Maybulk Intro

The MBC Group is the largest drybulk shipowner in Malaysia engaged in international shipping. The MBC Group presently owns and operates a fleet of vessels which includes dry bulk carriers and product tankers. MBC Group’s vessels are largely tramped on the spot and period markets.

he principal activities of the Group are:-

i) Owners and operators of

(Post-Panamaxes)

ii) Ship management

Source obtain from http://www.maybulk.com.my/index.html

Before i touch some thing about what happend on MAYBULK, let read some

news for your better understanding what is happening in shipping

industry.

With

freight rates low, existing arbitrages settled safely and shipping

while always there naturally was no longer perceived to be a crucial

factor in opening or closing trade routes.

However, times are changing. In addition to freight already being on a path for recovery due to rising demand, there is an upcoming disruptive regulation from the International Maritime Organization that could upset the apple cart.

The global sulfur cap of 0.5% on marine fuels that that will come into effect on January 1, 2020 is already seen as a perfect storm by the oil and shipping industries as it may cause extreme volatility in bunker prices.

The most likely outcome is a sharp rise in costs for shipowners, and — as in any business — these costs will be passed on to the customer. For anyone involved in seaborne coal trade, this would mean dealing with a dramatic, long-term increase in freight rates.

No easy way out

The new sulfur cap of 0.5% is a sharp drop from the current limit of 3.5% and in simple terms it means that come January 2020, all vessels around the globe will have to burn cleaner and more expensive fuels or take other costly measures to comply.

One way that shipowners could go is using special fuel oil blends, which would fall below the 0.5% cap. However, experts are doubtful that the global refining industry will be able to supply these in sufficient volume and variety in time for 2020.

Otherwise the industry could go straight to burning marine gasoil which many expect will be the most popular option, at least at first.

However, while MGO is compliant and more readily available, it also much more expensive than conventional IFO 380 bunker fuel.

Of course, there are a few alternatives available to shipowners, such as LNG bunkering or exhaust control systems, also known as scrubbers, but both have serious drawbacks.

For example, it takes $3 million-$6 million to install a scrubber on a dry bulk vessel, with costs depending on the size of the ship and the type of the scrubber.

Retrofitting a 5-10 year old ship, given current vessels prices, would therefore be prohibitively expensive.

It is even harder to justify LNG as the global bunkering solution as the infrastructure required to support it is not there yet and the upfront costs for retrofitting ships are even higher.

Who will pick up the bill?

Whichever way the industry moves, one thing is certain — it won’t be cheap. Estimates of how much the extra costs for shipping would be vary widely, ranging from modest a $5 billion to $70 billion a year, which clearly shows how much uncertainty surrounds the whole issue.

This is not just a problem for the shipping industry. Given the sorry state of the freight market, shipowners will not be willing or able to absorb such massive extra costs themselves and will have to pass on the lion’s share to their customers.

This would be people who trade the actual commodity, and the extra bunker fuel bill could be quite substantial, especially on long-haul voyages.

Let us look at a specific example — the coal arbitrage from Colombia to North East Asia. Obviously Columbia is not the biggest player when it comes to this region. Australia and Russia are as they are much closer to the buyers.

However, in both 2016 and 2017, Colombia successfully took a considerable bite out of their market share, selling over 3 million mt a year of bituminous thermal coal to NE Asia.

The graph below compares Australian and Colombian coal prices, including Panamax freight to NE Asia. For the sake of simplicity it is assumed that freight rates on both routes were constant throughout the year.

However, times are changing. In addition to freight already being on a path for recovery due to rising demand, there is an upcoming disruptive regulation from the International Maritime Organization that could upset the apple cart.

The global sulfur cap of 0.5% on marine fuels that that will come into effect on January 1, 2020 is already seen as a perfect storm by the oil and shipping industries as it may cause extreme volatility in bunker prices.

The most likely outcome is a sharp rise in costs for shipowners, and — as in any business — these costs will be passed on to the customer. For anyone involved in seaborne coal trade, this would mean dealing with a dramatic, long-term increase in freight rates.

No easy way out

The new sulfur cap of 0.5% is a sharp drop from the current limit of 3.5% and in simple terms it means that come January 2020, all vessels around the globe will have to burn cleaner and more expensive fuels or take other costly measures to comply.

One way that shipowners could go is using special fuel oil blends, which would fall below the 0.5% cap. However, experts are doubtful that the global refining industry will be able to supply these in sufficient volume and variety in time for 2020.

Otherwise the industry could go straight to burning marine gasoil which many expect will be the most popular option, at least at first.

However, while MGO is compliant and more readily available, it also much more expensive than conventional IFO 380 bunker fuel.

Of course, there are a few alternatives available to shipowners, such as LNG bunkering or exhaust control systems, also known as scrubbers, but both have serious drawbacks.

For example, it takes $3 million-$6 million to install a scrubber on a dry bulk vessel, with costs depending on the size of the ship and the type of the scrubber.

Retrofitting a 5-10 year old ship, given current vessels prices, would therefore be prohibitively expensive.

It is even harder to justify LNG as the global bunkering solution as the infrastructure required to support it is not there yet and the upfront costs for retrofitting ships are even higher.

Who will pick up the bill?

Whichever way the industry moves, one thing is certain — it won’t be cheap. Estimates of how much the extra costs for shipping would be vary widely, ranging from modest a $5 billion to $70 billion a year, which clearly shows how much uncertainty surrounds the whole issue.

This is not just a problem for the shipping industry. Given the sorry state of the freight market, shipowners will not be willing or able to absorb such massive extra costs themselves and will have to pass on the lion’s share to their customers.

This would be people who trade the actual commodity, and the extra bunker fuel bill could be quite substantial, especially on long-haul voyages.

Let us look at a specific example — the coal arbitrage from Colombia to North East Asia. Obviously Columbia is not the biggest player when it comes to this region. Australia and Russia are as they are much closer to the buyers.

However, in both 2016 and 2017, Colombia successfully took a considerable bite out of their market share, selling over 3 million mt a year of bituminous thermal coal to NE Asia.

The graph below compares Australian and Colombian coal prices, including Panamax freight to NE Asia. For the sake of simplicity it is assumed that freight rates on both routes were constant throughout the year.

Source obtain from https://steelguru.com/logistic/imo-2020-a-shipping-regulation-that-may-reshape-global-coal-trade/499669

More information pertaining MAYBULK outlook can be obtain by clicking this linkage.

To my personal point of view, In order to comply the IMO 2020 policy

that will significantly increase the cost of operating business for dry

bulk shipping vessel.

“But,

there is increasing expectation that ship demolition may increase as

some shipowners may be inclined to scrap vessels instead of incurring

additional costs for special surveys, installation of ballast water

treatment systems and scrubbers to meet the International Maritime

Organisation (IMO) 2020 sulphur regulations.

Source obtain from https://www.msn.com/en-my/money/topstories/uncertain-outlook-for-shipping-industry-this-year-%E2%80%94-maybulk/ar-BBVC4ua

Recent positive development news :

1.A

new ship-to-ship (STS) marine gas oil (MGO) and marine fuel oil (MFO)

storage and supply hub will be built off the Port of Tanjung Pelepas in

southern Johor, say sources familiar with the matter. It is touted to be

the largest in the world.

The construction cost of the hub — to be developed by little-known KA

Petra Sdn Bhd, partnering Hong Kong tycoon Li Ka-shing’s Hutchison Port

Holdings Ltd — is estimated at RM500 million, a Hutchison Port official

tells The Edge.

“KA Petra has been in the STS business since 2005, providing offshore

storage and MGO and MFO supply services between vessels in the waters

off Port Klang, Selangor, Tanjung Beruas, Melaka, and Tanjung Pelepas,

Johor.

“In Johor, it is one of four operators licensed by the Ministry of

Transport to provide STS services to vessels coming to the Port of

Tanjung Pelepas (PTP) and Port of Singapore,” says the official.

Hutchison Port will have an up to 30% stake in the completed STS hub,

the official adds. The project will have a gross development value of

RM8 billion to RM12 billion.

A check with the Registrar of Companies shows that KA Petra is a

distributor of marine lubricants and provider of shipping and oil and

gas-related services. It is almost wholly owned by Datin Lelawati

Raffik.

Source obtain from https://www.theedgemarkets.com/article/newsbreak-li-kashingbacked-venture-build-sts-hub-johor

2. The

other component of PIPC is the Petronas’ Pengerang Integrated Complex

(PIC) which is PETRONAS’ largest downstream investment in a single

location to date, the development includes the USD 16 billion Refinery

and Petrochemical Integrated Development Project or RAPID. This also

involves the USD 11 billion associated facilities consisting of Air

Separation Unit, Raw Water Supply, Cogeneration Plant, Regasification

Terminal, Deepwater Terminal and Utilities and Facilities. Upon its

completion in 2019, PIC will have a refining capacity of 300,000 barrels

per day with petrochemical plants yielding an estimated production

capacity of 3.6 million tonnes per annum of petrochemical products.[7] The

development of PIPC which received full support from the both state

government and federal government will also benefit the local community

by creating more access to economic opportunities other than the

provision of public infrastructure and a complete infrastructure in

Pengerang, Johor, PIPC also will create a total of 8,600 jobs in the operational phase by year 2020

Source obtain https://en.wikipedia.org/wiki/Pengerang

Toward completion of Pengerang project, it seem that Port of Tanjung

Pelepas need to be expand to cater the need for oil stroage and tank

which is well explain in a above manner.

There is some thing to be worry due to argument between the Johor Ruler

with Dr. M. To avoid touching sensitive information, you guy can google

to find out more pertaining this information.

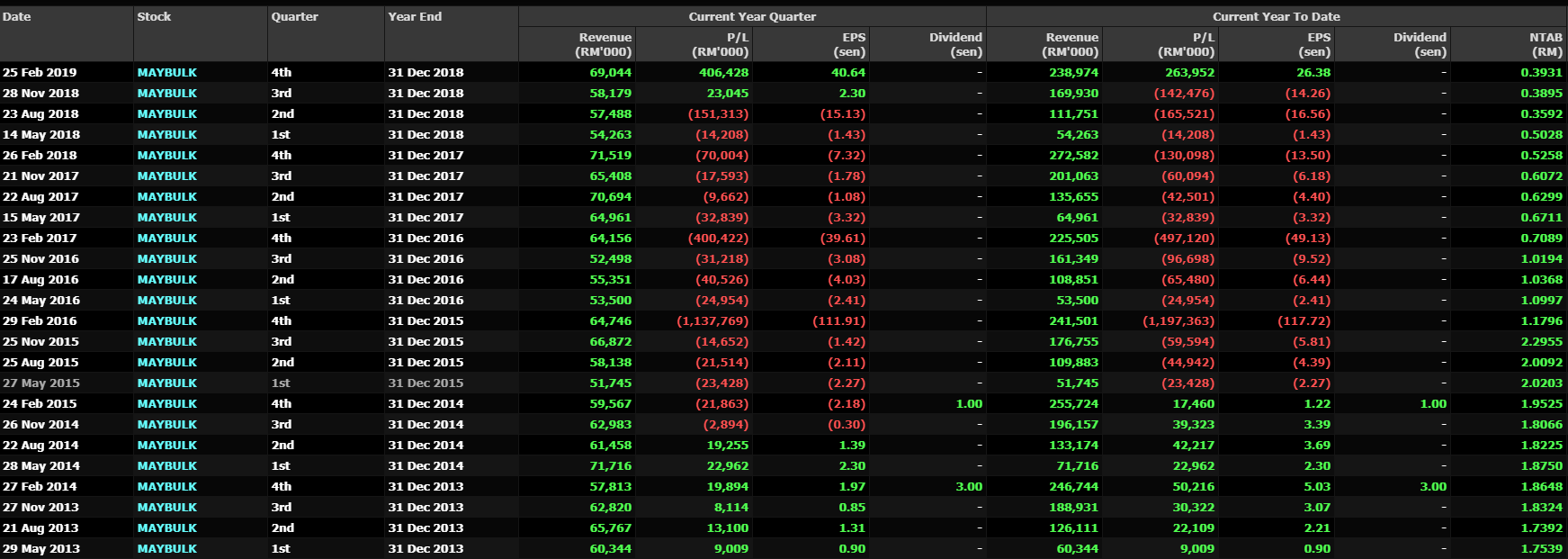

Financial Snapshot :

It is very crucial that the coming quarter result release determine

MAYBULK have the ability to turnaround. By disspose lost making company

POSH, it will help MAYBULK to focus on their core business and having a

better cash flow.

Financial Info

PE : 2.18 : VERY LOW, BUT YET TO JUSTIFY CAN IT RAISE UP HIGHER TO PE 8-10

NET GEARING RATIO : 0.3 ( COMPARE TO PREVIOUS FINANCIAL YEAR WAS 0.62) HUGE IMPROVEMENT TO MANAGE THEIR GEARING

TRADE RECEIVABLE : 28. ( 1 MONTH TIME FRAME ; ACCEPTABLE)

NTA : 0.39 ( PREMIUM COMPARE TO CURRENT SHARE PRICE)

TECHNICAL CHART :

SUPPORT : 0.53

RESISTANCE : 0.63 ; 0.68 ; 0.71 ; 0.80

Personal Point of view, there might some hickup if you would to hold

this stock as the Pengerang Project beneficiary will kick start by this

year or some time around 2020. However, this new new

ship-to-ship (STS) marine gas oil (MGO) and marine fuel oil (MFO)

storage and supply hub will be built off the Port of Tanjung Pelepas in

southern Johor does not specificy mention when it the completion date.

However, the entire process may take up several years and go phase by

phase. Good news is that global crude oil price is on the recovery mode.

Political issues can be resolve as long both party want the best for

the Malaysia economy and people which i think should not be a big issue.

Baltic Dry Index has been declining and old vessel will be scrap.

Indirectly it will lower down the supply in the market as well as asking

for higher price. This will take effective by the year 2020. So, to my

point of view. 2019 is not yet the year for maybulk. Is just a standby

preparation year. We should be seeing more active news coming out for

the year 2020.

Malaysia Short-Term Technical Analysis Workshop

Date : 16 April 2019

Time : 2.30pm - 4.30pm

Language: English

Location : Level 2, P-16, Icon City, No: 1B, Jalan SS8/39, Petaling Jaya, 47300, Selangor

Registration Link : https://www.eventbrite.com/e/malaysia-short-term-technical-analysis-workshop-tickets-59892323552?aff=ebdssbdestsearch

马股免费技术讲座会

日期: 18 April 2019

时间: 2.30p.m- 4.30 p.m

语言: 华语

地点: Level 2, P-16, Icon City, No: 1B, Jalan SS8/39, Petaling Jaya, 47300, Selangor

大马投资分享会 | Vol .1

日期: 21 April 2019

时间: 1.30p.m- 5.00 p.m

语言: 华语

地点: B-2-13A Plaza Arkadia, No 3, Jalan Intisari Perdana, Desa ParkCity

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

免责申明: 以上文章纯属个人意见以及学术性分享,不构成任何买卖建议。在你做出任何买卖之前,建议您和你的股票经纪质询任何投资意见。买卖风险自负

Disclaimer: Above article is for educational sharing purpose. Kindly

consult your dealer/remisier for any investment advise before you make

any decision. Trade at your own risk.

https://klse.i3investor.com/blogs/SICStockPick/202401.jsp

https://klse.i3investor.com/blogs/SICStockPick/202401.jsp