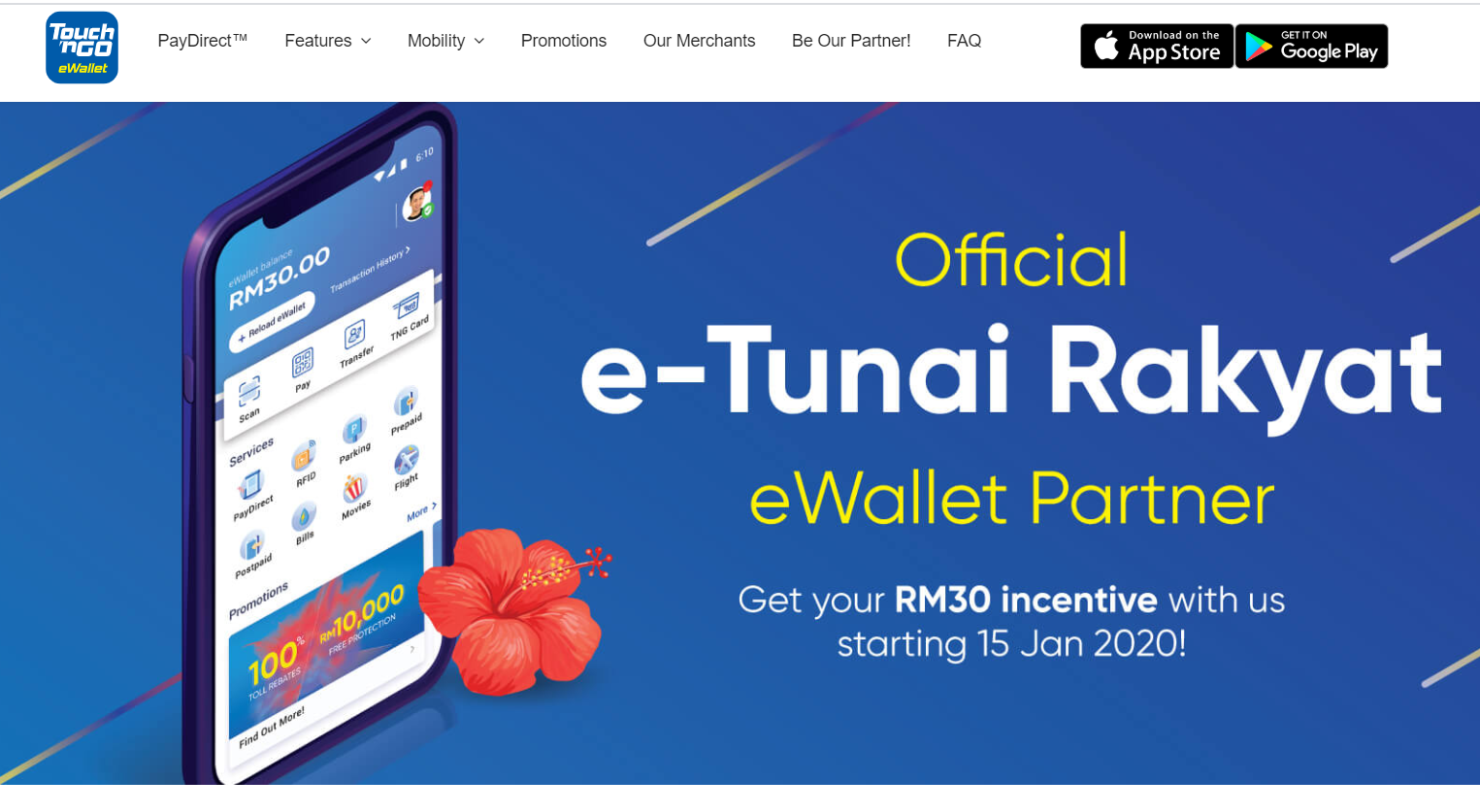

Umum mengetahui dalam Belanjawan 2020 kerajaan telah memperuntukkan RM450 juta balik perlaksanaan insentif eTunai Rakyat.

Melalui program ini, setiap rakyat Malaysia berumur 18 tahun ke atas

dan berpendapatan RM100,000 ke bawah setahun layak menerima RM30 kredit

dompet digital atau eWallet.

Penebusan boleh dibuat bermula 15 Januari 2020 dan program ini akan tamat pada 14 Mac 2020.

Antara dompet digital yang terpilih bagi perlaksanaan program ini ialah Touch n Go eWallet, Boost dan juga GrabPay.

These Companies are not Public Listed Companies.

Revenue 0200 is the one who have RevPay that cooperate with banks in Malaysia.

Lets Recap the Q&A sessions at Revenue AGM!

✅ Q:

Who are your current competitors? Will more competitors make software

like Revpay and take away your customers in the future?

A: GHL is the biggest competitor right now. In the IT industry, anyone

can do it, and competition always exists, hence we have been constantly

improving and innovating. If we don't, we will soon be caught up by

others. But to achieve the electronic payment industry, the threshold is

very high and it is not easy. First of all, our credit card machine

manufacturers need to obtain the VISA MASTER license, and then the

required level of IT technology is very high. Then, our own developed

apps must be approved by the National Bank, etc., and then go through

the responsible application process. Began leasing to customers (banks).

These steps will be repeated with a second bank. There are more than

ten banks in Malaysia, and we will repeat these steps more than ten

times. And it is very difficult to enter into this field, and we did it.

Revpay is certainly possible for others, but it is definitely not easy

task. Even if I show you the operation behind Revpay today, you can't

run this business because the hardest part is that you need to go

through a lot of procedures, licenses and approvals.

✅ Q:

Can you share how long it took you to develop Revpay? How long did it

take to find the first bank to work with those e-wallet providers?

A: We started this business in 2003. It was not until 2005 that we

received our first order, which was an AMBANK order. Because at that

time we only provided credit card machines and VISA MASTER card

software. At that time, we were not very professional in these

back-ends, and it took us 5 years to learn this knowledge. So, the

entire process took us more than 10 years to understand the platform,

and then another few years to create Revpay.

✅ Q: I heard that the company will not be limited to the business of payment services.

A: We have been in the payment services industry for 16 years, and most

banks are already our customers. We have a B2B partnership with banks

and Card Scheme, but we lack of partnership with Merchant B2C. We have

achieve this thing so that we can provide more value to these Merchants

and help them get more business, and ultimately we will get more

business as well. I need to explain why we want to acquire Anypay, it is

because more and more people use cashless, although profit will

increase, but our profit margin will definitely decline, so we need to

provide other services to maintain our profit margin. And Anypay can

provide some other services to maintain our profit margin.

✅ Q: The company recently announced a partnership with Grab Pay. Is it also available in Malaysia or abroad?

A: Currently only in Malaysia. I believe everyone knows that we have

also cooperated with Touch n go so that everyone can pay with touch n go

on Taobao. Grab pay has the opportunity to make payment to Taobao like

touch n go as well, but it is still under negotiation.

✅ Q: Can we replace EDC with mobile phones like China? Will this affect the company in the future?

CEO's answer: First of all, mobile phones are inherently an insecure

device. It cannot be used to replace EDC, but mobile phones can be used

to obtain QR codes. At present, QR code acquisition has not been widely

accepted in Malaysia. Hence the current mobile phone cannot replace EDC.

CTO Answer: Let's discuss whether mobile phones can replace EDC. I

think most mobile phone manufacturers are developing in this direction,

such as SAMSUNG PAY. No one can use these apps except the mobile phone

manufacturer. And we can only cooperate with them, but to cooperate with

them, we must go through a lot of procedures and compliance. However,

this is not an upcoming event, it is already happening, it is just

whether the market will accept it, and the market is still reviewing its

security and other issues. Then again, mobile phones are still a very

small part of the market as payment devices.

✅ Q: What factors will keep the company growing in the next two to three years?

A: The first is QR (two-dimensional code). When I talk about QR,

everyone's mind will appear E-wallet, Boost, etc., but if you notice,

Maybank and Hong Leong Bank also have QR function. The Central Bank Will

link all banks to a switch, called RPP switch. This RPP switch is for

QR business, which means that in the near future, you can use QR to post

without the need of touch n go or boost, because China has proven QR is

a very fast and convenient payment tool, such as self-service stations

and bank posting.

The second is an e-commerce platform (online shopping platform).

Currently less than 20% of Malaysia's purchases are made online. As of

now, Malaysian are too dependent on foreign online shopping platforms,

such as Taobao, Lazada, Shopee, etc.,. Malaysia does not have a very

huge online shopping platform, but there are many small platforms. I

believe that Malaysia's online shopping platform has yet started to

grow. Maybe in the future these small platforms can unite into a one big

platform in the future. This is just my personal opinion.

✅ Q: How will Digital Tax affect the company?

A: We are similar to agents. For example, when consumers buy goods on

Taobao, it is Taobao who needs to bear the taxes and fees, just to see

if it will pass the burden over to consumers. As for the Tax incentive

mentioned in the budget, it is good for our company.

✅ Q:

We noticed that from July to November, the three founders sold a lot of

shares. Of course, we know it is an OTC transaction. But why?

Answer: I (CEO) was the first out of the three to sell. Our share was

sold to Kenanga. We are currently in Ace Market. We need fund managers

to start buying REVENUE stocks. Kenanga is the first fund to buy our

stocks. With their purchases, it can help small shareholders because

each stock needs to have fund support. If we don't, the stocks will not

be liquid enough and the stock prices will be unstable, which will not

help small shareholders. We are running this company and we know the

company's prospects and future, so when we sell our stock to other, we

are also very sad.

✅ Q:

Are there any updates on the company's expansion in Myanmar and

Cambodia? Because the funds raised from the IPO have not been used.

A: We are here to report to all shareholders. We have officially

cooperated with a company in Myanmar to establish a company called

Revenue Link. Our partners are ATM operators in Myanmar. All ATM

machines in Myanmar are made by them. The business we do with them is

the Transaction Processing business and the Anypay platform. We

introduced Anypay platform into Myanmar, and also brought in Anypay to

Myanmar. That means that any Anypay user can pay any fees in Myanmar or

send money to relatives in Myanmar. As for Cambodia, we haven't started

yet, because the infrastructure and politics over there are still

unstable, and we need ensure our partners are good before we start.

HAMMER (BULLISH) was formed yesterday. We should Trend Trading to trade this gem stocks!

https://klse.i3investor.com/blogs/pandaman/2020-01-09-story-h1482094338-REVENUE_0200_Positive_Outlook_e_Wallet_Theme_will_start_15_January_2020.jsp