Danco (5276)

Dancomech

Holdings Bhd (DANCO) is engaged in trading and distribution of PCE and

Measurement Instruments. The Company offer its products to palm oil and

oleochemicals, oil & gas and petrochemical, and water treatment

& sewerage industries. The majority of its customers are from

industries such as palm oil and oleochemicals, oil and gas and

petrochemical, water treatment and sewerage. For now, it has a diverse

customer base of 1,459 customers from various industries.

Fundamental Analysis

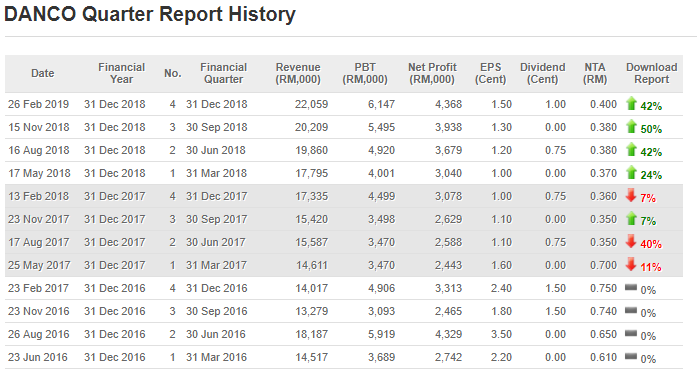

The

company has been reporting 3 good consecutive quarters result and their

company recorded new record high profit and revenues. Their peer like

UNIMECH reported 2 consecutive good quarters result too.

-

Supply and distribution of fluid control equipment and measuring

instrument products, not involved in any production (Manufacturing)

activities. Moreover, they do not have a plant. Their core product is

the valve, accounting for about 70% of the overall revenue; its

customers mainly on the basis of large-scale industry, including

refineries, biodiesel plant, palm oil, oleochemical, oil and gas, and

sewage treatment.

-

Valve as the national economy essential industrial equipment, machinery

and equipment is indispensable to all walks of life.Its quality is good

or bad in a way to give people and production safety, product quality,

production efficiency and other important impact.At present, Valve is

more and more widely used, the oil and gas industry has always been the

largest buyers.

-

Although there is no any support of large number of purchase orders,

but DANCO in the valve industry has more than 25 years of history,

indicating that has a way to maintain the business of survival; and

other pure distributors is not the same, the group has the ability to

obtain palm oil industry maintenance contracts, resulting in stable

income.

-

Driven by the steady gains from maintenance and after-sales service,

and effective cost management measures, DANCO's after-tax profit has

been maintained at RM10-15m in recent years; about 60%of its profit

contribution comes from maintenance, repair and operational services,

while the rest is from product sales, and from 3 to 6 months of

short-term projects.

-

Danco has not suffered any losses so far since it's listed on Bursa

Malaysia, mainly because the palm oil plant that purchased Valve earlier

needs regular maintenance every year, and can earn up to double-digit;

about 2,000 palm oil plants need some form of maintenance every year;

DANCO provides direct and indirect maintenance services for about 20-30%

of palm oil plants, and this number is growing every

-

At FY18, its earnings have been recording new high for 2 consecutive

quarters, thanks to the increased sales of fluid control equipment in

the local market and in the Indonesian market, largely driven by the

growth in demand in the oil and gas industry.We believe that this is

likely to come from an order contribution from the RAPID project.In

fact, management said earlier that the ongoing RAPID project has driven

product demand higher.

-

Management expects demand from both local and Indonesian markets to

remain good and expects to continue to deliver positive / positive

results at Q4. Excluding unforeseen incidents, the DANCO group is

optimistic about FY18's performance and outlook.

-

Looking ahead, DANCO is seeking to tap into Indonesia's Valve business

and target the local palm oil industry.At present, the local palm oil

plant is close to saturation, and Indonesia's palm oil plant is still in

demand above supply, the development prospects are Unlimited, has a

huge potential.

-

Currently, Danco holds the net cash of RM48m, which is equivalent to 16

cents per share; it can create operating cash flow between RM10-13m

each year, which can meet the capital expenditure required each year,

while maintaining a stable dividend rate of 30%.

-

There are signs of increasing upstream activity in the oil and gas

sector, both locally and in the Indonesian market. We think DANCO is

very likely to hand over the good performance again in Q4, and record a

new high.

Technical Analysis

Danco

tested twice for new high 0.675, but still unable to breakout from this

level. However, this company retraced from peak 0.675 to 0.595. Strong

support at 0.59-0.60 built for the past one month. This stock might have

a rebound very soon. Not to forget their result on May 2019 coming out

soon. Good companies usually will have a push up before result because

they have high expectation on it. With P/E 15 and latest EPS of 1.5 x 4 =

6, this company worth at least 0.90. However, that is just a target

price to be achieved in future. When market is bad, we always back to

fundamental stocks that is strong enough and good growth in future.

Disclaimer

I

am just an author who shares my opinion, views and general information.

The comments above do not represent any recommendation of buy or sell

call. Investments carry risk that you will have to bear at your own

cost. I will not be held liable for any investment decisions made.

Please seek for professional advice before you made any decisions. https://klse.i3investor.com/blogs/Roger1001/202482.jsp