HENGYUAN (4324) HENGYUAN REFINING COMPANY BERHAD FUEL CONSUMPTION TO RISE WHEN ECONOMY REOPEN !!! THIS STOCK WILL BENEFIT !!!

FUEL CONSUMPTION TO RISE WHEN ECONOMY REOPEN !!! THIS STOCK WILL BENEFIT !!!

Hello

to all readers out there. Yesterday on 1st May 2020 (Labour Day), our

Prime Minister announced that selective business which do not involve

physical contact, will be allowed to reopen on 4th May 2020 (coming

Monday). This includes also public transport:

Having said the above, the stock which I'd like to talk about today is Hengyuan Refining Company Berhad (Hengyuan - Stock Code 4324, Main Market, Energy - Oil & Gas Producers)

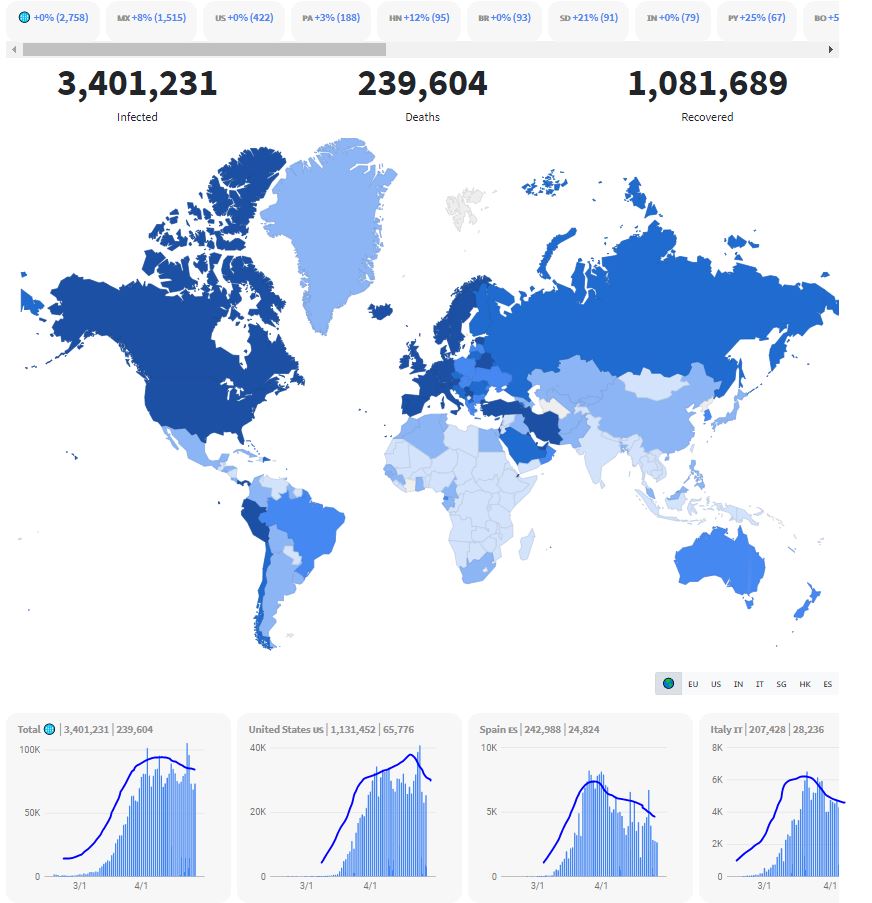

Recent

slump in oil consumption was mainly caused by stay-at-home orders all

over the world. However, looking at the trend of COVID19 cases across

the world (refer below image), it seems that the amount of new

infections has either flattended our or started to reduce in many

countries.

Some

countries have allowed partial re-opening of businesses, but with

strict procedures to be followed. With this trend in mind, fuel

consumption will generally be improving in the coming future months.

BASIC INFORMATION ABOUT PCCS

HENGYUAN

(formerly known as SHELL REFINING COMPANY) was incorporated in 1960 and

was listed on the Main Board of KLSE in 1962, is an oil refining

company operating in Port Dickson.

The total share float of this company is 300 million, which translates to a market cap of RM 936 million.

WHY INVEST IN HENGYUAN ???

Currently, there are a few factors which make the investment at current price look attractive. I will explain below.

1. FUEL CONSUMPTION BOOST CAUSED BY PARTIAL RE-OPEN OF ECONOMY

With

businesses re-opening on 4th May 2020, fuel consumption will be spiking

up as normal people and businesses start to resume operations. Among

those fuel consumption include:

i. premises such as factories, warehouses, facilities, etc

ii. transportations - aircraft, buses, trains, lorries, vans, cars, etc

This

surge in demand for oil, will demand refiners such as HENGYUAN to be on

standby to drive up oil processing in order to be able to timely

deliver to the local market demand.

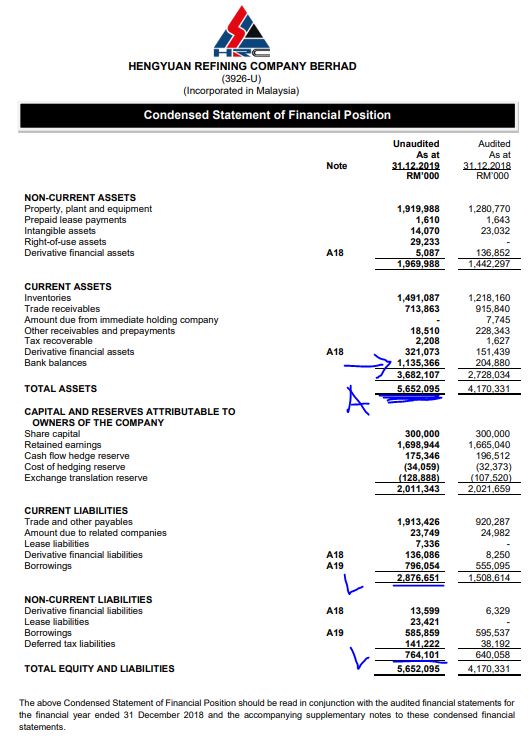

2. HENGYUAN HAVING A HEALTHY CASH PILE ON STANDBY IN CASE OF NEED TO RAMP UP VOLUME

Refer

to latest HENGYUAN book as of FEB2020 QR. We can see from the arrow

that HENGYUAN has about RM 1.135 billion in cash (which translates to RM

3.78 cash per share). This value is higher than the current market cap

of HENGYUAN at RM 936 million. Also, note that, the CASH PER SHARE

itself is already higher than the latest closing price of RM 3.12.

This

healthy cash pile, would be very important in the case of HENGYUAN

being required to ramp up its processing as required by the market

demand, to pay for the increased operating expenditures (manpower,

utilities, vendors, etc) and also higher product intake (crude oil) to

produce more output (finished oil goods)

Also worth to note that total assets stood at RM 5.652 billion versus liabilities of RM 3.64 billion.

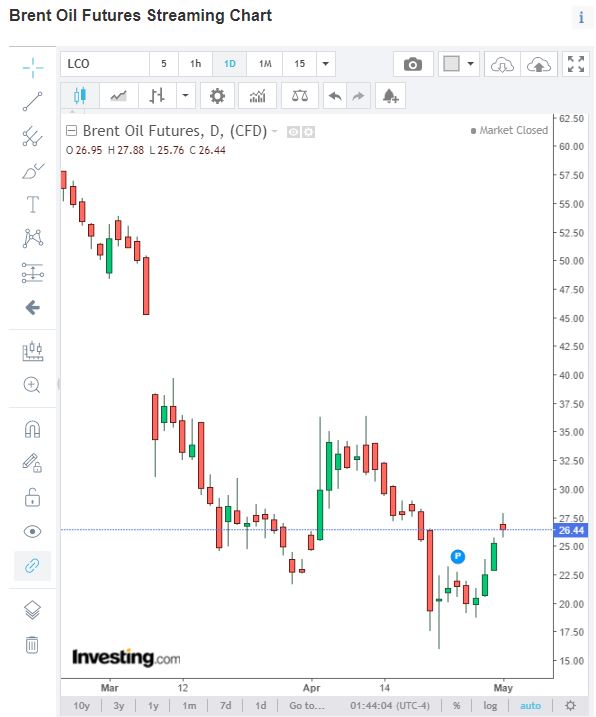

3. STOCK HOLDING GAINS IMPROVE AS OIL PRICE RECOVERS

Stockholding gain is referring to gain in the crude oil barrels being kept as inventory, as the price of crude oil moves up.

Let's

see the recent daily chart of Brent Oil, where it had bottomed at USd

15.98 on 22nd April 2020, and since then rebounded to close at USD

26.61. As oil prices gradually recover, HENGYUAN will be able to make

gains on its stock holding as it processes the oil products.

Also,

recently I read a very interesting article where Goldman Sachs had

mentioned 5 reasons why traders should load up on energy stocks

following oil's historic price plunge. The article below:

The reasons, in summary are:

i. Oil prices are at/below CASH COSTS

ii. Shut-in announcements are becoming material

iii. Demand appears to be at trough

iv. Valuation near 25-year lows on EV/gross cash invested basis

v. Stocks on average have stopped falling on recent bad micro news

4. TECHNICAL ANALYSIS - CUP AND HANDLE FORMATION, PENDING BREAKOUT

Refer below a simple price and volume chart, with EMAs 14, 43, 200 and 365.

We

can see that the candles had formed a cup and handle formation, which

recent high being at RM 3.29 area pending for breakout (refer Circle 2).

On

Thursday, 30th April 2020, the price managed to break-out above EMA14

of RM 2.98 and EMA43 of RM 3.03, which indicates short term bullish

momentum. This rise was accompanied by larger than usual volumes (Circle

3).

The next EMA to be tested is EMA200 at RM 3.96 and EMA365 at RM 4.64.

CONCLUSION

Considering all the above, I opine that current price for HENGYUAN is attractive due to below:

i) Fuel consumption to rise following economy re-open on 4th May 2020

ii) Healthy cash pile of RM 1.135 billion on standby in case the need to ramp up production as required by demand

iii) Improved stock holding gains as crude oil prices recover

iv) Pending cup and handle pattern breakout, with short term EMA broken out with significant volume

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-05-02-story-h1506854498-FUEL_CONSUMPTION_TO_RISE_WHEN_ECONOMY_REOPEN_THIS_STOCK_WILL_BENEFIT.jsp