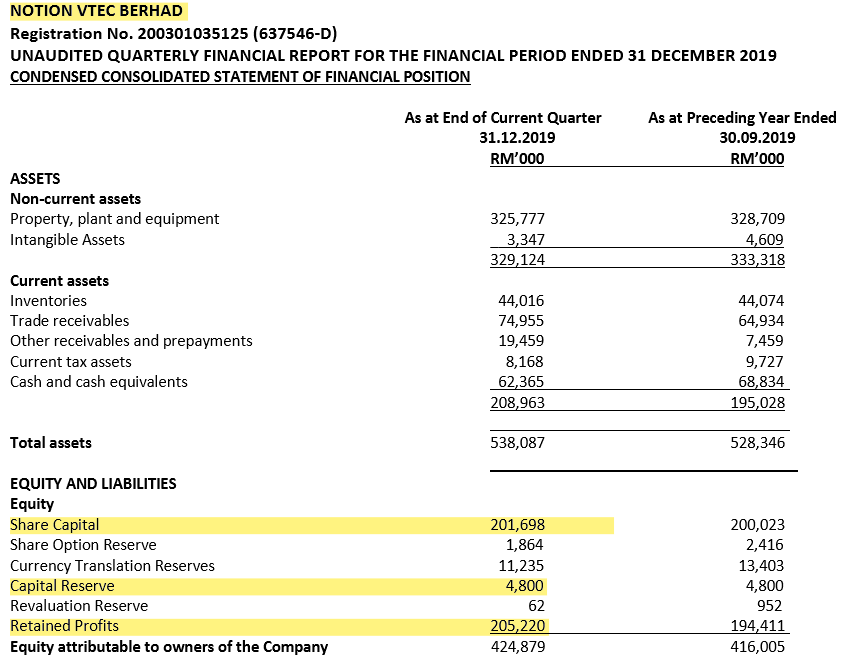

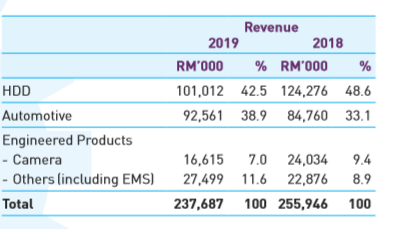

NOTION (0083) started their business with 4 machines back in 1995, listed in ACE market on 16th June 2005 with the IPO price of RM 0.63. Over the year of aggressive transformation, it had successfully progress from ACE market to Mainboard in the Technology sector. In Bursa, a few successful companies with similar transformation from ACE market to mainboard with outstanding performance. The most prominent one is Vitrox (0097) that listed with IPO price of RM 0.60 in 2005 and now RM 8.29 (1300% rise). There is one thing common in Notion (0083) and Vitrox (0097), both are very profitable business as their retained profit is very handsome compare to their share capital.

Compare the PE among these two, VITROX (PE 49) versus NOTION (PE 15). What will be the NOTION stock price if the PE goes up a little bit more, for example 30? The reasonable stock price will be around RM 2.18 (that is a whooping 100% potential from current price of RM 1.09)

Our reputable value investor – Mr. Fong Siling added NOTION as part of his portfolio in December 2019 and December 2016. If you click the link below, you will notice NOTION was his latest stock that he bought.

http://investips.my/?q=company&field_shareholder_tid_1=FONG%20SILING&field_symbol_tid=&items_per_page=50

Below is the RUG quote from his book published in 2018.

-

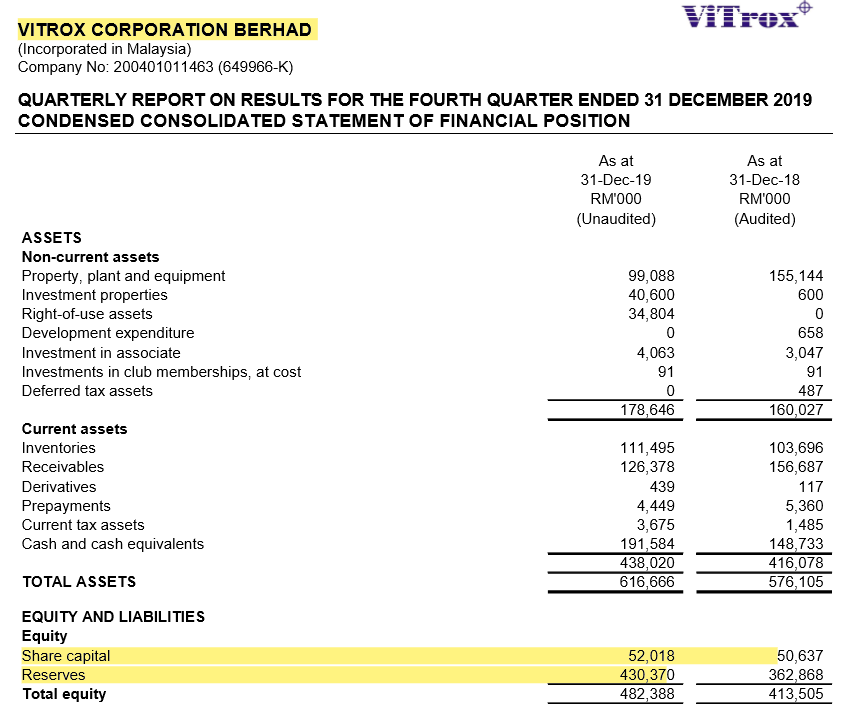

R (Recovery Stock) – Notion had a fire incident that significantly impacted Notion VTec’s operations since FY2018.

The

company slipped into the red with a net loss of RM4.4 million for the

nine months ended June 30, 2019 (9MFY2019), against a net profit of

RM8.2 million in 9MFY2018, partly due to the relocation and moving

expenses incurred.

But after the relocation, NOTION showed improving net profit earning. The latest Q1 2020 QR showed a remarkable 753% improvement EPS compare to Q1 2019. There is a potential further growth of the EPS in the coming quarter.

-

U (Undervalued Stock) –

NOTION current price at RM 1.09. NTA 1.26 (price have 15% upside

potential) or compare with Peer PE around 25-30 (If NOTION goes up to RM

1.83 to RM 2.10, this stock have 68-100% upside potential)

-

G (Growth Stocks) –

Explained by net profit growths from the chart above. In we take into

the profit generate from NOTION recent Healthcare venture as stated

below. The growth will be even better.

Given recent COVID-19 , do you need to worry about business impairment?

In their recent announcement. Executive chairman Thoo Chow Fah says Notion is expecting to produce 150 million pieces of three-ply surgical face masks per year, with annual sales estimated at more than RM100 million.

“The ventilator components are expected to garner sales of RM10 million to RM15 million over the next two months,” he tells The Edge.

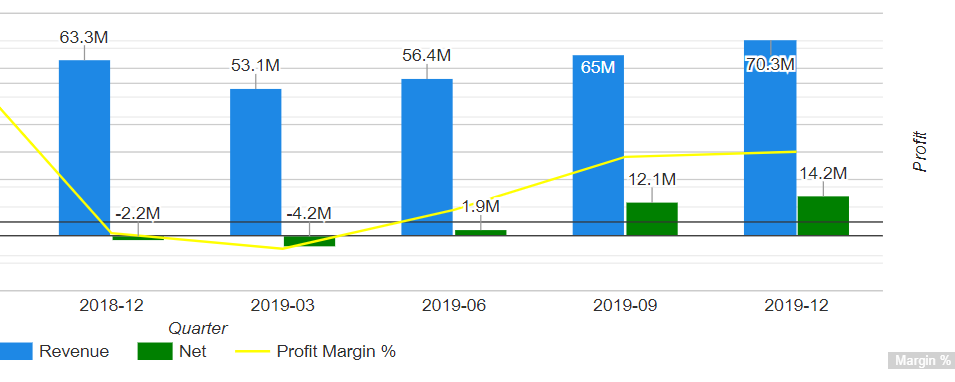

If we refer to their annual report 2019 for their whole year revenue

The new revenue of RM 110 mil (RM 10mil from ventilator sales and RM 100 mil from surgical mask) will contribute another extra 46% of the company revenue based on the total income of RM 237 mil in 2019

With the diversification of NOTION business, the risk of reduce order from Dyson (which belongs to others business) can easily balance by other aspect of business (ie. HDD, automotive, camera and healthcare product).

Furthermore, NOTION is one of the companies that got approval from MITI to allow partial operated during MCO period and fully operated since 28th April 2020.

NOTION also fulfil Warren Buffett stock selection criteria

-

Business model is easily understand.

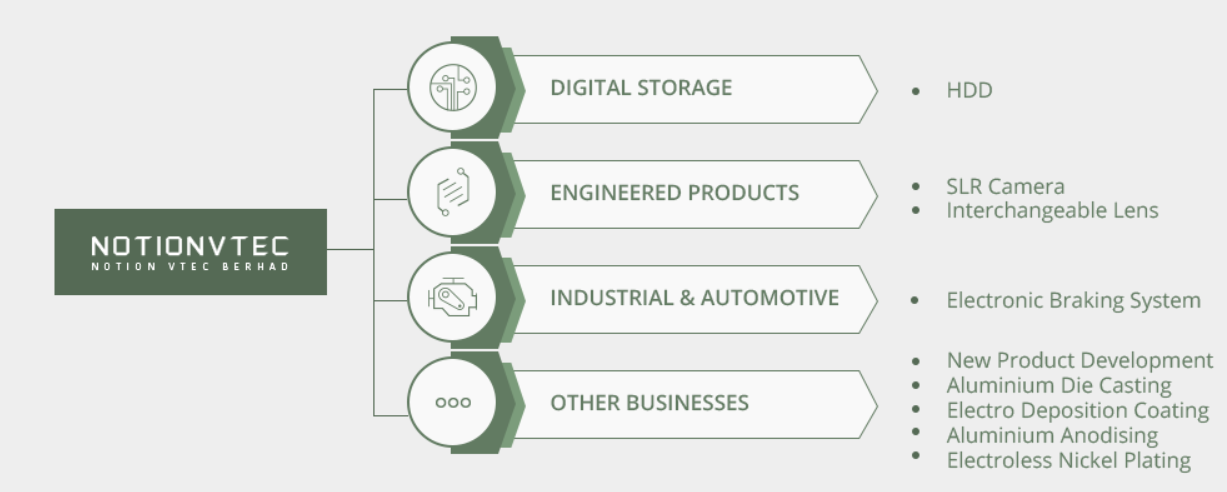

The structure of the business is self-explained by the chart below with

the new venture into healthcare (surgical facemask and ventilator).

-

With favourable long-term prospects.

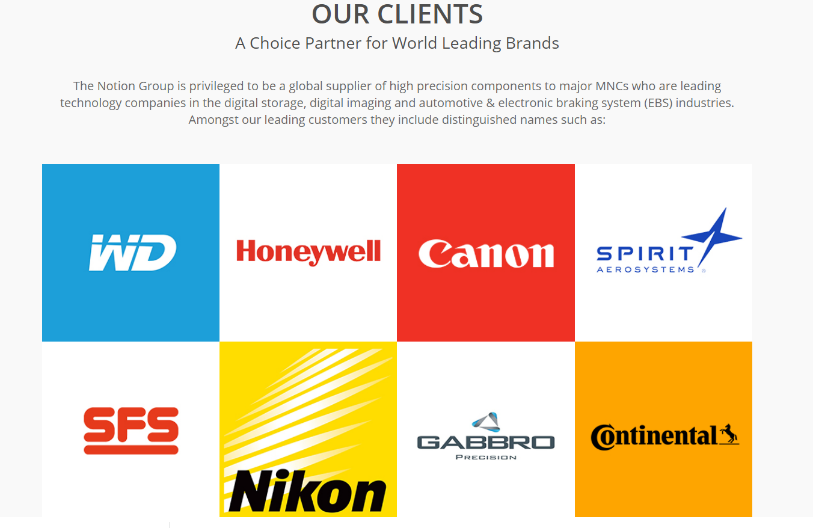

Looking into their prominent clients showed below from their official

website, all are reliable customer that will stay for long.

-

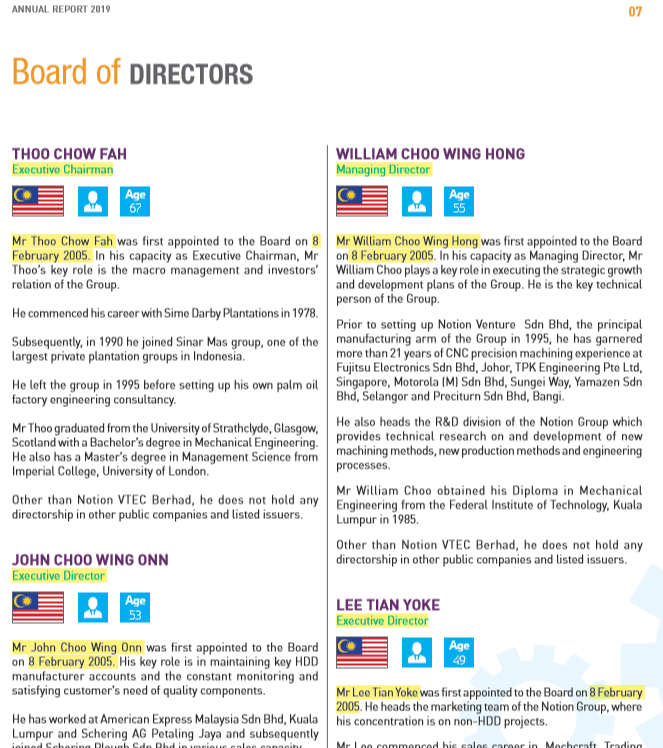

Operated by a competent team

– all their directors have been working in the company since NOTION

listed in 2005 for the past 15 years. In terms of experience and

capability, that had been showed with their business expansion,

transformation the company from ACE to Main board and create a good

opportunity to venture into healthcare in this business crisis period.

-

Available at a very attractive price-

as mentioned above, with current stock price of RM1.09. If compare to

the NTA 1.26 (price have 15% upside potential) or compare with Peer PE

around 25-30 (NOTION can goes up to RM 1.83 to RM 2.10, this stock have

68-100% upside potential)

https://klse.i3investor.com/blogs/0083/2020-05-04-story-h1506878623-NOTION_0083_Fong_Siling_latest_choice_of_stock_Don_t_miss_the_hidden_ge.jsp