LAST year was a black spot for global financial markets that experienced a big hit.

In Malaysia, the FBM KLCI was down 5.91% but does that mean that local stocks are not worth a look?

On the contrary, the slide in prices has made stock-picking more

appealing. In some cases, for the short-term, but in most cases, for the

longer-term.

The depressed prices are giving investors opportunities to start

scouting around and maybe start nibbling at certain counters that are

seeing some real value emerging.

In this regard, StarBizWeek has chosen 10 counters for investors to look at.

The stocks are picks by fund managers and journalists that track corporate companies listed on Bursa Malaysia.

FUND MANAGERS’ PICKS

FRANCIS ENG

Chief investment officer

UOB Asset Management (M) Bhd

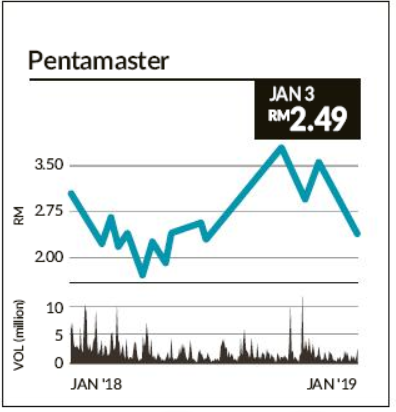

PENTAMASTER CORP BHD

Market capitalisation: RM747.1mil

Fifty-two-week high: RM3.79

Fifty-two-week low: RM1.70

PENTAMASTER is an automated testing, automation manufacturing and

technology solutions provider. The company’s main customers are in the

telecommunications, automotive, semiconductor, consumer electronics and

medical devices industry. Pentamaster employs over 350 engineers and is

based in Penang.

We believe that Pentamaster can sustain its earnings momentum going

forward, underpinned by a few key factors. Firstly, we expect demand for

Pentamaster’s testing solutions to be driven by increasing volume of

smart sensors and 3D sensing technology in smartphones.

Secondly, Pentamaster’s continuous diversification efforts and

expansion into new segments, particularly the automotive and medical

industries, are starting to yield results. Demand from the automotive

and medical sectors tends to be relatively more stable compared with

semiconductors, which can be cyclical. There are growth prospects for

Pentamaster in the automotive sector, especially in electric vehicles.

Thirdly, Pentamaster has developed in-house automation systems which

have capabilities in automating manufacturing processes. We believe that

there is strong growth potential for such systems as more manufacturing

companies embrace Industry 4.0.

Pentamaster is poised to capture opportunities as its capacity has

almost tripled with the completion of a new plant in Batu Kawan in

mid-2018.

Additionally, Pentamaster could be a beneficiary of the US-China trade

war if multinational manufacturers who shift their production from China

to Malaysia were to source their test equipment from local suppliers.

Valuation-wise, Pentamaster is trading at a price earnings ratio (PER)

of 10 times in financial year 2019, which is at a discount to its

equipment maker peers which are trading at more than 20 times the PER.

The company has a strong balance sheet with net cash equivalent to 30%

of its market cap.

VINCENT LAU

Vice-president of research

Rakuten Trade Sdn Bhd

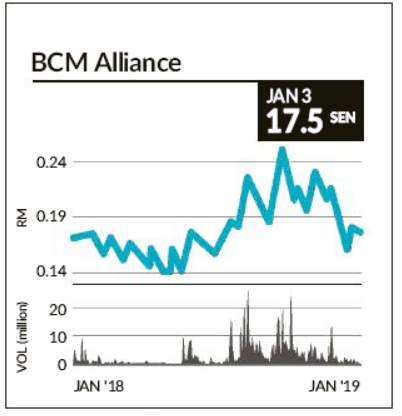

BCM ALLIANCE BHD

Market capitalisation: RM73.72mil

Fifty-two-week high: 25 sen

Fifty-two-week low: 14 sen

MEDICAL devices and laundry company BCM Alliance is at its inflection point in 2019.

Its share price has been langushing since its initial public offering (IPO) in 2016, where it was listed at 19 sen.

Things are set to change from a combination of a jump in its existing

healthcare business, mergers and acquisitions as well as overseas

expansion that will see BCM becoming a more serious medical devices

player.

Fundamentals-wise, BCM is trading at a historical PER of 10 times.

Coupled with a net cash position of RM11.7mil, the company is primed to

capitalise on opportunities that come its way.

It also had an order book of RM42.3mil as at Oct 31, 2018. At its

current price of 18 sen, the stock is trading below its IPO price, and

only has a market capitalisation of RM71.61mil.

BCM is in the business of selling medical equipment and devices, and

providing commercial laundry services. The medical devices business is

now seeing traction, thanks to healthy orders from the KPJ Group of

Hospitals and Columbia Asia.

The company is anticipating the replacement of several medical imaging

equipment by its major clients this year. Anecdotally, it has already

received these orders, with delivery expected before the first-half of

2019.

At the same time, BCM is also looking to expand its existing portfolio

of products and brands. For example, BCM was appointed as a distributor

of Siemens Healthineers’ range of cardiac angiography system and

fluoroscopy system last February. Meanwhile, BCM also acquired a 51.03%

stake in healthcare company Cypress Medic Sdn Bhd in January 2018 for

RM1.72mil cash. This came with a profit guarantee of RM600,000 in the

first year.

As Cypress is in its rapid stage of growth, BCM could be looking to buy the remaining portion of Cypress it does not own.

These have yet to take into account the total healthcare industry

spending in Malaysia, which is expected to reach RM80bil by 2020 from

RM52bil at end-2017.

For 2019, the government is allocating about RM29bil for the Health

Ministry, an increase of 7.8% compared with the previous year.

Out of this, RM10.8bil will be allocated to restoring clinics and

hospitals as well as purchasing medical equipment and medicine. This

will directly benefit BCM.

MOHD REDZA ABDUL RAHMAN

Head of research

MIDF Research

AIRASIA GROUP BHD

Market capitalisation: RM9.76bil

Fifty-two-week high: RM3.85

Fifty-two-week low: RM2.07

IN spite of the unfavourable fuel price movement, AirAsia Group Bhd

(AAGB) managed to rake in a nine-month financial year 2018 (9M18) core

net profit of RM805.8mil.

While its earnings saw a 33% decline in 9M18, its short-haul business

model proved to be defensive, with the earnings before interest and tax

(Ebit) margin standing close to 20% during the period.

Tracing back to the third quarter of financial year 2015 (3Q15), the

quarter experienced a net loss after tax of RM405.7mil before recording a

net profit of RM554.1mil in 4Q15. The main reason for the recovery was

the 12.9% decline in the average Brent crude oil price in 4Q15; from

US$51.29 per barrel to US$44.59 per barrel.

For 4Q18, the Brent crude oil price had dropped by almost 40% to hover

around US$50 per barrel to US$55 per barrel in the recent weeks, in

contrast to the 7.4% rise in 3Q18.

We believe that jet fuel prices will follow suit and that AAGB will be

able to take advantage by hedging more in the declining trend in oil

prices.

While the company added 27 planes last year, which translated to a

13.3% increase in the ASK (available seat kilometers), its load factor

remained resilient at an average of 85%.

As such, we expect AAGB to be able to reap the benefit in FY19. We

opine that this hedging policy will provide a shield to the volatility

of oil prices next year.

Furthermore, according to Malaysia Airports Holdings Bhd (MAHB),

passenger growth at its locally operated airport for the 11 months of

2018 saw a 2.2% growth to 89.4 million, and is on track to cross the

psychological 100-million mark this year (2017: 96.5 million). On the

other hand, despite the current tiff between AAGB and MAHB on passenger

service charges, we believe that the government will formulate an

amicable solution for both parties.

We maintain our “buy” call on AAGB, with a target price of RM3.48 per share.

WRITERS’ PICKS

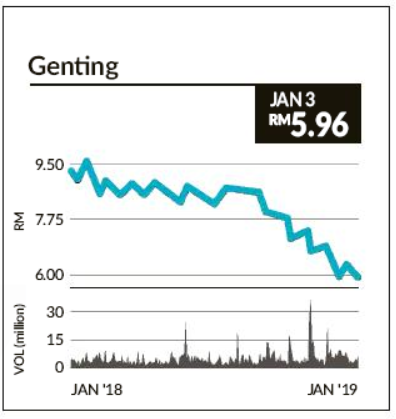

GENTING BHD

Market capitalisation: RM22.83bil

Fifty-two-week high: RM9.58

Fifty-two-week low: RM5.93

GENTING Bhd was one of the first companies to track how much investors

from the initial public offering had made. The message from conveying

such information to investors was just how well off they would have been

if they had held on to the original shares from the listing.

The growth of Genting has been splendid up to recently when the stock

took a beating from a sequence of bad news that affected the companies

it owns. From subsidiary Genting Malaysia being hit after 20th Century

Fox World pulled out from the outdoor theme park to higher gaming taxes.

Wynn Resorts Holdings LLC filed a lawsuit against Resorts World Las

Vegas for allegedly having a similar architectural design. The stock has

fallen to its lowest level since June 2010.

The decline in Genting’s share price has been somewhat of a surprise,

but given its blue-chip status, the odds of Genting’s shares picking up

from the current price of RM5.93 a share from RM9.57 is higher than it

falling by the same degree.

The reason why Genting is a stock to look at is the diversity of its

business. As a conglomerate, Genting Malaysia’s contribution to

Genting’s earnings before interest, taxes, depreciation and amortisation

(Ebitda) is about 34%, according to CGSCIMB. Genting Singapore accounts

for 45% of Genting’s Ebitda and its power division 5%.

The other reason is the cash that the group holds. At the end of

September last year, Genting had RM31.3bil in cash. Its long-term

borrowings stand at RM26.7bil, but this is a company that generated

close to RM5bil in operating cashflow for the three quarters of last

year, giving it significant heft in using its financial strength in the

future.

Furthermore, and notwithstanding its legal problems, it is going to

open its casino in Las Vegas next year and whatever current problems it

has do not detract from the current operations of the group that still

remains solid. These problems will be fixed in time and the solidity of

its operations have not been impaired significantly. — By JAGDEV SINGH

SIDHU

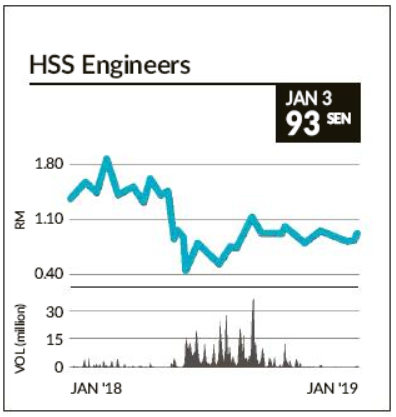

HSS ENGINEERS BHD

Market capitalisation: RM446.28mil

Fifty-two-week high: RM1.91

Fifty-two-week low: 44.5 sen

ENGINEERING and project management consultant HSS Engineers has been

one of the more outstanding engineering companies in Malaysia. It has

been delivering growth consistently and has been steadily increasing its

order book. Its share price has also stayed resilient despite the

bearish market over the last three months.

As it is also involved in design, net margins have been in double digits.

Its share price’s ability to weather the stormy season could be due to

its diversification into the water sector, thus making it not just

reliant on the construction sector, which is currently lacklustre.

At 93 sen, the share price is hovering between its 52-week low of 44.5

sen and 52-week high of RM1.91. At this price, it has a PER of some 20

times, with an indicated dividend yield of 2.5%.

Its acquisition of SMHB Engineering Sdn Bhd last year, an engineering

consultancy firm with expertise in the water industry, was an initiative

to expand its business in water infrastructure projects locally and

abroad.

Over and above that, the company is anchored by its order book of

RM588.6mil that will provide earnings visibility for the next two to

three years,

Meanwhile, Budget 2019 has allocated RM690mil for the implementation of

new water-supply projects and reducing non-revenue water (NRW).

AffinHwang Research says the government has allocated RM590mil in 2019

to build more municipal sewerage treatment plants and network systems to

connect households that are still using septic tanks and traditional

systems.

“This is positive for HSS following its acquisition of SMHB

Engineering, which is the largest local engineering consulting firm in

the water and sewerage sectors. The group has also submitted tenders for

water projects in Sabah and Sarawak, as water shortage in these states

remains a concern for the government,” it says.

For its third quarter ended Sept 30, 2018, HSS Engineers saw its net

profit jump more than three-fold to RM9.1mil compared with RM2.8mil a

year ago, with equal contributions from the HSS Group as well as SMHB

Engineering. Its revenue rose 44% to RM53.8mil in the third quarter,

versus RM37.4 million previously.

With 495.9 million shares in issue, the stock has a market capitalisation of RM277.3mil.

HSS executive vice-chairman Tan Sri Kuna Sittampalam is the single

largest shareholder with a 23.3% stake in the company. — By TEE LIN SAY

INARI AMERTRON BHD

Market capitalisation : RM3.9bil

Fifty-two-week high: RM2.48

Fifty-two-week low: RM1.23

THINGS may not be looking too good for the technology sector at the

moment, but opportunities could arise from some companies in the

heavily-battered sector this year.

With its value having fallen by about 50% from its peak, Inari’s shares

are not only offering value, but also look attractive from a

dividend-yield standpoint.

The counter is currently trading at 15.3 times its estimated earnings

for the financial year ending June 30, 2019 (FY19), and 12.7 times the

forecast earnings for FY20. This follows the recent correction of its

share price from the peak of RM2.56 on Aug 9 last year to close at a

20-month low of RM1.27 on Thursday.

The current weakness in Inari’s share price, which is the result of the

recent rout in global technology stocks, appears to give investors an

opportunity to buy on weakness.

Fundamentally, the stock offers a decent dividend yield of about 5.1%

at current levels, and the company boasts a relatively strong balance

sheet that is backed by a net cash position of RM525mil.

A Bloomberg poll of 16 analysts puts the 12-month median target price

for Inari at RM2, based on an average valuation of 23 times the group’s

forward earnings.

This implies an upside of about 57% from Inari’s closing price on Thursday.

Given its expertise in the radio-frequency and optoelectronics

segments, Inari is seen to be in a strong position to gain from the

adoption of 5G connectivity.

In addition, Inari’s recent diversification into laser devices is

expected to bring in new businesses that could further boost the

company’s bottom line.

Inari posted a lower net profit of RM60.2mil for the first quarter

ended Sept 30, 2018, down 12% from RM68.4mil in the corresponding

quarter a year earlier, and its earnings per share fell to 1.91 sen from

2.25 sen previously.

During the period under review, the group’s revenue decreased 12.7% to

RM325.7mil from RM373.1mil in the previous corresponding period. - By

CECILA KOK

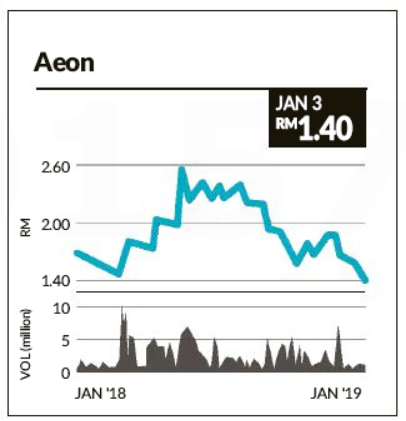

AEON CO (M) BHD

Market capitalisation: RM1.97bil

Fifty-two-week high: RM2.65

Fifty-two-week low: RM1.39

ONE of the reasons for choosing this stock is the fact that it is

currently tradidng at its yearr's low, given that manay stocks have been

battered in the past year amind the weak overall global and local

markets.

There are several other factors though, that make Aeon, a Japanese

company which operates the Aeon malls nationwide, relatively compelling.

Its coming fourth-quarter results for one, should be stronger than its previous quarters.

This is theoritically the case, given the massive year-end promotions

and festivities which tend to boost consumer spending at malls.

Aeon is also likely to be one of the direct beneficiaries of the goods

and services tax refunds totalling close to Rm20bil that is expected to

kick-in this year.

Recall, the refunds are a result of the previous government's failure

to reimburse more than 120,000 companies and individuals.

Consumer firms including Aeon are expected to get a boost from these refunds.

Aeon is also likely to gain from the removal of losses from its

associates, whereby divestments were completed last year amid a

mall-rationalisation strategy.

Then, there is the "defensice theme" that consumer stocks tend to be

known for, which bodes well for Aeon mind the current market volatility,

nevermind that it was not spared from the recent sell-down.

To be sure, the recent selldown of stocks has caused the FBM Small Cap

index, of which Aeon is a part of, to trade at about eight times

forward price to earnings. This is below its historical average of more

than 10 times, suggesting that it could be time to bottom-fish for small

caps.

The largest risk to Aeon is when consumers hold back purchases, preferring to hoard cash amind the challenging times.

At its current prices of RM1.40, the stock has a dividend yield of about 2.9%.

The company, which also generates income from property rental,

reported slightly higher numbers for its third quarter ended Sept 30,

making a net profit of RM12.01mil for the same period a year earlier.

Revenue for the period was over RM1bil compared with RM961.4mil a year ago. - By YVONNE TAN.

SUPERCOMNET TECHNOLOGIES BHD

Market capitalisation: RM353.7mil

Fifty-two-week high: 73 sen

Fifty-two-week low: 29 sen

IT is the little-known ones that hold the biggest surprises. In the

Malaysian equity universe, Supercomnet Technologies (Scomnet) is one

such example.

The Ace Market-listed company makes polyvinyl chloride (PVC) compound

as well as high-tech wires and cables for the information technology,

telecommunications and automotive sectors locally and globally.

Post-14th general election to Nov 30, 2018, Scomnet was Bursa

Malaysia’s second-biggest gainer, rising by over 104% even as the

broader stock market was down.

The stock’s uptrend last year was well supported by its strong earnings

delivery, led primarily by its subsidiary, Supercomal Medical Products

Sdn Bhd (SMP), which was acquired in April 2018. SMP sells medical

cables – approved by the Food and Drug Administration of the United

States – and disposal pressure transducers, a device used in the medical

devices sector.

Scomnet’s net profit in the first nine months of financial year 2018

surged 4.5 times to RM10.15mil, given the stronger revenue contribution

from SMP. As at Sept 30, 2018, its gross profit margin was 24.87%,

substantially higher than 4.55% a year earlier.

Scomnet is likely to maintain its earnings momentum this year, supported by SMP’s sustained bottom line performance.

SMP has a number of product offerings in the pipeline and expects to

see strong orders this year. Stronger sales by SMP in 2019 will reflect

positively in Scomnet’s earnings.

The continued growth in the technology sector this year, albeit an

expected moderation due to the economic slowdown, will be a key upside

factor for Scomnet.

The company will likely benefit from the sustained demand for high-tech

wires and cables from the information technology, telecommunications

and automotive sectors.

With the management eyeing more export markets, Scomnet could also capture a bigger demand for its products from abroad.

Scomnet was sitting comfortably on a cash pile of RM36.37mil as at Sept

30, 2018, with zero debt on its balance sheet. On a year-onyear

comparison, the company’s net cash position has grown by almost 200%.

In absolute terms, Scomnet’s net cash ranks among the top-100 companies on Bursa Malaysia, at 87th position.

The company’s cash position provides it with ample room to undertake

capital expenditure to build additional production capacity and seek

greater market expansion, without being heavily reliant on borrowings. –

By GANESWARAN KANA

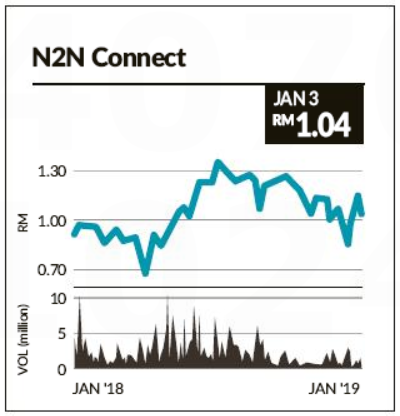

N2N CONNECT BHD

Market capitalisation: RM582.8mil

Fifty-two-week high: RM1.37

Fifty-two-week low: 67 sen

IF the recent interest shown in its stock is anything to go by, N2N Connect is a growth story in the making.

N2N is one of Asia’s largest online trading platform providers with

ambitions to develop an Asian Trading Hub, comprising of key South-East

Asian markets, Hong Kong and Macau.

The hub, upon completion, could be a game-changer for the group, as it

would allow brokers and other investors to trade in multiple asset

classes across various exchanges via a single financial network.

This would serve as a complementary business for the ACE Market-listed

company, which has its core business in its back office system (BOS)

offerings for brokerages.

In line with these ambitions, some new investors were seen entering the

group. Over the past six months, SBI Holdings and a subsidiary acquired

stakes in the company, creating new opportunities for N2N to expedite

its plans.

SBI Holdings Inc and SBI Japannext Co Ltd now own 19.9% and 11.65% direct stakes in N2N, respectively.

According to Japannext’s website, SBI Holdings has a 48.8% equity

interest in the subsidiary, giving SBI an indirect interest in N2N.

One of the linchpins of the strategic tie-up is the leveraging of SBI’s

blockchain technology to digitise the trading of financial instruments.

According to a June 28 report by AmInvestment, N2N’s management has

indicated that deployment of the blockchain-enabled platform could begin

as early as 2019.

In the same report, the research house believes a Main Market transfer

is “in the cards” for N2N given its profit track record, which should

enhance the stock’s visibility.

The group’s US$20.6mil purchase of Hong Kong trading solutions provider AFE has boosted its bottom line.

The consolidation of AFE’s earnings saw N2N’s net profit jump to

RM25.13mil in FY17 from RM11.75mil in the previous financial year.

Revenue more than doubled to RM97.29mil from RM41.82mil in FY16.

As at Sept 30, 2018, N2N was sitting in a strong cash position of RM123.76mil.

For the nine months ended Sept 30, 2018, however, the company saw

disappointing earnings, as it recorded a net profit of RM10.29mil

compared with RM18.66mil in the previous corresponding period due to

tax-related matters.

Despite the setback, the stock value has grown about 13.5% over 12 months as of Jan 3, 2019. — By FONG MIN YUAN

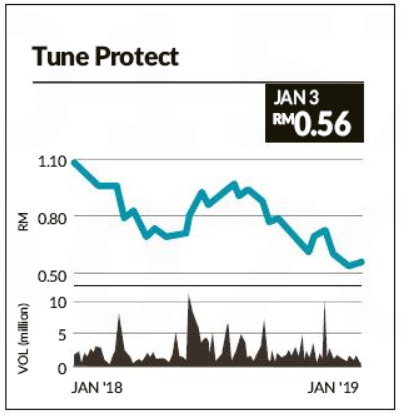

TUNE PROTECT GROUP BHD

Market capitalisation: RM421mil

Fifty-two-week high: RM1.08

Fifty-two-week low: 53 sen

TRADING near its five-year low, this insurance stock appears poised to ride on AirAsia group’s continued growth prospects.

Tune Protect is majority owned by Tan Sri Tony Fernandes’ Tune Group,

which is also the controlling shareholder of AirAsia Group Bhd and

AirAsia X Bhd (AAX).

It was recently reported that AirAsia targets to fly 100 million passengers in 2019.

This week, in a series of posts on Twitter, Fernandes said this year

would be its long-haul, low-cost carrier AAX’s most successful year.

He also described the next decade as “super exciting.”

Tune Protect has strong support from Tune Group, which also owns Tune Hotels, and strategic alliances with AirAsia.

AirAsia passengers remain the main driver of the insurer’s top-line

earnings, but at the same time, it is making good progress in growing

its non-AirAsia segment.

In the first nine months of 2018, the airline group carried 61.4

million passengers across its network. The target set for 2018 was 90

million passengers,

Generally, long-haul passengers flown by AAX have a higher tendency of purchasing travel insurance plans.

In the past year, Tune Protect’s shares have fallen by close to half to

56 sen, giving it a market capitalisation of RM421mil as at press time.

At this level, the stock is trading at an attractive forward price

earnings multiple of 6.8 times based on consensus earnings for FY19. It

is also trading below its book value of 69 sen.

CGSCIMB projects a strong earnings growth for Tune Protect of 15%-16%

in FY19-FY20, underpinned by the gradual recovery of its travel

insurance business and expected strong growth in general insurance. The

research house has upgraded the stock to a “buy” and pointed out that

its dividend yield is enticing at a projected 6.7% based on FY19

forecast earnings.

To be sure, Tune Protect posted earnings and cash flows below analyst expectations for its third quarter ended Sept 30, 2018.

It also recently undertook a voluntary separation scheme.

Going forward, its key strategic thrusts are on growing revenue and improving its digital business.

MIDF notes that the stock has been oversold and reckons the insurance

outfit is currently fine-tuning its model to fit future demand.

The stock slipped to a one-year low of 53 sen about two weeks ago. — By GURMEET KAUR

https://www.thestar.com.my/business/business-news/2019/01/05/stock-picks-for-2019/