[ECONBHD (5253) - Company AGM for Ground Piling Details]

✅ Details:

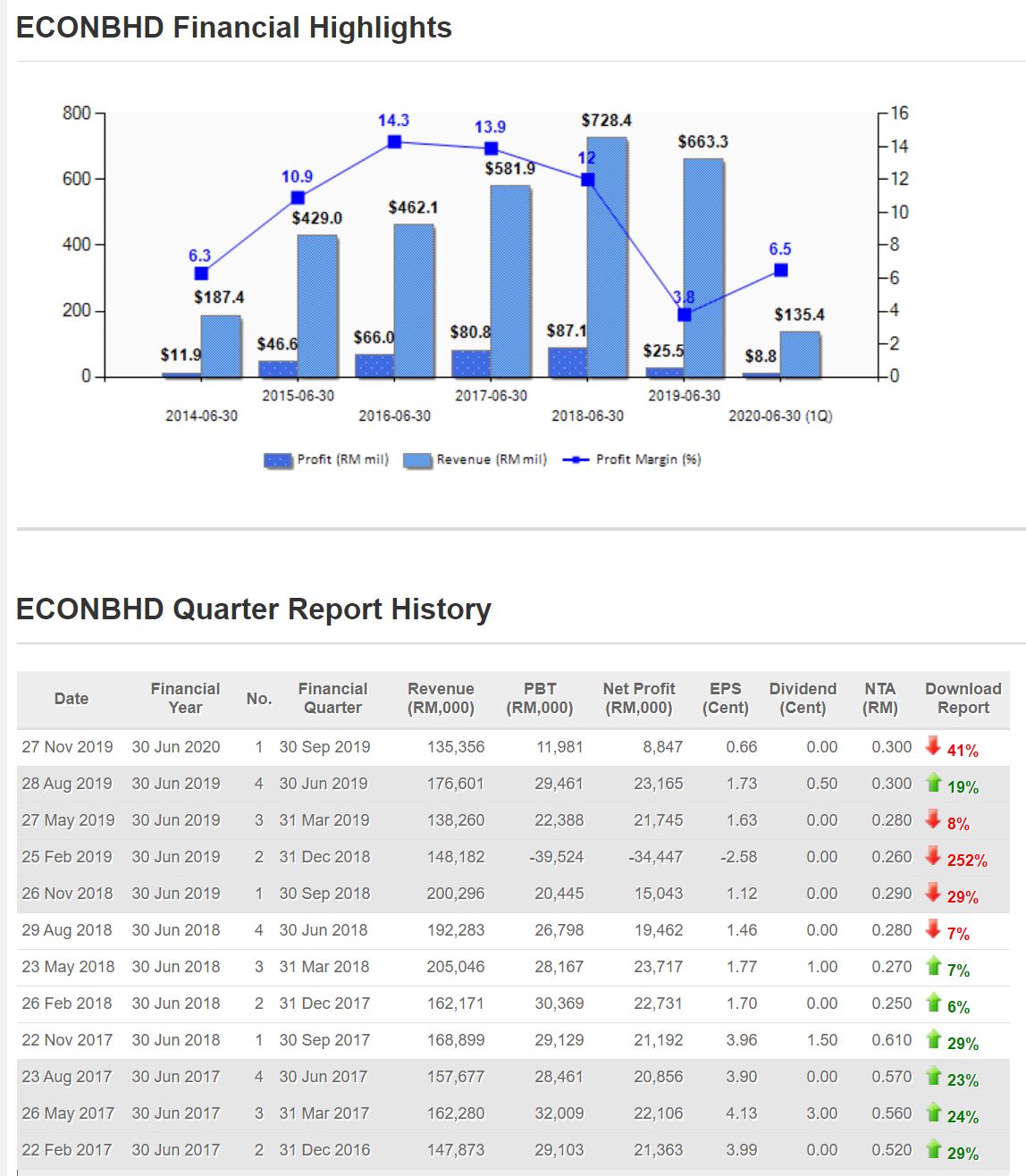

Group FY2019 Turnover: RM663.3 mil

Group FY2019 profit: RM25.5 mil

Dividend: 0.5 sen per share

Cash and bank deposits: 40.1mil

Loan: 73.5

Gearing: 0.08x

Group FY2019 Turnover: RM663.3 mil

Group FY2019 profit: RM25.5 mil

Dividend: 0.5 sen per share

Cash and bank deposits: 40.1mil

Loan: 73.5

Gearing: 0.08x

✅ Currently:

Order Book: RM 920 mil

Bidding Value: RM 300 mil

Ongoing projects: 27 Projects

FY2019 projects received: 643.7 mil

Order Book: RM 920 mil

Bidding Value: RM 300 mil

Ongoing projects: 27 Projects

FY2019 projects received: 643.7 mil

✅ Engineering update:

1) Pavillion Damansara Heights

The first phase is underway-valued at RM 570.4mil

Phase 2 (Package 1) completed-worth RM 18mil

Phase 2 (Package 2) Ongoing-Value RM 122mil

Phase 2 (Package 3) Ongoing-Value RM 209.3mil

1) Pavillion Damansara Heights

The first phase is underway-valued at RM 570.4mil

Phase 2 (Package 1) completed-worth RM 18mil

Phase 2 (Package 2) Ongoing-Value RM 122mil

Phase 2 (Package 3) Ongoing-Value RM 209.3mil

2) LRT 3-Matching GS04, ongoing-value RM 208.7mil

3) TNB Comprehensive Development, In Progress-Value RM 119.1mil

4) Gemas-Johor Bahru EDTP, ongoing – value RM 69.8mil

5) Tropicana Gardens, in progress – worth RM 44mil

6) Tropicana Metropark, in progress – worth RM 20.8mil

3) TNB Comprehensive Development, In Progress-Value RM 119.1mil

4) Gemas-Johor Bahru EDTP, ongoing – value RM 69.8mil

5) Tropicana Gardens, in progress – worth RM 44mil

6) Tropicana Metropark, in progress – worth RM 20.8mil

✅ Q & A session:

✅ Q:

Why the company was performance poor on last year? In the annual

report, there were two project cost overruns and Impairment of

receivable. Why? Do you have any actions to prevent this to happen

again?

A: Because the government changed and they wanted us to reduce costs, 2

Infrastructure Projects were temporarily put on hold. Although the

project was temporarily put on hold, at that time we still needed to pay

our employees, and of course there were other expenses. But both

projects have already started and are almost finished. These things will

never happen again. As for Impairment, it's about RM 15mil. For the

time being, we can't get this debt back in the short time period. We

have to work harder.

✅ Q: Can you explain the profitability of the Infrastructure and Piling business?

A: This is our business secret, hence I cannot tell you in detail. In

summary, our profit is about 10-12%. The profitability of Piling's

business will be higher, and the risk will be smaller. When the project

is completed, we will also ask the customer to pay the money back to the

new developer.

Management stated that the downturn in construction and real estate

also affected the company indirectly. Investors need to wait for the

return of real estate and construction.

The stock price slowly climbed from the bottom from this year and

today's stand at RM 0.735, which proves that investors' confidence in

the company has built up. Management also indicated that they would not

bid too many projects at once, after all, they could not finish. The

company will maintain a certain Order Book, but also tend to be stable

and consistent profit.

Louis Yap

https://klse.i3investor.com/blogs/LouisYapInvestment/2020-01-10-story-h1482099137-_ECONBHD_5253_Company_AGM_for_Ground_Piling_Details.jsp

https://klse.i3investor.com/blogs/LouisYapInvestment/2020-01-10-story-h1482099137-_ECONBHD_5253_Company_AGM_for_Ground_Piling_Details.jsp

Facebook:

Web Site: