HENGYUAN - WORST IS OVER FOR THIS COMPANY !!! RENEWED BUYING INTEREST EMERGES !!!

(INVESTMENT GRADE COUNTER)

I

would like to highlight about this big cap company; which I believe has

seen its worst days, and might see bright future ahead -HENGYUAN REFINING COMPANY (Stock Code 4234, listed on MAIN MARKET, ENERGY Sector, market cap RM 1.227 billion as at writing)

Please

do note that I am not an expert in oil & gas field, and that the

terms I am using are mostly layman terms that any average person should

be able to understand. Please feel free to add-on any comments that you

feel could contribute to this article.

1. First Factor - Improved Refining Crack Spread

What is a crack spread?

Crack spread is a term used on the oil industry and futures trading for the differential between the price of crude oil and petroleum products extracted from it. The spread approximates the profit margin that an oil refinery can expect to make by “cracking” the long-chain hydrocarbons of crude oil into useful shorter-chain petroleum products.

Previously,

one of our fellow senior investors had shared about this matter in

detail in his blog write-up. I append here the article link so that you

may read further as I find his write-up explains a lot more detail about

this.

Please refer below weekly chart of SINGAPORE MOGAS 92 UNLEADED (PLATTS) BRENT CRACK SPREAD FUTURES (link provided).

Some observations:

i) In between December 2019 to January 2020, crack spread remained between USD 5-6 dollars

ii) Starting early February 2020, crack spread started to improve above USD 6.50, touching highest USD 9++ before retracing back to USD 7.40

iii) Coupled with factor 2, 3 and 4 below, maybe caused HENGYUAN price to pickup momentum in buying

2. Second Factor - Stockholding Gain Increases as Crude Oil Moves Up in Q4 2019

Stockholding gain is referring to gain in the crude oil barrels being kept as inventory, as the price of crude oil moves up.

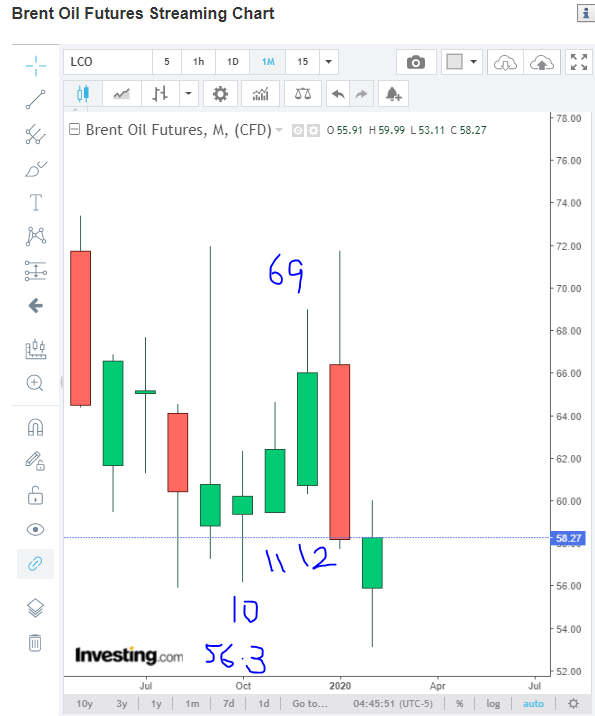

Refer below Monthly chart of Brent Oil. As we can see, the

price of crude oil in Q4 2019, had jumped from USD 56.3 to USD 69 peak

(a 22.6% gain in this quarter). Hence, therefore, HENGYUAN potentially

should be seeing a better stockholding gain in upcoming quarter, based on the movement of crude oil prices.

Although

recently, crude oil prices dropped temporarily due to coronavirus

issue, however we can see that the prices are gradually recovering as

the world is more aware of how to deal with the COVID-19 outbreak.

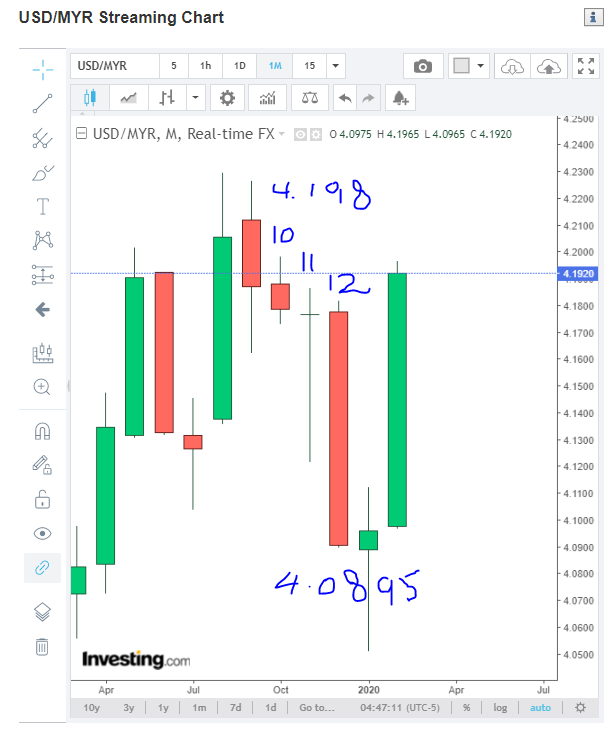

3. Third Factor - Strengthening of MYR Against USD in Q4 2019

HENGYUAN

is primarily relying on MYR denominated revenues compared to USD, hence

therefore any strengthening in the MYR would significantly impact

overall profit margins.

As we can see, in

Q4 2019, MYR had strengthened from 4.198 to 4.0895. This would mean a

positive impact to the company profit margins in upcoming quarter

result.

Same

as previously commented, MYR had temporarily weakened again due to

COVID-19 impact. This would be seen as temporary and would gradually

recover over time.

4. Fourth Factor - Charts Never Lie - Surge In Volume Buying Interest With Increased Price Spread

Refer below the daily chart for HENGYUAN.

A few observations below:

i)

In early February 2020, price hits recent low range of RM 3.30-3.40,

and stayed at this level within 8 market days. However the traded volume

remained significantly low

ii)

Between 14-21 FEB 2020, the trading volume surged 7 to 10 times that of

average trading volume, with the price spreading significantly on daily

basis (20-50c movement per day, from top to bottom)

iii) Touched EMA200 at RM 4.60 before making retracement towards EMA43 (green line)

CONCLUSION

Considering all the above, I foresee interesting time ahead for HENGYUAN due to below:

i) Improved crack spread starting from FEBRUARY 2020

ii) Improved stockholding gains in Q4 2019

iii) Improved profit gains due to strengthening of MYR against USD in Q4 2019

iv) Chart shows market is rejecting low prices, as the price appreciates together with trading volume

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER