Company Overview:

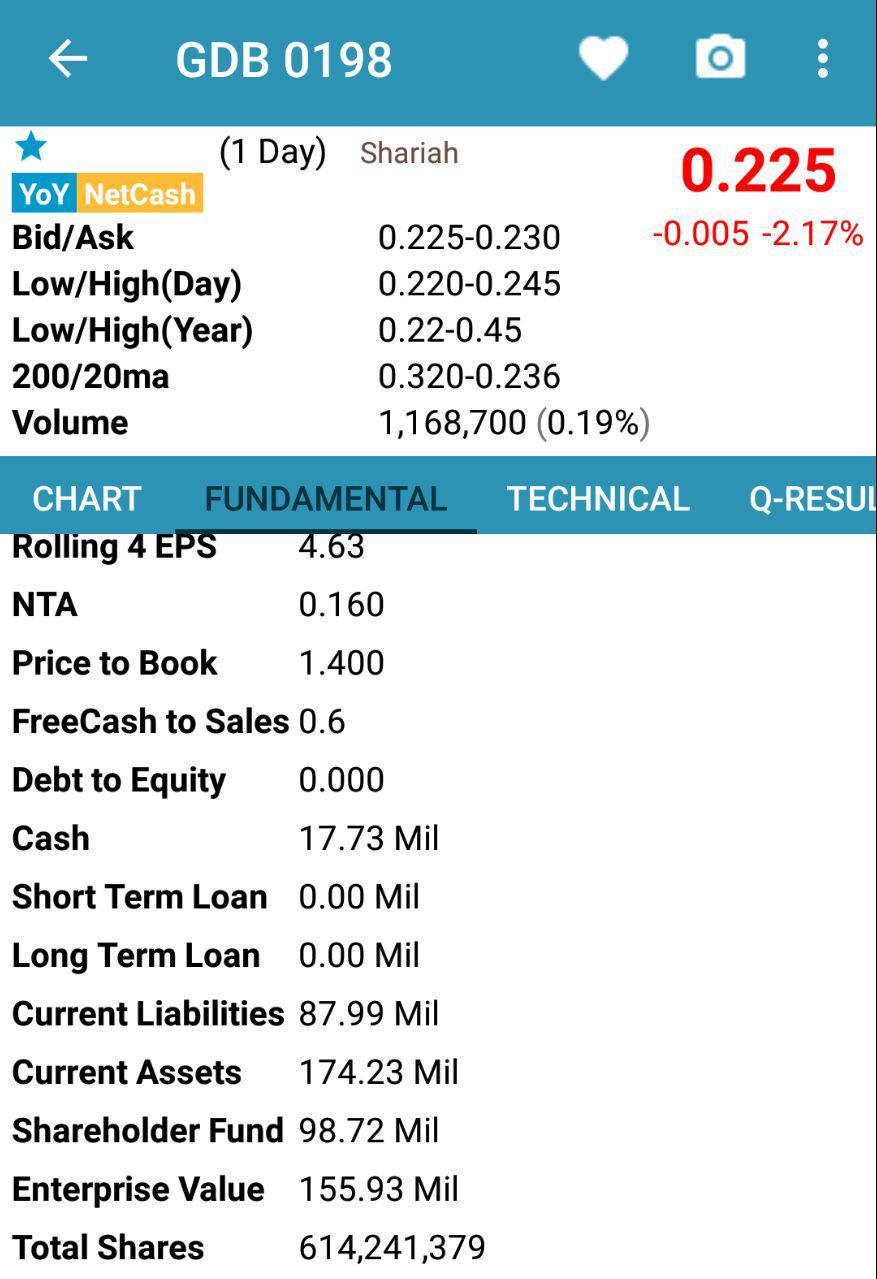

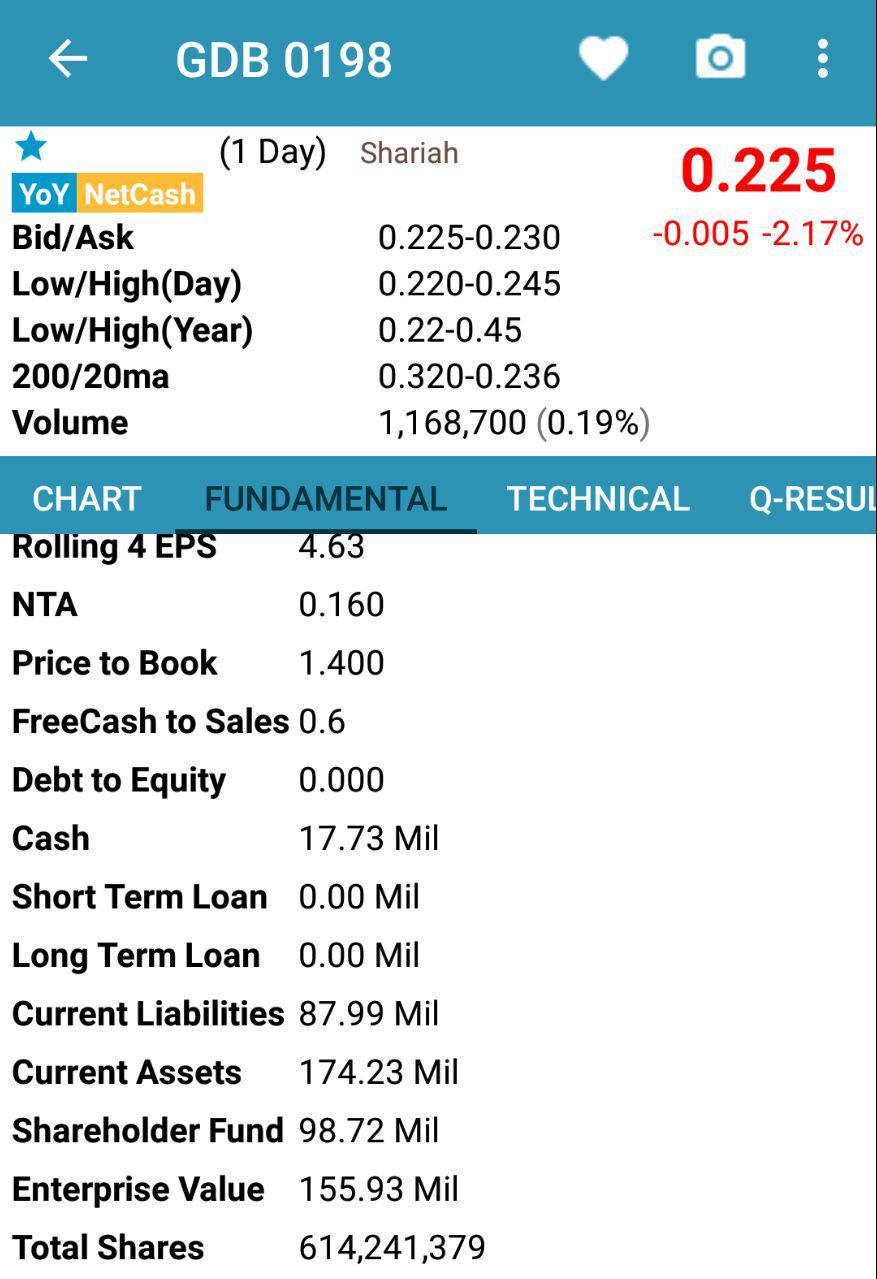

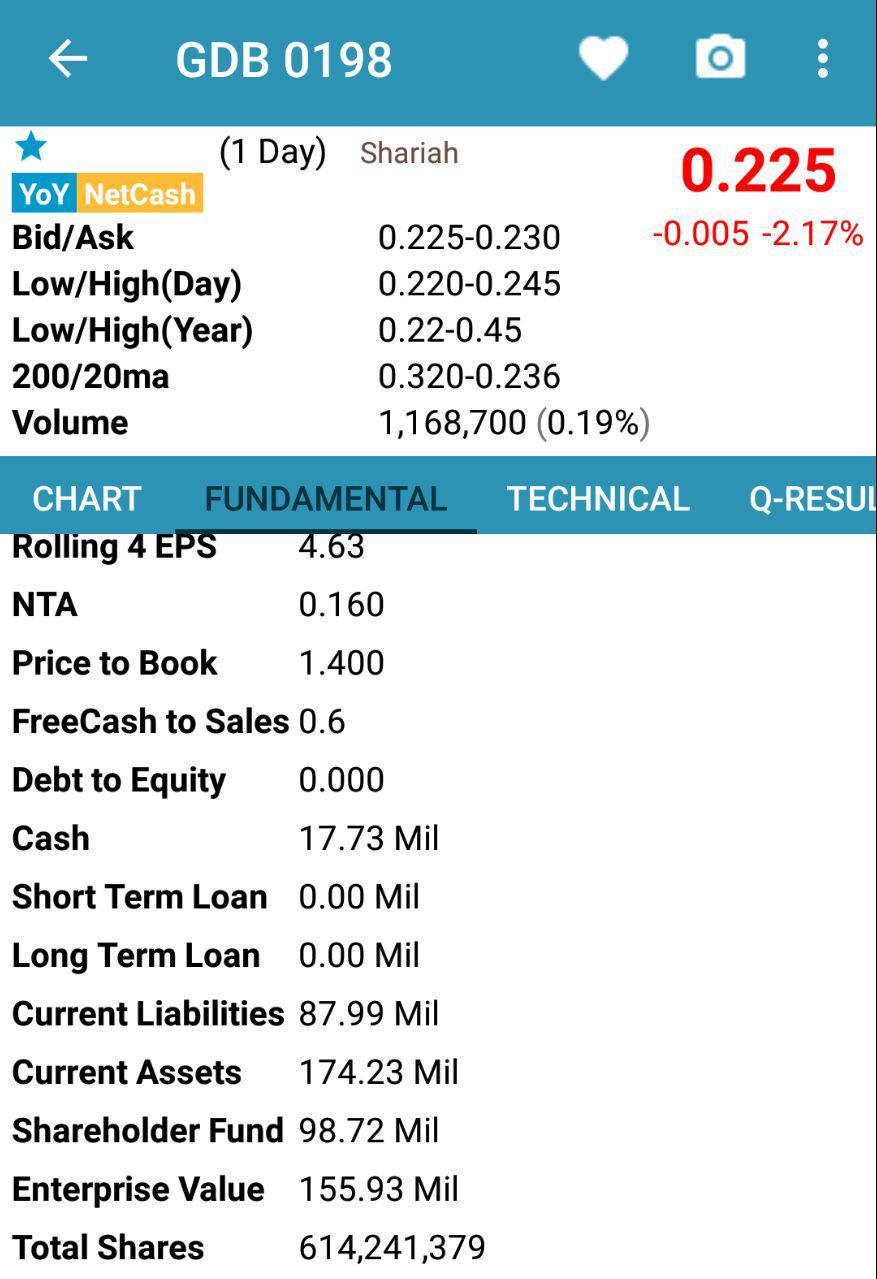

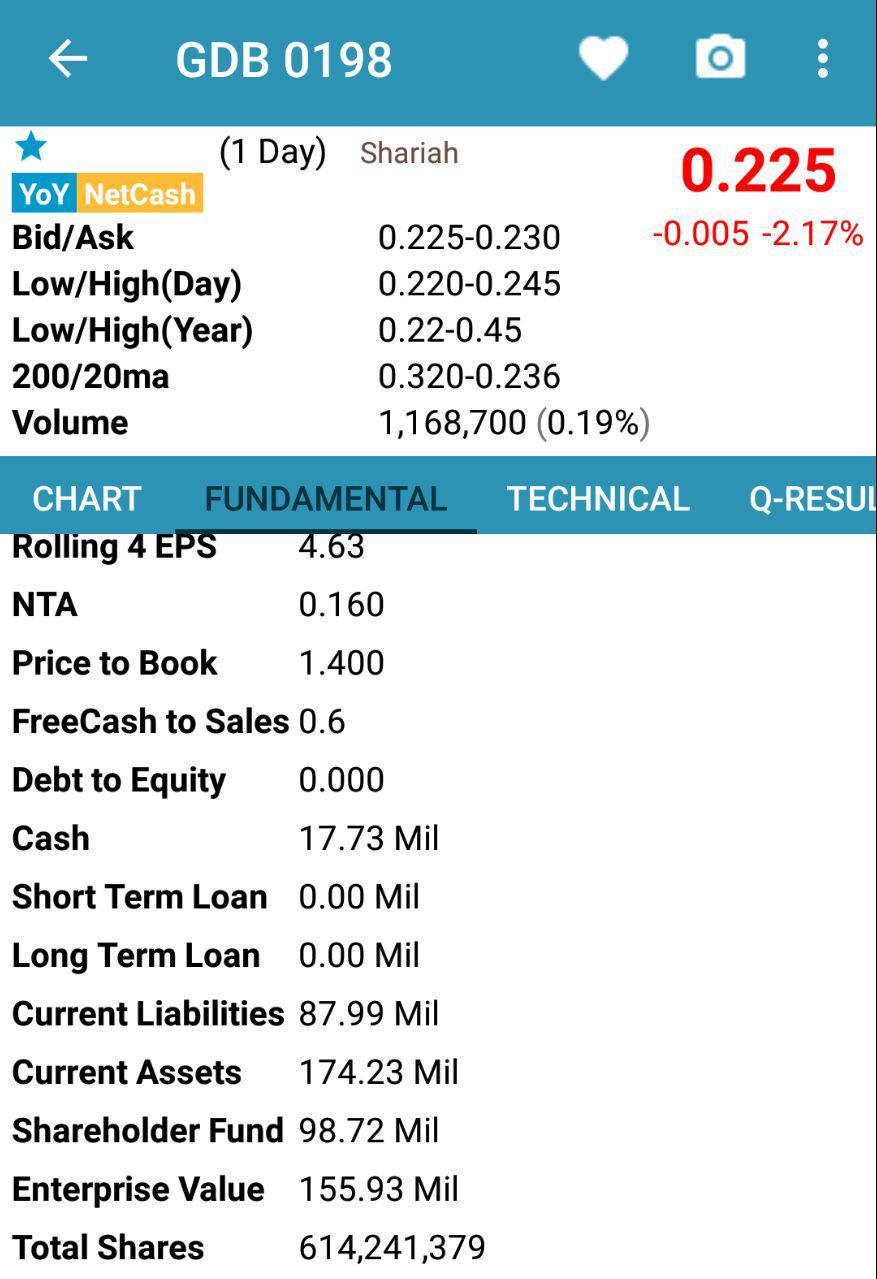

Fundamental:

Future Plans:

1. Further grow business in high rise building construction

2. Expansion of construction business to other building segments

3. Expansion into civil and infrastructure construction services

4. Purchase of a new office

Competitive Strength:

1. Experienced and technically strong management team (Majority of the management team have more than 20 years of relevant working experiences)

2. Proven track record in terms of delivery schedule, quality and safety (completed 4 projects and all accomplished ahead of the contractual completion date; certifications and achievements - go through yourself as it is too much)

3. Adoption of construction practices that optimise project efficiencies (Industrialised Building System (IBS))

3. Established relationships with customers and suppliers

4. Investment in technologies for improved efficiency (Building Information Modelling (BIM) software)

2. Dependency on the services of subcontractors

3. Dependency on foreign workers

4. Reliance on major customers (Perdana ParkCity S/B, Trans Resources Corporation S/B and Etiqa Insurance Bhd)

Financials:

1. Order book (RM613.74 million as at 30 September 2018)

2. Dividend Policy (30.0% of its net profits)

3. Past Financial Performance:

Valuation:

1. P/E valuation approach.

2019F (assuming earning per share is 5sen, very easy to achieve)

Technical Analysis:

Commentary on Construction indices:

1. Broke the first resistance

2. Still downtrend

2. might be "dead cat bounce"

Commentary on GDB:

1. Supported at 22sen, resistance at 25sen, consolidation breakout?

2. bottom might be 22sen (37% below IPO price)

3. 22sen to IPO price = 59.1% ROI

4. Volume getting thinner, the downtrend is ready to break

5. today closing candlestick we called it "仙人指路K线“ in Mandarin, whereby big kaki is "testing" this counter by fake "attacking", if you want to know more can try and google it.

Disclaimer: Just my 2cents, buy/sell on your own risk, do your homework especially the highlighted one before buying in this counter.

https://klse.i3investor.com/blogs/GDB0198/188857.jsp

- GDB Holdings Berhad is an investment holdings company. It's subsidiary, Grand Dynamic Builders Sdn. Bhd. is a full-fledged building construction firm commencing its operation in May 2013. GDBSB is founded on a platform of expertise and competencies in terms of its people, technical know-how and construction innovation towards Quality, Safety and Environment.

- GDB was founded in 2013 by former Putrajaya Perdana construction veterans Cheah Ham Cheia and Alexander Lo (2 largest shareholders). GDBSB vision of being REPUTABLE among players in the Malaysian construction industry in building foundations of success for all its stakeholders is pillared by a team of experienced construction personnel with years of exposure in delivering iconic and award-winning structures in building and infrastructure construction projects.

- Despite a relatively short history, the company managed to rake in a solid track record in securing major high-rise construction jobs and have completed 4 major projects since 2013. GDB’s order book stood at a healthy level of RM613.74 million as at 30 September 2018. The sizeable order book provides positive earnings visibility until third quarter of the financial year ending 31 December 2020, and comprise ongoing projects namely AIRA Residence in Damansara Heights and Menara Hap Seng 3 within the Kuala Lumpur city centre.

- Business: Construction Services (Residential: 35.05%, Mixed Development: 31.09%, and Commercial: 33.86%)

Fundamental:

Future Plans:

1. Further grow business in high rise building construction

2. Expansion of construction business to other building segments

3. Expansion into civil and infrastructure construction services

4. Purchase of a new office

Competitive Strength:

1. Experienced and technically strong management team (Majority of the management team have more than 20 years of relevant working experiences)

2. Proven track record in terms of delivery schedule, quality and safety (completed 4 projects and all accomplished ahead of the contractual completion date; certifications and achievements - go through yourself as it is too much)

3. Adoption of construction practices that optimise project efficiencies (Industrialised Building System (IBS))

3. Established relationships with customers and suppliers

4. Investment in technologies for improved efficiency (Building Information Modelling (BIM) software)

Key Risks:

1. Competition risk2. Dependency on the services of subcontractors

3. Dependency on foreign workers

4. Reliance on major customers (Perdana ParkCity S/B, Trans Resources Corporation S/B and Etiqa Insurance Bhd)

Financials:

1. Order book (RM613.74 million as at 30 September 2018)

2. Dividend Policy (30.0% of its net profits)

3. Past Financial Performance:

-

2018: RM205.215mil as sept 30, 2018 (eps: 0.0460)

-

2017: RM329.1 mil (eps: 0.0520)

-

2016: RM276.906 mil (eps: 0.0642)

-

2015: RM169.539 mil (eps: 0.0604)

-

2014: RM 86.628 mil (eps: 0.0301)

Valuation:

1. P/E valuation approach.

2019F (assuming earning per share is 5sen, very easy to achieve)

|

P/E |

Valuation |

|

5 |

25 sen |

|

6 |

30sen |

|

7 |

35sen (IPO price) |

|

8 |

40sen |

Technical Analysis:

Commentary on Construction indices:

1. Broke the first resistance

2. Still downtrend

2. might be "dead cat bounce"

Commentary on GDB:

1. Supported at 22sen, resistance at 25sen, consolidation breakout?

2. bottom might be 22sen (37% below IPO price)

3. 22sen to IPO price = 59.1% ROI

4. Volume getting thinner, the downtrend is ready to break

5. today closing candlestick we called it "仙人指路K线“ in Mandarin, whereby big kaki is "testing" this counter by fake "attacking", if you want to know more can try and google it.

Disclaimer: Just my 2cents, buy/sell on your own risk, do your homework especially the highlighted one before buying in this counter.

https://klse.i3investor.com/blogs/GDB0198/188857.jsp