1) Recent Development of Techbond

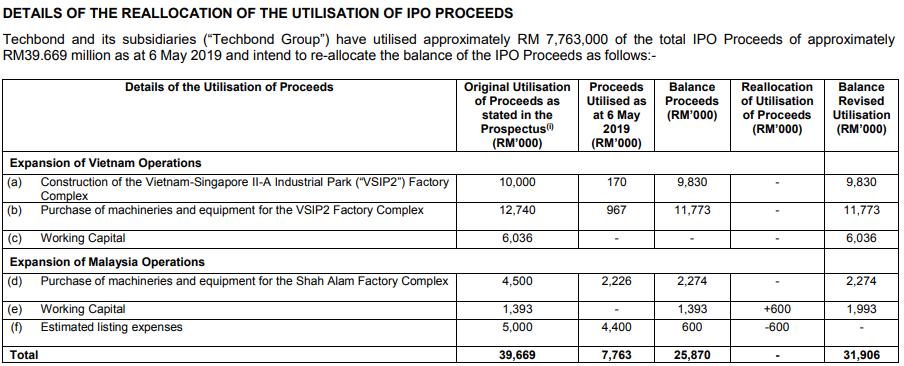

As per mentioned in Techbond Group Bhd prospectus and our introduction article on Dec 2018, partial of the fund raised in IPO listing will be used to build a factory complex in Vietnam for the group’s expansion.

In a recent filing with Bursa Malaysia, Techbond said its wholly-owned subsidiary Techbond MFG (Vietnam) Co Ltd has signed a construction contract with main contractor Trung Hau Construction Corp for the construction of a factory complex in Vietnam-Singapore Industrial Park (VSIP) in Binh Duong province (Figure 1). The whole contract worth US$2.7million (approx RM10 million) and it is scheduled to be completed by first quarter of 2020. The group also mentioned that the main contractor will hand over the project with a certified construction warranty of 24 months and a warranty guarantee of 5% of total contract value.

Figure 1

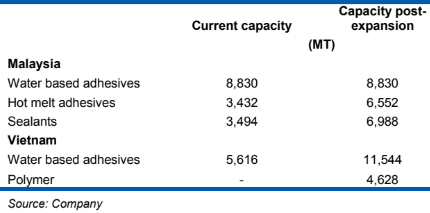

Upon above mentioned expansion on Shah Alam and VSIP factory, the company expected 100% expansion on hot melt adhesives, sealants capacity in Malaysia and also water based adhesives in Vietnam with new supporting capacity line for Polymer (Figure 2). With capacity expansion in Vietnam also able to lower down the transportation cost since Vietnam is the main importer for Techbond’s sales.

Figure 2

With Techbond financial year ended on every 30th June, it simply means that the expansion of production line with new factories in Shah Alam and Vietnam will be contributing eventually extra revenue and profit for the group on FY2020.

2) Benefit from Recent Weak Ringgit and Lower Oil Price

Techbond’s sales were mainly focused on exports. Exports accounted for 81.6%, 81.5% and 79.6% of Techbond’s FY16-18 total revenue. The largest export market is Vietnam, followed by Indonesia and China, which accounted for 54%, 12% and 7% of FY18 revenue.

Weakening ringgit and lower oil price push the revenue of Techbond from currency exchange gains and lower freight cost for transportation purpose.

With ongoing expansion project completing soon and recent positive macro-economic environment, we foresee Techbond will have a breakthrough growth in the future.

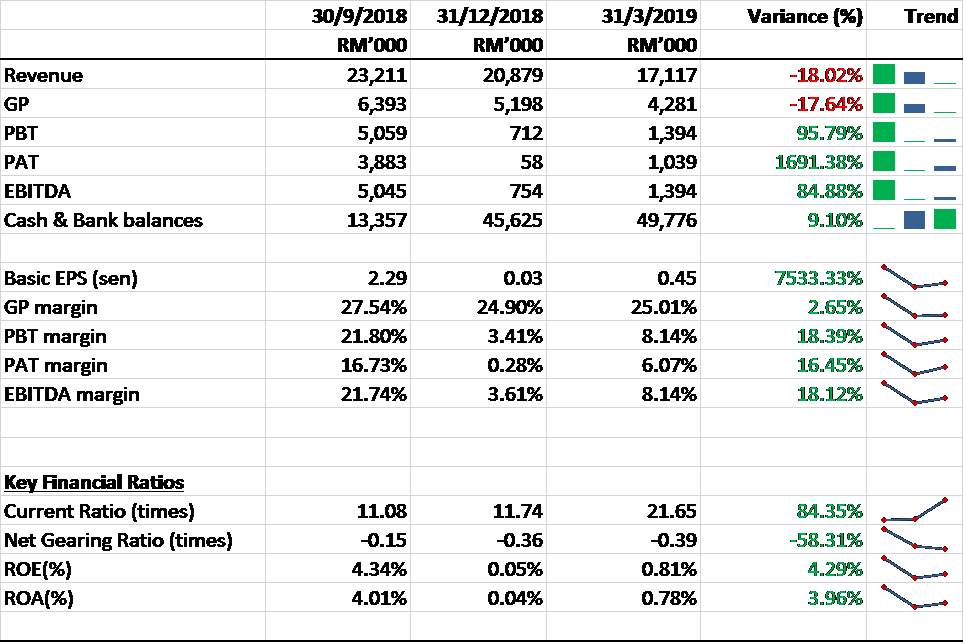

3) How was TECHBND doing financially since IPO?

With its grand IPO opening since December 2018, Techbond does reported net profits with positive margins for consecutive 3 quarters on its financial year end June 2019 despite facing external headwinds like trade wars & volatile business sentiment. The adhesives product has been the main growth catalyst for Techbond as the products play approximately 90% of the main revenue driver. Although there are hardly any competitive peers to be compared in Malaysia, Techbond was the first mover among other adhesives manufacturer to get listed and successfully expanding their manufacturing operation throughout the South-East Asia region.

The main reason why rich-cash based company like Techbond are worth to monitor on your watchlist was because they are fully operating with zero borrowings. It may sounds unrealistic by just looking at their current ratio of 21.65x as of 31st March 2019, but looking at the scale of their revenue, it is still in an early stage of business which seems to be making such sense as their working capital is just between the swing of under or above RM10 million. With their expansion in Malaysia & Vietnam region, future potential of enlarging their market share seems to be very possible as they are expanding their adhesives product range.

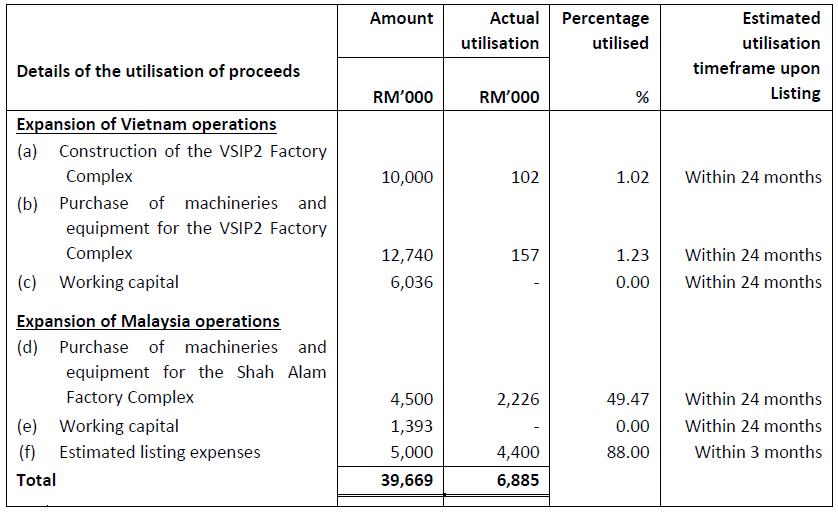

Further timeline of their utilization of RM35 million raised for expansion can be view thru as below:

With all this ongoing expansion running thru, Techbond are looking at a wider picture to further enhance their profit driver as we believe their historical profit has proven to be sustainable over the long term (20 – 30% GP margin consistently achieve in the past 3 years). On the other hand, adhesives typically account for an approximately 1-2% of total production cost for Techbond’s customer which gave Techbond an upper hand in managing their cost efficiency. Additionally, Techbond is also looking to further explore upstream opportunities on polymers production, one of the key raw materials of adhesives production, which would give a boost to their cost optimism and potential cross selling opportunities to other manufacturers.

4) Does Techbond signaling any rebound in near future?

TECHBOND had rose for a third straight session on Tuesday to cross higher than the 50-day simple moving average (SMA).

We believe the new breaking point will be at RM0.800 and could potentially reached back to the peak range of RM0.900 to RM1.00 once break RM0.800.

5) Target Price of RM0.900

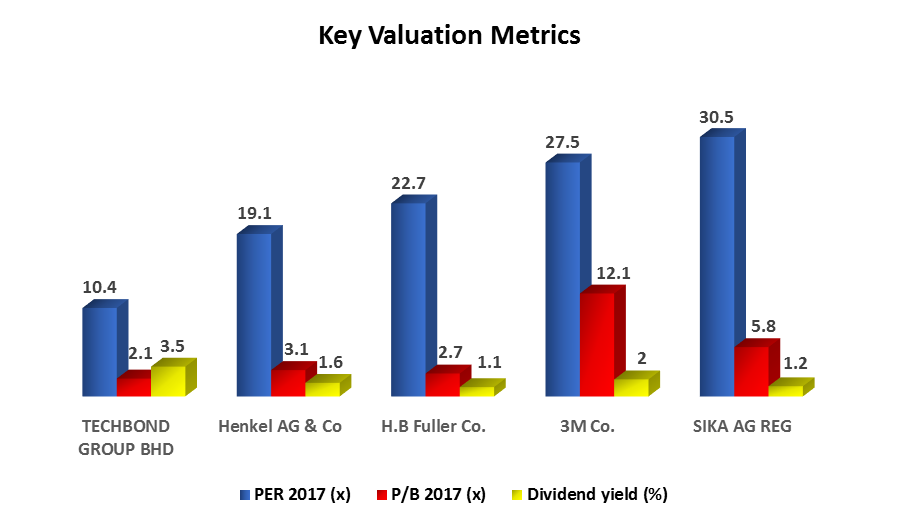

With the expansion initiatives & strong track records by Techbond, we believe the profit driver from adhesive industry will continue to sustain in long term given their consistent revenue line from their strong customer relationship based on their past income records. Therefore, we are projecting a 3-year net profit CAGR of 12.3% to MYR 21 million in FY22, taking into account of low-cost business model & consistent demand in adhesive industry. With that, Techbond could be valued at RM 0.900 assuming a 10x PER on 2022F EPS. Although Techbond’s actual PER (x) were valued at 26x, but we believe Techbond is moving towards a maturing stage beyond FY2022 where expansion uncertainty & industry pain will be factored in along. On that aspect, we will be using a more conservative approach of industry PER of 10x instead of 26x.

https://klse.i3investor.com/blogs/bullbearbursa/211936.jsp