2019 Quarter 1st Report for the BORNEO BIKERS GANG, and that annoying Honda Goldwing guy.... PCHEM, QL, YINSON, TOPGLOV

Author: (US/CHN trade war doesn't matter) Philip | Publish date:

Quarterly update for PCHEM, YINSON, QL, TOPGLOVE & STNE Feb 2019

This will be a simple quarterly report

that I will be putting up for my family and friends. So I will have

killed 2 birds with one stone, a simple letter to let everyone know what

I am doing with our investments (using my alias as (S=QR) Philip), as

well as sharing an investment journey that fellow retirees and new

investors can learn from and understand without paying training fees and

subscription payments. Admission is free.

_______________________________________________________________________________________________________

My investment strategy is simple, and yet difficult.

I am to invest in a concentrated manner, holding a small number of stocks that I can monitor and understand clearly its long term prospects.

I buy stocks based not on the stock price, but on the viability of its business

in growing and keeping its competitive advantage over a period of 5

years or more. In short, a wonderful, growing business. Hopefully, as I

am still an amateur with only 20 years of investing experience, I hope

to buy them at a fair price, failing which I hope to buy them cheaper

than what my 10 year projections of the business will be. I will be

wrong on many occasions.

I try to avoid buying

penny stocks, startups, turnaround stocks, asset plays, politically

connected stocks, and investment banker/shark promoted stocks. I will be

wrong many times, but more because of not acting on those

opportunities, and not because of making bad investments(hopefully). My

investment strategy involves reading annual reports, market journals,

news reports, press releases on many many stocks in the bursa market,

with the mental model that all businesses in malaysia will be related in

someway to each other (from developer to banker to contractor to

business owner to workers to government bodies to import to export and

so on). Out of these many businesses, using that framework of

relatedness, I monitor a group of stocks which has shown a background of

achievement, competence and business growth in a number of years. These

form my circle of competence, which I follow closely.

When I spot a viable long term growth trigger

for the business, and the share price is not too onerous, I buy the

stock with as much financial might as I am able to muster. I try to

ride the stock like a bat out of hell, reinvesting all dividends and

quarterly capital as I can reliably muster. At each quarterly report

juncture, I read the quarterly report (usually starting from the back

where all the juicy details are), and see if the stock has performed

along my expected projections. If it has, and the investing public has

not yet caught on, I buy more.

________________________________________________________________________________________________________

The results of my personal legacy investments are as follows:

My personal investments:

Shares owned Company

Cost* Market value

2,010,500 QL Resources Berhad RM1,265,892 RM13,751,820.00

2,043,800 Topglove Corp Berhad RM1,340,796 RM10,035,820.00

665,400 Yinson Holdings Berhad RM789,900 RM4,052,286.00

1,090,000 George Kent Malaysia Bhd RM1,125,136 RM1,231,700.00

Total shareholding value Q2: RM29,071,626.00

(RM1,000,000.00 margin loan minus)

Total shareholding value Q1: RM25,816,225.00

Returns this quarter: +8.03%

* Cost includes all margin loan costs, interest payments, dividend

reinvestments, monthly salary contributions, commissions from amway,

year end bonuses, performance bonus, palm oil plantation returns, money

drop from the sky, picked from rubbish bins, selling 4D private bookie

activities(to company and subcontractor workers only - divested )

begging, mugging, borrowing, inheritence and so forth.

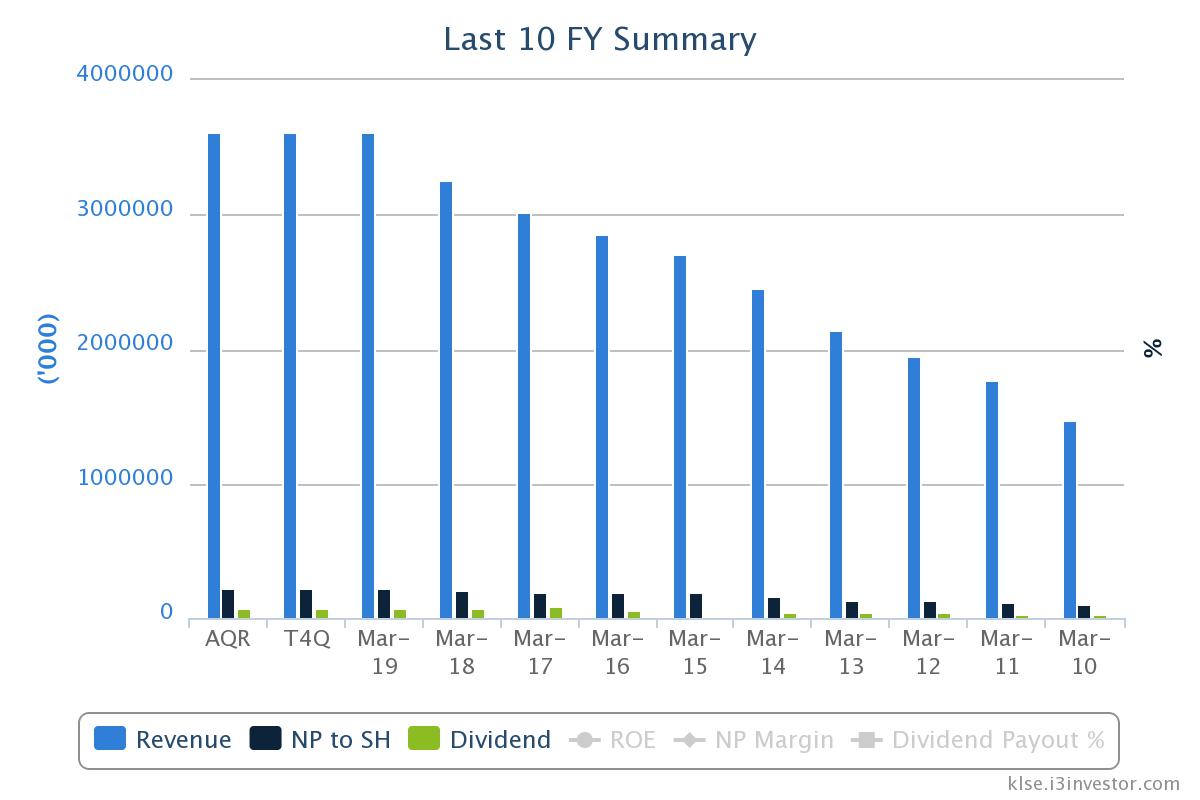

On QL Resources Bhd,

the full year results are out, and I am pleased with the results. last year QL did 3.2 billion with 206 net profit. This year QL did 3.6 billion with 216 million in net profit. That is s a wonderful sign of QL keeping to their promise of a master plan of double digit growth over the next 5 years.

this chart shows the trajectory of QL performing on all quarters, with them making headway on the family convenience Family Mart (growing today at 108 stores, and expansion plans to penang, melaka and other places). They are targeting 300 stores long term and it is now self propagating, meaning no additional capital from parent is needed to sustain the business. With regards to their palm oil plantation and processing business, they have hit unheard of levels of efficiency, with 13.2% returns, even with the context of the lowest CPO pricesin the past few years. This quarter is a slow one, but I am very confident that next year with the tokyo olympics 2020 happening in july, a huge jump in the export prices and demands of QL to japan would prove to be a huge boon in another double digit growth year next financial year for QL. After all, when you think about a moat, how many companies do you think produce surimi and frozen seafood in large quantities enough to feed all those tourists coming down for the entire of july-august month? QL is the biggest surimi producer in south east asia, and long term growth triggers are looking wonderful.

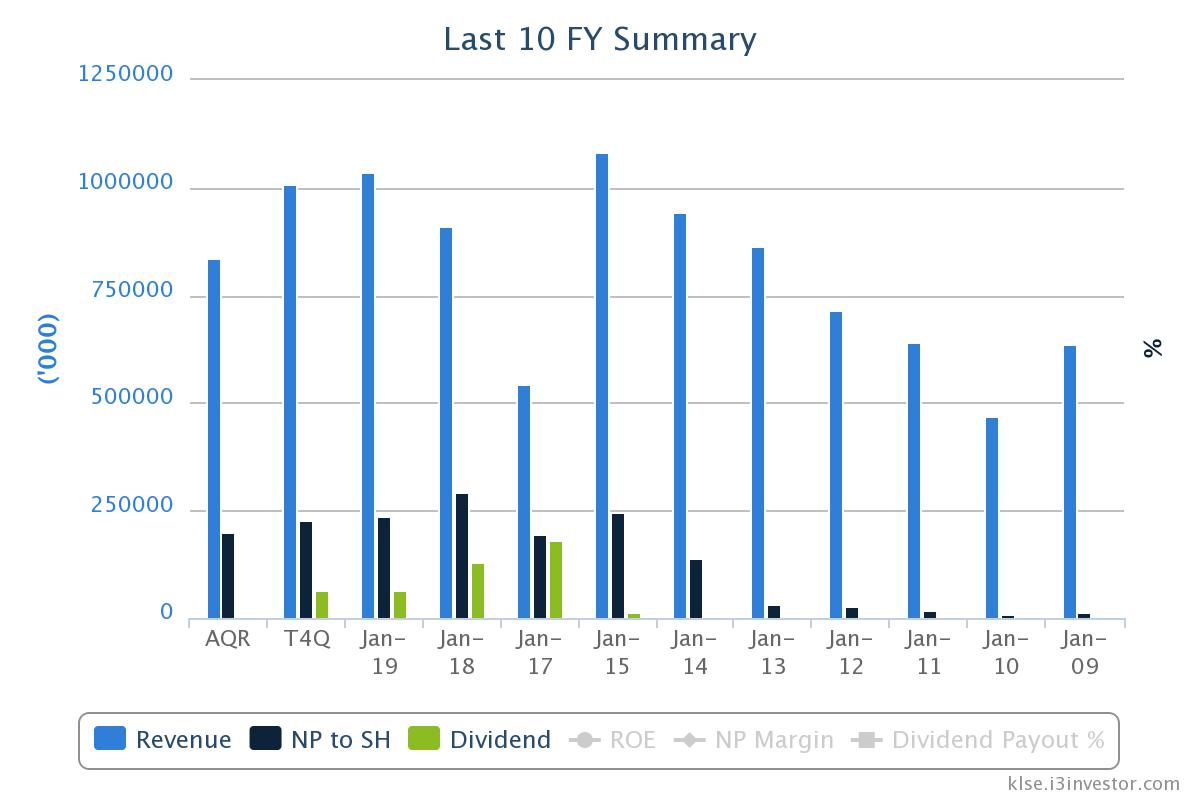

Topglove corp bhd is an exemplary company in Malaysia which has a 25% hold of the world gloves market. This company has a huge moat, where more technologically advance countries are unable to produce with the same gusto as topglov due to the ecological conditions of the rubber tree ( russia, USA and UK for example use a lot of rubber gloves but can never produce the quantity needed due to inability of growing their own trees), while countries which are rubber exporters (like india, brazil etc) are unable to compete with topglove (and hartalega) in terms of manufacturing quality/capacity/pricing due to first mover advantage. It is a very resilient basic business that is very difficult to break into, but the worldwide demand is growing at a huge 10% pace each year. ( http://www.bernama.com/en/news.php?id=1715667).

In terms of local production, topglov is king in terms of production, hartalega is king in terms of nitrile R&D and production. Topglove has taken steps to solve that with their recent acquisition of Aspion for 1.3 billion, however it has hit a backwall due to production issues. To reduce the debt and gearing, topglove has raised bonds at a very low rate ( 200 million usd bonds at 5 year rates with a 2% FIXED interest) which alleviates the LIBOR floating rates and is half the previous loan rate interests of 4%. On top of that, bondholders hold the right to exchange the bonds for shares at a prevailing price of RM 6.20, which is managements method of protecting share dilution and earnings dilution for the minority shareholders.

I continue to be amazed at the quality of management shown by topglove, and am holding fast to my shares and enjoying my dividends as it comes. I have great faith the ability of Topglove to perform in the coming years.

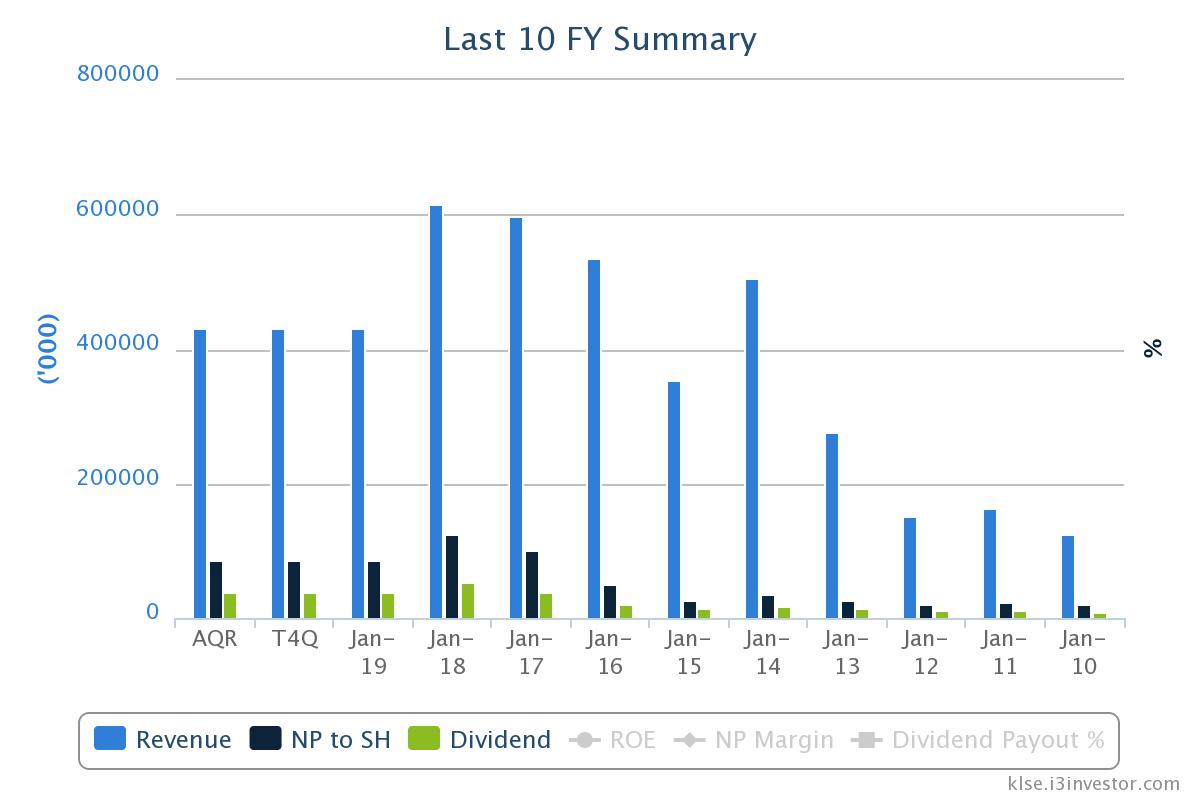

Yinson holdings berhad has performed far beyond my expectations.

They take very little risks, putting in tenders and charter bids with ironclad contracts that are give your free converted ships for penalties, and full payment for the ships with a good profit upon completion of project. They are also very good at sourcing out the most efficient and cheap shipyards to build and convert their ships for FPSO purposes ( but definitely not low quality). For one simple example, after THHE is unable to complete the petronas project, it is novated to Yinson (marking the first journey for yinson into malaysia waters, which is ironic), and it is being done and completed far ahead of schedule. How is the conversion so fast? Wheres a company like bumi armada does their ship conversion and building at Keppel shipyards in Singapore, yinson does theirs at Cosco's shipyards in Qidong, China. It is done at wonderful speed and even more wonderful prices. Yinson prides themselves on efficiency, prefering to hire entire team from Norways Fred Olsen Production ( buying over the company), and letting them decide on the management and production matters, instead of trying to put their hands into the mix. I would say yinson has a wonderful moat in a management that chooses the right people for the job (instead of skin color) and does things in a conservative way (with good repayment to creditors and borrowers who then in turn feel more comfortable in borrowing even more money to them).

It is with this mindset that Yinson is now the sole competing bid for the brazil FPSO project "Whale park tender" (as the other competitor SAIPEM was unable to comply due to financial capability structure not fitting to Petrobas requirement.) Japans Modec has trimmed its scope for only 1 field in Marlim, leaving the room open for Yinson as the sole tenderer. Even more amazing, yinson day rate charter of 750,000 USD per day is almost 100,000 more than the previous bid by Modec for the field. If Yinson wins the bid at this price, it would be an amazing coup for the little bus company that decided to float.

In terms of projects bids, for the Ghana FPSO, yinson is a 2 horse bid with netherlands SBM, however Yinson has the upper hand with existing ghana projects while SPM has been trying to enter ghana market for years. So it seems chances are high that Yinson could end up with 3 major FPSO charter wins that will keep it busy for the next 10 years.

To recap:

1. Marlim 2 (pretty much guaranteed Yinson is only bidder) - 1.6 USD billion revised, initial offer from Yinson 750K day rate, renegotiated to 709K day rate. (2022 start date)

2. Greater Pecan FPSO - 2 horse race between SBM ( no existing exposure in Ghana) and Yinson (project win and good will earned from previous project in Ghana) (2022 start date)

3. Parque das Baleias FPSO - SAIPEM has been disqualified (leaving Yinson as sole tenderer) (2022 start date)

with these in mind, any one of these projects is expected to provide 2 billion each for time charter and O&M (if negotiated), which provides a clear return of 12% IRR, and additional total revenue of 24 billion MYR if all 3 contracts are won over the period.

George Kent Malaysia bhd is an interesting company that I started a small position in with margin. It pays 6% in dividends, is now valued at 625 million. and has 200 million in cash. It has both a manufacturing/operational fixed income business in the water meters and water treatment plant concession, and also a specialized rail system contract in MRT and LRT as well as design and build contractors for hospitals and WTP.

Everything seemed wonderful, with a revenue of 616 million, 124 million in earnings, and a valuation 2.4+ billion valuation. And then disaster struck. Government change, share price crash, valuations inverted. The share price dropped from RM4 to RM1, estimates on the possibility of contract cancellation, MACC checking, golf buddy change were the rumour mongers of the day. It was believed that GKENT is a goner.

How different is the outlook today. the water meter business is as resilient as ever, with big contract wins in hong kong and singapore. Finance minister LGE came out to renegotiate the price of LRT3 project, with the decision to downsize the project, reduce the number of cars, lower the costs and change the project from a PDP format into fixed contract sum of 11.6 billion MYR. In the end, LGE renegotiated and reawarded the project to the MRCB-GKENT joint venture as a fixed contract.

All the fears and problems that would be associated with GKENT are no longer in the horizon. The business fundamentals for GKENT is intact. Their cash position is as strong as ever. The contracts are flowing in. Now as much as ever is the time to invest when all the downside risks have be settled, as we wait for the revenue to come in.

Part 2 to follow.

https://klse.i3investor.com/blogs/phillipinvesting/212928.jsp