some basic info on this company:

i. Number of shares float : 600.57 million

ii. Market Cap : RM 231.22 million

iii. Last closing price : 38.5 cents

SYMLIFE - INSANE ! THIS STOCK IS ONLY TRADING AT PE

RATIO 2X & 77% DISCOUNT TO NTA !

1. Couldn't find any analyst report on SYMLIFE for the past 1-2 years

Been trying to see if any IB had written any coverage on this stock, however to my dissapointment, I can't find any.

I guess this can be one of the many reasons the price had been depressed for so long, despite the good financials and business.

Any of my IB analysts or reporter friends out there, hope you get this

call and do some justice to this company, so that existing shareholders

and potential investors are able to see the data & prospect of this

company in order to make a better informed decision on their

investments.

2. Too undervalued, trading at PE 2X Ratio

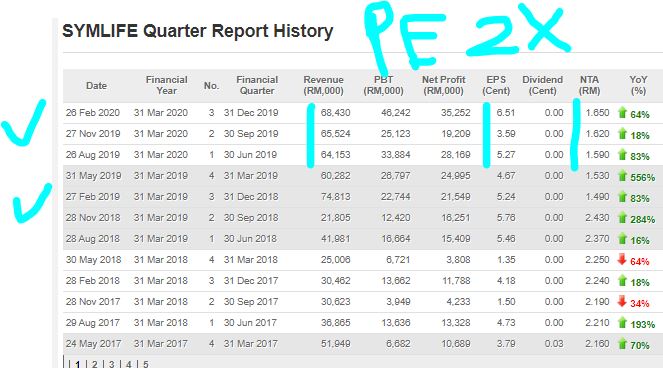

Refer below latest QR summary of SYMLIFE for the past 3 years.

For FY 2019, we see that total earnings were roughly 21c per shares.

This means that latest share price of 38.5c indicates PE Ratio of only

around 1.5-2X. This is very absurd considering how good the company

earnings in FY2019 and also in FY2020 up to date.

As of latest FY2020 3 quarters, the company already earned 15.4c per

shares. If this profit is consistent for another quarter, we should be

looking at EPS around 21-23c for the FY2020 closing.

3. Trading at 77% discount to its NTA of RM 1.65

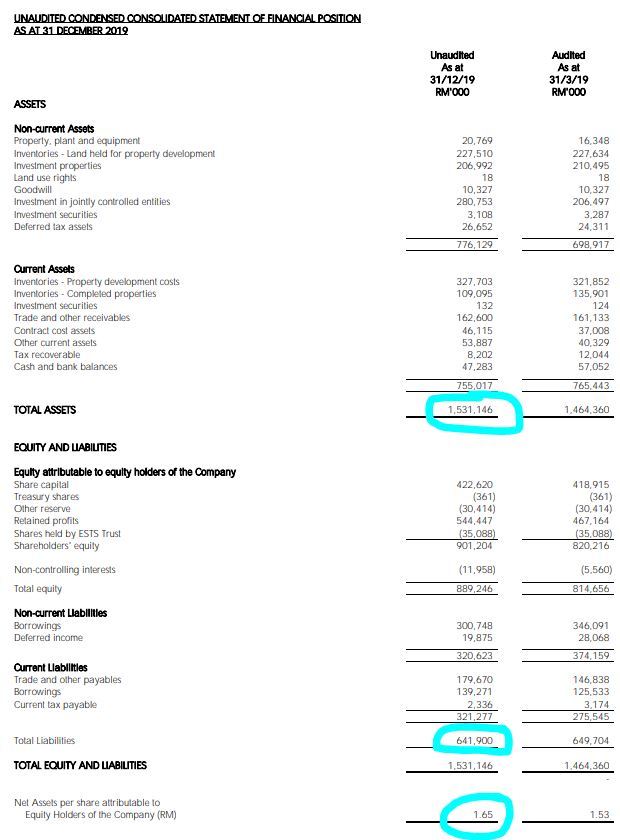

Refer below on the latest assets versus liabilities for SYMLIFE.

Note the total assets of about RM 1.53 billion (NTA RM 1.65) versus liabilities of RM 641.9 million.

This makes the company a net asset surplus of RM 888.1 million.

I am surprised at how the share price of this company can be so low all these while.

4. Notable funds and individuals at top 30 shareholders (as of latest list available in Annual Report)

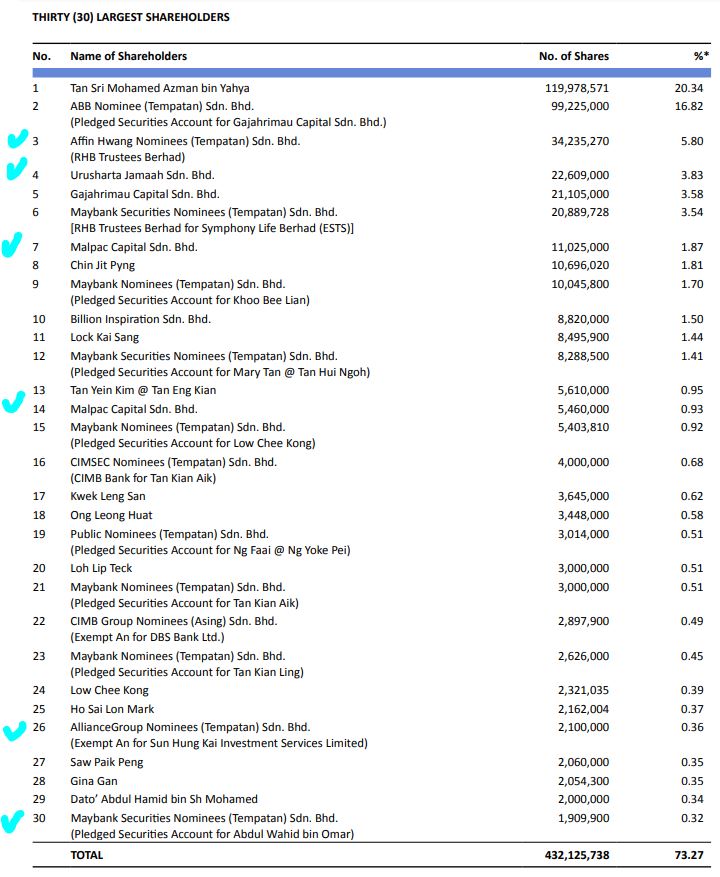

Refer below list of shareholdings in SYMLIFE as of latest FY2019 annual report.

Besides the majority shareholder / owner which is Tan Sri Mohamed Azman Bin Yahya, we see a few other notable names:

i. RHB Trustees Berhad

ii. Urusharta Jamaah Sdn Bhd (investment arm of Tabung Haji)

iii. Malpac Capital Sdn Bhd

iv. Sun Hung Kai Investment Services Limited

v. TS Abdul Wahid Omar (ex minister, ex CEO Maybank, ex Chairman PNB, and currently non-executive Chairman of BURSA)

5. Exciting prospects ahead in FY2020

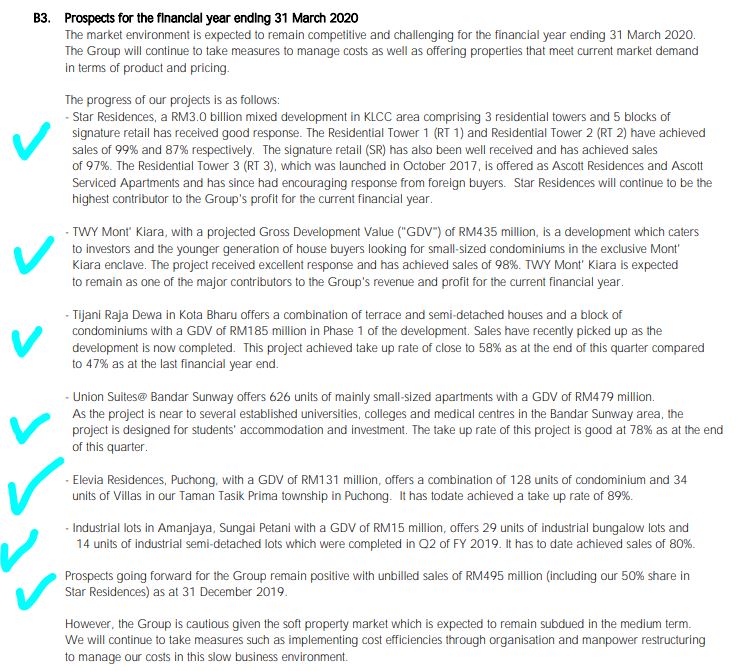

Refer below prospects of SYMLIFE for FY2020 as mentioned by the company. Let me summarize for your ease of reading:

i. Star Residences, a RM 3 Bil GDV in KLCC received very good response,

with sales 99% for RT1 and 87% for RT2, SR at 97%. Also new launch is

RT3 receiving good response from foreign buyers.

ii. TWY Mont Kiara with GDV RM 435 million, achieved sales of 98%

iii. Tijani Raja Dewa in Kota Bharu, GDV of RM 185 million, currently at 58% take up rate

iv. Union Suites at Bandar Sunway, GDV RM 479 million, with 78% take up rate

v. Elevia Residences, Puchong, GDV RM 131 million, with 89% take up rate

vi. Industrial lot in Amanjaya, Sg Petani with GDV RM 15 million, take up rate of 80%

All in all, prospects look positive with unbilled sales of RM 495 million.

6. Technical Analysis - Red chips entering in 60m chart, red chips holding on for a breakout above 40c in daily chart

Let's take a look at the 60 minutes chart of SYMLIFE using Homily software:

A few observations:

i. Recently, price faced some retracement below the support line, as the number of weak sellers increased

ii. As of latest closing, we see 2 bars where red chips had entered

this stock, and taking the price back towards the important breakout

point

Should the stock continue trending upwards next week, there would be

more renewed interest in buyers wanting to take a stake in the trend

Let's take a look at the daily chart of SYMLIFE using Homily software:

A few observations:

i. After hitting low in March 2020, red chips had started to accumulate position in this stock

ii. Recently the stock faced some selling pressure, however we see that

red chips still remain inside this stock despite the recent price

retracement

iii. Important level to watch is whether it can able to breakout above the 40c level, to indicate bullishness in the momentum

CONCLUSION

Based on my opinion, SYMLIFE should be given attention in coming weeks, based on below:

i. Too undervalued, trading at PE Ratio 2X

ii. Trading at 77% discount to its NTA of RM 1.65

iii. Notable funds and individuals inside top 30 shareholder list

iv. Exciting prospects ahead, unbilled sales of RM 495 million

v. Chart indicating long term shareholders, are holding on to expect higher prices in future

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-06-20-story-h1508881278-INSANE_THIS_STOCK_IS_ONLY_TRADING_AT_PE_RATIO_2X_77_DISCOUNT_TO_ITS_NTA.jsp