[Details of UWC (5292) -AGM Meeting]

The company's goal is to become the preferred OEM partner in the future and provide complete solutions with leading technology.

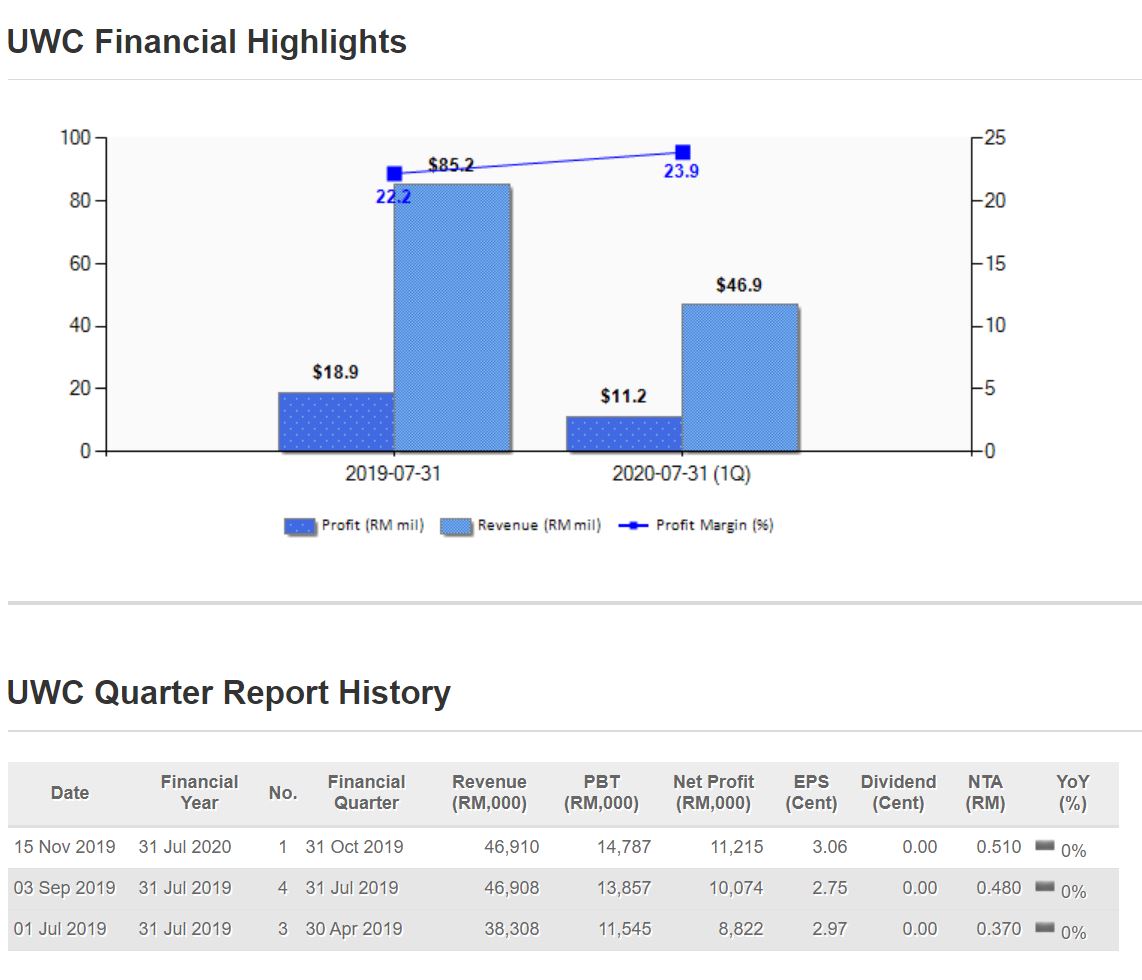

Looking back at FY2019, the company generated a turnover of RM144.4mil.

From the past 3 years until today, its average annual growth rate is

23.7%.

Profit margin has been improving since FY2017. UWC is also a net cash company with net cash of RM39.8mil.

UWC provides sheet metal fabrication and machining services for semiconductors to Life-science.

Headquartered in Malaysia and has multinational customers. UWC is

constantly improving its expertise to obtain higher value contracts. And

the order on hand (up to 3 months) continues to increase, currently up

to RM57mil.

The company proposes to pay RM11mil as a dividend for FY2019, which is

3.0 cents per share. The company proposed a bonus issue - 1 for every 2

shares. In addition, the company also proposed the establishment of

employees ’share grant scheme.

Compared with FY2019 and FY2018, the company's turnover and PAT

increased by 5.8% and 16.1%, respectively. The company's listing cost

was RM2.8mil, which was offset by a one-time gain of RM8.8mil from

selling the old factory.

The company's FY2019 turnover comes from different fields, which are:

1. Semiconductor – RM 86.3 mil (60%)

2. Life Science – 37.4mil (26%)

3. Medical Technology – RM15.1mil (10%)

4. Heavy Duty - 5.5mil (4%)

1. Semiconductor – RM 86.3 mil (60%)

2. Life Science – 37.4mil (26%)

3. Medical Technology – RM15.1mil (10%)

4. Heavy Duty - 5.5mil (4%)

The main sources of turnover include Malaysia (58.8%), Singapore (34%),

the United States (2.2%), China (1.8%), France (1.7%), and elsewhere

(1.5%).

In the next 3 years, the company's goal is to double its business

(expand customer base and expand to more areas), achieve sustainable

market value (ensure performance and value growth, maintain dividend

policy), and undertake more activities to enable the company has

achieved sustainable development.

The company is also actively researching and participating in 5G technology development.

According to Ericsson and Arthur D. Little's research, the 5G era can

allow the ICT industry to generate total revenue of US $ 1,233 bil in

2026. These industries include financial services (6%), automotive (8%),

and public transportation. (12%), multimedia entertainment (10%),

medical (12%), energy (20%), manufacturing (19%), and public safety

(13%).

And UWC will focus on the direction of 5G testing and Core Network

Devices providers, hence UWC can get a share out of the 1,233 bil

dollars, which is also a stepping stone for UWC to double its revenue in

3 years.

Q&A Time:

✅ Q: From 2017 to 2018, UWC ’s profitability has increased significantly (by about 110%), and from 2018 to 2019, although it has also increased (by about 16%), it has a larger growth rate compared to 2018. It seems to be weakening. Is it because of the China-US trade war?

A: In fact, we have a one-time gain in 2018, and we also have a

one-time loss in 2019. Excluding these one-off gains and losses, I

believe that the growth of 2019 is not small compared to the growth of

2018. As for the China-US trade war, I would say that is only for short

term, it will not have deep impact on us. I know that many companies are

victims of the China-U.S. Trade war, and some are beneficiaries. I

would say that UWC is definitely not on the victim's side, but we are

not too optimistic about the China-U.S. Trade war.

✅ Q: What do you think of 2020?

A: For 2020, we are still optimistic.

✅ Q: How much has the fall in the US dollar against the ringgit affected you?

A: We promised our customers that if the fluctuation of the US dollar

exchange rate is within 5%, we will bear it. If it exceeds 5%, those

will be passed on to the customer.

(According to the company's exchange rate risk data in the 2019 annual report, if the U.S. dollar falls by 5%, using the profit of 2019 as the standard, it will affect the company's profit by up to 2.3%.)

(According to the company's exchange rate risk data in the 2019 annual report, if the U.S. dollar falls by 5%, using the profit of 2019 as the standard, it will affect the company's profit by up to 2.3%.)

✅ Q: What percentage of the company's turnover will the semiconductor business account for in the future?

A: Currently it is 60%. I think there will be more in the future

because the margin of the semiconductor business will be higher, and the

Gross Profit Margin is more than 30%. To do business is to seize the

opportunity. When 5G comes, if you don’t seize it, there will be no

more. We must be ready now. We have a lot of business to do, but we will

mainly choose high value to do, so we will Increase semiconductor

business. However, we will not be solely semiconductors. Although

semiconductors are more profitable than Life Science, we must spread the

risks.

Team Opinion:

UWC is a very good company. The management announced at the shareholders meeting that they would double UWC's turnover within 3 years, and the management has always emphasized that they can achieve it, as if they wanted to list UWC 3 years ago, and it was done in two and a half years.

The CEO also mentioned that CEO graduated from the university at the

age of 22 and started a business after working for 5 years. Started

buying machinery. CEO is proud to say that he made 70% of all electrical

appliances in Malaysia at that time, and then slowly transformed,

constantly seizing trends and business opportunities. Until now, he has

more than 30 years of experience and led UWC to become a listed company.

CEO was also very confident to say, "I never know what a bad market

is." It shows the CEO keen business acumen and confidence. And he valued

UWC more than himself. Without UWC, his life would not change so much.

Overall, the management of UWC is very confident and optimistic about

the company's prospects, and also revealed that the next performance

will not disappoint everyone. Based on the company's orders are

increasing, profit margins are also improving, and the performance

remains double-digit Growth is not a surprise, and because of this, the

stock price has hit a record high!

Louis Yap

Facebook:

Web Site: