On 23 May 2019, Mestron Holdings Bhd (Mestron) has officially released

its IPO Prospectus and has opened application for its IPO shares at RM

0.16 a share. Its IPO Prospectus can be downloaded:

IPO applications will be closed by 3 June 2019 and its shares would be listed on 18 June 2019.

Personally, I’d studied its IPO Prospectus and would like to share my findings on Mestron in this article. Therefore, here are 7 key things to know about Mestron for its IPO.

For the last 4 years, Mestron has increased its annual production capacity from 3,694 MT in 2015 to 5,670 MT in 2018. As a result, it has recorded growth in its annual production from 3,296 MT in 2015 to 3,912 MT in 2018. Utilisation rates have fallen from 89% in 2015 to 69% in 2018 as Mestron’s growth in production capacity had outweighed its production growth during the period.

Source: IPO Prospectus of Mestron

Note: Others refers to sales to Brunei, Myanmar, Sri Lanka and Maldives.

Source: IPO Prospectus of Mestron

Read more at this link - https://www.smallcapasia.com/mestron-ipo/

| Mestron IPO | |

| Mestron IPO |

Personally, I’d studied its IPO Prospectus and would like to share my findings on Mestron in this article. Therefore, here are 7 key things to know about Mestron for its IPO.

#1: Business Model

Mestron is involved in two business operations via two fully owned subsidiaries in Malaysia. First, via Meslite, it manufactures steel poles in a facility situated in Puchong, Selangor. Second, via Max Lighting, it trades and distributes a handful of outdoor lighting products under major brands such as GRUPPE, NIKKON, and OSRAM.For the last 4 years, Mestron has increased its annual production capacity from 3,694 MT in 2015 to 5,670 MT in 2018. As a result, it has recorded growth in its annual production from 3,296 MT in 2015 to 3,912 MT in 2018. Utilisation rates have fallen from 89% in 2015 to 69% in 2018 as Mestron’s growth in production capacity had outweighed its production growth during the period.

| Year |

2015

|

2016

|

2017

|

2018

|

| Max Capacity (MT) |

3,694

|

4,435

|

5,670

|

5,670

|

| Production (MT) |

3,296

|

3,481

|

3,990

|

3,912

|

| Utilisation (%) |

89%

|

79%

|

70%

|

69%

|

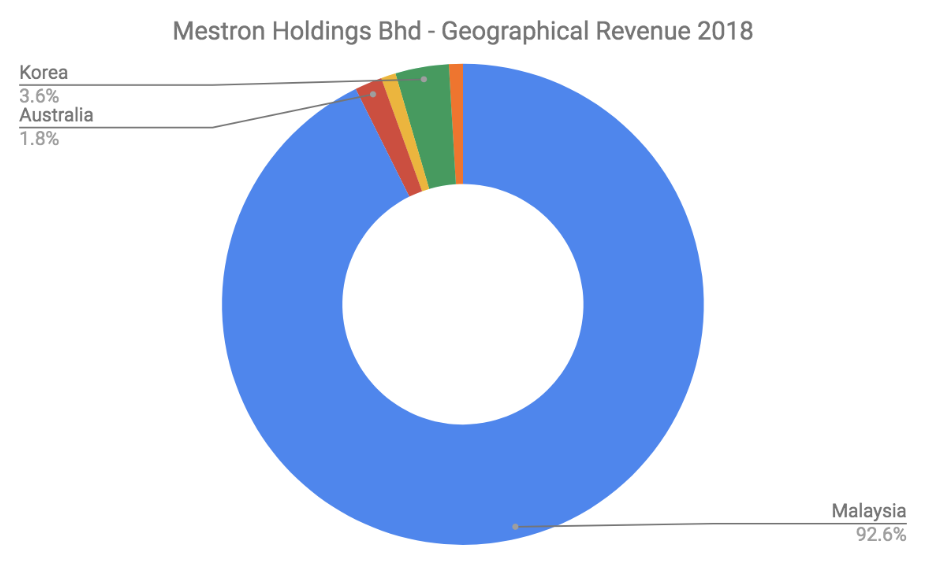

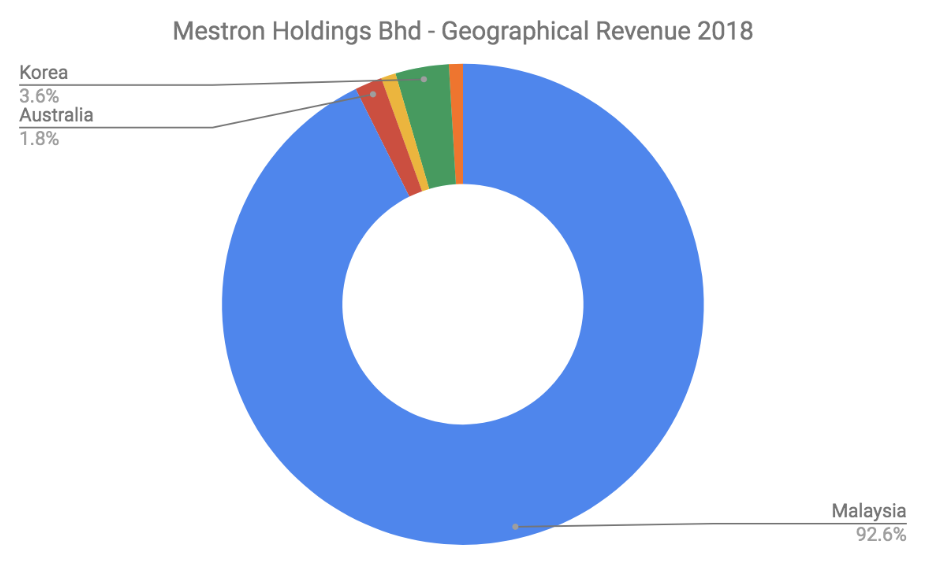

#2: Geographical Markets

Mestron’s principal market is in Malaysia as it had derived 92.7% of its revenue from domestic sales. The remaining 7.3% of its sales are contributed by exports to Australia, Singapore and Korea.

Note: Others refers to sales to Brunei, Myanmar, Sri Lanka and Maldives.

Source: IPO Prospectus of Mestron

Read more at this link - https://www.smallcapasia.com/mestron-ipo/

https://klse.i3investor.com/blogs/small_cap_asia/209455.jsp