Interesting conversation going on in the QL i3 forum (10154899906070843, Ricky Yeo, Jon Choivo, and many others) on whether QL is overvalue or not.

It is a most illuminating conversation about the use of PE to judge the value of a company versus the fundamental study of the company business, especially with the introduction of Family Mart (FM).

I did make a comment in the same forum when FM was announced; this is what I said back in 2016:

teoct From a business point of view, the FamilyMart should be complementary to current business. That is, it is additional outlets for QL's products. Secondly on logistic, QL already is a master as they are distributing their product to the many supermarkets, etc around the country. So maybe with the convenience store, the current distributing fleet maybe better utilize, thus lowering overall operating cost.

With adoption of IT (which I am sure they will, especially FamilyMart system), the inventory holding cost should be low and there should be minimal dead products.

Management of pilferage and cash flow should be the key focus and this could easily add to the overall margin.

Yes, return for this investment will only become visible in 5 to 10 years. Some figures:

Propose 300 stores in 5 years, each cost 250k, investment of 75 million.

Each store expected to have revenue of 800k, i.e. overall revenue of 240 million.

Say, margin of 5% only, give profit of 12 million, that is 16% return on investment, not bad.

Yes, this is a simple back of the envelop calculation, but think, out of the 240 million revenue, maybe about 40% (i.e. 96 million) of this goes directly back to QL for eggs, fish products, etc. This is about 3% of overall QL revenue. Now, when they hit 1000 stores, that would contribute about 320 million, no small change this.

Of course, one could argue that this may cannibalize it's traditional market, a bit yes. The targeted market is different from traditional supermarkets. Execution risk is there.

My family hold QL shares and will continue to hold.

14/04/2016 09:51

Now, two years later and with QL trading at PE of 50, surely it is overvalue said some, no said others, it is growing and there is more to come. What / which exactly is it.

Like the saying goes, a picture paints a thousand words, as most readers know, I like graphs / charts.

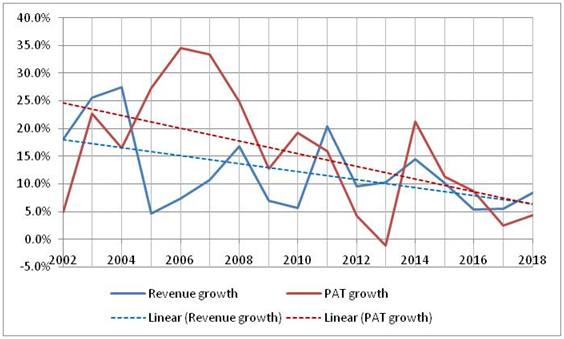

As one can see, the Revenue growth rate and the Profit after tax (PAT) growth rate have both come down and I think approaching a terminal value of about 5%.

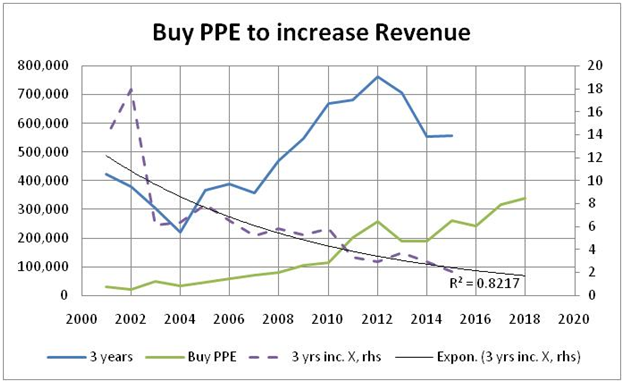

Yes, QL has been “investing” in properties, plant and equipment (PPE). My data goes back to 2001.

Here is shown the gain in revenue on invested PPE three years before, that is, I have shifted the 3 years (blue) line so that one can have a feel for the “benefit” invested three years ago. Example, in year 2015, QL invested 262m in PPE and this shows up as a gain in Revenue on year 2018 less revenue of 2015 i.e. 3,263m-2,708m=555m. Again, the return on the investment is reducing and an exponential trend gives the best fit. Going forward, the return from future investment would give lower return (<2 span="">

Obviously, not all the increase in revenue (from 3 years ago) can be attributed to the investment done in PPE. There would be maybe price increases of products sold, etc. But suffice to say, for all purpose and intent, it is sufficient for this thesis, that all increase is due to the investment of PPE.

Why 3 years, there is a lag as it takes about 3 years to build a plant, get equipment in, test and commission the production. Of course, it can be shorter or longer, let’s not split hair here.

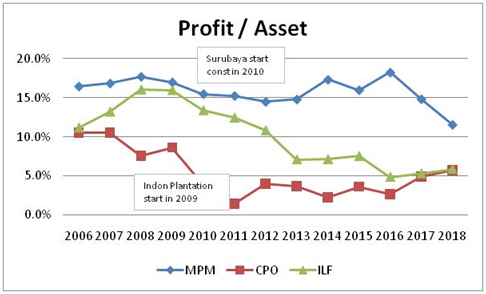

Throwing more money will eventually lead to diminishing return. So have to “invest” on new line that can have potentially higher return than current business lines – MLM, CPO & ILP (terms adopted from QL annual reports). That possibility is Family Mart, a “tender” step with mutual benefit, i.e. buys QL products. There may be other projects (in the pipeline) other than MLM, CPO & ILP as these are all reaching a diminishing return as shown in the next few charts.

The various segments are also approaching a terminal profit margin, maybe 7%.

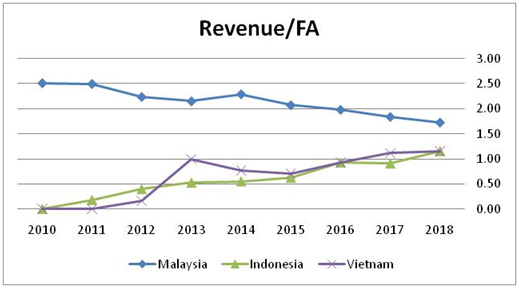

And investment in Vietnam and Indonesia is also reaching a plateau in generating revenue. As can be seen in the chart below, investment in Indonesia and Vietnam is not giving the type of return like in Malaysia - home ground advantages. Nonetheless, it appears to converge at 1.5.

All these data are from QL annual reports.

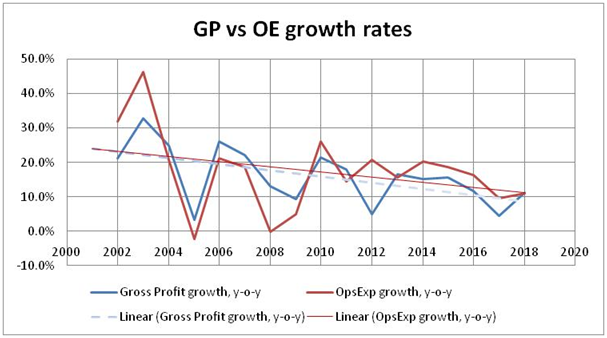

And the gross profit growth rate is slowing as well as the operating expenditure growth rate. However, the operating expenditure growth rate is higher than gross profit growth rate. This means that the PAT will stagnant. This can be seen in the next graph.

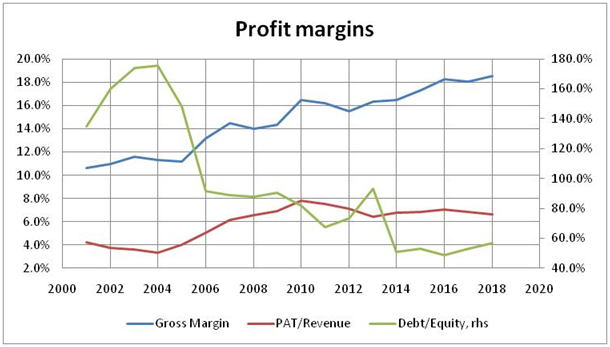

The gross margin is going up while the net margin is stagnating. As one of the contributors said, the operating expense is growing faster than the growing gross profit.

Debt to equity has come down a lot but appear to be increasing slightly in the last 2 years.

Of course, there will be up and down but averaging up, the (revenue, profit margin growth rates) trend is all down.

So is QL worth RM 10.75b (PE50), i.e. PATxPE=215mx50=10.75 billion?

That is earnings (PAT) of 10.75 billion.

PE means price to earnings, and here earnings is PAT.

PAT of 10b, definately not in my lifetime.

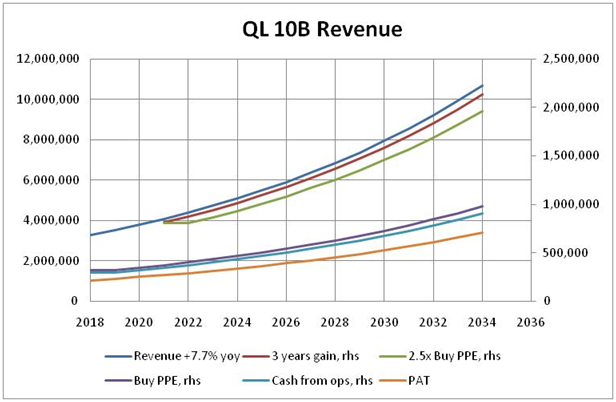

But with the above information, one can extrapolate just to find when REVENUE will hit RM 10.75b.

Yes, there are so many assumptions that this can be shredded immediately, but just for illustration purposes, it will take at least 16 years (give and take a few years) to reach 10.75 billion, REVENUE only. And PAT, well say 6.6%, will give 708 m, not even close to 1b, not to say 10b EARNINGS.

Yes, PAT has grown 3.3x (708/215) in 16 years, a 7.7% CAGR (compounded annual growth rate).

For those technically interested

Cash generated from operation is estimated at 8.5% of revenue and investing PPE is about 1.08 x cash generated. This will mean debt to equity will increase, never mind, let’s assume this is OK. And being very optimistic, the return for every ringgit invested gives 2.5 ringgits three years later.

Only with revenue growing at about 7.7% pa (the red line) matches the 2.5x revenue gain (green line) (OK, close enough). As you can see this will give a circular iteration in EXCEL, but if one manually try with the growth rate of the revenue, the 3 years gain can be estimated.

So is the PER of 50 too high? If yes, then the next step is equally if not more onerous, Sell or Keep?

This is a dilemma, if one sell now, will there be another company with such track record? For more of this, refer to Philip A Fisher “Common Stocks and Uncommon Profits”, Chapter 6: When to Sell – third reason, if one can find a company that can do higher growth rate than QL current estimated 8%, it will be worthwhile to switch.

OK, sell and buy back later, according to Philip A Fisher same book as above, page 236, Stay or Sell in anticipation of possible market downturns. I urge you to read the book as it explains better than I can.

In investing, there is always the emotional aspect, and here lies also the irrational / exuberant Mr. Market.

Both sides have decent points and faced with the above, I am in real dilemma.

Have a good 2019 investing all, PEACE.

E&OE

Disclosure: I and my family own QL shares.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Buy / sell at your own risk.

https://klse.i3investor.com/blogs/teoct_blog/188858.jsp