MARKET OVERLOOKED THE REAL VALUE OF THIS COMPANY ! UPLIFTED FROM PN17 & NOW TRADING AT ONLY PE RATIO 4X !!!

Hello

to all readers out there. Recently I saw that many penny stocks had

rallied. But I wish to shift your attention to this penny stock in the

MAIN Board which I feel had been overlooked by the market.

The stock which I'd like to talk about today is HB GLOBAL LIMITED (HBGLOB - Stock Code 5187, Main Market, Consumer Products & Services - F&B).

I

saw some heavy accumulations in this stock for the past few weeks at

6.5-7c range and believe that once the accumulation is over, price will

be trending upwards strongly.

BASIC INFORMATION ABOUT HBGLOB

HBGLOB is a leading international one-stop gourmet convenient food specialist in China.

Their

food processing capabilities includes Cleaning, Slicing/Cutting,

Blanching, Boiling, Frying, Vacuum Frying, Steaming, Smoking, Stewing

and Barbequing.

They produce various types of food material and packed with quick freeze mainly to meet customers orders and distributors.

They

produce more than 1,000 types of products, all of which are approved

and export to more than 20 countries such as Japan, USA, Singapore,

Australia and Korea

Market Capitalization : RM 35.1 million

Shares Float : 468 million

Website : http://www.hbglobal.asia/

1.

UPLIFTMENT OF PN17 IN OCTOBER 2019 - PRICE SHOULD BE HIGHER THAN BEFORE

WHEN THE STOCK WAS IN PN17 - MARGIN ACCOUNTS ABLE TO BUY IN THIS MAIN

MARKET STOCK

Refer below news on

15th October 2019 where HBGLOB had risen to a high of 15.5c when it was

announced that BURSA had uplifted its PN17 status as it no longer

triggers any criteria under it.

However, as Khazanah

wanted to exit from this company. the stock saw selling pressure to push

it back to the prices before the company was uplifted on its PN17

status.

To me this does not

look illogical, as normally, the price of a stock should be higher after

it is uplifted of its PN17 status, and not lower.

However, maybe

because this stock is not getting the right media or Investment Bank

(IB) coverage, it has been overlooked by investors and traders alike.

The upliftment of

PN17 status also means that margin accounts are able to take a stake in

this company and be able to hold it for longer term investment purposes,

as the stock is listed on Main Market.

2.

KHAZANAH CEASED TO BE A SUBSTANTIAL SHAREHOLDER AS OF 4TH NOVEMBER 2019

& POSSIBLY IS HOLDING 0 SHARES AS OF TODAY - LESS RESISTANCE FOR

UPTREND

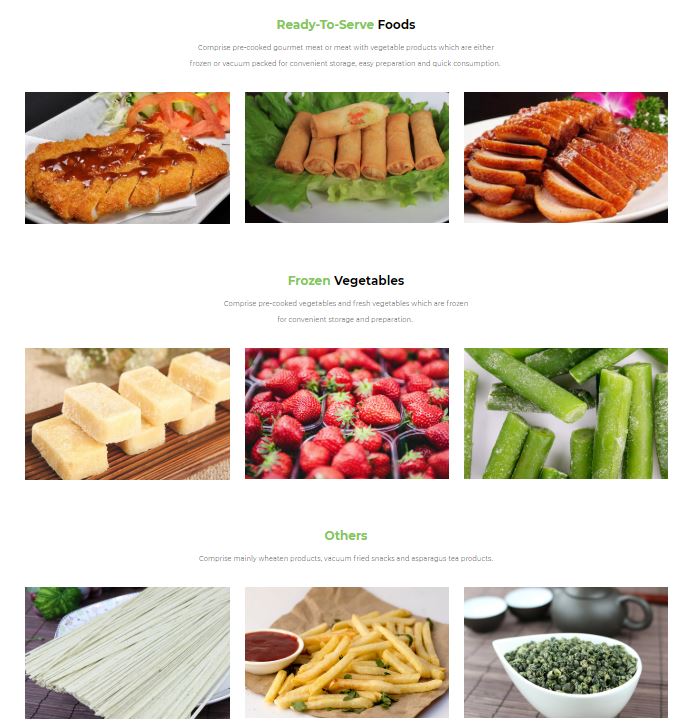

Refer below

announcement on 4th November 2019 where Khazanah had sold off 2.54

milion shares and on the same day ceased to be a substantial shareholder

in HBGLOB.

This means that Khazanah shareholding in this counter is less than 5% as at 4th November 2019.

After this sale,

Khazah was left with 22.9 million shares which still might be a

resistance for the price to move up (should Khazanah decide to sell all

shares and be left with 0).

However, let me

highlight one thing. You may refer to the monthly chart of HBGLOB below.

From NOV2019 where Khazanah ceased to be a substantial shareholder,

until latest closing on 11th June 2020, a rough total of 115 million

shares volume had been traded (in comparison to the 22.9 million shares

which Khazanah has left)

Therefore, in my

opinion, it is HIGHLY LIKELY that Khazanah has sold all of its

shareholdings and is left with 0 shares, should their management

instructed them to do so last year.

This means that the path to uptrend now has lesser resistance, with one big fund out of the way.

3. MAJOR SHAREHOLDER (CEO), SHEN HENGBAO HAS STRONG GRIP ON HBGLOB AND NO SELLING IS SEEN FROM HIM IN NEAR FUTURE

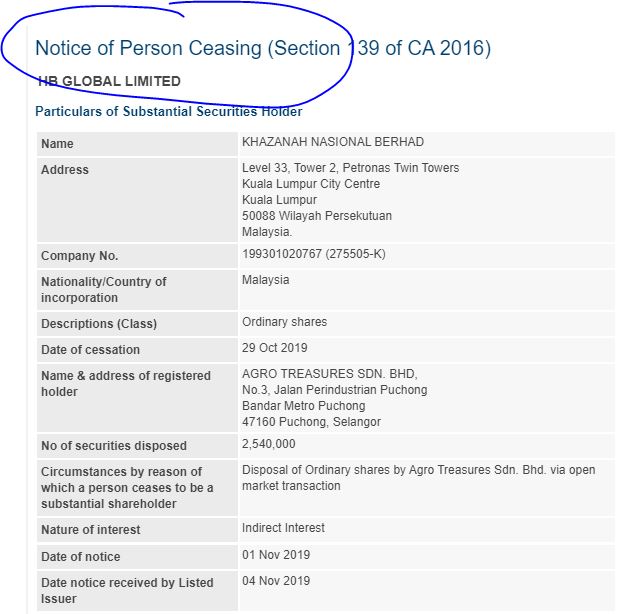

Refer below latest major shareholders of HBGLOB as at 15th April 2019. There are only 2 major shareholders who are:

i. Shen Hengbao who is also CEO of HBGLOB at 57%

ii. Khazanah Nasional Berhad at 10.43%

As

explained above, if Khazanah had disposed their entire stake in this

stock, I foresee that there will be less resistance on the path upwards

as the major shareholder will not be selling his shares any time soon.

Therefore the public effective total float is only 43% of the total stock float.

4. TRADING AT VERY LOW PE RATIO OF 4X AND 82.5% DISCOUNT TO ITS NTA OF 43 CENTS

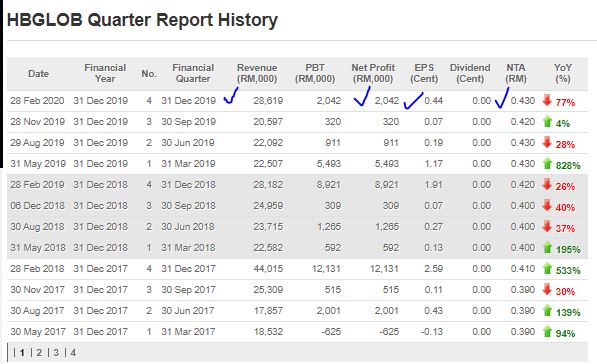

Refer

below latest QR summary of HBGLOB. As we can see, since the company was

uplifted of PN17, they have been profitable every quarter.

In the latest quarter, revenue was at 2 year high of RM 28.6 million and net profit at RM 2 million (EPS 0.44 cents).

The

NTA stood at 43c, so this means at the latest closing of 7.5c, this is a

discount of 35.5c or 82.5% of the NTA, which means the stock is trading

way below its underlying asset value.

In

terms of earnings, the total EPS for this year is 1.87 cents. This

means that the stock is currently trading at only PE Ratio of 4X its

earnings, which is considered quite low for a stock in f&b industry.

For the sake of comparison lets take a few profitable F&B stocks and see their PE Ratio:

a) OFI - PE Ratio 15X

b) PWROOT - PE Ratio 19X

c) SPRITZER - PE Ratio 13X

d) APOLLO - PE Ratio 18X

e) BIOHLDG - PE Ratio 13X

Therefore,

if we look at above and take a conservative PE of 10X ratio, this

values HBGLOB at least at 18 - 19 cents based on earnings. Taking a more

aggressive PE Ratio of 15-20X, gives a fair value of 28-37 cents in the

longer term.

5. TECHNICAL ANALYSIS - PENDING BREAKOUT ABOVE EMA365 OF 7.5 CENTS ON THE BACK OF IMPROVED VOLUME TRADING

Refer below the basic price and volume chart with key EMAs for HBGLOB daily chart:

A few observations on the daily chart chart:

i. Refer Circle 1 & 2, HBGLOB had hit a high of 15.5c before Khazanah decided to sell down its shareholdings in this stock

ii.

Refer Circle 3 & 4, during the March 2020 COVID19 crash, HBGLOB

dropped to a low of 3c, however this was on the back of low volume

trading, indicating no major shareholders sold out during this time

iii.

Refer Circle 5, HBGLOB close at 7.5c is above the EMA200 at 6.8c and

the next important level to break is 7.5c to indicate a bullish trend

for this stock

iv.

Refer Circle 6, trading volumes are significantly improved, and we see

that selldown volume is very small compared to buying volume

CONCLUSION

Considering all the above, I opine that current price for HBGLOB is attractive due to below:

i) Stock has been uplifted of PN17 in October 2019, which allows margin accounts to buy into this stock

ii)

Khazanah ceased to be substantial shareholder as at 4th November 2019,

and possible reduced to 0 based on volume analysis, allowing less

resistance on path upwards

iii) Majority shareholder and CEO Shen Hengbao has strong grip on HBGLOB with 57%, and no selling in sight in the short term

iv) Trading at ONLY PE Ratio 4X which is very low compared to its other F&B peers. Also trading at 82.5% discount to its NTA

v) Price pending breakout of long term EMA365 at 7.5c on the back of improved volume trading

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-06-13-story-h1508732327-MARKET_OVERLOOKED_THE_REAL_VALUE_OF_THIS_COMPANY_UPLIFTED_FROM_PN17_NOW.jsp