On behalf of Stocks Insights Team, I’d like to wish everyone a very

happy Chinese New Year in advance! Let’s kick of this New Year with a

brand new article about a Malaysian real estate investment trust,

CapitaLand Malaysia Mall Trust (“CMMT”).

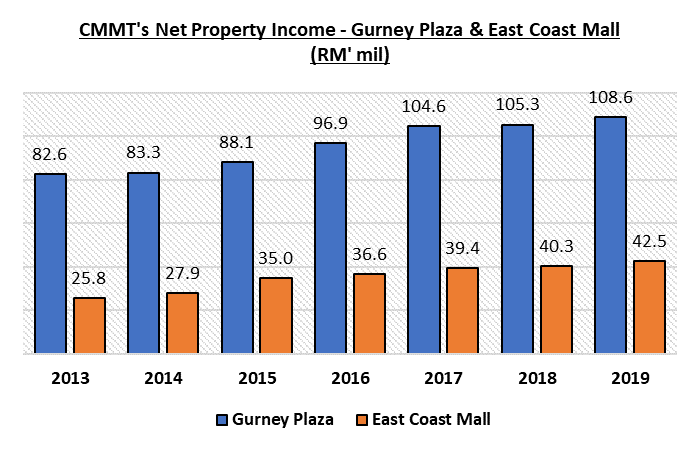

Like any other real estate investment trusts, CMMT is listed in the

Main Board of Bursa Malaysia with the stock code, KLSE: 5180. The

company mainly focus on retail spaces in Malaysia and in recent years

have not been doing well.

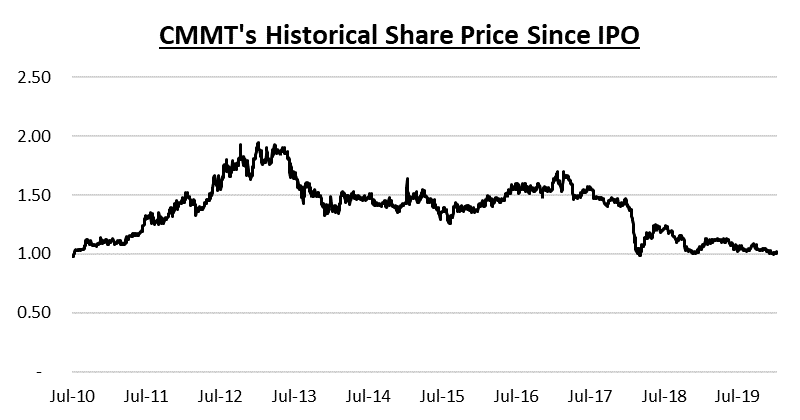

Share price have come under pressure from its peak of RM1.95 per share

in year 2013 to just RM1.00 per share at the time of writing. This gives

an attractive distribution yield of 6.19%. However, we should always

examine further whether such dividend yield is sustainable or not.

So, here’s 3 reasons why CMMT is trading at cheap valuation:

#1: Negative Rental Reversion

As at 4Q 2019, CMMT has an average negative rental reversion of -5.7%.

Out of the 5 properties owned by CMMT, only 2 properties have positive

rental reversion. This means lower rental income moving forward for

CMMT.

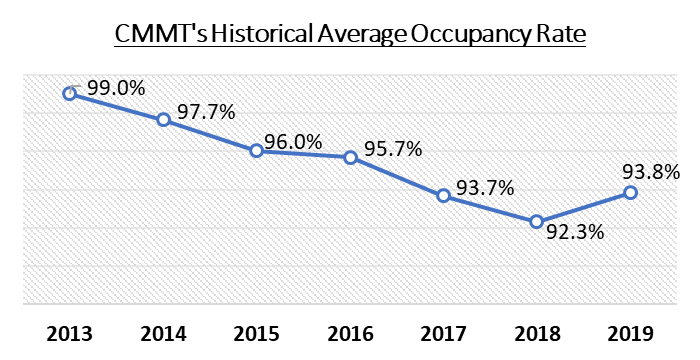

I believe that such negative reversion was to maintain the occupancy

rate for both CMMT’s retail and office spaces. As at 4Q 2019, CMMT has

an average occupancy rate of 93.8% which is healthy but at the expense

of lower rental income.

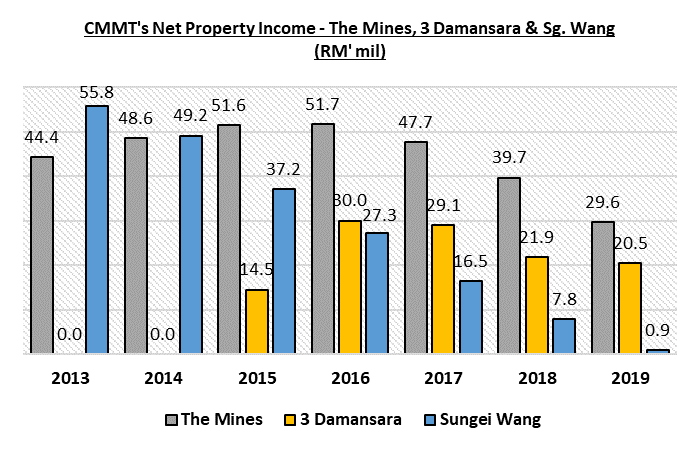

#2: Major Asset Enhancement Initiative on Sungei Wang

In 2Q 2018, the management announced a major asset enhancement

initiative (“AEI”) for its Sungei Wang (“SW”) Plaza following the exit

of Parkson from SW Plaza. The AEI costs a total of RM54.5 mil for

reconfiguring part of SW Plaza’s annex space.

The annex space was known as “Jumpa” with the interior designed to

attract urbanites and tourists alike. It was opened on 25 September

2019. I was curious about how the crowd is like at there, so I went to

check it out on a Friday night. Below are the photos I have taken on 3

January 2020:

The annex has 6 levels in total. Except for level 1 and 2, all other

levels are occupied. However, there is not much crowd during my visit.

I’m surprised to be able to take a clear shot without any people walk

pass-by. This is worrying because it’s Friday night and there is not

much shopper traffic here.

Nevertheless, something caught my attention is the directory board here:

It seems there is a cinema at Jumpa. If this is true, then I believe it

is good news for investors because cinema is one of the best anchor

tenant for retail REITs, in my opinion. Good cinemas such as TGV, GSC or

MBO can be a crowd puller for Jumpa. Thus, increases the shopper

traffic.

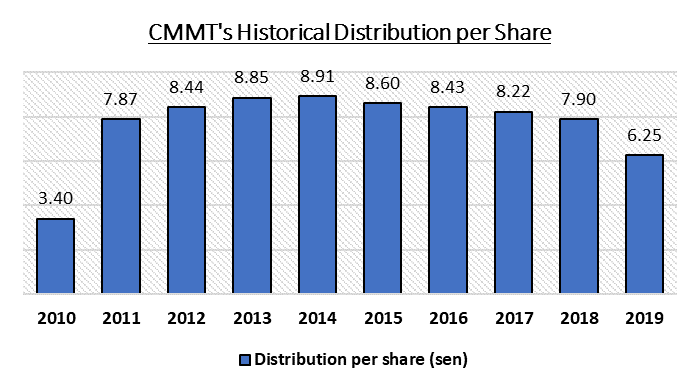

#3: Lower Distribution per Unit Declared

Despite CMMT is trading at an attractive distribution yield, the

company actually is paying lower distribution per unit since 2016. The

main reason being the deteriorating financial results due to the above

reasons.

My Insights

There is always a reason why a stock is trading at cheap valuation. You

can never have both positive company’s outlook and cheap valuation.

Both outlook and valuation will always goes in an opposite direction.

Find out the reason why CMMT is trading at cheap valuation and ask

yourself, “is the issue facing CMMT temporary or permanent?” Then you’ll

know whether to invest or not.

For CMMT, I would adopt the “wait and see” approach as things are not looking good for them.

This article is taken from https://www.stocksinsights.com/. If you would like to receive more key insights article for free, do subscribe to my website. You can also check out my past articles on REITs or increase your investing knowledge by browsing through my articles on Investing 101.