Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

EG INDUSTRIES BHD or EG (Code 8907, MAIN Market, Industrial Products & Services, Food & Beverage)

EG - UNDERVALUED STOCK - FOR THOSE BARGAIN HUNTERS (EPF A SHAREHOLDER) !!!

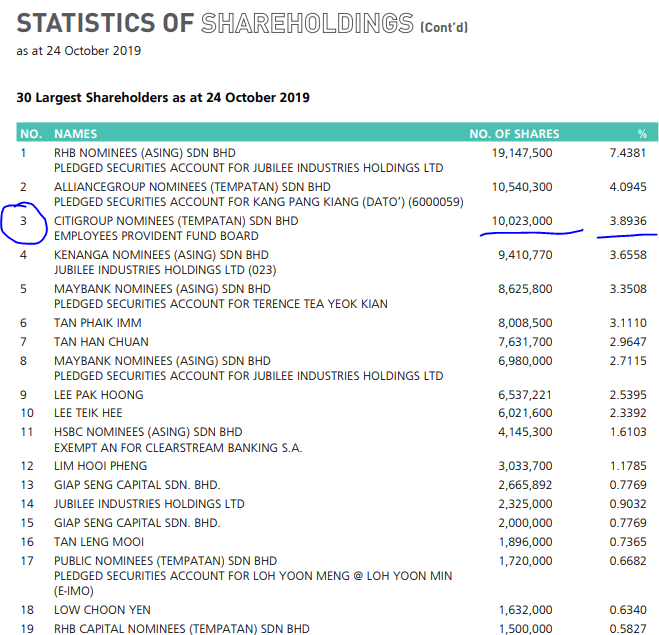

1. EPF As A Substantial Shareholder As of 2019 Annual Report - 10.023 Million Shares (3.89%)

Below is the list of 30 largest shareholders as at 24th October 2019 (taken from Annual Report 2019).

As we can see, EPF is one of the major shareholder holding 10.023

million shares or 3.89%. I believe EPF made an investment into this

company, due to its long term profitability potential and asset

positioning in Malaysia.

EG operates mainly in Kedah, Penang.

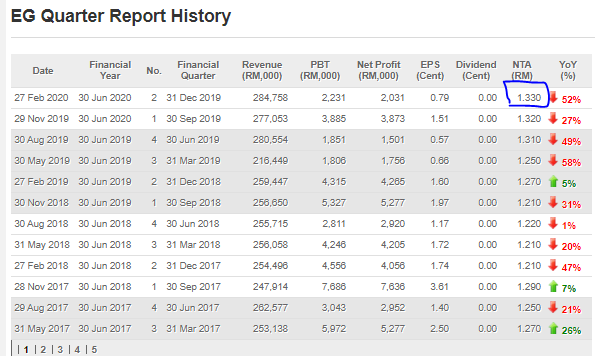

2. Stock Price Is Way Below Its NTA of RM 1.33 & Low P/E Ratio At 6.3X

Below is the latest quarter result summary of EG. A few observations:

i. Revenue has been consistent since last 3 quarters at RM 277 - 284 million per quarter

ii. Net profit ranged between RM 1.7 - 3.8 mil in the last 4 quarters

iii. NTA value stood between RM 1.25 - 1.33 in the past 4 quarters. The

current closing price of 29c, is way below its NTA value of RM 1.33 as

of latest quarter. Longer term investors might be looking for such a

bargain in the market.

iv. Current 2 quarter Earnings Per Share (EPS) stood at 2.3c. If this

performance is maintained for the following 2 quarters, the full year

EPS will stand at 4.6c. This means that the current closing price of

29c, is only a 6.3X PE Ratio for this company. Considering a company in

manufacturing sector, this is quite low as compared to a few peers below

in same category:

BOILERM, P/E RATIO 10

DANCO, P/E RATIO 9.7

FPGROUP, P/E RATIO 29

3. Prospects Which Might Boost Earnings In Upcoming Quarters As Commented by The Board

As mentioned in the Annual Report 2019 and Latest February 2020 Quarter

Report (links provided below), the below prospects of the company look

promising:

i. Group anticipates global electronic manufacturing services to

continue to shift out from China to South East Asia (the effect from

US-China trade war). Thus factory expansion Malaysia will be ongoing as

the Group had received more enquiries from several multinational

companies and several new projects successfully launched in 2019

ii. The newly-acquired land and factory is the Group's first fully

automated manufacturing facilities has commenced operations in November

2019, enabling the Group to take on more jobs and expected to contribute

positively in coming quarters

iii. Group will continue its effort towards adoption of Industry 4.0

and factory automation to improve its overall cost-efficiency, quality

and reduce reliance in human labor

iv. Group to continue to enhance product mix to focus on high margin

operations and constantly look for ways to enhance production efficiency

v. Group will target more on medical and automotive industry, as these 2

industries are seen to continue rapid phase of growth in technology.

These 2 industries will be relying heavily on Internet of Things (IoT)

in the future. Group will actively engage sector players, to offer high

quality standards and broad range of solutions.

February 2020 Quarter Report link:

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=208808&name=EA_FR_ATTACHMENTS

2019 Annual Report link:

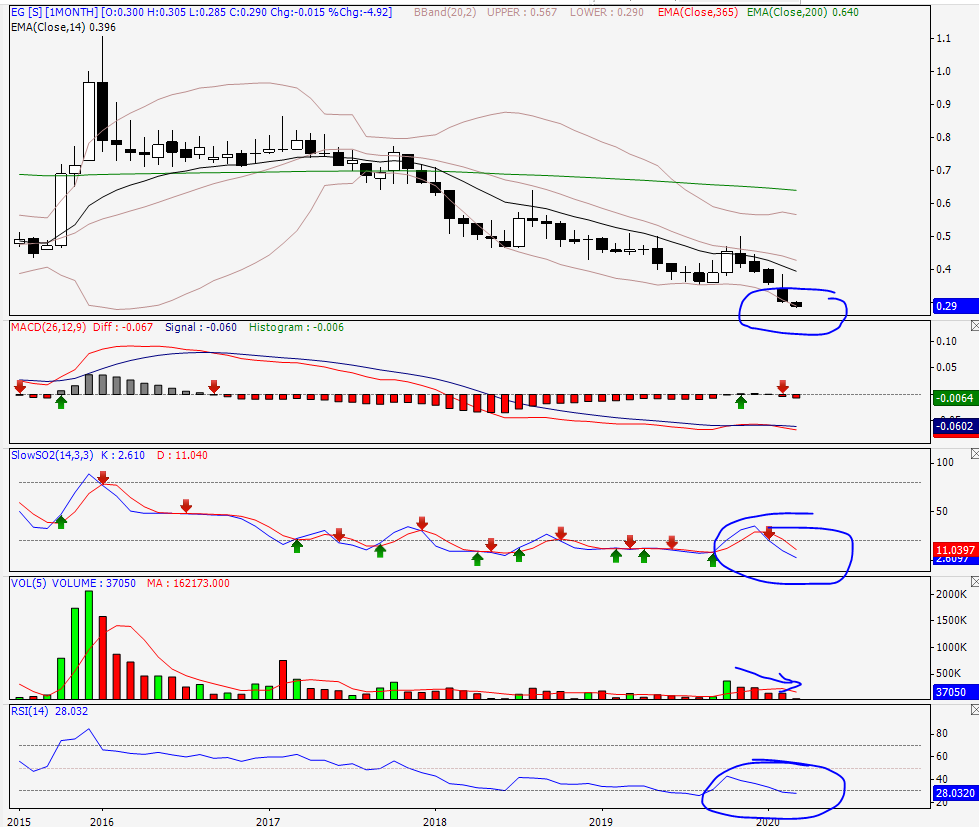

4. TECHNICAL ANALYSIS - Trading At Historical Low Price, With Sellers Volume Diminishing

Let's take a look at the monthly chart of EG:

A few observations below:

i) EG is now trading at historically low prices since its listing. The

previous historical low was 32.5c, during the 2008 financial crisis. It

seems the selling has been overdone, considering the strength in company

revenue and prospects, coupled with improving economic conditions, do

not indicate that we are in any financial crisis

ii) Stock is now trading at lower BB, indicating a bargain hunting opportunity for long term investors

iii) Selling volume is diminishing, and buyers are rejecting lower prices

iv) RSI and stochastics also indicating oversold positions

Let's take a look at the daily chart:

A few observations:

i) Stock touched a low of 28.5c and refused to drop further. Volumes of buyers are starting to support it

ii) Stochastic and RSI indicating oversold condition

iii) Volume of sellers are diminishing

5. Lower Entry to EG via EG-Warrant C (EG-WC)

For investors with lower capital, may consider entry into the company warrants.

Let's take a look at profile of EG-WC:

A few observations:

i) Maturity in November 2020, another 8 months to go till expiry

ii) Strike price of 42c, which is considerably ok considering the amount of time left until expiry

iii) Premium of 55%

If we look at the mother share price, EMA14 is at 40 cents. Should the

mother shares see rebound in price soon, the warrants will also see

potential gain of price as there is sufficient time for price

appreciation and the strike price is reasonably within the range of

achievement within 8 months.

CONCLUSION

Based on my opinion, I believe EG is undervalued and should be given attention, based on below:

i. EPF as a substantial shareholder in EG at 10 million shares (3.89%)

ii. Stock trading way below its NTA of RM 1.33 and Low P/E Ratio at 6.3X

iii. Prospects Mentioned by The Board On Improvement of Earnings In Coming Quarters

iv. Chart Shows Buyers Rejecting Lower Prices, And Stock Is In Oversold Condition

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-03-03-story-h1484688911-UNDERVALUED_STOCK_FOR_BARGAIN_HUNTERS_EPF_A_SHAREHOLDER.jsp

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-03-03-story-h1484688911-UNDERVALUED_STOCK_FOR_BARGAIN_HUNTERS_EPF_A_SHAREHOLDER.jsp