WANT TO BE KIM'S STOCKWATCH GROUP?

Official Telegram : https://www.telegram.me/kimstock

Official Website : http://www.kimstockwatch.com/

Date : 16 June 2020

GLOVE STOCKS - WHAT SHOULD I DO NOW? MY ANSWER IS ..

Firstly, thanks for all my readers and

followers. I would like to share my ideas when I saw many of my them

have dropped a message to me and some of forumers keep arguing like

Supermax thread at i3investor forum. So all of about Glove Stocks being

selling-off today. What should I do now? Panic selling.. Should I buy

now?..or Should I cutloss now?

WHAT KIM SAID ABOUT GLOVES SECTOR NOW?

So here's my answer to those asked

about. From my view, Glove stocks were the selling targets on Bursa

Malaysia today with many of them plummeting more than 10%, although the

rising risk of a second wave of infections in China could mean another

boost to rubber glove demand. Lets me tell you what's my plan now

again..as follows :-

My 10 Points, Why You Should "Buy" "Add" "Average" "Hold" and definitely with yet "No Sell"

1. Today's price performances for glove stocks are considered very normal.

2. Gloves still on Bullish mode 'refreshing signal'. The sell-off just a Consolidation Phase.

3. Just a healthy pullback after the strong March to record highs.

4. This what I said in my previous blog. "Buy in June - April history will repeat".

5. You wont get back a cheaper price on

July. Same as I did said in my previous blog back on April. "You wont

get cheap prices in May".

6. The pattern of Covid-19 waves is

same at March-April level. The feared of second waves Covid-19 just

started. As I said the most upcoming sector will hit is "Oil &

Gas".

7. Crude / Brent Oil will plunge at range USD30 - USD45 till end of this year.

8. Today's decline prices could present

an Entry Opportunity (EO) as Entry Price (EP) for those who missed the

rallied / boat previously.

9. No functional and proven vaccine in

sight yet in the fight against Covid-19. So I definitely agreed this

sector would continue to attract interest as the strong demand sustain

for a prolonged period of time at least as I said before till earlier

FY21.

10. Dont worry about our KLCI, as I

forsees it has been on a hyperbolic uptrend in the last few weeks. So it

sent out a signal to me sign of overheating and one could expect the

market to be poised for healthy 'correction and pullback'.

The conclusion is "BUY" or "ADD" or "HOLD". My prediction this week will strong and massive rebound or rally on glove stocks.

My Strongest Key-Points is :

1. The Coronavirus (Covid-19) still drives rubber gloves in demand.

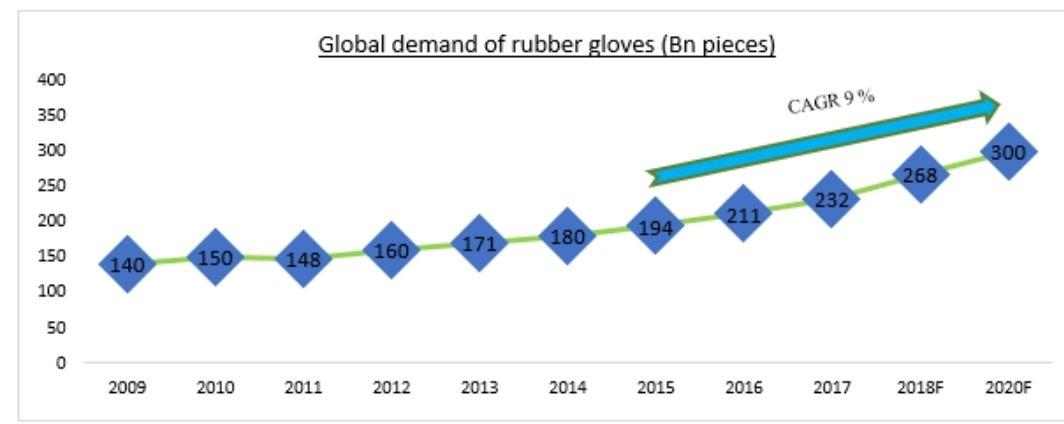

The global demand for gloves maintained

an 8% CAGR in the last decade and as per the initial estimates from the

MARGMA, the overall global demand for rubber gloves stood 268 billion

pieces in 2018. Surely this 2020 could be done more than 300 billion

with Covid-19 affected.

Rubber gloves suppliers of Malaysia

supplied 168.8 billion pieces or met 63% of the global demand, amounting

to RM18.8 billion in 2018. Moreover, rubber gloves make up more than

70% of all the rubber good exports for Malaysia.

An analysis of Malaysian rubber glove

industry, it was analysed that the growth in the healthcare industry

worldwide is one of the key drivers for the rubber gloves industry.

Further, the anticipated implementation of USP 800, which will be

effective from 1st Dec. 2019 (as per the recent guidelines from the US

Pharmacopeia Convention), is seen resulting in a healthy demand from the

US, which already accounts for more than a third of the global demand

for gloves.

Malaysia hold 65% of the global market

and will continue its leading position in coming years based on the fact

that the US hold 35% export value for Malaysian gloves and the local

government is also taking steps to support rubber gloves industry like

Entry Point Project of the promotion to increase Malaysia’s share on the

global map.

Malaysia’s rubber glove players could

also benefit from the latest US-China trade spat as medical gloves from

China are on the US$ 200 billion lists for Chinese goods, subject to a

10% import tax and this will certainly hamper China’s rubber gloves

manufacturers’ competitiveness.

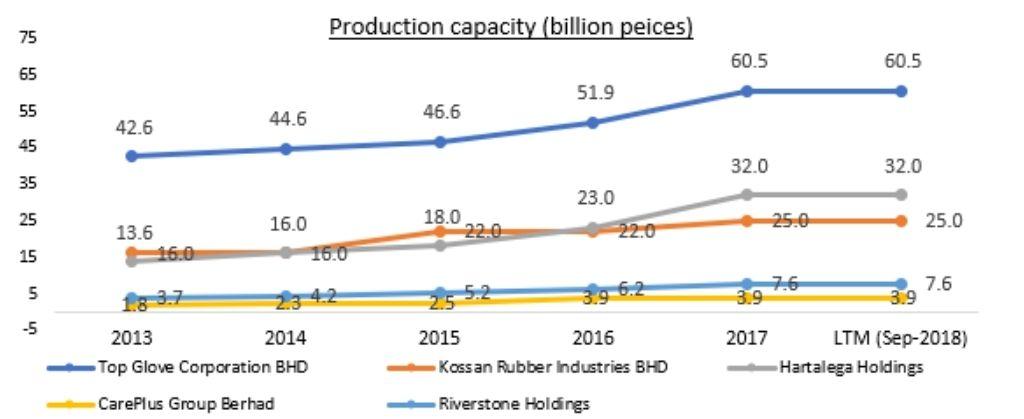

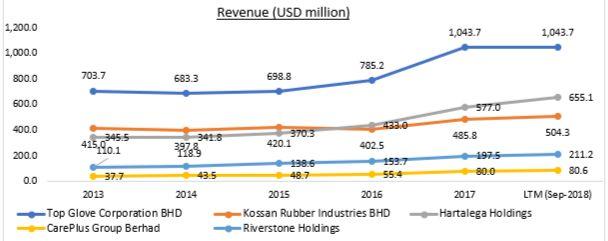

Internally for Malaysia, the major

producers have either increased their capacity or are increasing it

gradually, for the next 1 to 3 years, in order to fulfil the rising

global demand. The growth in the top line of the top five companies in

Malaysia; Top Glove, Hartalega, Kossan, CarePlus and Riverstone is in

line with the rising global demand for gloves.

Over the near term, a marginal

appreciation in the MYR against the USD will aid Malaysian players on

raw material costs (Latex), which is mainly imported from Thailand,

however, cost rationalizations are seen getting negated by modestly

lower realizations as a major part of sales are export driven.

Future outlook

Malaysia continues to hold the

dominant position in the global market with Thailand standing a distant

second and China holds a marginal market share of 5%. Malaysia is backed

by some of the largest players in the world and support from the

government is expected to continue with its leading position in the near

future. Furthermore, as per mid-year estimates from the MARGMA, the

annual growth in demand is expected to be 15% for the next few years. I

feel that the industry demand would see an increase from the broader

average of 8 to 15-20% this year, with 30% looking a bit high on

expectations due to pandemic Covid-19. This strong increase is

anticipated by a high percentage growth from global due the pandemic

went to worldwide alert.

2. Fears Of Fresh Virus Wave (2nd Waves)

Today, Coronavirus Cases hit 8,060,443

and the deaths nearly 437,052. People are fearful about new cases

rising, but at some point when you move 45% off the lows in such a short

period of time, any excuse will do to have a nice consolidation of the

gains.

And now a dismal economic outlook from

the U.S. Federal Reserve and jitters over a resurgence in coronavirus

cases sent the Wall Street's main indexes for their worst week since

March.

Once the market global stable back in a

few days, first recovery and surges sector MUST be a glove stocks. So

think twice if you want to cut-loss any of your holding glove stocks.

3. My other points same as I said on previously blog

1. Buy in June. History will repeat on previous April

2. Covid-19, Phase II just started

3. Other Glove Stocks limited signal

4. Crude and Brent Oil upcoming breakdown repeat.

5. Dow Jones will send to bear back.

6. My real target still remained with no changes.

More details, please read here

Ok,

so If we recall back on February 2020, the market is likely to see a

shortage of 10.8bn pcs of rubber gloves for this year amid new demand

from the coronavirus and the US influenza season. The recent virus

outbreak is expected to drive demand growth for rubber gloves for the

year, with earnings growth for glovemakers likely to be stronger in the

next coming quarters soon.

On

the back of a previously positive results of Top Gloves and Hartalega.

The rubber gloves sector is seeing signs of an uptick in demand in

subsequent quaters.

As

we know the latest Top Gloves Berhad had annouced their excellent

result. From here, I am seeing also perspective as I had told many times

to public that Gloves Sector standing on "Defending Stocks Territory".

Also, I am agreed some analysts said Top Glove have projected a net

profit of as high as RM3 billion for FY21 So if they really can

archieved that of course and definitely my last target RM35 surely hit

FY21.

TWO (2) GLOVE STOCKS IN MY FOCUS NOW

1. HARTALEGA

HARTALEGA - After

the uptrend. Now, the stock is in consolidation stages. The stock might

move around the price range 11.20 - 13.40 with strong volume. Once the

consolidation is done. You will see the next wave of breakout of this

stock to reach my highest Target Price (TP).

2. TOP GLOVE

TOP GLOVE -

It almost wanted to complete the 1st wave of uptrend after the

breakout. As long as it move above the moving average. High chance for

consolidation for next wave to move higher. For those who want to now

how you still can make money even the price of the stock already up

high. This is the good timing for those who still want to make money and

buy on this counter.

* Chart interpret by Kim's Chartist Team (Mr. Cheah) . Telegram : @KhengHan

HARTALEGA (BUY)

Entry Price : [ < 12.00 or 11.* ranges ]

Target Price : [ TP5: RM18 – TP6 RM23 ]

Last target : RM30 (Mac-2021 – Last target depend on COVID-19 situation)

Call Warrant : HARTA-C39 [ TP: RM2.05 ]

Good luck and stay tuned! #staysafe #stayhome

Best regards,

Kim

The Founder Of Kim's Stockwatch

The Founder Of Kim's Stockwatch

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advisor.

https://klse.i3investor.com/blogs/spartan/2020-06-16-story-h1508812952-GLOVE_STOCKS_WHAT_SHOULD_I_DO_NOW_MY_ANSWER_IS.jsp