At this current challenging market and economic slowdown, there is no other good stocks besides utilities, healthcare and education - which is EDUSPEC. There is no way people stop taking education, particularly primary and secondary schools in regardless of economic situation is good or bad. EDUSPEC has a recession proof business. EDUSPEC specialises in providing e-learning products to primary and secondary schools.

Don't forget that Kencana Capital Sdn Bhd owns 36.62 million shares in EDUSPEC. Bloomberg data shows that Tan Sri Mokhzani Mahathir owns Kencana Capital. With the new government - PH led, the Company's outlook look secure and will be even brighter now!

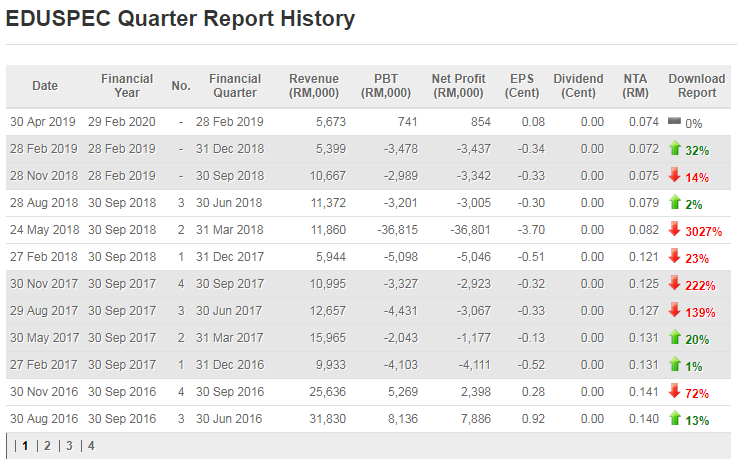

Looking at EDUSPEC, it finally turned around in the last quarter results for FY19 (ended in March 2019) and we could expect a full-year black in its FY20 (ended in March 2020). There will be more to come based on the way in which the Company restructured its operation.

The Company remodelled its business in 2018, which is now focus on “fees-based recurring income” education products such as Science, Technology, Engineering and Mathematic (STEM) and Eduspec Services for Parents (ESP). The company sets to reap fully benefit from this remodelled business from FY20 (from April 2019 to March 2020) and onwards.

Latest positive developments

(1) In recent weeks news, Sharp Electronics (M) Sdn Bhd and EDUSPEC recently signed a memorandum of understanding (MoU) aimed at developing 21st century classrooms in Malaysia. Sharp is excited to enter into this partnership with EDUSPEC and to begin our work of helping more classrooms embrace new technological advancements. They believe the combination of Sharp’s Smart Solution, the leading technology present in our interactive whiteboards and EDUSPEC’s expertise in integrated education solutions brings the right synergy towards creating 21st century classrooms.

(2) Last Friday, the group had proposed to diversify into development and operation of an edutainment theme park business. The company said the move was to widen the group’s target markets to the public at large and not confined to schools or other educational institutions only.

It added

the venture into the edutainment theme park business would serve to

diversify the group’s revenue and earnings stream and is expected to

provide a new earnings driver to reduce the reliance on its existing

customer base.

The

company, through its unit Time IT E (Sabah) Sdn Bhd, had entered into a

lease agreement with Tanco Holdings Bhd’s unit, Palm Springs

Development in relation to the leasing a land located in the Port

Dickson, Perak for the proposed diversification.

In addition, EDUSPEC

and Advance Opportunities Fund have entered into a subscription

agreement in relation to the proposed issuance of cumulative redeemable

convertible preference shares (RCPS) to raise up to RM60 million.

The

total proceeds of RM60 million, of which, RM38.10 million has been

earmarked for the expenditures for STEM Edupark, RM6.1 million for the

expenditures for flagship STEM EduLab and STEM learning centre, RM6

million for the repayment of bank borrowings, RM4 million utilised for

working capital and RM5.8 million for the expenses incurred for the

proposed exercises.

Regional presence

The

Group has also continued to expand its regional presence in Thailand,

which together with the Philippines and Vietnam shows good promise for

growth over the next few years.

The Group also intends to continue to invest in its R&D to improve

on its existing products and services, and to introduce more innovative

products and services to schools in the region. The Group will progressively roll out the ESP business in stage over the course of this year. ESP will create better interaction between the school faculty and parents. It is an application providing students with tools such as self-assessment, lesson plans and e-wallet. The Group is aware that the governments of several developed countries have transformed their education policies for the K-12 segment (Kindergarten to year-12 of school education), encouraging the private sector to be more involved in public school education. The Group identifies this to be an opportunity and will continue to explore further in this area.

Technical Analysis wise

With the Company’s outlook has turned positive, its share price is now heading to break 200-day simple moving average of 4sen to reflect the Company’s positive fundamentals. Should the share price close above 4sen, it is expected to trading as high as to at least 10sen resistance level - psychological level soon.

At 10 sen, it only implies 50% fibonacci retracement level from 18sen. It is still a conservative target price and it could even surge upwards towards fair level of between 12sen and 15sen, which are in range 61.8% and 78.6% level of fibonacci retracement respectively.

The fact that the daily money flow indicator (MFI) has been showing inflow of money into the stock for the past few months until now. There has been positive divergence between share price and the MFI. While the share price has been moving sideways/downtrend, the MFI has been in the uptrend. Also, both weekly and monthly charts show the positive divergence. With all these three timeframe charts are showing the same pattern, it confirms there has been money inflow into the stock. This indicates the share price is due for upside rally anytime soon!

Daily chart

Weekly chart

Monthly chart

https://klse.i3investor.com/blogs/winners/209410.jsp