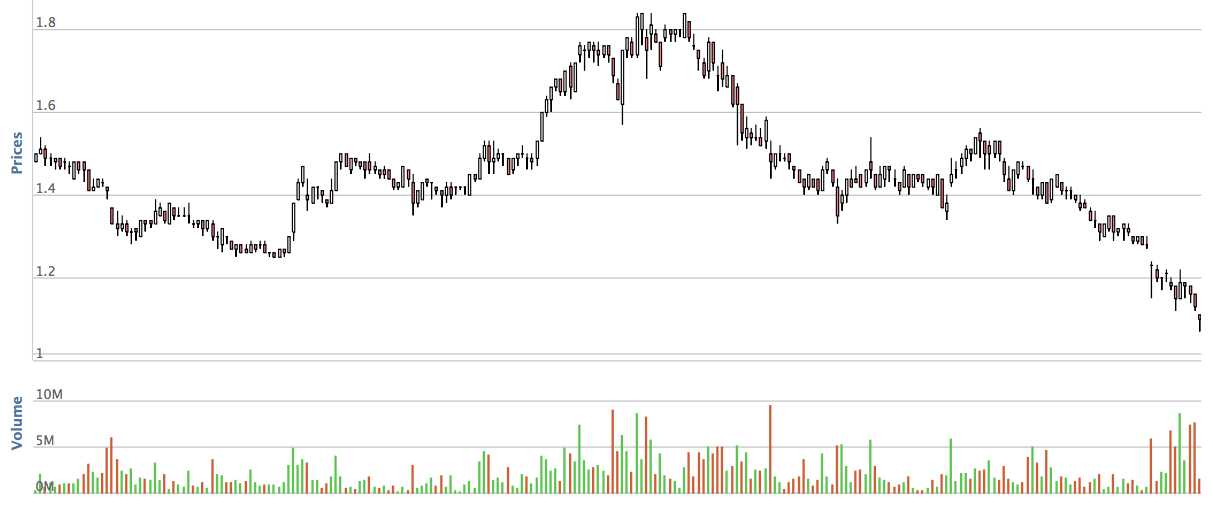

Over the past 6 months, Jaks' share price has declined from RM1.80 to the current RM1.04.

What was the reasons behind this drastic drop ?

Well, Jaks has some problem with The Star. It got a piece of land from The Star few years ago. In return, it will have to construct an office building for The Star. Due to various reasons, the building is only 96% completed by due date. The Star called on the Bank Guarantee of RM50 mil. Jaks is seeking restraining order from Court. The company lost the first round and has submitted an appeal. Today will be the hearing day. This latest development is unfortunate, but the amount is actually very small. Jaks holds 50% of the affected property subsidiary. As such, its exposure is only RM25 mil. By declining from RM1.80 to RM1.04, market capitalisation has evaporated by RM415 mil. This is too excessive.

Another possible reason is KYY's so called forced selling. On Monday, KYY came up with an article to explain that his bankers had been force selling his shares in the past few days. On 26 July 2018, he followed up with disclosure of the relevant details.

According to the table above, from 20 July until 25 July, banks had forced sold about 7 mil shares. As KYY holds more than 150 mil shares in Jaks (being 30% of 540 mil shares), the market's imagination ran wild and panicked. Just imagine the wave and wave of selling ahead !!! As a result, share price posed a drastic drop this morning to fresh low of 1.04.

I beg to differ. I started buying few days ago at RM1.17. Today, I took opportunity to buy more.

In the first place, I don't believe in the forced selling story. If the bankers really wants to deleverage KYY, they can PLACE OUT JAKS SHARES TO INSTITUTIONAL OR HIGH NET WORTH INVESTORS THROUGH DIRECT BUSINESS TRANSACTIONS.

The stock is now trading at significant discount to its intrinsic value, which is backed by 30% stake in the valuable Vietnam IPP. The project is scheduled to be completed in approximately 18 months time. It shouldn't be difficult to find investors to pick up his stakes at current depressed price.

In other words, it is stupid to sell in the open market in such a disruptive way. I just don't buy the story.

This is a golden opportunity to buy. If you are not comfortable, you can buy half at current price and average down gradually. Barring a major cock up of the Vietnam project, you are likely to make money from your investment over the next 6 to 12 months

Have fun !

http://klse.i3investor.com/blogs/icon8888/167135.jsp