With a market capitalisation of RM95

million, OpenSys (M) Bhd is a micro-cap company with a still small but

rapidly growing revenue base that is off the radar screen of most

institutional investors. The MSC-status company specialises in providing

cash and non-cash payment processing solutions, including the

distribution and rental of bill payment kiosks, cash recycling machines

(CRM) and cheque deposit machines (CDM) as well as cheque processing

services.

OpenSys was founded in 1995 by two former

employees of the US-listed NCR Corp. Drawing on the duo’s past

relationship with NCR, OpenSys started out with a three-year contract

from the American company to serve its customers in Malaysia. Following

its successful development of non-cash efficient service machines (ESM)

for bank branches in 2001, OpenSys rapidly expanded its client base in

the industry in the following years and was listed on the ACE Market in

2004.

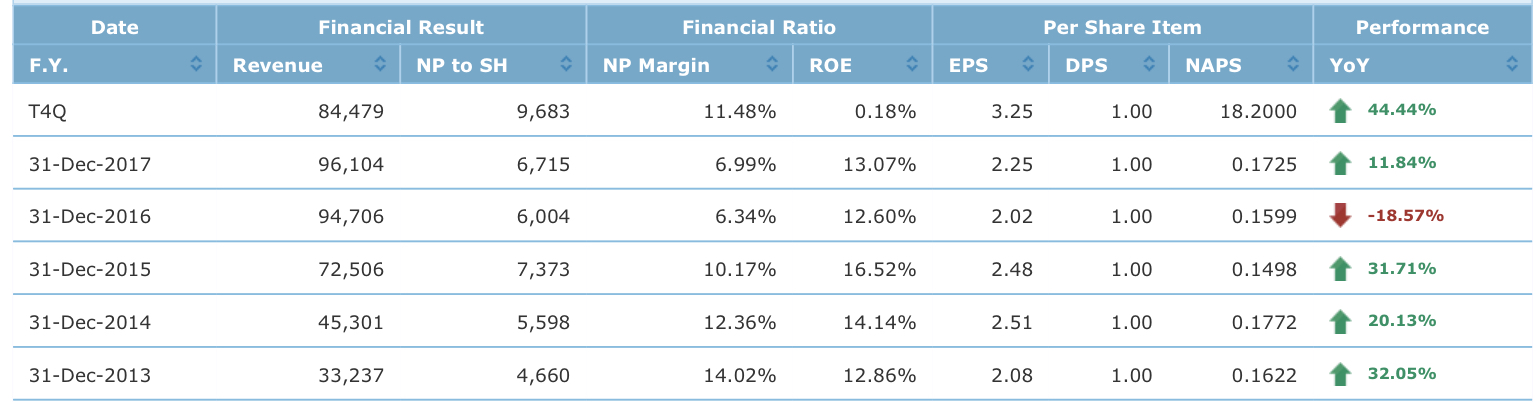

Since then, its net profit has been on a

tear while revenue more than tripled from RM20.3 million to RM72.5

million over 12 years. The better economies of scale, coupled with

improving margins, also helped propel its return on equity (ROE) by an

impressive 16 percentage points to 18.4%.

Today, the company counts among its

clients all major banks in the country, such as Maybank, Public Bank,

Hong Leong Bank and United Overseas Bank, and insurance and

telecommunications companies.

Banking on dual-function machines

Weaker margins notwithstanding, the

hardware segment has now overtaken the software and services business as

the larger revenue contributor, bringing in 60% of total sales in

FY2017. This was mostly due to the continued market acceptance of its

CRM and it is not hard to see why this trend is catching on in the

banking industry.

Combining cash-dispensing and cash

deposit ATMs into dual-function machines, CRM help banks to save up to

25% to 30% in capital expenditure and operating cost in cash

maintenance, cash handling and space rental. Besides higher cost

efficiency, CRM also have lower downtimes compared with the traditional

single-function ATMs due to the automatic recycling of cash in the

machines.

At the company’s extraordinary general

meeting last October, co-founder-cum-CEO Tan Kee Chung — also OpenSys’

largest shareholder with 21.2% equity interest — said he was optimistic

of growth prospects as there was a huge opportunity to expand its market

share.

He added that there were about 17,000

ATMs in Malaysia with an annual growth rate of about 5% while the

penetration rate of CRM stood at a mere 4% of the installed base. “Just

based on replacement alone, that is already a huge market,” he

concluded.

In line with the cash recycling trend

worldwide, OpenSys partnered Japan’s OKI Electric in 2013 to supply and

provide maintenance services for CRMs in Malaysia. In 2014, it secured

orders for several hundred CRM from two major banks in Malaysia worth

over RM20 million.

OpenSys says in its latest annual report

that the other banks in Malaysia have taken notice of the successful

deployment of CRM in the two banks. To maintain their competitiveness,

OpenSys noted that several banks had since expedited their CRM strategy

by commissioning customer trials with OpenSys/OKI in 2015.

With regard to

claims that Bank Negara Malaysia’s various initiatives and long-term

trend to migrate to a cashless society will render its business model

unsustainable, OpenSys countered that cash was still the preferred

payment mode and that the number of currency notes in circulation will

continue to grow.

According to Bank

Negara’s Financial Stability and Payment Systems Report 2015, ATM

transaction volume still grew at a CAGR of 6.7% in the past five years,

albeit much lower than a CAGR of 22.9% for transaction volume carried

via internet banking.

Accounting for 70% of gross profit in

2017, OpenSys’ SSS segment includes the provision of bill payment and

cheque processing solutions. For the former, OpenSys manages the whole

infrastructure (both hardware and software) of bill payment kiosks on

behalf of utility, insurance and telecoms companies in Malaysia. In

return, OpenSys charges a fee for each payment transaction performed,

resulting in steady recurring income for the company.

For cheque processing solutions, OpenSys

is the market leader in cheque-deposit machines and image-based cheque

processing systems in Malaysia, commanding a hefty 85% of the market in

local self-service machines. Commenting on the structural decline in

cheque usage, the company said it would also gain if banks started to

outsource the processing of cheques to third parties. OpenSys already

has a track record in providing cheque-clearing services to the

country’s largest bank in Malaysia.

Cheap valuation

Despite the high growth in earnings,

shares of this low-profile company have been range-bound, trading

between 26 sen and 37.5 sen over the past year. As a result, its

trailing 12-month PE compressed from 19.7 times in 2014 to 15.6 times in

2015 and 13.3 times in 2017 and further to 9.7 times.

Its valuation appears comparatively cheap

compared with its ACE Market-listed peers, such as Rexit Bhd (14.7

times), Microlink Solutions Bhd (N.A. lossmaking), Excel Force MSC Bhd

(31.6 times) and GHL Systems Bhd (54.5 times).

OpenSys has consistently paid a dividend

of one sen per share in the past five years, translating into a decent

yield of 3.1%. Thanks to net profit growth, the dividend payout ratio

had also dropped from 89.7% in 2010 to 44.4% in 2017. Coupled with its

low capex requirements, this gives management plenty of room to increase

dividends in the future.

44.44% Trailing 4Q earnings growth.

(Click to enlarge)

CAGR of close to 40 percent

CRMs

are dual-function machines that merge the cash dispensing functions of

ATMs and the cash deposit functions of CDMs. CRMs accept cash from

depositors and dispense them to withdrawers, so cash is essentially

‘recycled’. Banks are benefitting from the cost- effectiveness of CRMs

in areas of cost of ownership, lower cash holding and reduction in cash

handling cost. Banks can typically save between 25 to 30 percent in both

capital expenditure and annual operational costs.

These

significant savings have been a major driving factor for banks to

undertake major fleet replacement and consolidation, resulting in the

exponential growth of CRMs. In the last five years, the total number of

CRMs in the market has grown exponentially with a Compound Annual Growth

Rate (CAGR) of close to 40 percent.

Source: Annual report

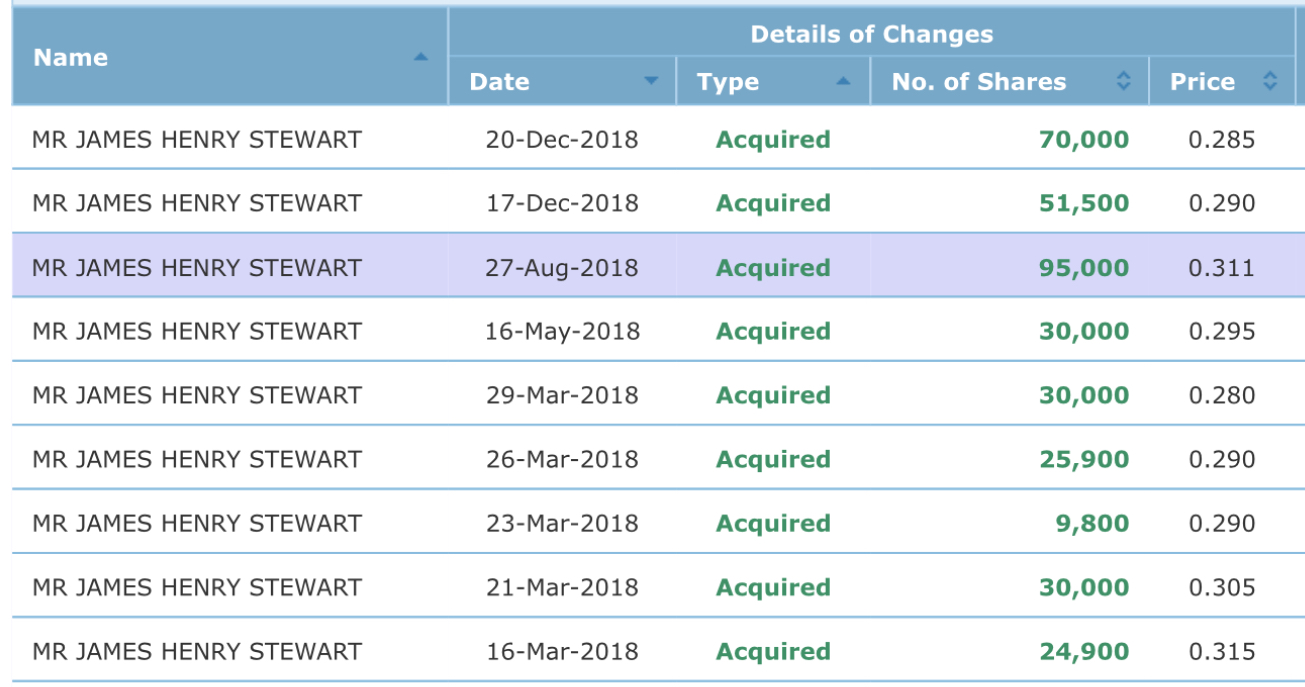

Opensys Chairman accumulating shares in open market.

Source

https://klse.i3investor.com/blogs/Amazinggrowth/191559.jsp