Dear Valued investors,

Most of you have already read the news on the government's plans on Listing the World's First AIRPORT REIT.

While many investors have their bullish and bearish views, We suggest that the chart and the market price of Airport will only determine who is the winner.

The reversal in Airport's share price on Wednesday may signal a potential bottom and its resumption of an uptrend.

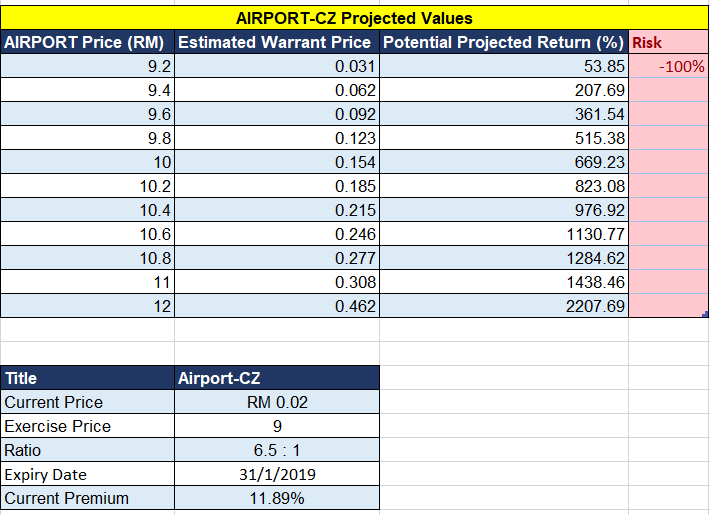

AIRPORT - CZ

Among all Airport's warrants, Airport-CZ is relatively a more interesting pick.

It was a shame the warrants were rather inactive despite the large rally in Airport's Price. It may be due to the fact that these warrants are still trading at a premium.

However, should the underlying share price of Airport surge close to the exercise price of warrants, the volume in warrants should start to pick up pace.

Projected Tables of Estimated values are as follows.

Investors should study the warrants into more detail first before buying into high risk instruments. Do not buy warrants if you do not know the risk.

KLCI Index Component

Currently, AIRPORT is the 30th Most valuable company in Bursa with a Market Capitalization of RM 13.539 Billion. Hence, this should be a proxy to the KLCI index as well as it was just included into KLCI in year 2018. It should also defend its position as a constituent of the KLCI index as other companies such as F&N and WPRTS are catching up closely.

Thank you for reading,

Best Regards,

Greatwarrants

Disclaimer:

Trading Warrants is a great tool for leverage. However, high returns come with high risk. Therefore, investment decisions should be borne at your own cost and I will not be held liable for any investment decisions made. DO NOT BUY WARRANTS IF YOU DO DO NOT KNOW THE RISK. The market does not need you to push up the warrants price. Let the market issuer play its role and the forces of supply and demand take place for the case of Warrants.

https://klse.i3investor.com/m/blog/greatwarrants/181506.jsp