ABLEGRP - WILL THIS COMPANY ABLE TO ROCKET SOON

(MY PERSONAL TP 0.12 Short Term, 0.20 Mid to

Long Term)

Recently I had spotted this small cap company; which I believe has a bright future ahead -ABLEGROUP

BERHAD or ABLEGRP (Stock Code 7086, listed on MAIN BOARD, INDUSTRIAL

PRODUCTS/SERVICES, BUILDING MATERIALS, market cap RM 22.43M as at

writing)

In summary, AbleGroup

Berhad is an investment holding company, with two (2) wholly owned

subsidiaries, namely Syarikat Bukit Granite Sdn Bhd which is involved

with the processing of high quality granite and marble for supply and

installation to the domestic market, and Atlas Rythm Sdn Bhd which is in

the property development business.

I noticed considerable interest starts to build in on 28/6/2019 where the volume registered a sizeable increase to 2.4million units.

With this

positive momentum & enthusiasm ahead, I believe, should spillover to

next week. I foresee it trending to the next resistance of 0.10 before heading to my personal TP of 0.12 (short term) to 0.20 on the intermediate to long term.

WHY I THINK THIS STOCK COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

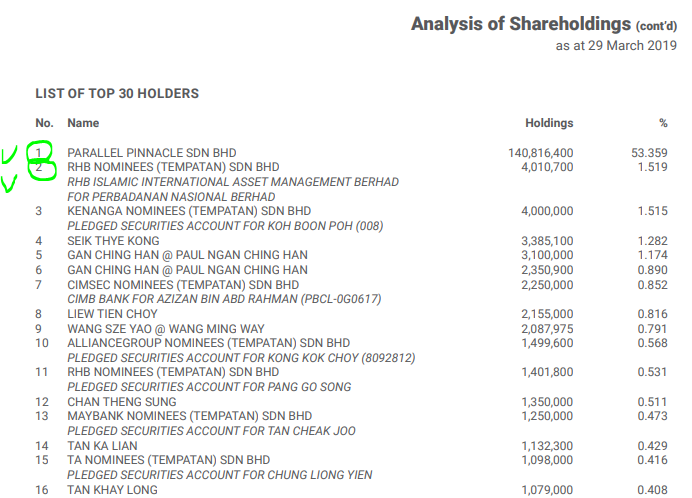

1. Major Shareholder With Tight Grip & PNS as a Shareholder to be Noted

Refer below latest shareholding report as of 29th March 2019 taken from latest Annual Report. The major shareholder is Dato' Lim Kim Huat (via Parallel Pinnacle Sdn Bhd) who holds 140.816 million units (53.359%) of the company. We also noted PERBADANAN NASIONAL BERHAD (PNS) as the 2nd largest shareholder with 4.01 million (1.5%) stake.

With

such a tight holding in the company by the MD, the balance float which

is tradeable is 46.641% only. This implies a less resistance on the

uptrend path should the price decide to trend upwards in near time.

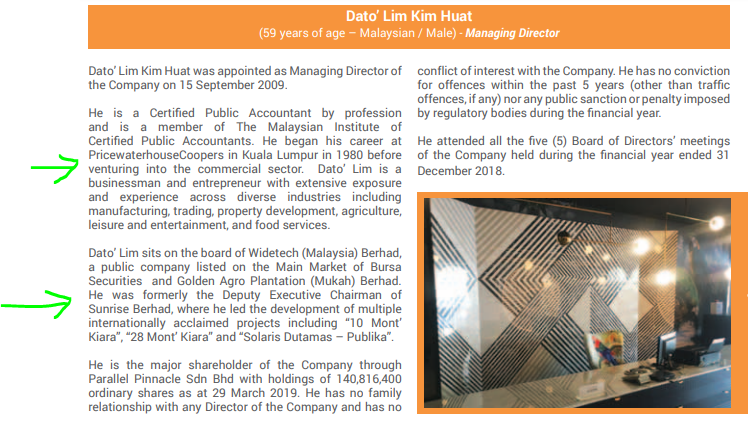

It is worth to note Dato' Lim Kim Huat profile as below taken from the Annual Report. A few important points to note:

i. He is a Certified Public Accountant by profession with experience in diverse business fields

ii. He also sits on board of Widetech (M) Bhd and Golden Agro Plantation (Mukah) Bhd

iii. He was formerly Deputy Executive Chairman of Sunrise Bhd (now known as UEM-Sunrise after merging with UEM Construction Bhd). He had led few known development in KL area such as "10 Mont Kiara", "28 Mont Kiara" and "Solaris Dutamas - Publika".

2.

NTA of 17 cents (Potential Takeover Target for Backdoor Listing) and

Bright Prospect Ahead as Beneficiary of MEGA PROJECTS in Malaysia

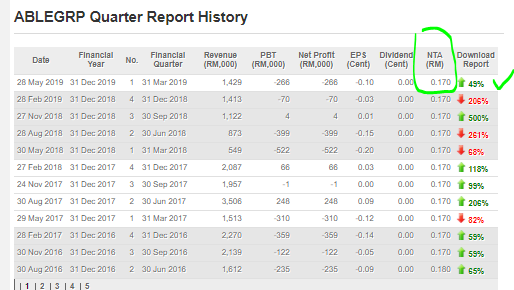

Let's see

ABLEGRP latest results. The company had reported increase in revenue,

and reduced losses compared to similar quarter last year.

Also to be noted its NTA of 17 cents and therefore at the current price of 8.5 cents, the company is trading at less than half of its full NTA value.

This makes the company a highly

possible takeover target for companies looking for backdoor listing in

BSKL due to it trading at significantly low price compared to the NTA

value.

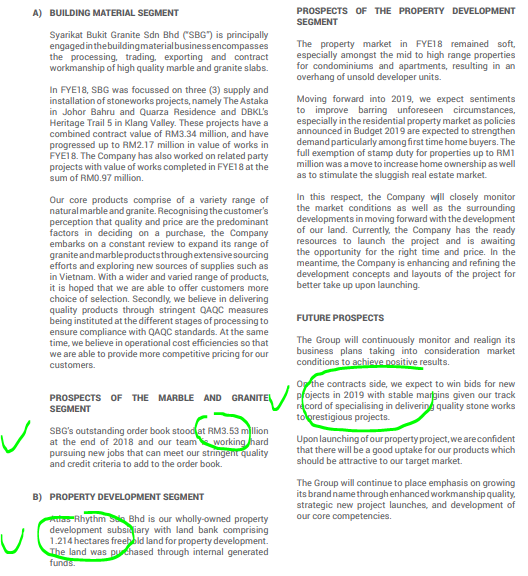

Refer below management analysis taken from latest Annual Report.

Key Prospects for Marble and Granite Segment :

i. RM 3.53 million orders secured and to be delivered in FY 2019

ii. To pursue new jobs that meet their stringent quality criteria

iii. With MEGA PROJECTS resumption (ECRL and Bandar Malaysia), the outlook of marble and granite suppliers look to be in higher demand from all the construction of buildings and houses

Key Prospects for Property Development Segment :

i. 1.214 hectares of freehold land ready for development (part of it in Mont Kiara area)

ii. Expecting to win bids for new projects in 2019 given their track

record in delivering quality stone works to prestigious projects

iii. Buyer sentiments to improve due to stamp duty exemption on purchase

3. Technical Analysis - ICHIMOKU CLOUD Breakout on Daily

Refer below WEEKLY chart of ABLEGROUP. We see that since 2017 it has

been on a downtrend and had tested resistances about 4 times and did not

succeed to break out.

From recent closing of

this week, we can see that the candle had formed a breakout of the trend

and thus highly likely to continue uptrending in future.

We can also see stochastics at the oversold point and turning upwards, with volume building up.

Refer below DAILY chart of ABLEGRP. We

could see the surge in volume today, and that the price had closed

above the ICHIMOKU Cloud, signalling a bullish momentum ahead.

Upon breakout of 10 cents resistance, I see the target at recent high of 12 cents which was achieved in August 2018 (last year).

CONCLUSION

Considering all the above, my personal TP for ABLEGROUP is set at RM 0.12 (Immediate & Short Term ), and RM 0.20 (Mid to Long Term).

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY

CALL whatsoever. I am only sharing my observations ONLY based on

fundamental; past history; current trading pattern; charts etc. Please

make your own informed decision before buying this share or whatever

share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/212899.jsp