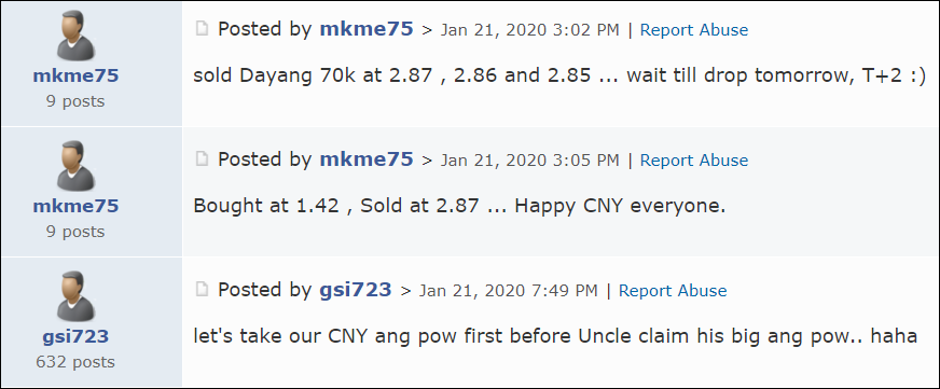

After I have seen these foolish investors as shown below who were boasting about their sale of Dayang on i3investors forum, I have to write this useful lesson.

The price chart shows that Dayang has gone up from 50 sen to close Rm 2.85 yesterday, an increase of 570% within 1 year. As I often said, no stock can continue to go up or come down for whatever reason. After some time, it will change its price trend line.

Even expert chartists do not believe it

Unlike many other stocks, Dayang’s price corrections are always very small. During these 12 months, many foolish investors in anticipation of buying it back at cheaper prices. Now they are in a dilemma because the price continues to go up higher and higher. They are regretting for their mistake.

Willing to eat a humble pie

Unless they are prepared to eat a humble pie, they will miss the golden opportunity to make a lot of money because Dayang will continue to go up higher and higher for many more years to come.

A few days ago, I saw 1 rich investor queuing to buy 2.6 million Dayang shares at Rm 2.50 and someone queuing to sell 31,100 shares at Rm 2.51 at the close of today’s trading.

The big buyer was from UBS Securities which has its HQ in Zurich. This can only mean that the price will continue to go up high and higher and all those investors who sold earlier cannot expect to buy back at cheaper prices.

Petronas will not stop pumping oil

Even if the petroleum price dropped by drastically, Petronas will still continue pumping oil because the cost for just pumping is very small. Petronas has already paid billions of Ringgit for the construction of oil rigs or oil platforms. It is still very profitable to just pay for pumping and selling the oil.

If you google you can see that the average cost for an off shore oil rig is US$ 650 million which is like a city and they all need maintenance and repair.

Dayang is the largest maintenance contractor in this region where Petronas has discovered a total of 163 oil fields and 216 gas fields. That is why Petronas continues to award more maintenance contracts to Dayang.

On 22nd Nov the company announced its 3th quarter result. Both its profit and revenue have improved.

1st quarter eps -0.43 sen, revenue Rm 156 million

2nd quarter eps 5.71 sen, revenue Rm 247 million

3rd quarter eps 11.10 sen, revenue Rm 357 million

Since it has resolved its financial constrain by its recent right issues, its 4th quarter result should be better than its 3rd quarter. Based on its profit growth rate of the last 3 quarters, from – 0.43 to 5,71 to 11.1 sen, its 4th quarter should be more 15 sen. The total for the year will be more than 30 sen per share. Since it has such a rapid profit growth rate, it deserves to sell at above P/E 12. My immediate target price is Rm 3.60.

Dayang’s prospect in 2020

It is safe to assume that Dayang will perform better this year than last year after it has resolved its financial constrain and also it has gained more experience. My target price for this year is above Rm 4.00 per share.

Dayang has very good profit growth prospect which is the most power catalyst to move share price higher and higher.

In the last few months I have been searching for another stock with similar qualities as Dayang in vain.

As a co- founder of Ipoh Garden Bhd. (IGB), in the early 1960s when we offered to sell 100 houses, we always had a few hundred buyers. We had to ask the Perak Mentri Bersar to draw lots to select the lucky buyers. It was like IGB had the monopoly to sell houses.

Dayang is now in a monopolistic position

https://klse.i3investor.com/blogs/koonyewyinblog/2020-01-22-story-h1482896615-Dayang_Only_fools_will_sell_Koon_Yew_Yin.jsp