Success is principally involved in manufacturing of transformers and lighting fixtures. It is a decent company with reasonable profit track record.

I bumped into it recently while scanning for undervalued stocks.

The reasons for buying :-

(a) the stock is currently trading at multi-year low;

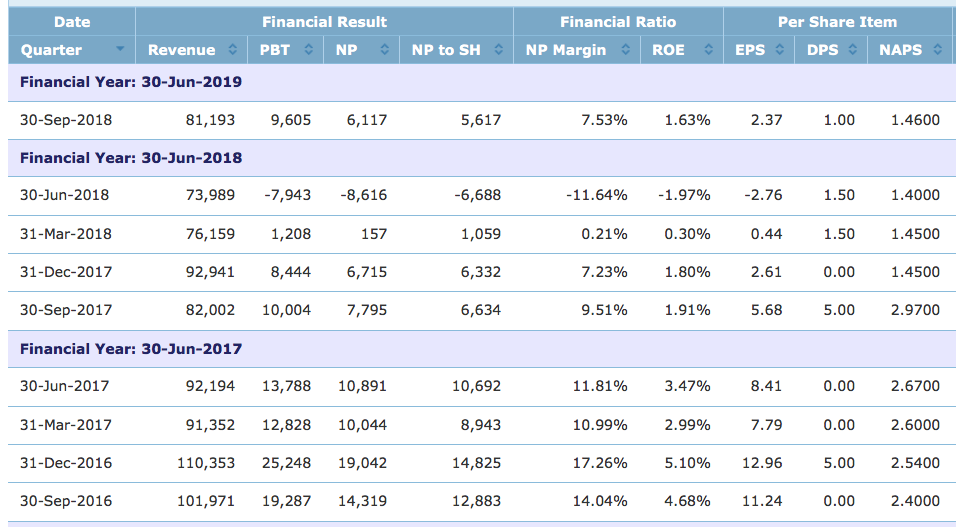

(b) reported EPS of 2.37 sen in September 2018 quarter. Based on annualised EPS of 9.5 sen and 55 sen market price, prospective PER is 5.8 times;

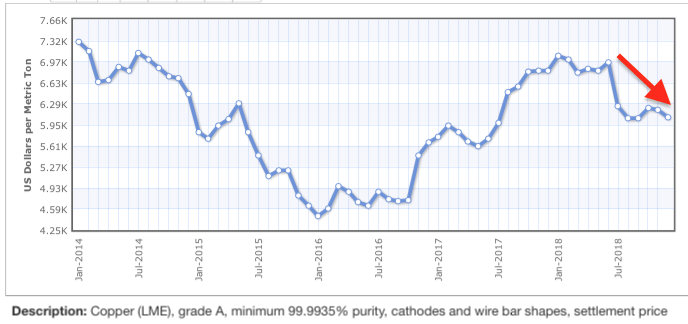

(c) copper price has declined by 15% since mid 2018. Success uses copper for its transformers;

(d) Strong balance sheets. Based on shareholders' funds of RM315 mil, borrowings of RM56 mil, cash and equivalent of RM50 mil, net borrowing and net gearing is RM6 mil and 2% respectively only.

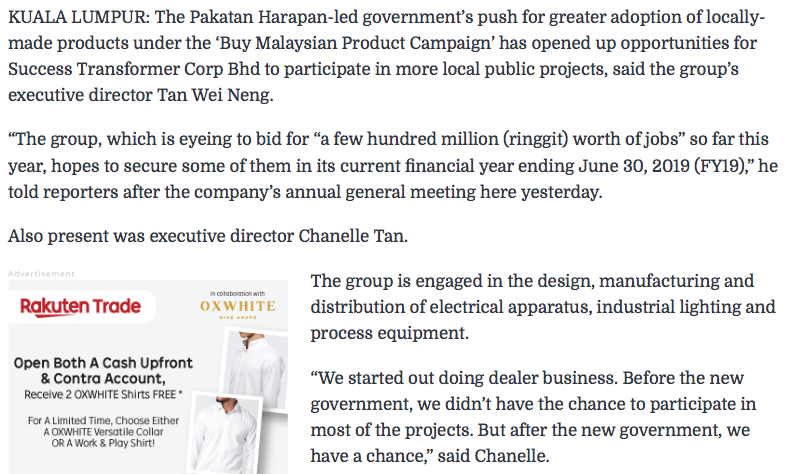

(e) Positive guidance by management recently. Please refer to article below.

Take a look. Don't worry, I won't pump and dump you.

Have a prosperous Chinese New Year !!!

https://klse.i3investor.com/blogs/icon8888/192265.jsp