Malaysia Stock Analysis Report – GCB (5102)

Guan Chong Berhad (GSB) is a family business based in Johor that

started cocoa trade in Johor since 1980 and now is the largest cocoa

processing plant in Asia today. Currently, there are total 3 processing

plants in Malaysia and Indonesia. One of the processing plants in

Malaysia has just completed the expansion in the first quarter of this

year. The production capacity increased from the original 9,000 tons to

50,000 tons, bringing the overall annual production capacity to 250,000.

Ton.

Within 3 years, GCB's stock price has grown from around RM 1.2 to

today's RM 4.6, an increase of more than 280% and an annual increase of

57%.

The company have just issued bonus issues and issue warrants on

November 5, 2019. As long as investor hold 3 units of GCB shares on

November 4, 2019, investor will receive 3 units of bonus shares and 1

unit of warranty and the stock price will be adjusted (divided by 2).

GCB is the largest local cocoa processing producer with an annual grinding capacity of 250k MT per year.

Its main business focuses on cocoa processing, which includes

processing cocoa beans into cocoa semi-finished products such as cocoa

powder, cakes, butter and wine.

It has production facilities in Johor and Indonesia and a mill for cocoa cakes and butter in the United States.

GCB's cocoa ingredients are sold under the 'Favorich' brand and are

widely used in the manufacture of chocolate, confectionery, food and

beverages, and many related industries worldwide.

Of these businesses, approximately 36% are local and the remaining 64%

are overseas. The main overseas businesses are Singapore and Indonesia.

Many of GCB's customers are world-renowned chocolate and consumer

brands, including Nestle, Mars and Hershey ’s, but these customers

already account for half of GCB's turnover.

Raw material costs are one of the company's main costs, accounting for

approximately 35%. The company's main ingredient is Cocoa Beans. After

the 2014 Ebola outbreak caused a shortage of global cocoa beans,

Now the supply of cocoa beans has returned to normal, and the price has

also recovered from the peak of about $ 3,300 / MT to the current price

of about $ 2,400 / MT.

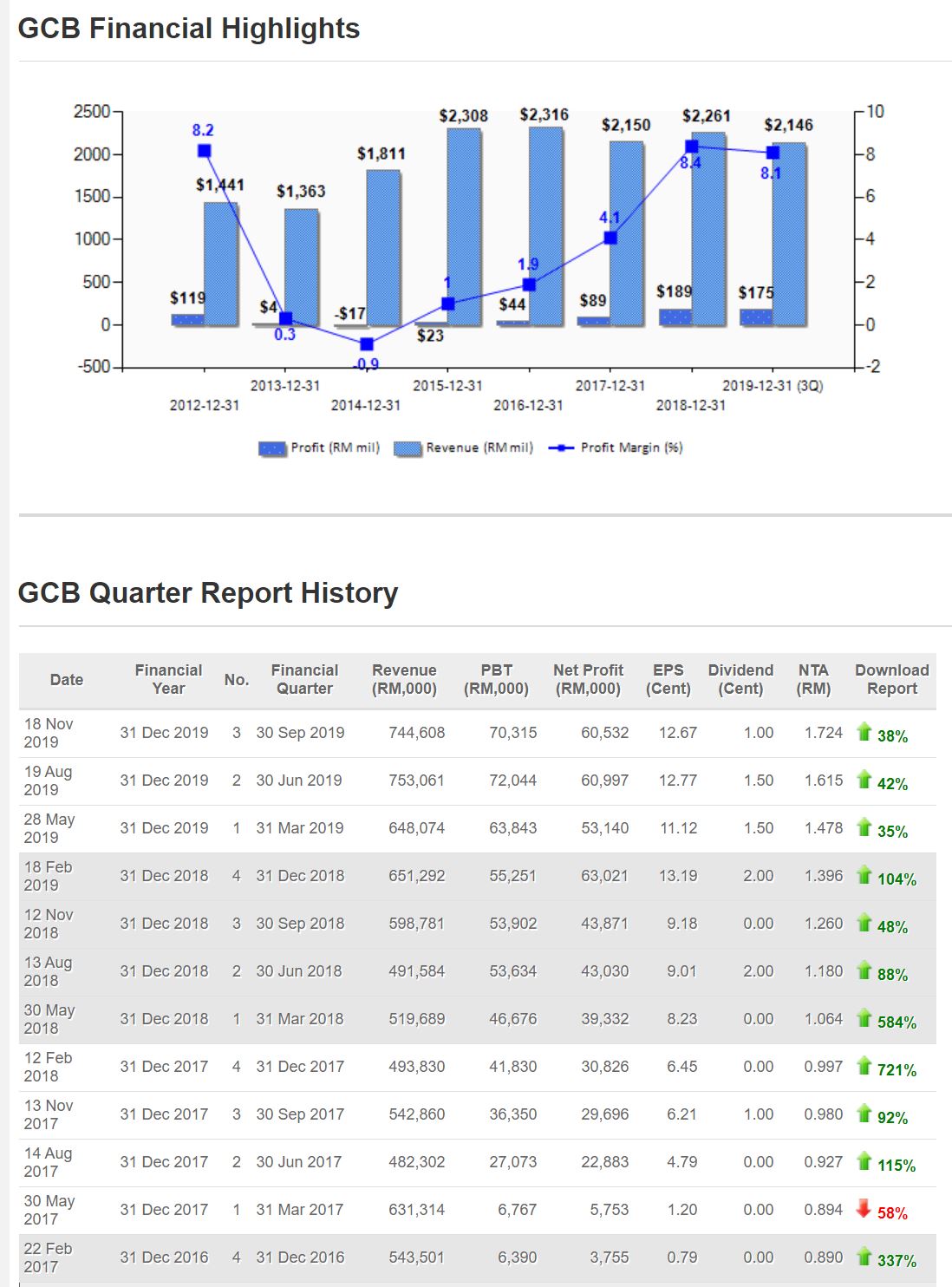

From FY2015 to FY2017, the company's turnover showed a decline, but

this is not because of the company's ability to decline, the real reason

is as follows:

FY2016: The company restructured and sold 3 subsidiaries that were

previously able to contribute to the company's RM 84 mil turnover.

However, with the efforts of the marketing team, the increase in sales

of cocoa cake and cocoa powder offset this effect.

FY2017: The selling price of the company's cocoa products fell by an

average of about 10%. However, this did not cause any profit damage to

the company, because the company's raw cocoa beans also fell sharply,

down 30%.

In FY2018, the company's turnover increased mainly due to the increase

in sales of cocoa ingredients, which offset the impact of the decline in

selling prices.

Although the company's turnover is not stable, the company is still

capable of growing profits. The average annual growth rate of the

company's pre-tax profit is close to 80%, and the number is very

amazing.

In FY2018, the company's pre-tax profit reached RM 209 mil, of which RM

22 mil was a one-time loss. After removing the effect of one-time loss,

the company's pre-tax profit increased by about 83% year-on-year.

In FY2014, the company showed a loss, which is also the first loss in

history. It is mainly due to the decline in margin caused by the

excessive supply of cocoa ingredients, coupled with the rise in the US

dollar, which caused high sales costs and borrowing costs to form

foreign exchange losses. Downturn.

At that time, however, management expressed confidence that those

challenges could be overcome and stood out again when the cocoa market

returned to normal. Later, GCB also proved that they did.

In general, GCB is a high-quality company that has continued to grow.

Even if the industry market is sluggish, GCB has the ability to overcome

challenges and recover quickly. This proves once again the strength of

GCB.

Management expects global demand for chocolate to continue to grow.

Based on the strong demand from Asian consumers for chocolate, the

company aims to double its production capacity to 500,000 tons in the

next five years. As the cocoa bean production in Malaysia and Indonesia

declines, the company is exploring the expansion into Africa or South

America to ensure an adequate supply of cocoa beans.

In response, management is also actively increasing market share in the

cocoa ingredients manufacturing market. The main strategy is to

increase grinding capacity and expand the geographic scope of the

business.

In addition, management expects the business environment to be less volatile as of December 31, 2019 (FY2019).

As global demand for chocolate is expected to grow strongly, management

expects the company's overall performance to remain positive.

The company will continue to focus on exploring new markets for its

broad range of cocoa ingredients, optimizing production and expanding

overall grinding capabilities based on market conditions.

Despite the challenges in 2014, GCB was able to recover in a short period of time, and it is undeniably a very good company.

As the company's prospects are optimistic, the price of cocoa beans is

stable, and the company has been expanding. It is believed that the next

performance will be good, and the PE is expected to be lower.

GCB recently reduced its dividend payout and used the saved funds to

expand. In other words, it is to use the money that should have been

distributed to current shareholders for expansion. Unless the stock

price reflects the future value, it is very unprofitable for

shareholders to sell stocks before the results of the expansion.

https://klse.i3investor.com/blogs/LouisYapInvestment/2020-01-08-story-h1482068353-Malaysia_Stock_Analysis_Report_GCB_5102.jsp

Louis Yap

Facebook:

Web Site: