Our February alpha picks delivered a simple average return of 2.3%, outperforming the FBMKLCI’s -0.7%. The recent market pullback provides good opportunities to accumulate our March alpha picks (unchanged from February’s picks) of Ann Joo, Bumi Armada, GAQRS, Serba Dinamik, VS Industry and Yong Tai. We continue to expect emerging re-rating catalysts for these stocks by 2Q18.

WHAT’S NEW

• Review of February picks. Four out of our six alpha picks outperformed the market in February, delivering a simple average return of 2.3% (FBMKLCI: -0.7%). Leading the list was Ann Joo which saw a 7.4% increase on a low base from last month’s fall and amid recovering steel bar prices (+4.4% mom), followed by Serba Dinamik’s 6.4% increase and Yong Tai’s at 3.3%.

• Opportunities amid cautious investment sentiment. While market sentiment has turned cautious earlier than expected, we still expect selective small-mid caps to outperform the market. Key events to watch out for in the coming weeks or months are the dissolution of parliament for the general election (expected in March), the award of mega projects (ECRL, MRT3 and the PDP portion of HSR), and Yong Tai’s opening of the acclaimed Impression Melaka theatre.

• Overreaction to US’ proposed tariff on steel imports. Malaysian steel stocks took a beating last Friday, as investors reacted to the US’ intention of slapping a 25% tariff on steel imports (targeted at China imports). Specific concerns are: a) China redirecting surplus production to Asia; and b) an expanded US-China trade war could extend the US dollar’s weakness. Nevertheless, we assess that ASPs in Asia would continue to be firm, and markets will eventually react positively to an expected qoq rise in 1Q18’s profit margins.

ACTION

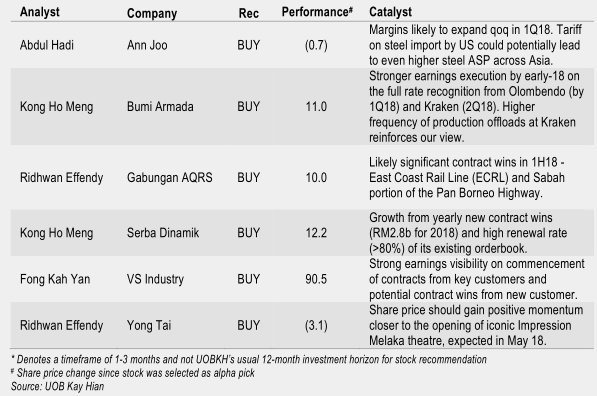

• Retaining our March picks of Ann Joo, Bumi Armada, Gabungan AQRS, Serba Dinamik, VS Industry and Yong Tai (see re-rating catalysts in the table below). While not in the list, other notable BUY rated stocks like Genting Bhd and Inari could offer attractive upside.

ANALYSTS’ TOP ALPHA PICKSanalyst top picks 2018

Ann Joo Resources (Abdul Hadi Manaf)

• Following the strong yoy earnings growth in 2017, we believe that the positive momentum will continue with local steel bar prices having increased further to RM2,750/MT (+4.4% mom) in Jan 18, mainly due to the sharper-than-expected production cuts in China during the heating season.

• The potential US tariff implementation on imported steel may not necessarily be bad news for Malaysian steel producers. This is because Turkey, which is a key steel exporter across Asia, may incur higher scrap metal costs should steel production in the US rise. To note, currently Turkey sources most of its metal scrap from the US.

Share Price Catalyst

• Significant improvement in local steel demand.

• Local steel ASP rising to a multi-year high.

Bumi Armada (Kong Ho Meng)

• 2018 is set to be a turnaround year for the group, with earnings set to pick up from 1Q18 when Bumi Armada potentially receives almost full charter rate recognition from both Olombendo and Kraken (Kraken by 2Q18). The offloadings of Kraken onto three tankers since Jan 18 is positive as it shows Kraken’s production improvement is real and ongoing, which should translate into higher rate recognition in 1Q18. We also see the possibility of a TGT1 extension.

Share Price Catalyst

• Conclusion of final acceptance of Kraken and Olombendo by 1H18.

• Recovery of OMS utilisation and rates.

Gabungan AQRS (Ridhwan Effendy)

• The group is armed with an outstanding orderbook of RM2.8b. For 1H18, expect contract wins of high-profile construction jobs in the East Coast Rail Line (ECRL) and the Sabah portion of the Pan Borneo Highway (PBH). The group’s precast manufacturing division is also poised to benefit from the Sabah PBH as it owns one of the largest precast manufacturing facilities in Sabah together with the Sabah Economic Development Corporation.

Share Price Catalyst

• Positive contract newsflow by 1H18.

• Concrete premix production associate securing a substantial contract.

Serba Dinamik (Kong Ho Meng)

• Earnings growth to trump expectations on yearly new contract wins (RM2.8b target to bring total 2018 orderbook to RM7.2b - close to management's guidance of RM7.5b) and high renewal rate (>80%) of its existing orderbook. We expect Serba to announce more contracts as it embarks on its asset ownership strategies. Our earnings forecasts are above consensus’.

Share Price Catalyst

• Higher-than-expected new orderbook wins and renewals.

• Lower-than-expected costs and quicker profit breakeven achievement from JV income (Muaro Jambi)

VS Industry (Fong Kah Yan)

• In addition to several assembly lines for box-build products that have commenced production since Nov 16, VS Industry began building another three assembly lines in 4Q17. Key catalysts in the medium term will be the gradual capacity fill-up at its new plant (which can accommodate up to 12 assembly lines) upon completion in mid-18 on the back of potential contracts from new customers.

Share Price Catalyst

• Securing new contracts from existing or new customers.

• Securing new contracts for its China operations via 43.5%-owned VS International Group.

Yong Tai (Ridhwan Effendy)

• Tourism-related developer Yong Tai targets to open the critically-acclaimed Impression Series theatre in Melaka by end-April, the first outside of China, which could generate annual net profits of >RM60m in a full year of operations. To further tap on the success of the Impression Melaka show, Yong Tai will develop the land around the theatre. It will also undertake niche developments to diversify earnings growth drivers. We are also optimistic on the viewership for the theatre’s shows, given the success it had in China.

Share Price Catalyst

• Positive construction progress of the Impression Melaka theatre which is set to open in

May 18.

VALUATIONstocks valuation

source: UOBKayHian – 06/03/2018