Points To Consider:

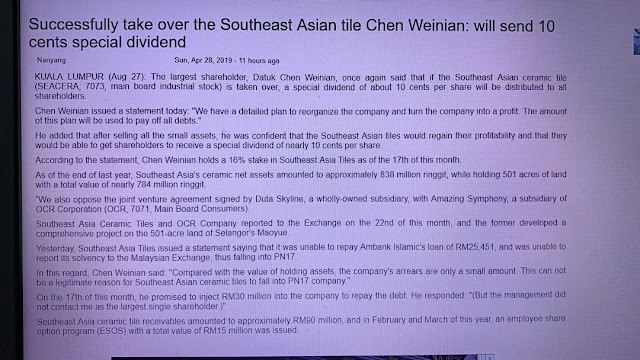

- Net current assets of Seacera was RM838m, largely backed by its 501 acres of land in Semenyih.

- Current management and CEO proposed to do a jv on that land with Duta Skyline (OCR)

- Datuk William Tan is the single largest shareholder with a 16.4% block and has pledged to inject RM30m into the company to resolve the company's cash flow. Tan basically was against the jv.

- Seacera just defaulted on an RM25,451 payment for its Ambank Islamic loan, putting it into PN17.

- Tan also mentioned that if he manages to take over the company he will declare a 10 sen special dividend after minor asset sales.

Commentary:

- Obviously Tan has other plans to develop the 501 acres, apparently with strong China involvement (Country Garden). So who is to say which jv is better? The CEO has the right to call the shots here.

- However, the CEO and present management totally ignore their largest shareholder's pledge to inject RM30m. How to justify the "silly" missed payment of just RM25,451? Cutting the leg to get rid of an itch!!!

- Should the SC step in? In this instance, there appears that there may be a case that the CEO may not have been acting in the company's best interest. On that note, the board of directors should have a lot to answer as well.

- This is an interesting situation where the shareholdings are splintered and no one really has effective control. What are the rights of the largest shareholder then?

It said on Friday that it had triggered the prescribed criteria after it defaulted in the payment of principal and profits to AmBank Islamic Bhd and it was also unable to provide a solvency declaration to Bursa Securities.

Trading in the securities of Seacera was halted at 11.48am on Friday. The tile maker's share price was flat at 31.5 sen before its request for voluntary suspension.

The tile maker has 12 months to regularise its financial condition. It also has to submit a regularisation plan to the Securities Commission if the plan will result in a significant change in the business direction or policy of the company.

However, Datuk William Tan Wei Lian (Chen Wei Nan), the single largest shareholder of Seacera with a 16.4% stake, pledged to inject RM30mil, or more into the company to resolve its cash flow and credit liability, if need be.

The company had attracted interest following Tan's move to call for an EGM to remove several directors.

In the latest development, Seacera announced that its application for injunction in respect of the notice of EGM issued by Tan and three others was heard on Thursday before the High Court judge.

Seacera had withdrawn the application on the undertaking provided by Tan and three others that "they will not jointly or severally issue any fresh notice of EGM until and unless they are members of at least 10% of the company".

Apart from that, Tan and three others had also withdrawn the notice of EGM dated April 15, which the company reserves its rights.

Read more at https://www.thestar.com.my/business/business-news/2019/04/26/seacera-suspends-trading-ahead-of-fresh-news/#lcjGHfAueZ0IkefT.99

- Net current assets of Seacera was RM838m, largely backed by its 501 acres of land in Semenyih.

- Current management and CEO proposed to do a jv on that land with Duta Skyline (OCR)

- Datuk William Tan is the single largest shareholder with a 16.4% block and has pledged to inject RM30m into the company to resolve the company's cash flow. Tan basically was against the jv.

- Seacera just defaulted on an RM25,451 payment for its Ambank Islamic loan, putting it into PN17.

- Tan also mentioned that if he manages to take over the company he will declare a 10 sen special dividend after minor asset sales.

Commentary:

- Obviously Tan has other plans to develop the 501 acres, apparently with strong China involvement (Country Garden). So who is to say which jv is better? The CEO has the right to call the shots here.

- However, the CEO and present management totally ignore their largest shareholder's pledge to inject RM30m. How to justify the "silly" missed payment of just RM25,451? Cutting the leg to get rid of an itch!!!

- Should the SC step in? In this instance, there appears that there may be a case that the CEO may not have been acting in the company's best interest. On that note, the board of directors should have a lot to answer as well.

- This is an interesting situation where the shareholdings are splintered and no one really has effective control. What are the rights of the largest shareholder then?

Seacera now a PN17 company

KUALA LUMPUR: Seacera Group Bhd has become an affected listed issuer under Practice Note 17 (PN 17) under the Main Market Listing Requirements of Bursa Malaysia Securities.It said on Friday that it had triggered the prescribed criteria after it defaulted in the payment of principal and profits to AmBank Islamic Bhd and it was also unable to provide a solvency declaration to Bursa Securities.

Trading in the securities of Seacera was halted at 11.48am on Friday. The tile maker's share price was flat at 31.5 sen before its request for voluntary suspension.

The tile maker has 12 months to regularise its financial condition. It also has to submit a regularisation plan to the Securities Commission if the plan will result in a significant change in the business direction or policy of the company.

However, Datuk William Tan Wei Lian (Chen Wei Nan), the single largest shareholder of Seacera with a 16.4% stake, pledged to inject RM30mil, or more into the company to resolve its cash flow and credit liability, if need be.

The company had attracted interest following Tan's move to call for an EGM to remove several directors.

In the latest development, Seacera announced that its application for injunction in respect of the notice of EGM issued by Tan and three others was heard on Thursday before the High Court judge.

Seacera had withdrawn the application on the undertaking provided by Tan and three others that "they will not jointly or severally issue any fresh notice of EGM until and unless they are members of at least 10% of the company".

Apart from that, Tan and three others had also withdrawn the notice of EGM dated April 15, which the company reserves its rights.

Read more at https://www.thestar.com.my/business/business-news/2019/04/26/seacera-suspends-trading-ahead-of-fresh-news/#lcjGHfAueZ0IkefT.99

http://malaysiafinance.blogspot.com/2019/04/drama-minggu-ini-seacera.html