THHEAVY - POSSIBLE PRIVATIZATION TO TURNAROUND

COMPANY ???

(PERSONAL TP 0.10 Short Term, 0.20 Mid to Long Term)

Recently I had spotted this small cap company; which I believe is on its path towards upliftment of PN17 -TH HEAVY ENGINEERING BHD or THHEAVY (Stock Code 7206, listed on MAIN BOARD, ENERGY, market cap RM 72.88M as at writing)

In

summary, THHEAVY is a company whose core business is in the fabrication

of offshore oil and gas facilities. Recently, THHEAVY had diversified

into Ship Building & Ship Repair (SBSR) business.

I noticed considerable interest starts to build in on Friday where the volume registered a sizeable increase to 7.5 million units.

With

this positive momentum & enthusiasm arising from the quarter

report, I believe, should carry forward next week. I foresee it trending

to the next resistance of 0.08 before heading to my personal TP of 0.10 (short term) to 0.20 on the intermediate to long term.

WHY I THINK THIS STOCK COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Asset Takeover by SPV - Possible PRIVATIZATION to Turnaround Company ???

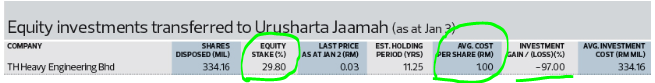

Refer below article on the takeover of Tabung Haji equities by SPV Urusharta Jamaah Sdn Bhd.

Take note that the SPV had taken over THHEAVY shares from Tabung Haji at book value (RM 1.00) which equates to a total of RM 334.16 million, and not the market value.

Many companies which the SPV had taken over from Tabung Haji, had

appreciated since early January 2019. These include FGV, UEMS, MMCCORP,

MHB, IJM & DAYANG and many more. This means that the SPV is now in a big paper gain compared to its earlier position in January 2019.

Recently, Tabung Haji had been under public scrutiny and close watch

due to declaring a very low dividend in 2018. At the same time, public

is also keeping a close watch on the SPV to see how it will perform in

recovering back the value of equities which it had taken over from

Tabung Haji.

That being said, we can

say for almost certain that neither Tabung Haji nor the SPV would want

THHEAVY to fail, and be delisted from BURSA. It would be a bad outcome

for their reputation moving forward.

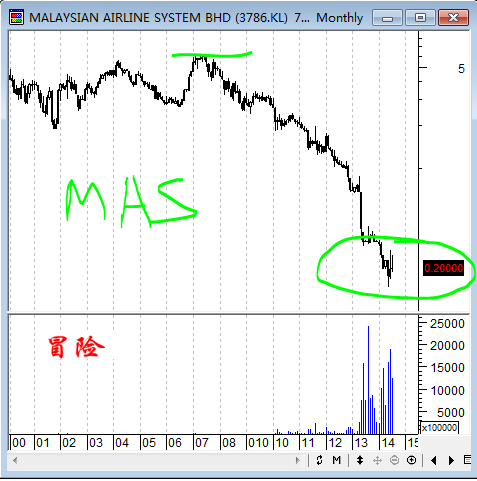

One prominent example of such a similar situation was the

privatization of Malaysian Airlines (refer link below). Khazanah had

spent nearly USD 500 million (which equates to about RM 2.4 billion as

of today exchange rate) to takeover MAS private at 27 cents a share, and this was about 5% of the peak price around RM 5.20 in 2007.

Therefore, one possible move

to be taken by the SPV, to ensure a faster decision making in turning

around the company, avoiding hassle of needing to convince shareholders

in every corporate move, is to takeover the remaining shares that it doesn't own.

For illustration purpose, let us do the example calculation.

The shares that SPV do not own are 786.84 milllion (1.121 billion minus 334.16 million)

Let's say a takeover price of RM 0.10, then the total consideration amount is RM 78.684 million (which is 23.5% of the total initial investment of RM 334.16 million which the SV put in)

Let's say a takeover price of RM 0.20, then the total consideration amoount is RM 157.368 million (which is 47% of the total initial investment of RM 334.16 million which the SPV put in)

Considering the above, if any takeover move should be considered, then the action better be taken sooner or later to avoid paying higher costs.

2.

Quarter Results - Genuine Revenue and Profit (Not One Off), Forecasted

Positive Contribution From OPV Contract & Diversification into Ship

Building Ship Repair (SBSR)

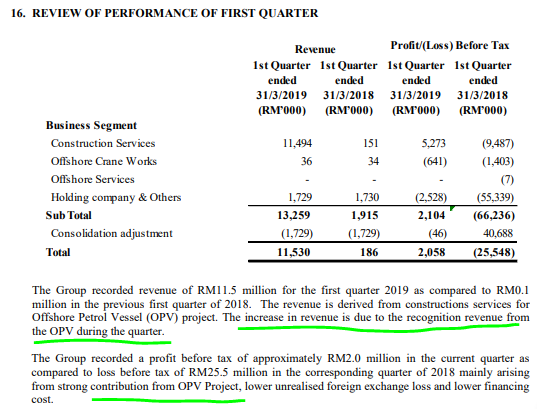

Refer below snapshot taken from latest QR 31/5/2019. We see that the main

contributor to the revenue and profit is coming from the Offshore

Patrol Vessel (OPV) Project, which THHEAVY has a JV with DESTINI via

THHE Destini Snd Bhd (THHEAVY owns 49% stake in the JV).

Refer earlier article (link below) on this contract when THHEAVY had secured it. The

total contract value is RM 738.9 million. THHEAVY having a 49% stake in

the project means that their portion amounts to RM 362.06 million.

From the above report we see that only RM 11.5 million has been

realized. Therefore, the balance of contract (est RM 350 million) shall

be recognized in the upcoming quarters, which might help THHEAVY to be

uplifted from PN17 soon.

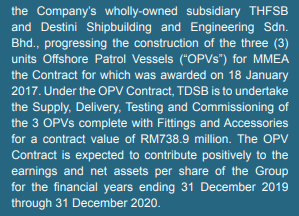

Also, take note of Management's comment in Annual Report as per snapshot below. Don't take it from me, but rather the

management themselves have mentioned that this OPV Contract is expected

to contribute positively to the earnings and net assets per share of

the Group for FY ending 31 December 2019 through 31 December 2020.

Diversification into Ship Building and Ship Repair (SBSR)

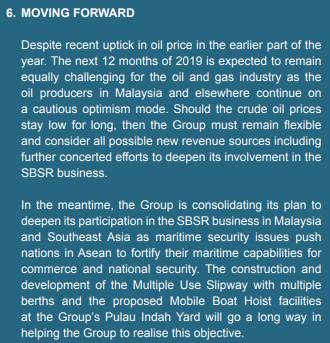

Refer

below snapshot taken from latest Annual Report. Company has mentioned

to remain flexible and not to depend on oil & gas business due t o

the nature of volatile crude oil prices.

Therefore, the Group is consolidating its plan to deepend participation in the SBSR business in Malaysia and Southeast Asia

as mostly are maritime based countries. The Group is developing its

SBSR facilities at it's Pulau Indah Yard for the long run in realizing

this objective.

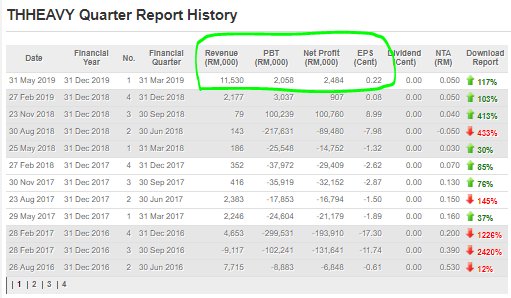

Long Term Target from EPS

Refer

below the summary of QR as of latest. Latest report shows that earnings

is 0.22 cents per share. However, another estimated RM 350 million from

the OPV Project is pending to be captured as revenue. Considering a

conservative growth of 10% EPS per quarter to be captured from this

project, we would see total EPS full year at 1.02 cents. Taking a 10 X PE Ratio, we would arrive at a target price of RM 0.10.

However,

let's say in a best case scenario, half of the contract gets realized

this year 2019. This would come to about RM 175 million revenue. Taking a

10% margin net profit, we get RM 17.5 million (EPS 1.56 cents). Adding

the current EPS, we get full year EPS of 1.78 cents. With a 10X PE Ratio, we arrive at a target price of about RM 0.18.

All

the above are considering that THHEAVY delivers the ongoing project,

and does not take into consideration other new potential projects which

might be in the pipeline of the company.

3. Technical Analysis - Breakout of Downtrend (Monthly) & Ichimoku Breakout (Daily)

Refer below monthly and daily chart for THHEAVY.

From

monthly chart, we see that since 2016 downtrend, THHEAVY price has

tested the downtrend resistance for 3 times but failed to break through.

However, recently, after hitting its all time low price in December

2018, the price had started to see support. Recently in April 2019, we see that THHEAVY had successfully broken the downtrend

and price had been supported well. This signals that a long term

uptrend is forming and major resistances are seen at 0.10 and 0.20.

As for daily chart, we see a few bullish indicators in this counter:

a. Price has achieved ICHIMOKU Cloud Breakout above 0.06 and managed to close at 0.065 conclusively

b. MACD is crossing the signal upwards

c. RSI and Stochastics are moving from oversold position, to upwards indicating uptrend momentum

d. Significant volume appeared on the solid daily chart

CONCLUSION

Considering all the above, my personal TP for THHEAVY is set at RM 0.10 (Short Term), and RM 0.20 (Mid to Long Term).

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTERhttps://klse.i3investor.com/blogs/Bursa_Master/209106.jsp