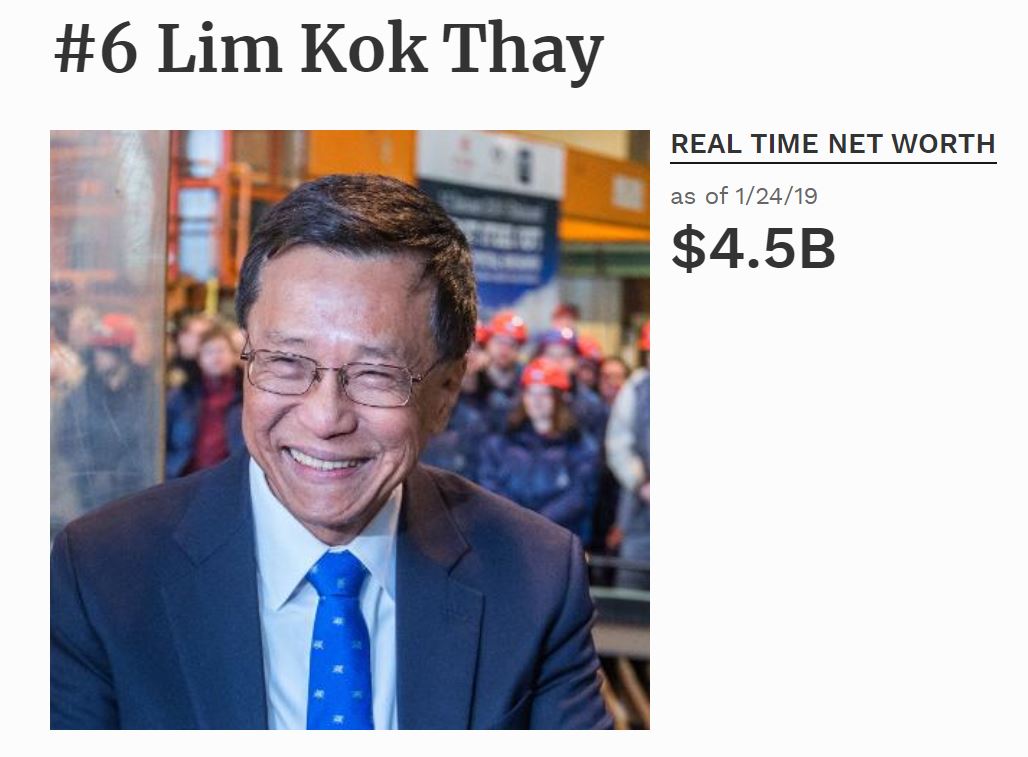

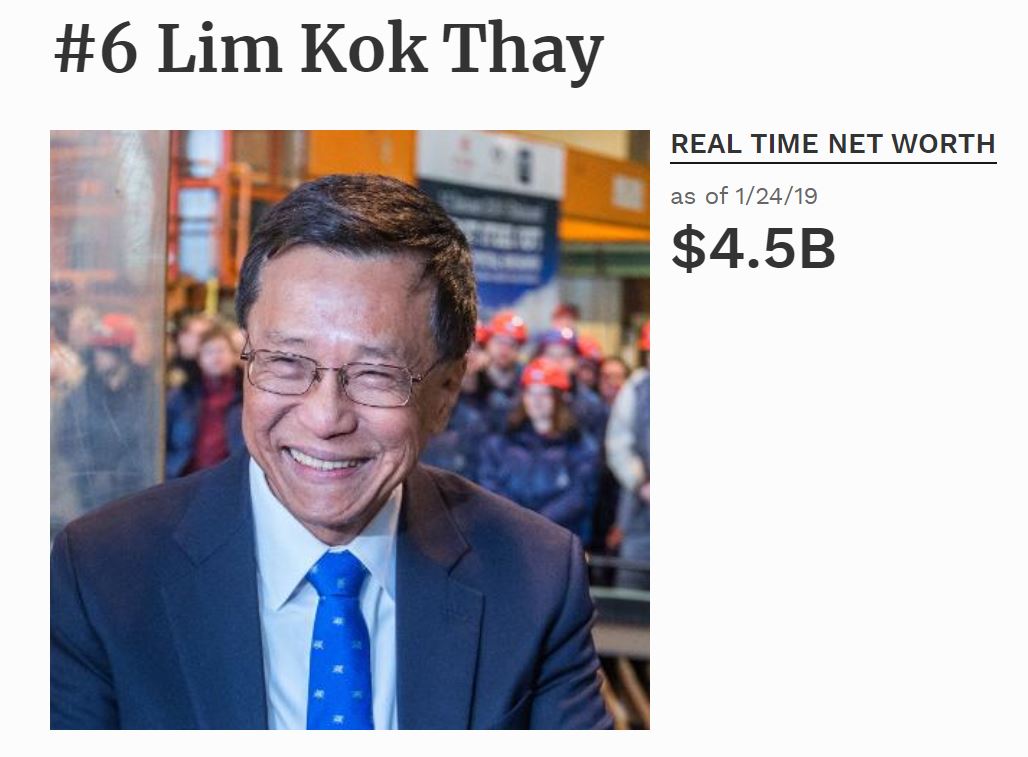

KARAMBUNAI CORP BHD (KBUNAI, 3115) is a listed company control by Ultra Rich Papa - Tan Sri Dr Chen Lip Keong.

Tan Sri Dr Chen Lip Keong is Malaysia 7th richest man with net worth USD4.3 Billion (RM17.8 Billion).

KBUNAI.... KBUNAI.....KBUNAI.....KBUNAI.....KBUNAI......KBUNAI......KBUNAI.......KBUNAI

KBUNAI sharep price closed at 5 years high today. What trigger the buying interest in KBUNAI ? Maybe because KBUNAI got an Ultra Rich Papa !!!

Tan Sri Dr Chen Lip Keong is Malaysia 7th richest man with net worth USD4.3 Billion (RM17.8 Billion).

Tan Sri Dr Chen Lip Keong is Malaysia 7th richest man with net worth USD4.3 Billion (RM17.8 Billion).

Malaysia's Richest 2018: How 'Accidental' Casino Billionaire Chen Lip Keong's Cambodia Bet Paid Off

This story appears in the March 2018 issue of Forbes Asia. Subscribe to Forbes Asia

TWEET THIS

This story is part of Forbes' coverage of Malaysia’s Richest 2018. See the full coverage here.

When

Chen Lip Keong won Cambodia's first casino license in 1994, he had

hardly ever stepped inside a casino. He'd been to Malaysia's Genting

Highlands once on a date in the 1970s and visited Las Vegas once as a

tourist. Casinos are "not in my blood; I'm not a gambler," he says. Yet

today, renowned casino architect Paul Steelman calls Chen "one of the most powerful creators of these properties in the world."

This

self-proclaimed "accidental" gambling billionaire is the chief

executive and majority shareholder of NagaCorp. Its NagaWorld

casino-resort complex in the capital Phnom Penh boasts 1,700 guest

rooms, 600 gaming tables and more than 5,000 gaming machines. Despite

his gambling aversion, he bet $369 million of his own money to build Naga2, an opulent twin-tower extension opened in November that

features nine floors of guest rooms for high rollers with adjoining

private gaming rooms. And soon there'll be a 2,200-seat theater where

Chen is aiming to host the likes of Lady Gaga, a favorite of his. The

addition makes Cambodia and NagaWorld first-rank contenders in Asia's

$51 billion casino market.

Along

the way this native of Malaysia has helped Cambodia recover from

decades of upheaval. The country's gross domestic product has grown by

7.5% a year since 1994, putting it among the world's top performers.

Only 118,163 people visited the country in 1993, according to the

ministry of tourism; that figure topped 5.6 million last year, with 7

million expected by 2020. Tourism accounted for more than 12% of Cambodia's GDP last year -- and Naga has claimed a hand in 25% of it.

Amid

the rising tide of tourists, Naga is booming. Last year net profits

soared 23%, to $255 million, on an 80% jump in revenue, to $956 million.

VIP roll -- or losing bets -- more than doubled, to $21.1 billion,

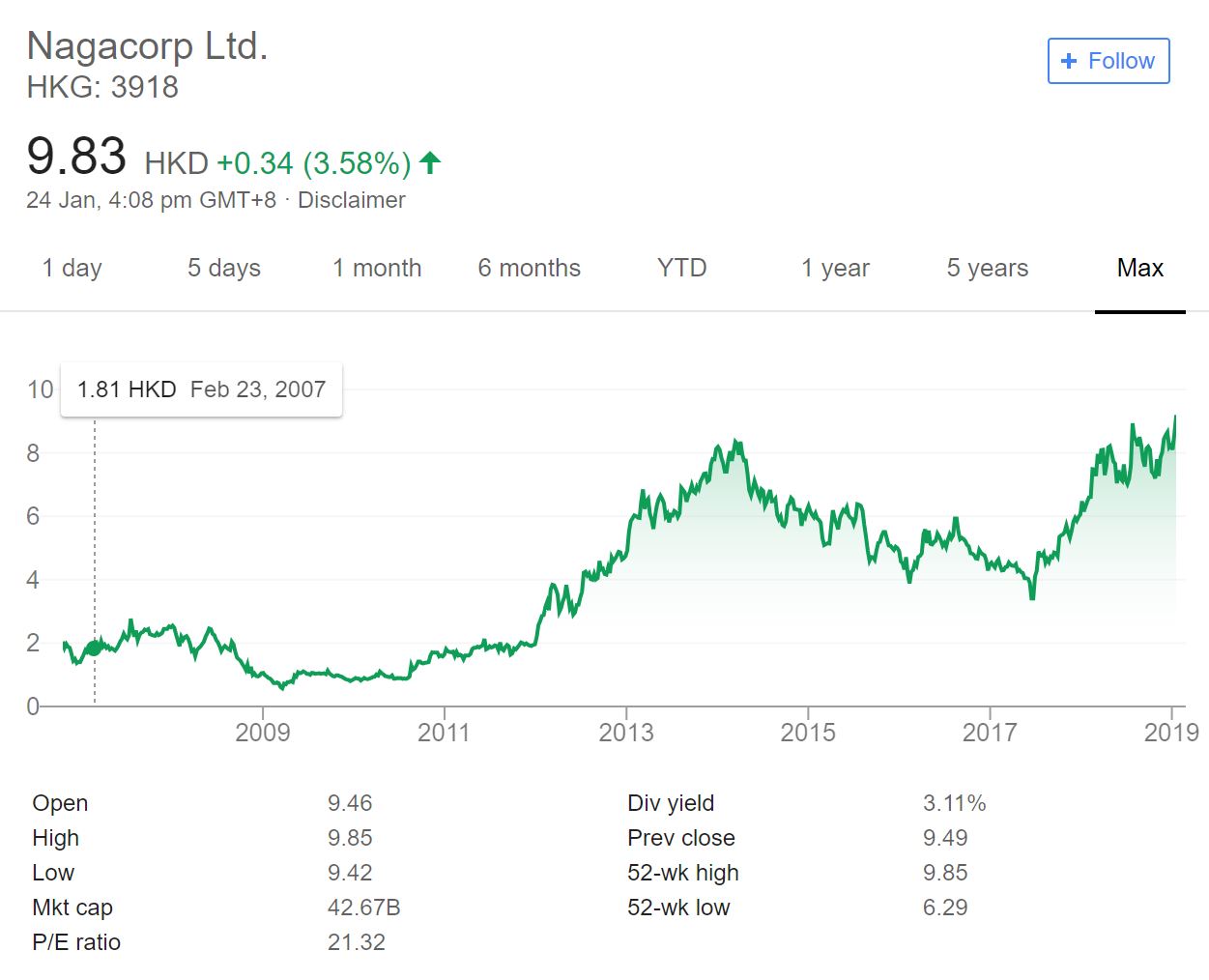

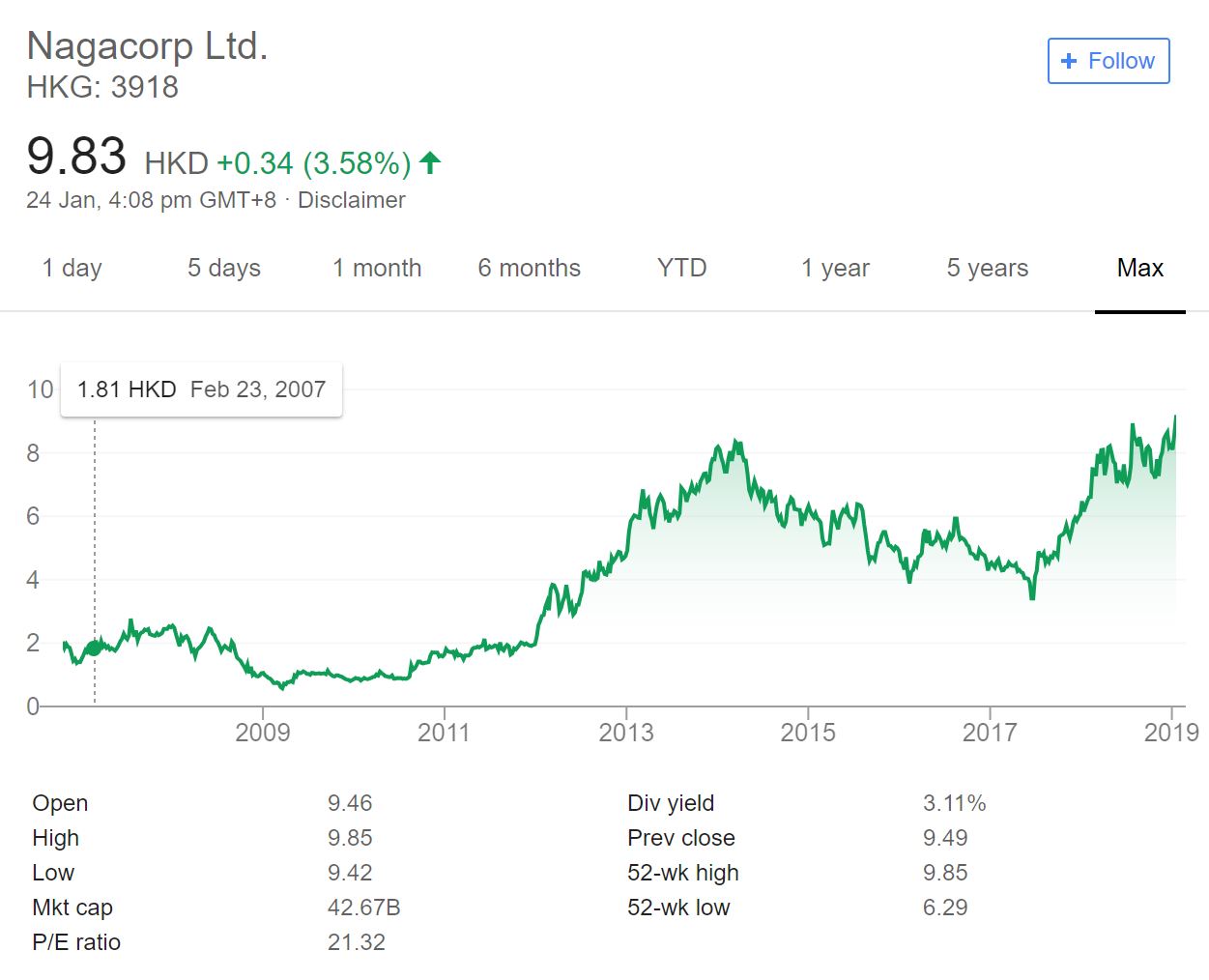

accelerating after the launch of Naga2. NagaCorp's $4 billion market

capitalization represents an 11-fold appreciation since it listed in

Hong Kong in 2006, and it consistently outperforms other gambling

stocks. "We're antigravity," says Chen.

Naga

benefits from Cambodia's low labor costs and Chen's tight controls on

capital expenditures. Naga says it spent $1.5 billion building the

complex that commercial real estate specialist Colliers International

now values at $5.4 billion. And, as he loves pointing out, Naga has no

debt. All this is boosting his fortune -- he's worth $3.3 billion, up

from $1.6 billion a year ago.

Now

70, Chen is casting his net wider. He's building a casino in Russia's

far east, and he's eyeing hotel and casino projects in Australia,

Mongolia and Kazakhstan. Then

there's a Borneo resort that's the keystone of a multibillion-dollar

Malaysian government eco-tourism master plan to be led by his Kuala

Lumpur-listed companies Karambunai and Petaling Tin. "I am in the springtime of my business career," he says.

A chance start

Chen

grew up in the Kinta Valley tin-mining area, a second-generation member

of an immigrant family from China. He trained as a medical doctor at

the University of Malaysia and practiced briefly as a general

practitioner, but felt that his real calling was business. So he decided

to go into property development and for a time also ran an

aviation-parts company, producing components for Malaysia's

government-backed attempt to produce planes.

In

the 1980s, Malaysia Prime Minister Mahathir Mohamad launched his policy

of Prosper Thy Neighbor -- not beggar thy neighbor -- to encourage the

country's predominantly Chinese business community to seek out what Chen

calls "win-win" situations in other Southeast Asian countries. Cambodia

was among the neediest -- Khmer Rouge rule in the late 1970s left an

estimated two million people dead out of a population of eight million.

Vietnamese troops overthrew the communist regime in 1979, but fighting

persisted into the 1990s.

Chen,

now wealthy, arrived in the early 1990s. He saw Cambodia as a place

where he would have to dig for opportunities, "a fish pond without

fish," and planned to explore for oil in the Gulf of Siam. But following

UN-supervised elections in 1993, the new government tendered a casino

license. "It's not the business I chose, I planned or I envisioned," he

says. But he viewed hospitality as a way to combine property development

and a steady cash flow, and his company won the bid. "Gambling is a

means to achieve a certain purpose and that purpose is tourism," he

says.

Naga launched casino operations on a leased barge on the Bassac

River near Phnom Penh's Royal Palace in 1995. In 2000, Naga bought land

near the barge dock and began building NagaWorld, and the casino moved

onshore in 2003. Situated across a boulevard, Naga2 connects to the

original via NagaCity Walk, a 3,800-square-meter underground shopping

mall. "We try not to build monuments: We build jobs and contribute to socioeconomic development," says Chen. "We

have contributed to tourism growth, raised the international investment

profile, attracted FDI [foreign direct investment] and are the biggest

taxpayer in the country."

Win-win situation

Chen, who now spends two thirds of his time in Phnom Penh and most

of the rest in Kuala Lumpur, has certainly found a win-win situation

with the Cambodian government. Naga's casino license is good for 70

years and includes a 40-year monopoly in Phnom Penh and everywhere else

within 200 kilometers. "On the same hill you cannot have two tigers," he

says, quoting a Chinese aphorism. The 70-year term is well beyond

Macau's 20 years, but in many jurisdictions, including Nevada and parts

of Australia, licenses never expire; they're valid as long as licensees

follow the rules and pay their fees.

The favorable conditions extend to taxes. Naga is exempt from

Cambodia's 20% corporate-profits tax, and there's no gaming tax.

Instead, it makes payments to the government that last year amounted to

$8.12 million, only 3.2% of operating profits. The part of that payment

based on gaming rises 12.5% a year but was equivalent to only 0.6% of

gaming revenue last year, a fraction of the gaming taxes levied

elsewhere in the region. Macau charges a 35% gaming tax, and fees can

add several more percentage points. Singapore takes 5% of VIP gaming

revenue and 15% of mass market revenue, plus a 7% sales tax on both.

Naga made additional payments to the government of $9.4 million in 2015

and $16.6 million in 2016 but hasn't announced an additional payment for

2017.

Naga also funds a wide range of corporate social-responsibility

programs. Naga Academy has taught trade skills and languages to

thousands since 2012. The company guarantees jobs for all graduates, in

its own company or elsewhere in hospitality. In addition, Naga created

the Cambodia Sport Award, sponsors a national league football club and

supports athletes training for international competitions. Chen's son,

Chen Yepern, oversees much of this effort, visiting poor areas of Phnom

Penh or provincial villages on weekends with Naga staff, distributing

medicine, awarding scholarships or planting trees.

Being a good corporate citizen may get a Malaysian casino owner only

so far in Cambodia under the authoritarian regime of Prime Minister Hun

Sen, in power since 1985. But Chen isn't worried. "This country means

business," he says. "If you take away Naga's license, FDI would

collapse. Our agreement with the government is highly visible, so taking

away the license to give it to a third party [would scare] overseas

investors. And the country does not want to chase away foreign

investment. The annual budget depends on it."

Chen says Naga has driven Cambodian efforts to enact a

casino-gambling law that will codify and likely increase government

oversight, and potentially raise tax rates. He expects it to be adopted

before the election scheduled for July 29. "NagaCorp's legal casino

license shall be protected by law as soon as the casino law is

promulgated," he says. "This shows that foreign investors shall be

protected."

Working to improve Cambodia's investment climate

The casino law is the latest phase of Naga's 15-year quest to

improve Cambodia's investment climate. The Singapore stock market

rejected NagaCorp for a listing in 2003 because Cambodia lacked

international-standard casino regulations and anti-money-laundering

laws. Chen realized that to advance, Naga would have to raise Cambodia's

game along with its own.

He approached Timothy McNally, a former FBI agent and prosecutor

brimming with Middle American earnestness, to help get NagaCorp ready to

list in Hong Kong. McNally was wrapping up a stint at the Hong Kong

Jockey Club, which handles $25 billion in bets a year. "I came down here

and I truly didn't expect much," he recalls. "The founder's thinking is

certainly what drew me," particularly the focus on improving

regulation. "He wanted to see the development of the country and

development of the company work in parallel. That struck me as something

worthwhile."

McNally, 70, became NagaCorp's chairman in 2005, and the next year

it became the first gambling company listed in Hong Kong and, says Naga,

the first company principally doing business in Cambodia listed

anywhere. Chen says the $105 million initial public offering wasn't

about international capital as much as international standards.

After the Singapore rejection, NagaCorp hired global security

consultant Hill & Associates to audit its anti-money-laundering

efforts. Twice-yearly inspections became one of the conditions for

Naga's Hong Kong listing. "H&A has discovered no significant lapses

or weaknesses on the part of NagaCorp. Incremental improvements and

adjustments that have been advised by H&A have been undertaken

efficiently," the auditor tells Forbes Asia.

Cambodia may be one of the most corrupt and least transparent

countries in the world, but Chen insists on international best practices

at NagaCorp. It follows a 50-page Code of Conduct & Anti-Corruption

manual that helps it abide by local and foreign laws, such as the U.S.

Foreign Corrupt Practices Act. "We are not a bunch of cowboys," he says.

"We believe in the responsibility that has been given to us as an

operator that we preserve the social sanity, the integrity which the

country deserves."

To raise Cambodia's game, the government adopted international

financial standards, signed the global Financial Action Task Force

protocols and joined its Asia Pacific Group to combat money laundering,

as well as passed national financial-crimes statutes, all at Naga's

urging. Though enforcement is spotty, "the company operates as if it

were in a heavily regulated jurisdiction," says Grant Govertsen,

managing director in Macau for boutique investment bank Union Gaming

Group.

Cambodia's reputation made financing Naga2 difficult. McNally says

international bankers offered $175 million, less than half the amount

needed, at 16% interest, four times the then-U.S. prime rate. So Chen

funded construction himself through a convertible-bond arrangement with

the company. The conversion, finalized last August, gives him 65% of

NagaCorp.

Doubling down on China

These days Naga is doubling down on the China market, supplementing

its Southeast Asian base. It's declaring itself "China ready" with more

Mandarin-speaking staff, a lavish Cantonese restaurant in Naga2 and more

deals with Macau's mainland-focused junket promoters. Naga has raised

betting limits at VIP tables through revenue-sharing arrangements with

junkets, spreading the risk.

For the mass market, the source of most of NagaWorld's profits, main

floor baccarat bets start at a pricey $100 for so-called "squeeze

games" in which players can handle their cards themselves. To recruit

this crowd the company engaged state-run China International Travel

Service to market tours to second-tier cities Changsha, Hangzhou, Xi'an

and Qingdao, flying via Naga-affiliate Bassaka Air's three-times-weekly

service. Bassaka also flies daily to Siem Reap, site of the Angkor Wat

complex often included in tour itineraries, and twice weekly to Macau.

CITS subsidiary China Duty-Free Group is NagaCity Walk's anchor tenant.

"With the wave of consumerism in China -- a lot of energy there, and we

are on the doorstep of China -- we can squeeze a lot out of China," says

Chen.

He says he envisions Naga -- a pan-Asian term for dragon --

encircling China with gambling and non-gambling resorts, utilizing its

frontier-market skills honed in Cambodia. It's broken ground for a

casino hotel outside Vladivostok, and at last September's Eastern

Economic Forum, Chen lobbied Russian President Vladimir Putin to "punch

through" a railway to Vladivostok from Harbin in northeastern China, the

casino's target market. There's no word on whether Putin is on board.

Naga has met with government officials about developing hotels in

Mongolia and Kazakhstan. And it's intrigued by the casino-resort license

offered in Australia's far northern Queensland near Cairns, where Chen

envisions a 1,700-kilometer (1,056-mile) rail link from Brisbane. But

closer to home, NagaWorld remains focused on the 650 million people in

Southeast Asia, and executives are already talking about Naga3. Chen may

never have intended to become a casino mogul but NagaCorp's success is

no accident.

KBUNAI sharep price closed at 5 years high today. What trigger the buying interest in KBUNAI ? Maybe because KBUNAI got an Ultra Rich Papa !!!

Tan Sri Dr Chen Lip Keong is Malaysia 7th richest man with net worth USD4.3 Billion (RM17.8 Billion).

https://klse.i3investor.com/blogs/pennystocks/191391.jsp