迷你年报用途是了解公司的基本资料,

不是分析,不是买卖建议,

对于英文不好的投资者或新手来说,

更应该多看,多背,多记,多学,

很多时候基础就是这样磨炼回来的。

注:全哥研究不代表持有股票或有意购买,纯粹记录用途。

Announcement Date : 30 Apr 2018

公司简介

*Inta Bina Group Berhad(“IBGB”或“Our Group”)是一家建筑承包商,在马来西亚建筑行业拥有超过25年的经营历史。

*已完成超过117个建筑施工项目

合同金额超过23亿令吉,主要在巴生谷和柔佛州。

*有能力建造各种类型的建筑物,包括住宅,商业,工业和休闲物业。

*1997-1998 亚洲金融危机中生存下来。

*2017 年在创业版上市。

*2012收入超过了2亿令吉,Upgraded as a G7 contractor with subhead for CE21 (General Civil Engineering Works).

*2014 获得大马建筑工业发展局(CIDB)认证的第7级承包商(有资格可以招标无线价值的合约)。

INTA 的成绩单

财务报表

30大股东

Management Discussion & Analysis

*公共发行募集资金总额为2676.3万令吉被用于资本支出(18.68%),偿还银行借款(33.63%),一般营运资金(35.73%)和上市费用(11.96%)。

*Other income decreased by RM0.955 million or 22.4%, from RM4.259 million in FY2016 to RM3.304 million in FY2017 mainly due to lack of one off gain of disposal of investment properties, even though there was an increase of fixed deposit interest income earned in FY2017 compared to FY2016.

*Finance costs were lower in FY2017 at RM1.211 million compared to RM2.710 million for FY2016 due to decrease of bank borrowings as our Group have repaid its bank borrowings and finance lease amounting to RM19.662 million in FY2017.

Segmental Breakdown Analysis

Analysis of revenue by geographical location

在2017财年成功获得接近2.93亿令吉价值的新项目。 其中包括以下内容:

稳健的招标书

*马来西亚房地产市场的普遍看法是,该行业仍处于整合阶段,2014年初开始放缓。

*但是,在2017年客户的强大招标邀请,开发商、新老客户都邀请集团投标他们将在2017年推出的各种房地产项目。

*Inta 获得了其中价值最高35亿的招标书(对比2014-2016投标书介于15亿至25亿),同时他们也积极投标不同性质的各类建筑的工程开发商,从地产、高层地产到混合开发项目。

*尽管市场疲软,但有能力的建筑承包商及客户高质量的需求仍然很有市场,加上2017 年上市后也为新客户提供了更大的信心。

PROSPECTS AND OUTLOOK

*unbilled order book of RM573 million as at 31 December 2017.

*The Group has secured additional new contract of RM254 million during the first 2 months of 2018, which further increased the unbilled order book value to RM776 million as at 28 February 2018.

*However, our key challenges and risks include unexpected economic downturn, rising raw material prices, shortage and rising costs of foreign labour, unexpected delays in the execution of projects and prolong softening of the property market.

*Our Group’s unbilled order book has increased from RM555 million as at 31 December 2016 to RM776 million as at 28 February 2018,Based on the unbilled order book as at 28 February 2018, 79% or RM610 million is for residential properties projects and the remaining 21% or RM166 million is for non-residential properties projects.

*Our current order book is more than sufficient to keep our Group busy over the next 2 to 3 years.

We have witnessed an increase in demand for IBS construction

method consequential from the following developments affecting

the construction sector:

(a) the Malaysian Government’s 70% IBS Content Policy;

(b) the shortage in the supply of foreign labour consequential

upon the tightening of foreign labour policy by the Malaysian

government from time to time, affecting in particular

construction projects which adopts labour intensive

conventional construction method.

*We have secured a total of 27 projects from Gamuda Berhad

group of companies for more than a decade from 2005 until 2018,

12 projects were awarded by Horizon Hills Development Sdn Bhd,

a joint venture between UEM Sunrise Berhad and Gamuda Berhad,

to us from 2009 to 2017 and 8 projects were awarded by Eco World

Development Group Berhad to us from 2015 to 2017.

简单来说,Inta 的业绩有进步的空间,订单足以忙上2-3年,

至于建筑领域所面临的挑战与风险如经济低迷、原材料价格上涨、短缺和劳工成本上升、项目执行过程中的意外延误以及房地产市场持续走软。他们看见使用工业化建筑(Industrialised Building System (“IBS”))可以提高效率。

注:IBS是一种最新的施工技术,建筑构件是在场外或现场制造的,然后安装到正在进行的建筑工程中。

。。。。。。。。。。。。。。。。。。。。。。。。。。

顺带跟进2018年季度报告

Announcement Date : 24 May 2018

Q1- Quarterly rpt on consolidated results for the financial period ended 31 Mar 2018

*The Board is of the opinion that the Group will be able to sustain its growth and remain resilient. As at 31 March 2018, the Group’s unbilled order book is RM749 million.

Announcement Date : 30 Aug 2018

Q2-Quarterly rpt on consolidated results for the financial period ended 30 Jun 2018

*As at 30 June 2018, the Group’s unbilled order book is RM785 million.

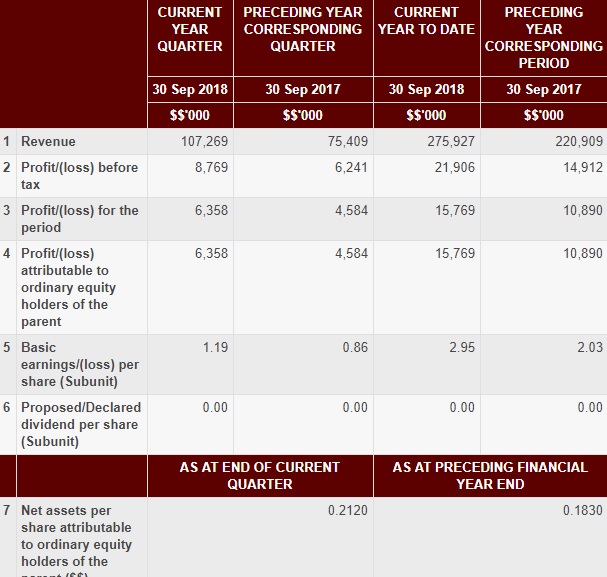

Announcement Date : 30 Nov 2018

Q3 -Quarterly rpt on consolidated results for the financial period ended 30 Sep 2018

*As at 30 September 2018, the Group’s unbilled order book is RM748 million.

。。。。。。。。。。。。。。。。。。。。。。。。。。

KLSE 记录 9 JAN 2019

PRICE: RM0.285

EPS :3.86

NTA :0.212

DPS :-

P/E :7.38

ROE :18.21

DY :-

52W : 0.25 - 0.42

CAPITAL :153m

SHARES :535mil

QoQ - 2 Quarter over Quarter profit growth

TopQ - Latest Quarter profit is 2 years high

QoQ - 2 Quanter over Quater Revenue growth

conQ - 3 Continuous Quarter revenue growth

TopQ - Latest quarter revenue is 2 years high

喜欢的话请分享出去,“顺便”给个Like 或 Follow 因为这就是全哥的动力来源

v( ̄︶ ̄)y Just Do It~

By 全哥分享 (9-1-19)

进入股市就是要防止被“抢劫”, 独立思考, 因为,股价与股票的内在价值最终会取得平衡.

全哥股票&投资理财新手教室 (部落格)

全哥股票&投资理财新手教室 (Facebook)

http://richbrotherschool.blogspot.com/2019/01/9914-inta-0192-ar2017.html

不是分析,不是买卖建议,

对于英文不好的投资者或新手来说,

更应该多看,多背,多记,多学,

很多时候基础就是这样磨炼回来的。

注:全哥研究不代表持有股票或有意购买,纯粹记录用途。

公司简介

*Inta Bina Group Berhad(“IBGB”或“Our Group”)是一家建筑承包商,在马来西亚建筑行业拥有超过25年的经营历史。

*已完成超过117个建筑施工项目

合同金额超过23亿令吉,主要在巴生谷和柔佛州。

*有能力建造各种类型的建筑物,包括住宅,商业,工业和休闲物业。

*1997-1998 亚洲金融危机中生存下来。

*2017 年在创业版上市。

*2012收入超过了2亿令吉,Upgraded as a G7 contractor with subhead for CE21 (General Civil Engineering Works).

*2014 获得大马建筑工业发展局(CIDB)认证的第7级承包商(有资格可以招标无线价值的合约)。

INTA 的成绩单

财务报表

30大股东

Management Discussion & Analysis

*公共发行募集资金总额为2676.3万令吉被用于资本支出(18.68%),偿还银行借款(33.63%),一般营运资金(35.73%)和上市费用(11.96%)。

*Other income decreased by RM0.955 million or 22.4%, from RM4.259 million in FY2016 to RM3.304 million in FY2017 mainly due to lack of one off gain of disposal of investment properties, even though there was an increase of fixed deposit interest income earned in FY2017 compared to FY2016.

*Finance costs were lower in FY2017 at RM1.211 million compared to RM2.710 million for FY2016 due to decrease of bank borrowings as our Group have repaid its bank borrowings and finance lease amounting to RM19.662 million in FY2017.

Segmental Breakdown Analysis

Analysis of revenue by geographical location

在2017财年成功获得接近2.93亿令吉价值的新项目。 其中包括以下内容:

稳健的招标书

*马来西亚房地产市场的普遍看法是,该行业仍处于整合阶段,2014年初开始放缓。

*但是,在2017年客户的强大招标邀请,开发商、新老客户都邀请集团投标他们将在2017年推出的各种房地产项目。

*Inta 获得了其中价值最高35亿的招标书(对比2014-2016投标书介于15亿至25亿),同时他们也积极投标不同性质的各类建筑的工程开发商,从地产、高层地产到混合开发项目。

*尽管市场疲软,但有能力的建筑承包商及客户高质量的需求仍然很有市场,加上2017 年上市后也为新客户提供了更大的信心。

PROSPECTS AND OUTLOOK

*unbilled order book of RM573 million as at 31 December 2017.

*The Group has secured additional new contract of RM254 million during the first 2 months of 2018, which further increased the unbilled order book value to RM776 million as at 28 February 2018.

*However, our key challenges and risks include unexpected economic downturn, rising raw material prices, shortage and rising costs of foreign labour, unexpected delays in the execution of projects and prolong softening of the property market.

*Our Group’s unbilled order book has increased from RM555 million as at 31 December 2016 to RM776 million as at 28 February 2018,Based on the unbilled order book as at 28 February 2018, 79% or RM610 million is for residential properties projects and the remaining 21% or RM166 million is for non-residential properties projects.

*Our current order book is more than sufficient to keep our Group busy over the next 2 to 3 years.

We have witnessed an increase in demand for IBS construction

method consequential from the following developments affecting

the construction sector:

(a) the Malaysian Government’s 70% IBS Content Policy;

(b) the shortage in the supply of foreign labour consequential

upon the tightening of foreign labour policy by the Malaysian

government from time to time, affecting in particular

construction projects which adopts labour intensive

conventional construction method.

*We have secured a total of 27 projects from Gamuda Berhad

group of companies for more than a decade from 2005 until 2018,

12 projects were awarded by Horizon Hills Development Sdn Bhd,

a joint venture between UEM Sunrise Berhad and Gamuda Berhad,

to us from 2009 to 2017 and 8 projects were awarded by Eco World

Development Group Berhad to us from 2015 to 2017.

简单来说,Inta 的业绩有进步的空间,订单足以忙上2-3年,

至于建筑领域所面临的挑战与风险如经济低迷、原材料价格上涨、短缺和劳工成本上升、项目执行过程中的意外延误以及房地产市场持续走软。他们看见使用工业化建筑(Industrialised Building System (“IBS”))可以提高效率。

注:IBS是一种最新的施工技术,建筑构件是在场外或现场制造的,然后安装到正在进行的建筑工程中。

顺带跟进2018年季度报告

Announcement Date : 24 May 2018

Q1- Quarterly rpt on consolidated results for the financial period ended 31 Mar 2018

*The Board is of the opinion that the Group will be able to sustain its growth and remain resilient. As at 31 March 2018, the Group’s unbilled order book is RM749 million.

Announcement Date : 30 Aug 2018

Q2-Quarterly rpt on consolidated results for the financial period ended 30 Jun 2018

*As at 30 June 2018, the Group’s unbilled order book is RM785 million.

Announcement Date : 30 Nov 2018

Q3 -Quarterly rpt on consolidated results for the financial period ended 30 Sep 2018

*As at 30 September 2018, the Group’s unbilled order book is RM748 million.

。。。。。。。。。。。。。。。。。。。。。。。。。。

KLSE 记录 9 JAN 2019

PRICE: RM0.285

EPS :3.86

NTA :0.212

DPS :-

P/E :7.38

ROE :18.21

DY :-

52W : 0.25 - 0.42

CAPITAL :153m

SHARES :535mil

QoQ - 2 Quarter over Quarter profit growth

TopQ - Latest Quarter profit is 2 years high

QoQ - 2 Quanter over Quater Revenue growth

conQ - 3 Continuous Quarter revenue growth

TopQ - Latest quarter revenue is 2 years high

喜欢的话请分享出去,“顺便”给个Like 或 Follow 因为这就是全哥的动力来源

v( ̄︶ ̄)y Just Do It~

By 全哥分享 (9-1-19)

进入股市就是要防止被“抢劫”, 独立思考, 因为,股价与股票的内在价值最终会取得平衡.

全哥股票&投资理财新手教室 (部落格)

全哥股票&投资理财新手教室 (Facebook)

http://richbrotherschool.blogspot.com/2019/01/9914-inta-0192-ar2017.html