MPCORP (6548) - Substantial Progress To Exit PN17 !!!

Listing : Main Market

Category : Property

2. MPCORP disposal of units owned in Wisma MPL to ASIA NEW VENTURE CAPITAL HOLDINGS SDN BHD for a cash consideration of RM 189 million

Future Projection for MPCORP

1. After disposal of land to Amanahraya and Wisma MPL to Asia Ventures, the group has remaining approximately 234 acres of land in Johor for future projects.

Technical Analysis

Candlestick formed a solid closing at 14c on 24/1/2020, with a significant increase in trading volume.

Technical Indicators

1. RSI – Buy

2. MACD - Buy (Oversold Cross)

3. Stochastic – Buy

Listing : Main Market

Category : Property

Target Price: 0.25

Company Background

Company Background

MPCORP is a company involved in Property Development.

It owns two prime properties, namely:-

1. The Wisma MPL,

the first shopping cum office complex, located in the CBD prime golden

triangle district of Kuala Lumpur, within walking distance of Petronas

‘Twin Towers’ (KLCC), the KL Convention Centre, KL Tower, Pavilion

Shopping Mall, Bintang Walk, Starhill Gallery, Sungai Wang Plaza, Low

Yat Plaza. It is located in Jalan Raja Chulan where many major local and

international banks, insurance companies and also the KL Stock Exchange

Building are situated. It is in the heart of the tourist and

entertainment belt of Kuala Lumpur.

2. A 905 acres of

land located in Johor Bahru, Johor. The land is planned for residential

and commercial developments. Current projects include the

joint-ventures with Bina Puri properties Sdn Bhd, Chun Fu Development

Sdn Bhd and PR1MA Corporation Malaysia.

Reasons to look at MPCORP

MPCORP is a PN17 company which is progressing toward its upliftment. The 2 major transactions below are helping them do so :

1. MPCORP

disposal of land in the Mukim of Plentong, District of Johor Bahru, as

Settlement of Debt owing to AMANAHRAYA Development Sdn Bhd amounting to

RM 115 million

Source: BURSA Announcement

Refer earlier news link below on this matter. I noticed that The EDGE

Paper and The Star (English papers) did not write any article about this

matter so this might have been overlooked by the market.

As of latest official announcements, this transaction is still in progress.

2. MPCORP disposal of units owned in Wisma MPL to ASIA NEW VENTURE CAPITAL HOLDINGS SDN BHD for a cash consideration of RM 189 million

Source : BURSA Announcement

From the latest announcement on 8/1/2020, this transaction had been

completed. However, there had been no media coverage on this matter at

the time. Below I quote from the announcement for reference.

"We refer to

the announcements dated 11 March 2019, 15 March 2019, 8 April 2019, 9

May 2019, 28 May 2019, 13 August 2019 and 28 August 2019 in relation to

the Building Disposal (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of

the Board, TA Securities wishes to announce that the Building Disposal

has been completed on 8 January 2020 in accordance with the terms and

conditions of the SPA.

This announcement is dated 8 January 2020. "

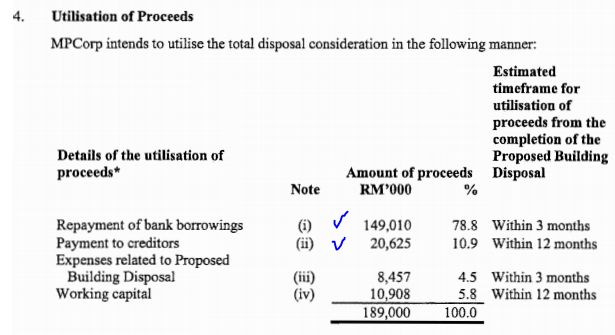

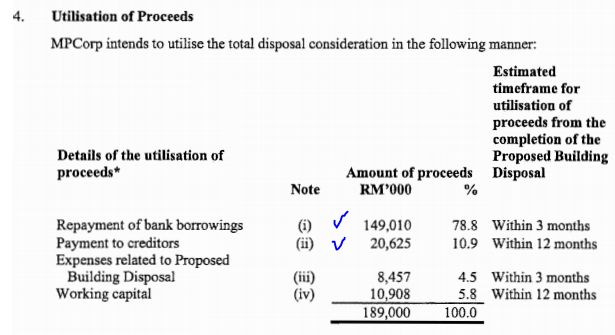

Below are the proceeds of the disposal summary. They will be able to

settle a big chunk of debt with banks and creditors (RM 169 million),

and in addition there will be an additional RM 10.9 million standby for

working capital.

Future Projection for MPCORP

1. After disposal of land to Amanahraya and Wisma MPL to Asia Ventures, the group has remaining approximately 234 acres of land in Johor for future projects.

2. The group will explore possibilities to collaborate with other parties in construction to undertake development projects.

3. Formulation and submission pf PN17 regularization plan to BURSA by 30 June 2020

Source: MPCORP Annual Report 2019

Source: MPCORP Annual Report 2019

Technical Analysis

Refer below daily chart of MPCORP.

MPCORP is forming a triple bottom pattern, pending a breakout above 16.5c to confirm bullish trend.

Candlestick formed a solid closing at 14c on 24/1/2020, with a significant increase in trading volume.

Technical Indicators

1. RSI – Buy

2. MACD - Buy (Oversold Cross)

3. Stochastic – Buy

4. Ichimoku - Breakout of Cloud and Trading in Bullish Region

Disclaimer

At this point of time the writer has a position in MPCORP. This article is purely meant for educational purposes only and it’s not BUY/SELL recommendation. Please consult your remisier /dealer before making any decision.

Disclaimer

At this point of time the writer has a position in MPCORP. This article is purely meant for educational purposes only and it’s not BUY/SELL recommendation. Please consult your remisier /dealer before making any decision.

https://klse.i3investor.com/blogs/Innothestar/2020-01-26-story-h1482930284-MPCORP_6548_Substantial_Progress_To_Exit_PN17.jsp