HOHUP - A GEM UNDERLOOKED !! (PERSONAL TP 73 - 80 cents)

This week, BSKL has seen rising interest in the CONSTRUCTION sector as talk of ECRL project revival is nearing to completion; which should continue into next week.

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - HOHUP CONSTRUCTION COMPANY BHD or HOHUP (Code 5169).

I noticed considerable interest starts to trickle in on Friday where the volume registered a sizeable increase to 4.5 million.

A

bullish bias may appear above the MYR0.445 level, with an exit set

below the MYR0.405 threshold. Towards the upside, the near-term

resistance is at MYR0.505. This is followed by the MYR0.54 level.

This positive momentum should carry forward next week ( forbearing

instances of the adversity/ negativity of the regional markets sentiment

affecting Bursa Malaysia) since it was able to close Friday

conclusively above its major resistance of 0.445.I forsee it trending to

the next resistances of 0.505 & 0.55 before heading to my personal

TP between 0.73 to .80 on comfortable P.E. of 10 to 11 in the

intermediate term.

I would like to express my opinion on this stock :

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Lack of Coverage by IB / Research Houses

I think this is the biggest factor causing this stock not to reflect

its true value. For the past 1-2 years, there have been lack of analyst

reports and media coverage on this stock. With this article being

posted, I hope that some of the IB / Research Houses and media members

can serve public the justice by analyzing and publishing coverage on

HOHUP.

2. Financial Analysis Point of View

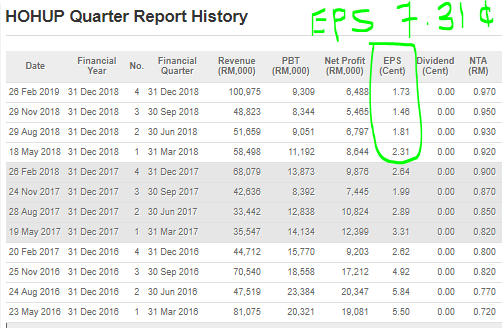

Let us refer to below image of the latest 3 years quarter reports of HOHUP.

Recently, HOHUP had posted its historic highest revenue or RM 101

million in Feb 2018 report. Also, earnings in latest quarter are better

compared to previous quarter. Totalling up the EPS per quarter, we get a

total full year EPS of 7.31 cents.

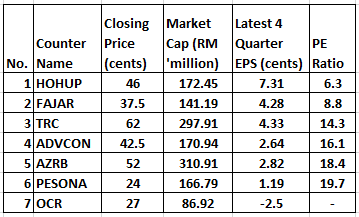

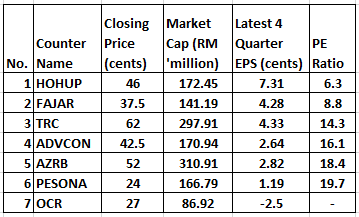

Comparison With Few Main Board Construction Stocks

Below table of comparison between HOHUP and few peers in the Main Board - Construction.

As you can see, HOHUP is currently trading at only a PE Ratio of 6.3,

which is significantly lower compared to its few other peers out there.

With a conversative PE Ratio of around 10-11, I would opine that this

stock should be trading around 73-80 cents in near term.

2. Technical Analysis Point of View

Let us refer to the monthly chart belowof HOHUP; captured from January

2013 to March 2019. We can see that HOHUP was trading significantly

higher in the past and the current price presents big upside opportunity

(up to 80 cents for first major resistane), compared to downside.

Technically, the stock is seen in bullish momentum as the MACD has crossed upwards with positive buildup in volume.

As the financials get better for HOHUP, for example EPS gets to 15-20

cents, I do not see any reason why it cannot go to above RM 1 in the

longer term.

Considering all the above, my personal TP for HOHUP is set between RM 0.73 - 0.80.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

I WILL PLACE HOHUP INTO MY INVESTMENT PORTFOLIO BEFORE FUNDS START BUYING INTO IT.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/200169.jsp

https://klse.i3investor.com/blogs/Bursa_Master/200169.jsp