POS (4634) - WHY I THINK THE GOVT SHOULD BE OBLIGED TO SUPPORT THIS COMPANY ??!!!

POS MSIA BHD - SUPPORT BY THE GOVT, VIA RATE HIKE

(SOONER OR LATER) !

(INVESTMENT GRADE - MY PERSONAL TP 3.00 Mid to

Long Term)

Recently I had spotted this big cap company; which I believe has an interesting future ahead -POS

MALAYSIA BERHAD (Stock Code 4634, listed on MAIN BOARD, TRANSPORTATION

& LOGISTICS, market cap RM 1.393 Bil as at writing)

DON'T you miss your old fashioned birthday card sent to you by your crush last time in school ?

DON'T you miss counting those

raya cards sent to you by your school friends in the fasting month, and

to compare with other friends on who had received more ?

I know that I do miss those old times..well we are not in that time

anymore..and times have passed..now we are in the technology era where a

lot of documents are being sent electronically..however, hard copy mail

still plays an important part in our daily life today..

I noticed considerable interest starts to build in on 2nd

July when the volume registered a sizeable increase to 10 million, and

then on 10th July when the price hit a high of RM 2.00 on the back of

6.7 million volume.

With this

positive momentum & enthusiasm ahead, I believe, should spillover to

next week. I foresee it trending to the next resistance of 2.25 before heading to my personal TP of 3.00 on the intermediate to long term.

WHY I THINK THIS STOCK WOULD RECEIVE SUPPORT FROM THE GOVERNMENT (SOONER OR LATER) VIA A RATE HIKE?

In summary, below are the 4 reasons why..I will elaborate in detail in the following paragraphs:

1.

POS to deliver their Universal Service Obligation (USO) as per POSTAL

SERVICES ACT Malaysia, hence cannot be continuously loss making further (POS has recorded 3 consecutive quarter losses)..POS at least needs to make enough money to cover expenses and worker welfare, and pay dividend to its shareholders

2. It has been 9 years since last tariff hike in 2010, and costs have escalated since then to justify for a tariff hike (can be seen in the recent losses made by POS)

3. DRBHCOM took over POS 32.21% stake from Khazanah in 2010 at RM 3.60 per share (value RM 622.79)..government should be returning the favour by lending a hand in troubled times

4. TA point of view - Volumes do not lie..big volume of buying started early June 2019 up to RM 2.00 highest price, a tree does not move if there is no wind

1. POS to deliver their USO as per POSTAL Services Act - In order to do it they must stop making losses

Definition of Universal Service Obligation (USO) taken from GOOGLE -

"The purpose of the Universal Service Obligation (USO) is to ensure that the Postal Service provides a minimum level of service to all areas of the country. There is no set and clear definition of the Postal Service's USO; it is generally assumed to be a collection of various laws and regulations"

In Malaysia, the applicable law is POSTAL SERVICES ACT 2012.

POS Malaysia has been making 3 consecutive quarter losses in a row now.

In order to ensure that they deliver the minimum required postal

services to registered addresses (which are growing year by year), POS

needs to ensure that they have the required funds to run day to day

operations. Some simple things that I can think off are : Management and

Workers Salary, Fuel, Office Leases, Agent & Middle Men Costs, etc.

Therefore, the minimum obligation could not be served if they keep on

making losses. Refer example news write up below which explains how POS

cannot simply shut down underperforming outlets even though they are

making a loss.

There was one articcle in December 2016 that said POS had proposed to

government to revise the tariff (refer article below). However, I

believe due to POS still making a profit at the time, the government had

probably delayed the decision until further notice.

In August 2018, POS had renewed talks with government for the rate hike

(refer article below). By this time, POS still made a profit but the

profit had shrinked to the lowest level in a few years.

In April 2019, again DRBHCOM CEO had mentioned that due to increasing

costs the POS had to bear, POS is waiting for the government to approve

its postal tariffs in order to get back in the black.

Earlier this month, we saw again news highlighting that the recent rise

in POS share prices might have been due to the tariff hike is nearing

the official announcement.

2. Its been 9 years since last tariff hike !!! (in 2010)

The last time tariffs was increased was in 2010. Now it has been 9

years since the tariff hike. Therefore, costs of manpower and

expenditures have increased in these 9 years time, which justify for a

rate hike to ensure POS survives and delivers its minimum obligation

under the Act.

Let us have a look at the share price reaction when the announcement

was made in 2010 on the rate hike (for study purposes). On the day the

rate hike was announced, the price had moved from RM 2.17 to close at RM

2.63 (gain of 46 cents on the day). The stock then continued to further

climb until it hit a high of RM 3.18. After that the stock went to

rally continuously until it had hit the peak of RM 6.05 in November

2013.

3. DRBHCOM took

over 32.21% POS stake from Khazanah in 2010 at RM 3.60 per share (value

RM 622.79) - govt to at least lend a hand in hard times

Refer below news link of 23rd April 2010 of the above mentioned title.

The current trading price of POS is RM 1.78, but DRBHCOM has not sold a

single unit even though they are now in a paper loss. As a reasonable

government, they should be lending a hand in these troubled times, as

how DRBHCOM had offered to take over the big stake from government

previously.

At the end of the day, majority shareholders of DRBHCOM and POS, are

mostly big funds which are servicing the public (either GLCs like EPF,

KWAP, and also mutual funds)..therefore, the government should support

POS, for the benefit of the greater good of the people

4. TA Point of View - Volumes do not lie - Big volume buying started early June 2019 up to RM 2.00 highest price

If we look at the daily chart,

POS is starting to rebound after hitting the trend support. We see the

recent rally to RM 2, then the price retraced to RM 1.68 before starting

to pickup pace again at today's closing.

If we analyze the volumes on the

upday, compared to the down days, we notice that majority of volumes

are still holding on to their shares as if they are expecting a big

announcement to come soon.

In this recent month of July

2019, we see that buying volume has substantially picked up, and on a

down day there are not many sellers appearing to throw down. With the

strong volume of 4.95 million units transacted on Friday 19th July 2019,

the market players have seen that there is more upside room compared to

downside, until the first resistance of RM 2.00 is reached, after which

the next resistance is at the year high of RM 2.25.

Should the tariff hike be

announced soon, I am expecting a surge in volume and price hence why I

set my target at RM 3.00 in the long term.

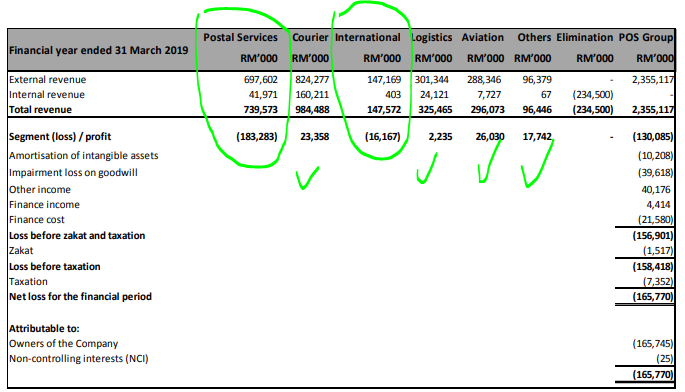

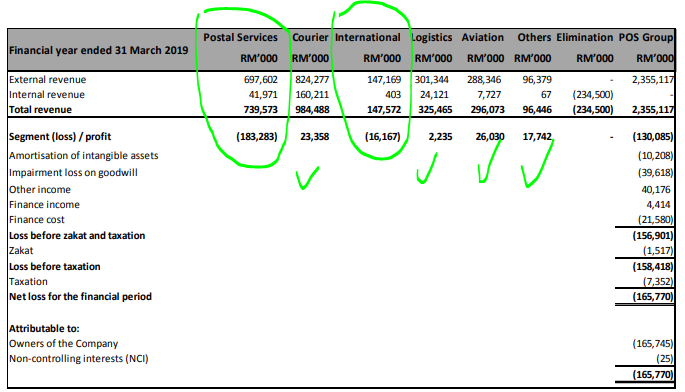

IMPORTANT SIDE

NOTE - Why are we focusing to highlight on the traditional part of the

business e.g. domestic and international mail (which are losing)?

Refer below latest quarter report in May 2019 on the breakdown of segmental revenue of POS.

Some of you might wonder, why am I only talking about POS traditional business which is the domestic and international mail segment ?

From below, it is evident that POS has about 5 business segments, and

the other 3 besides the traditional mail segment are doing profitable,

namely the courier, logistics and aviation business. Hence why there is

no need for us to highlight those good segments are the results will

speak for themselves.

However, the need to highlight

the losing segments is important, as when these 2 segments can turn

around their losses into profits, then POS will be back in overall

profit as soon as possible. This will ensure POS to be able to deliver

its services to the people and deliver some returns for its

shareholders.

CONCLUSION

Considering all the above, my personal TP for POS is set at RM 3.00 (Mid

to Long Term) pending the official rate hike announcement. Funds &

Investors should consider POS to add to their long term portfolio.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY

CALL whatsoever. I am sharing my observations ONLY based on fundamental;

past history; current trading pattern; charts etc. Please make your own

informed decision before buying this share or whatever share for that

matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/215930.jsp

https://klse.i3investor.com/blogs/Bursa_Master/215930.jsp