Why we should put this counter into our radar on the coming week:

1) TA

A few indicators showing this counter in rebound and bullish trend:

- MACD upper golden cross on 16 days ago and now maintain at the upper level

- RSI 75% and Vol is showing healthy buying interest

- After 1 week of consolidation the price still strongly supported above 54c

- Parabolic indicates buying signal start from 26-Feb

2) FA

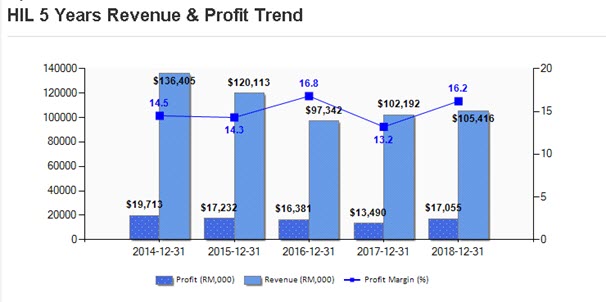

From the above 3 photos enough to tell how strong the FA position of this company. NTA = RM1, PE ~10, Div 3.15%, earning yield >10% and most importantly you can see it is making profit on 5 consecutive years.

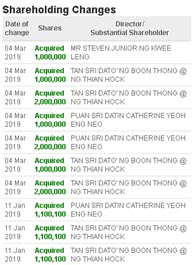

3rd photo shows that director keep buying the company shares in big quantity. In other words it is telling us he is very much confident with the company future.

3) TP 70c set by Mplus Research on 27-Feb-2019

In view of the above data and facts, i believe HIL will easily hit TP1 (60c) and TP2 (70c) in short term.

https://klse.i3investor.com/blogs/hil2019/198193.jsp